As a leader with over 20 years of experience leading pricing strategy at a major US grocery chain, I deeply understand the complexities pricing teams face when trying to derive, quantify, and execute corporate pricing initiatives.

Providing insights into the competitive marketplace in order to ensure the overall success of directed pricing strategies is more than simple reporting.

That’s what many teams get wrong.

Reporting is a post-mortem, which is a valuable exercise, but not one that will help you achieve your pricing goals all by itself. After all, your pricing goals can change due to a number of reasons: macroeconomic challenges, regional competition, corporate objectives, along with several other factors.

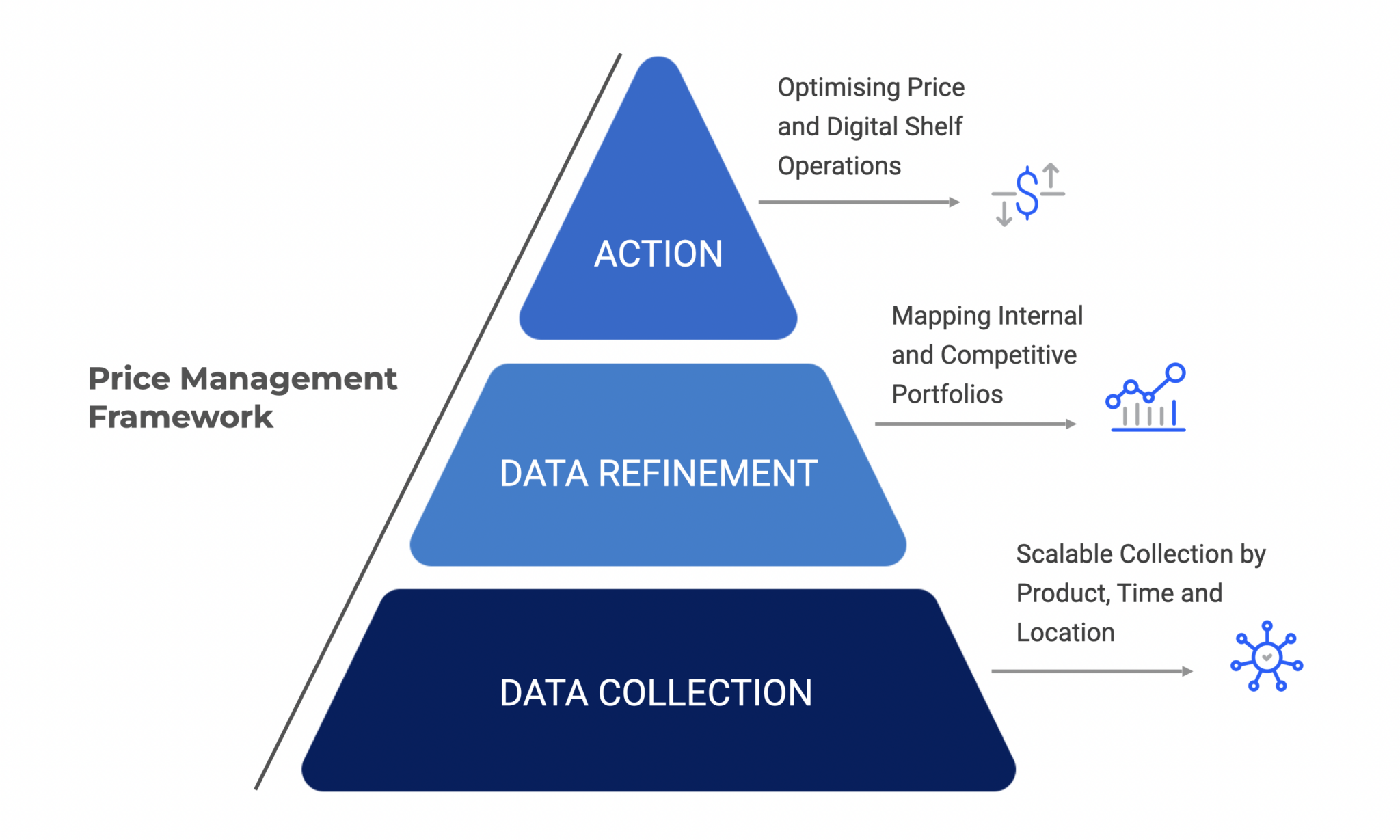

Pricing teams need a well-defined process to devise and implement their pricing strategies. This process needs to holistically examine your product base to provide robust price management. It also needs to be backed up by technology powered by the latest advancements because you can be sure your competition is already thinking that way.

Let’s break down an effective and modern price management process for retailers.

Data Collection

The first aspect of any effective price management framework for retailers is a clearly defined product data collection. You need to understand your collection in terms of who to collect pricing data from, what data to collect, where to collect it from, and how often.

- The who: Consists of both primary competition and others you’d like to keep tabs on

- The what: Can range from targeted single items like Key Value Items (KVIs) or total portfolio

- Where: Can range from targeted locations within your market or the total competitive network

- How often: To be able to support your price management process and for reporting purposes, determining a cadence is essential.

Data is power and the more data you can acquire, the more insights you’ll gain. Make sure that your collection data is well thought out ahead of time. Leaning on a price management framework built for retailers that can aggregate all your data into representative prices can help.

For example, if you have multiple competitive stores in a single market, flattening pricing data into a defined representative price will help speed up your analysis. Don’t get confined to a single store when a comprehensive assortment view across your target markets will provide a more accurate understanding.

Data Refinement

Competitive Matched Items

Next, you need to examine your competitive-matched items. These are the products that you want to be priced in direct response to your competitors’ pricing. The goal is to remain closely aligned with their prices so as not to lose market share while simultaneously achieving your corporate strategies.

Your price management system needs to help you manage your overlapping items. Trying to do so manually will be inefficient and is almost impossible to execute across 100% of your product catalog.

The mapping needs to go beyond exact UPC / PLU matches to encompass other match criteria. It needs to be able to incorporate any number of derivatives, including competitor-specific item codes like Amazon’s ASINs or Target’s DPCIs. This will help you overcome the challenge of mapping exact items to a competitor when the competitor’s site doesn’t showcase a UPC. It will also help you map your own private-label items to your competitor’s private-label counterparts.

A good price management framework will also help you match the same items but with dissimilar sizes (e.g., Cheerios 18 OZ vs. Cheerios 20 OZ), either by letting you match directly within acceptable tolerances or by enabling you to compare prices on a per-unit basis.

We need to leverage GenAI to help facilitate matches beyond UPC / PLU exact matches, such as Exact Item with no Competitor Code, Exact Item with Competitive Specific Codes, Similarity Matching on Private Label, Similarity Matching on Size all need to leverage it.

If you’re playing in a vertical that doesn’t always have a unifying code (restaurants, apparel, etc.) you’ll need to leverage the latest GenAI tools to map items together for price management. The variables are simply too numerous and complex to do manually.

Unmatched Items and Internal Portfolio

Not every product will be included in your competitive-matched items collection. Competitive matches in your internal portfolio offer a proxy for building clear and concise price management strategies that are in line with your corporate initiatives.

However, your unmatched items still need to be factored into your price strategy. If you only manage your competitively priced items, you won’t have a holistic viewpoint of your total product catalog and pricing. It’s critical to ensure that internal portfolio items are effectively mapped and grouped in order to extend overall price management.

Here are three things you need to consider when managing the pricing of your internal product portfolio. A smart price management framework is your best bet for achieving these results:

- Value Size Groupings

Value size groupings allow for the same branded items of different sizes to be priced accordingly to ensure price parity. You don’t want to sell a private label gallon of milk for $4.00 while the half gallon is at $1.75, for example. You need certain mechanisms in place to alert you when price parity is off. This is especially true when some of your items are competitively matched, and others are not. - Relationships between Brands

Relationships between brands are also critical to ensure price parity. There should be well-defined relationships between like-sized products that are from different brands. This will ensure that your private label program is priced ‘at a value’ compared with their national branded counterparts. You need to maintain the balance between different private label tiers along with different national brand tiers. - Price Links

Price Links are also critical to keeping up to date from a consumer perspective. Your customers expect that certain items should be priced together and will be put off if they are not. For example, if you sell an item in different sizes or flavors and scents, their prices should be logically linked.

For your internal portfolio, there may be items that don’t have a competitive match or simply don’t fall into one of your internal portfolio groupings. These are unique items to your banner and should be considered margin drivers for your brand.

Leveraging Data for Action

Now that you have a complete line of sight into both competitively matched items and internal mappings, you can move to fully leveraging your data. Figuring out how to utilize these competitive insights to understand where your price positioning is compared with your competition can be a challenge without a playbook. An effective price management framework will help guide you to the best insights and help you understand how it relates to your corporate strategy.

If you don’t have a well-defined corporate pricing strategy (competitive or margin) or you need to update it to be more modern, the data sets provided by a price management framework can help you ascertain where you are in your pricing journey. They can also help you identify options for where you want to go.

Here are some other ways a price management framework can help you improve your pricing strategy:

- Utilize Competitive Data

Get competitive insights, identify competitive price zones, and understand your competitors’ pricing philosophy. Figure out if they’re using strategies like:- High-Low

- Everyday Low Price (EDLP)

- Cost Plus

- Unravel Competitor Strategy

See if you can unlock what your competition has planned for pricing strategy and promotions. Try relating what you see in corporate filings and tie back to what you see in your competitive data sets. - Assortment Analysis

Try looking at the data not only from a pricing perspective but also from a competitive assortment, promotion, and supply chain perspective. - Proactive Alerts

Establish alerts for your internal portfolio to ensure that you don’t exceed your tolerance based on price moves.

Leveraging a Price Management Framework Designed for Retailers

A price management system designed specifically for you as a retailer is a game changer. An effective one can be configured specifically for the price owners, whether you have a dedicated team for this function or the price is owned by the category management team.

For category managers, standard reporting offers a clear view of pricing performance and trends. Beyond that, competitive intelligence becomes crucial—using data from various sources like collected pricing data, market filings, social media insights, etc. to provide the senior leadership team with a deeper understanding of competitor strategies and actions. This empowers informed decision-making at the highest levels.

With these price management insights, retailers can gain a holistic view of the competitive marketplace, uncover gaps and opportunities, and scale their business more effectively. As someone with experience on the retailer’s side of the market, I know first-hand how valuable these insights can be.

We’d love to talk with you if you’re interested in learning more about DataWeave’s AI-powered price intelligence solution for retailers. Click here to schedule an introductory conversation.