It’s up to senior leadership, whether you’re a Chief Strategy Officer, Pricing Executive, or Commercial Director, to think big picture about your company’s competitive intelligence strategy. For more junior team members, it’s easy to get caught in the “this is how we’ve always done it” mindset and continue to go through the motions of price monitoring.

You don’t have that luxury—it’s up to you to find and implement new ways to move beyond basic price monitoring and usher your company into an era of achieving actionable insights through competitive intelligence. There is much more to gain from competitive data than simple price monitoring.

How can retailers leverage clean, competitive data to uncover strategic insights beyond basic price comparisons? This article will help you shift your mindset from tactical monitoring to strategic insight generation. We’ll see how sophisticated analysis of clean and refined competitive data can reveal competitor strategies, regional and geographic opportunities, and overall market trends.

It’s time to shift away from standard reporting, which should be left for your pricing owners and end users, and towards gaining competitive intelligence to shape your holistic company pricing strategy. With the right tools, you can make this shift a reality.

Regional Price Intelligence

One significant opportunity you should take advantage of is a greater understanding of regional price intelligence. Understanding the nuances that shape how products, categories, and other retailers’ prices according to geographical differences can set your company up to win customer trust and dollars at checkout.

Understanding geographic and regional pricing strategies

Geographic price intelligence helps leaders leverage market opportunities based on where sales are happening. Variations in how products and categories are priced across regions often reflect competitor tactics, local demand, and cost structures.

Let’s consider an example that impacts a broad geography, such as the entire continental United States – egg prices. Eggs are a staple grocery item and are frequently a loss leader in stores. This means they are products priced below their cost specifically to draw customers into stores.

However, Avian Flu outbreaks affecting millions of birds have become more common recently. These outbreaks drive the cost of eggs higher as flocks must be culled to prevent the spread of the disease. This means that retailers must act to maintain acceptable margins or losses without frightening away customers or losing their trust.

Avian Flu has been especially bad in Iowa and California. Retailers in these regions face tough decisions during outbreaks. They need to figure out how to balance the high prices required to cover the supply shortages with maintaining consumer trust that this staple product will not be perceived as ‘overpriced.’ Customers expect retailers to be fair even when supply chain issues make it challenging to keep prices stable.

Another example impacting the broader USA is credit card defaults. Credit card defaults are reaching levels unseen since the financial crisis of 2008. $46 billion worth of credit card balances were written off in the first nine months of 2024 alone. This unprecedented figure highlights the fact that many Americans are struggling financially. Higher-income earners continue to do ok, but lower-income families are feeling the pressure more than ever.

Understanding the differences between the geographies you sell in can help you construct your pricing strategies better. This is especially true as consumers brace themselves for more anticipated economic hardship.

Retailers must set realistic financial targets without overpricing their catalogs. Otherwise, they risk losing customers who would otherwise have bought their products. Competitive intelligence can help retailers understand how economic disparities impact core consumer bases.

Pricing leaders can leverage insights around geographic variations in supply, demand, and competitor pricing to help in situations like these. With how important eggs are, changes to their price can spill over into other categories. And with credit card defaults affecting hundreds of thousands of Americans, having a way to dive into these topics can help shape overarching strategies.

Customer perception is a recurring theme in competitive intelligence. It’s not only about the actual value your brand offers but the perceived value based on historical context, current events, and competition.

Leveraging Regional Price Differences for Strategic Advantage

On the topic of customer perception, there are strategic ways to use customer perception to your advantage. One of these is detecting cross-market arbitrage opportunities using competitive intelligence and actioning them.

But what is cross-market arbitrage? It’s the practice of exploiting the differences in price across different markets or regions. As a retailer, you can use cross-market arbitrage to your advantage by finding disparities in market conditions and strategically pricing your products to entice customers or offer more value. These opportunities can be in demand, supply, or competitive pricing. Acting quickly in markets where frequent disruptions happen can drive your business forward.

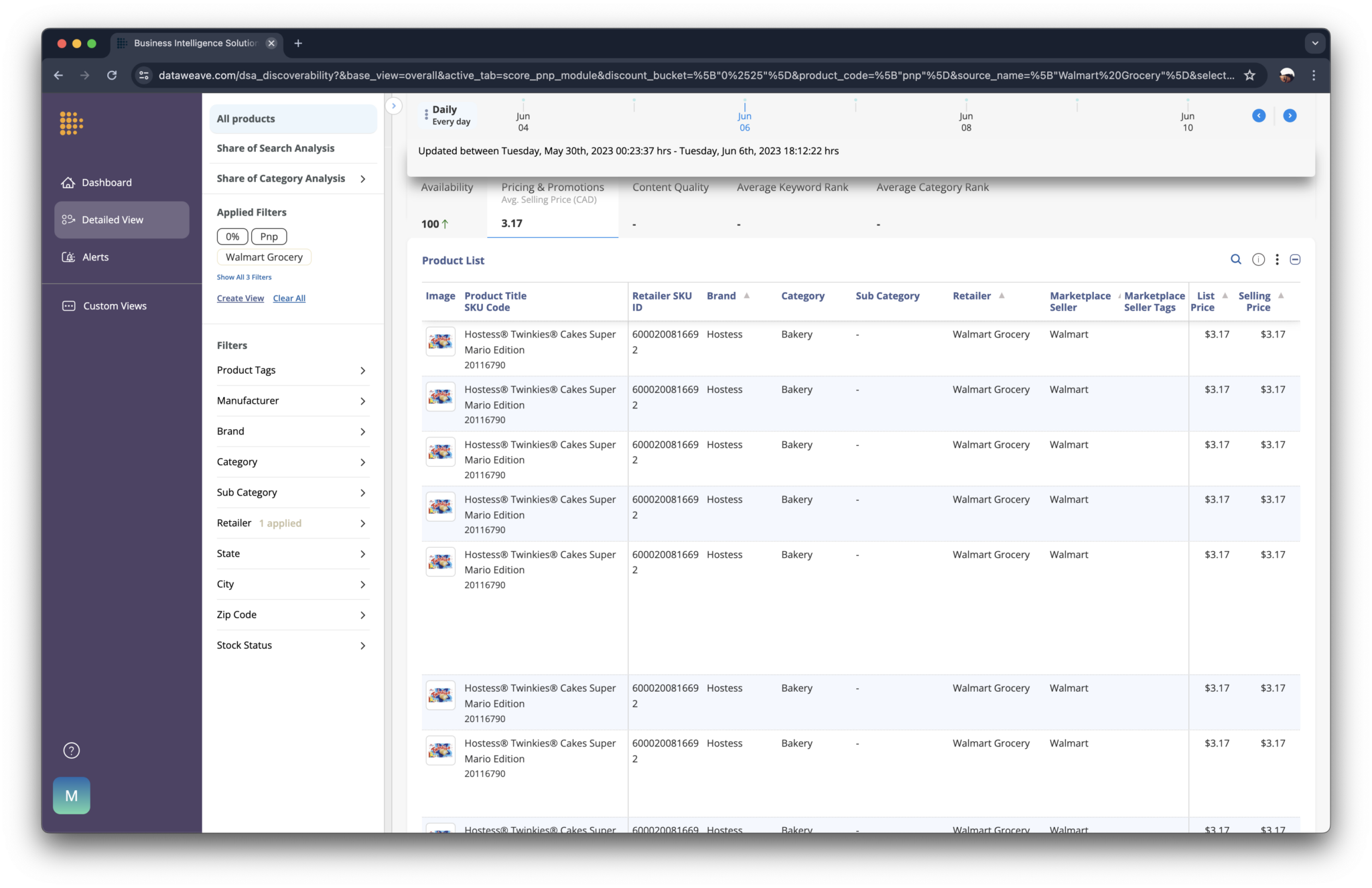

DataWeave’s advanced competitive intelligence tools can analyze regional market trends to help you respond to real-time local demand fluctuations or cost pressures.

Local Market Dynamics

Pricing isn’t a one-size-fits-all operation. Where and what you’re pricing truly matters. Pricing teams should take price zones into account when constructing pricing strategies. This is because pricing isn’t equivalent across locations; it’s localized. Understanding this fact is critical for category-specific considerations at the macro and micro levels.

This map shows a retailer’s regional price differentials on a breakfast basket. With the ability to access and refine your data, you can better construct maps like this one to track local market dynamics. Determine where you need to differentiate prices based on locality, understand the strategic stance of your competitors, and plan if you start to see changes in competitive price zones.

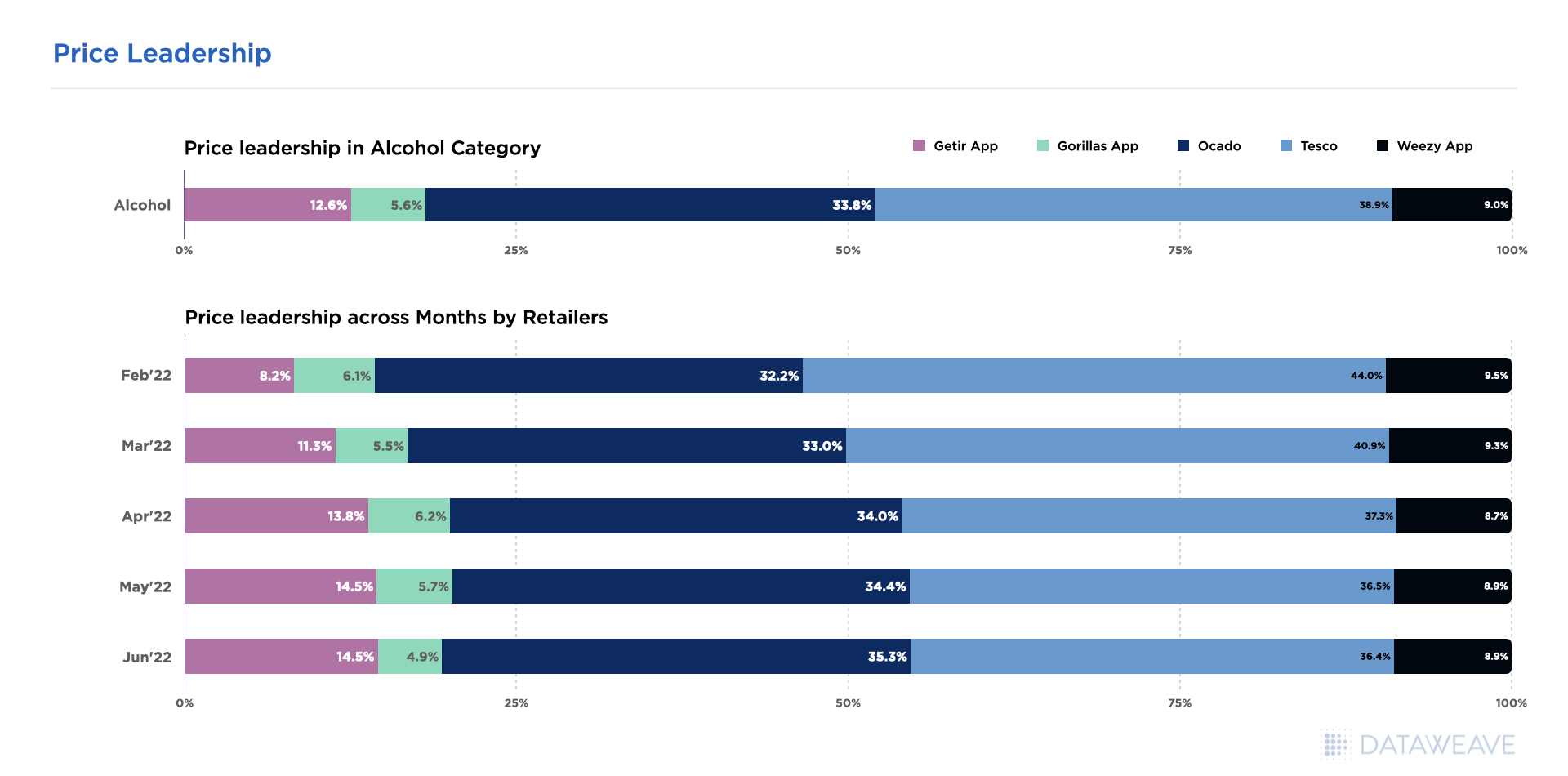

Competitor Strategy Detection

As a retailer, you should continuously monitor your competitors, whether they’re succeeding or stagnating. One example of a major retailer that is seeing growth even during this challenging economic time is Costco. Costco is an interesting case because they do not have stores in every major city or even in every state.

Costco has its brand strategy down, and it is tied to the pricing strategy. Costco has committed to its customers to provide quality items at competitive prices, and they’ve delivered even in a volatile economy. Costco has managed to maintain competitive prices on core merchandise and make strategic pricing adjustments on items that matter most to members. Their private label brand, Kirkland Signature, highlights their value-first approach. They continue to lead with price reductions like:

- Organic Peanut Butter: $11.49 → $9.99

- Chicken Stock: $9.99 → $8.99

- Sauvignon Blanc: $7.49 → $6.99

Costco has figured out how to balance premium offerings for cost-conscious consumers with standardly priced items filling the shopper’s basket. This demonstrates that they have a pricing strategy that relies on competitive intelligence and market trends.

With the correct data and tools, any retailer can conduct research to discover more about their competitors and gain usable insights into their implemented pricing strategies. Once established, this can act as an early warning signal so you can take action.

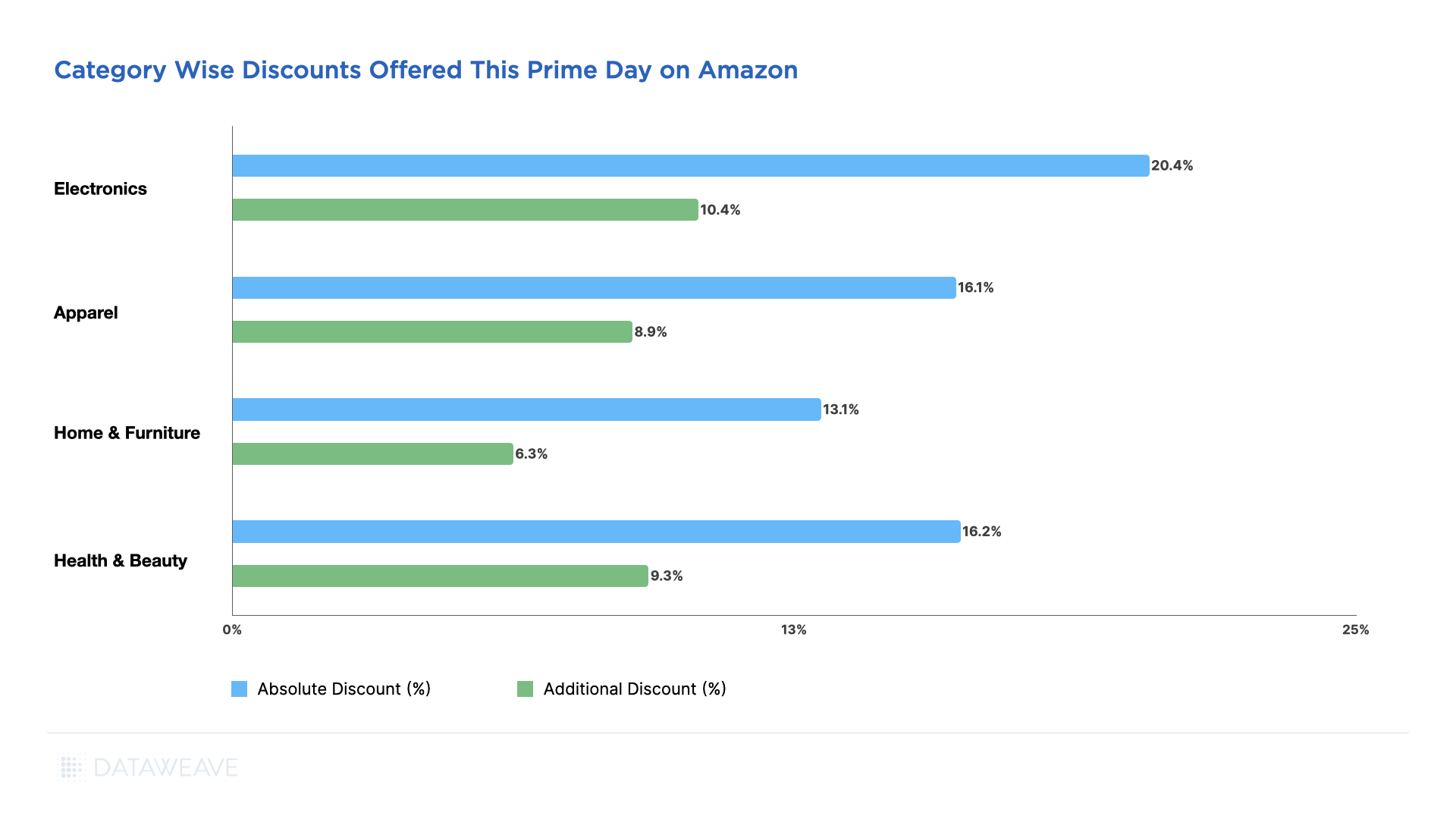

For example, understanding whether a retailer operates with a stable Everyday Low Price (EDLP) strategy or a more dynamic High/Low pricing approach is crucial when building and maintaining the integrity of your pricing strategy.

Data should be able to show you things like:

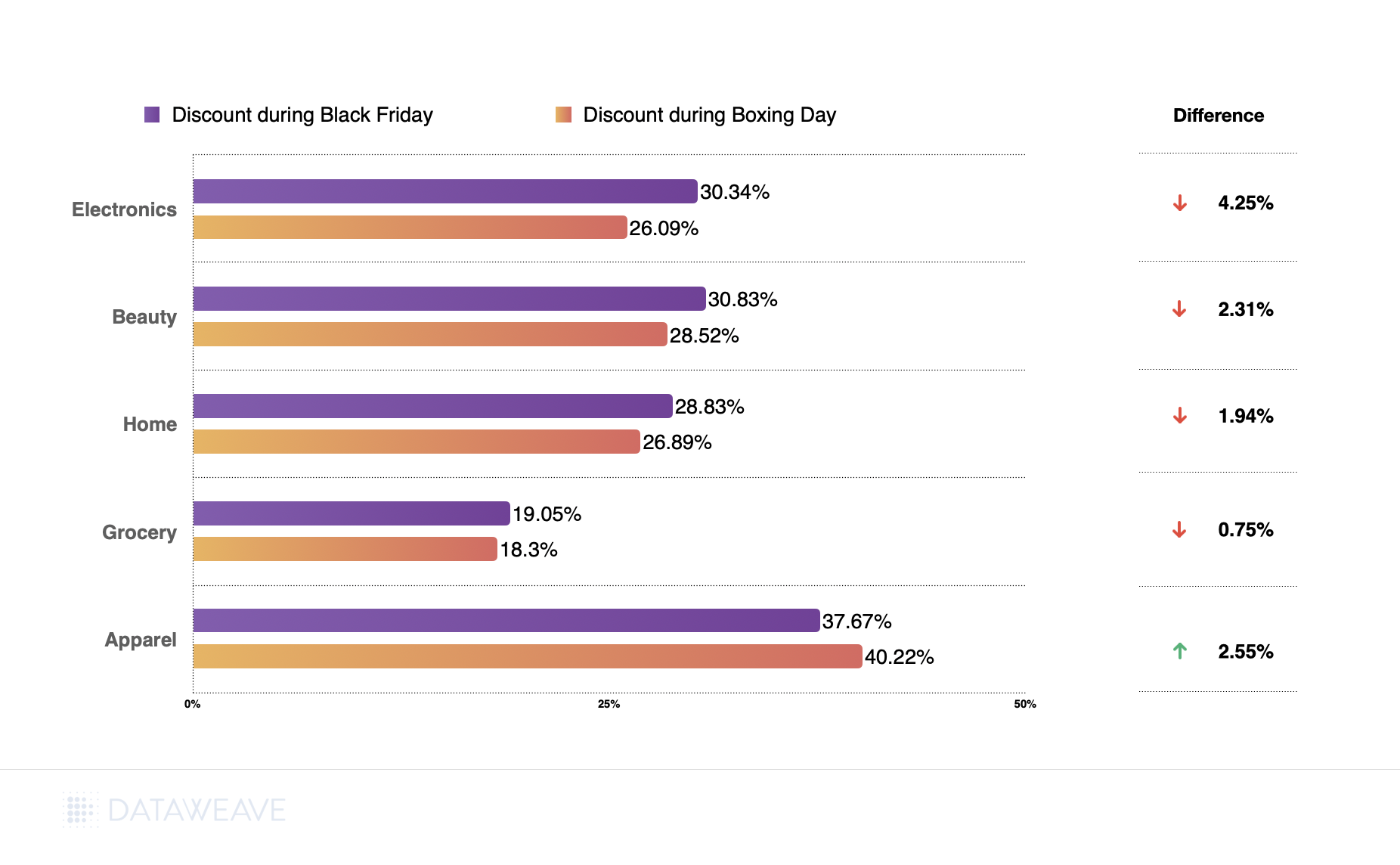

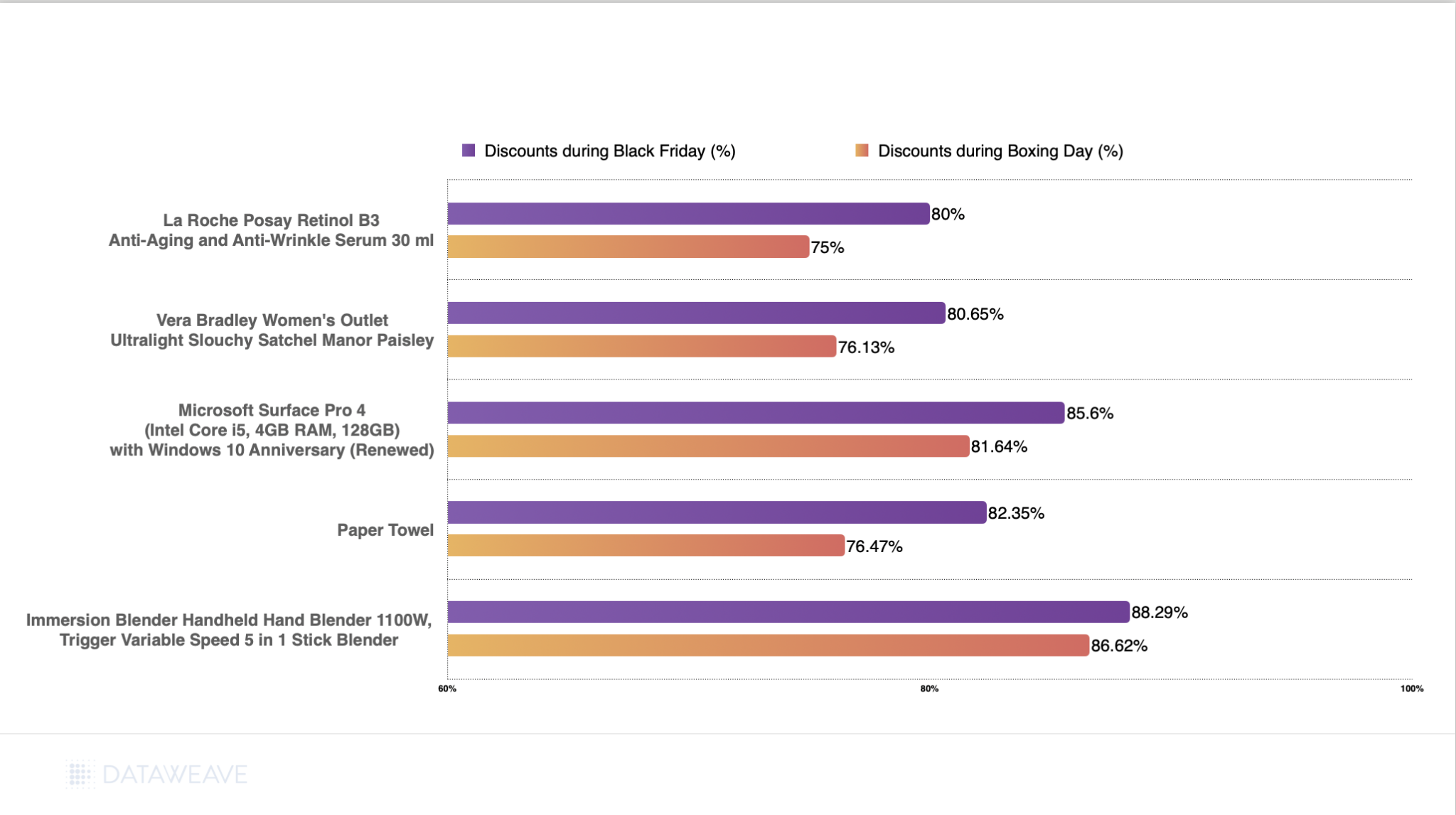

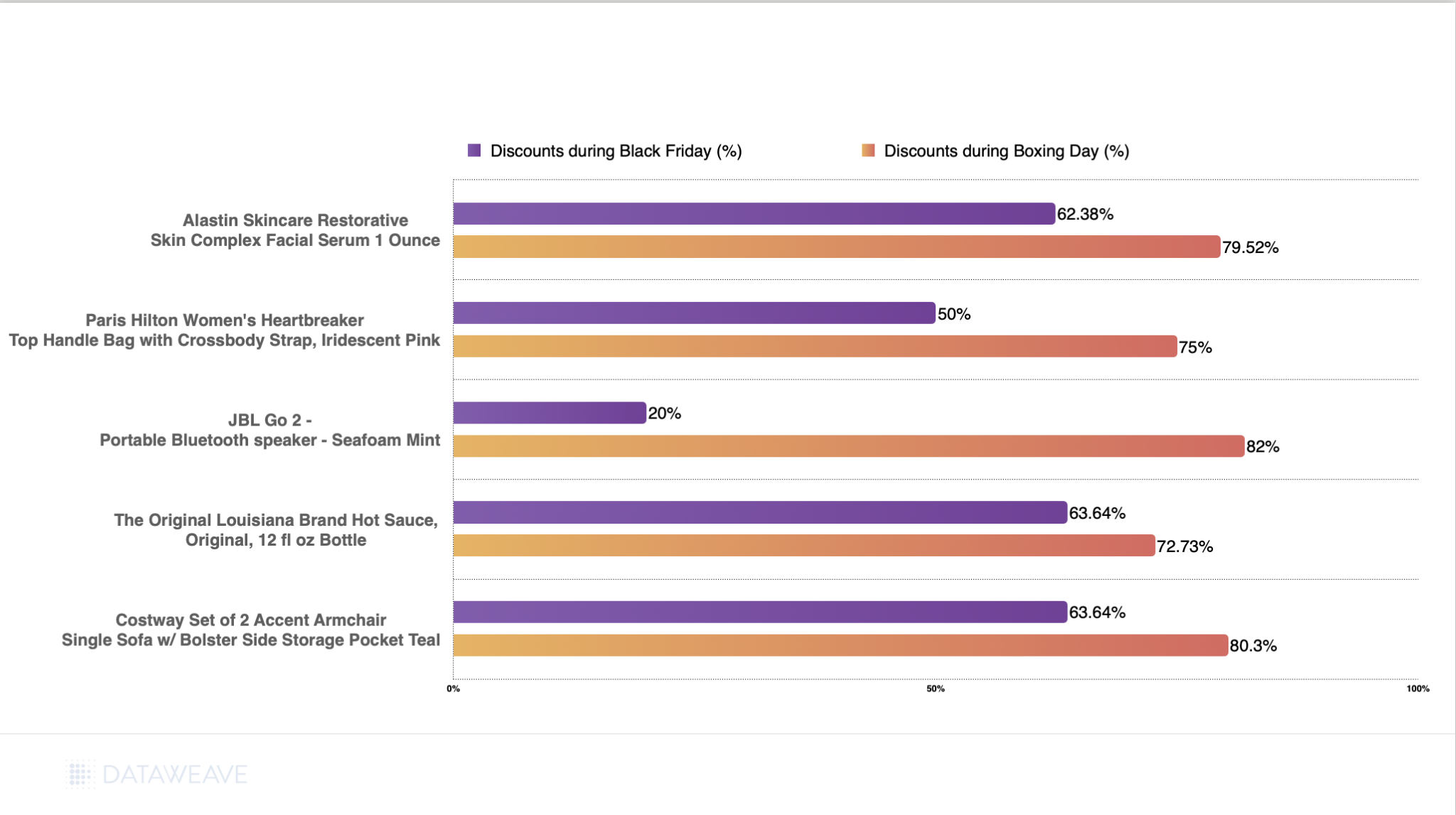

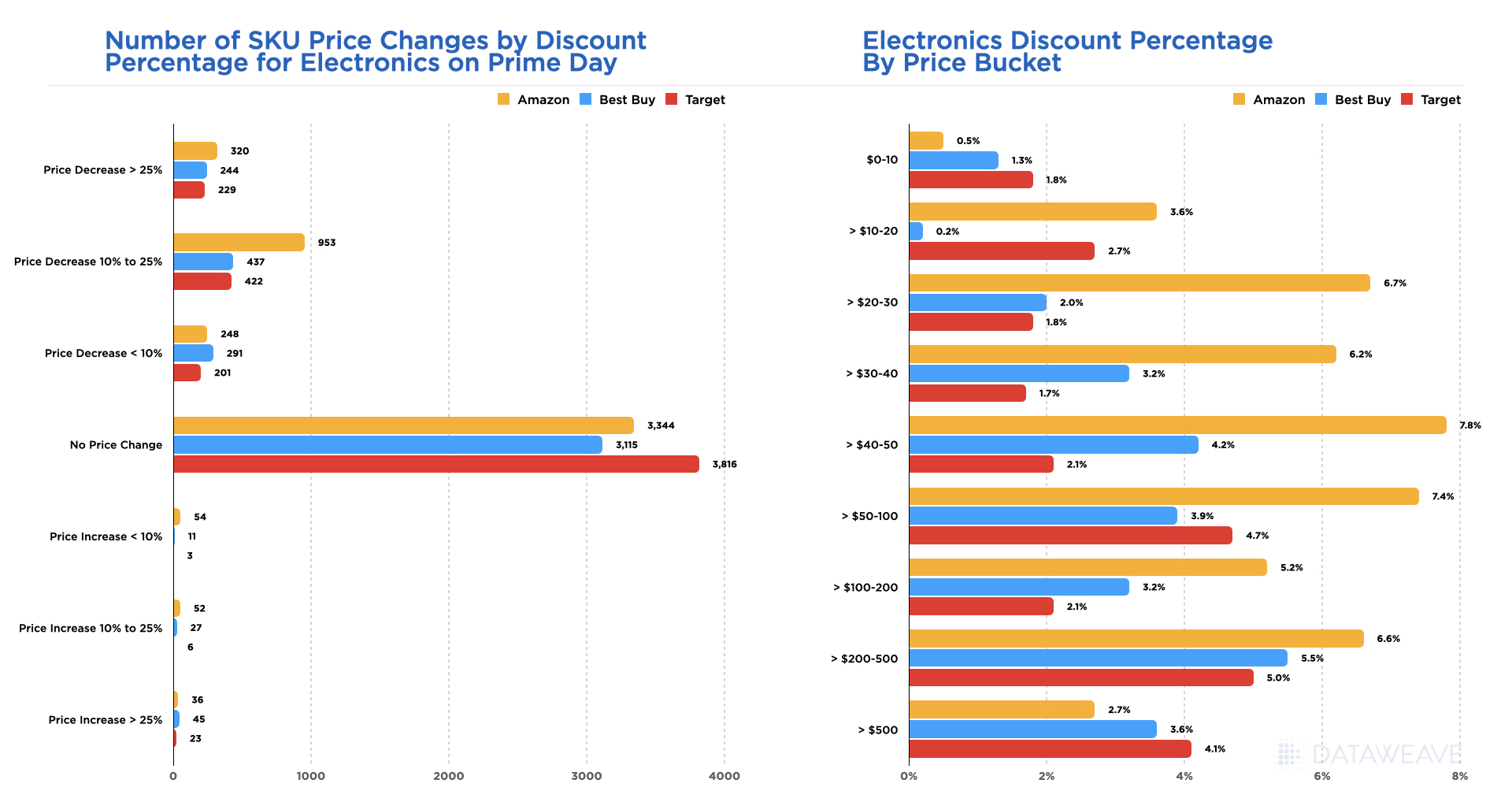

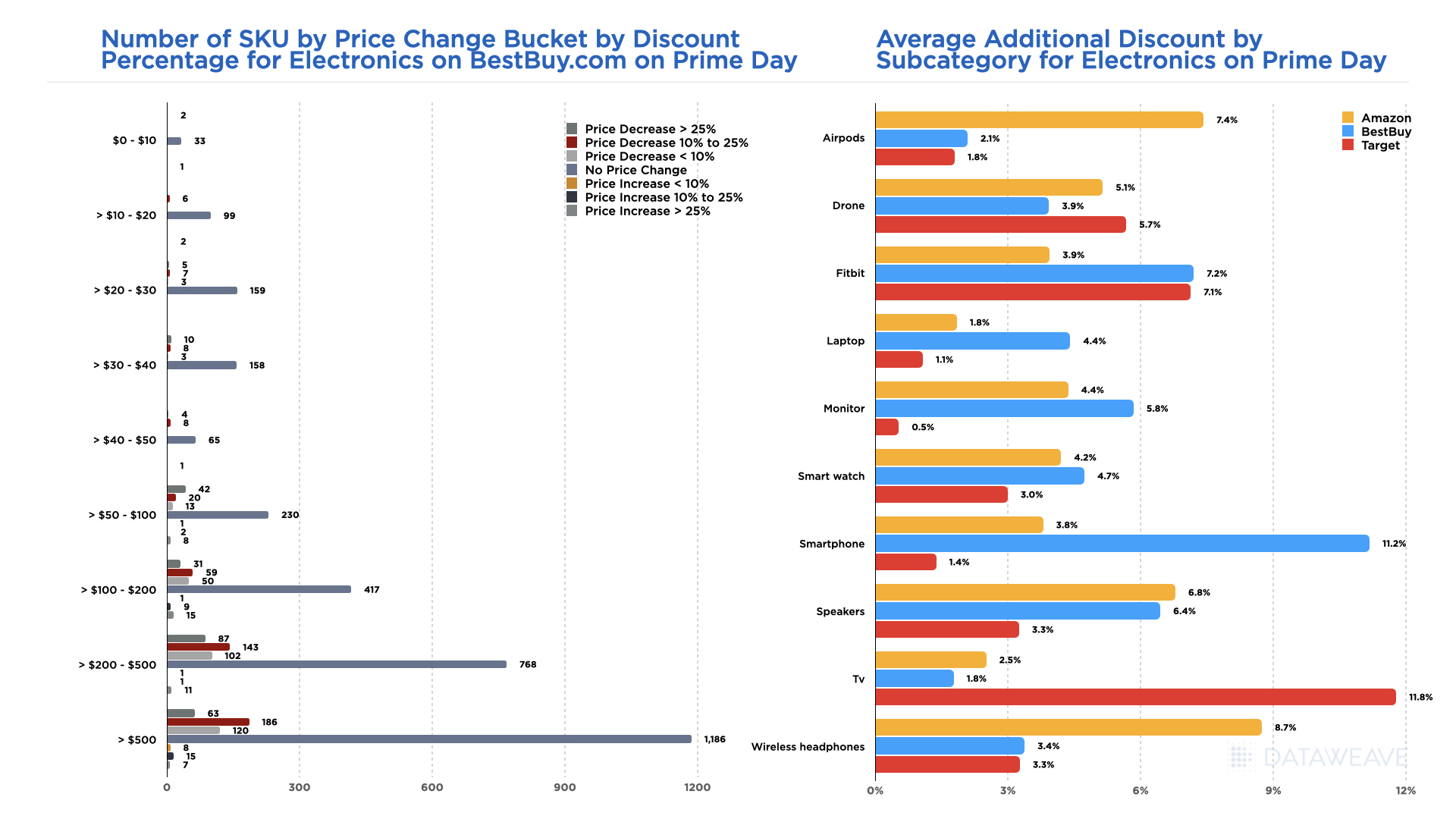

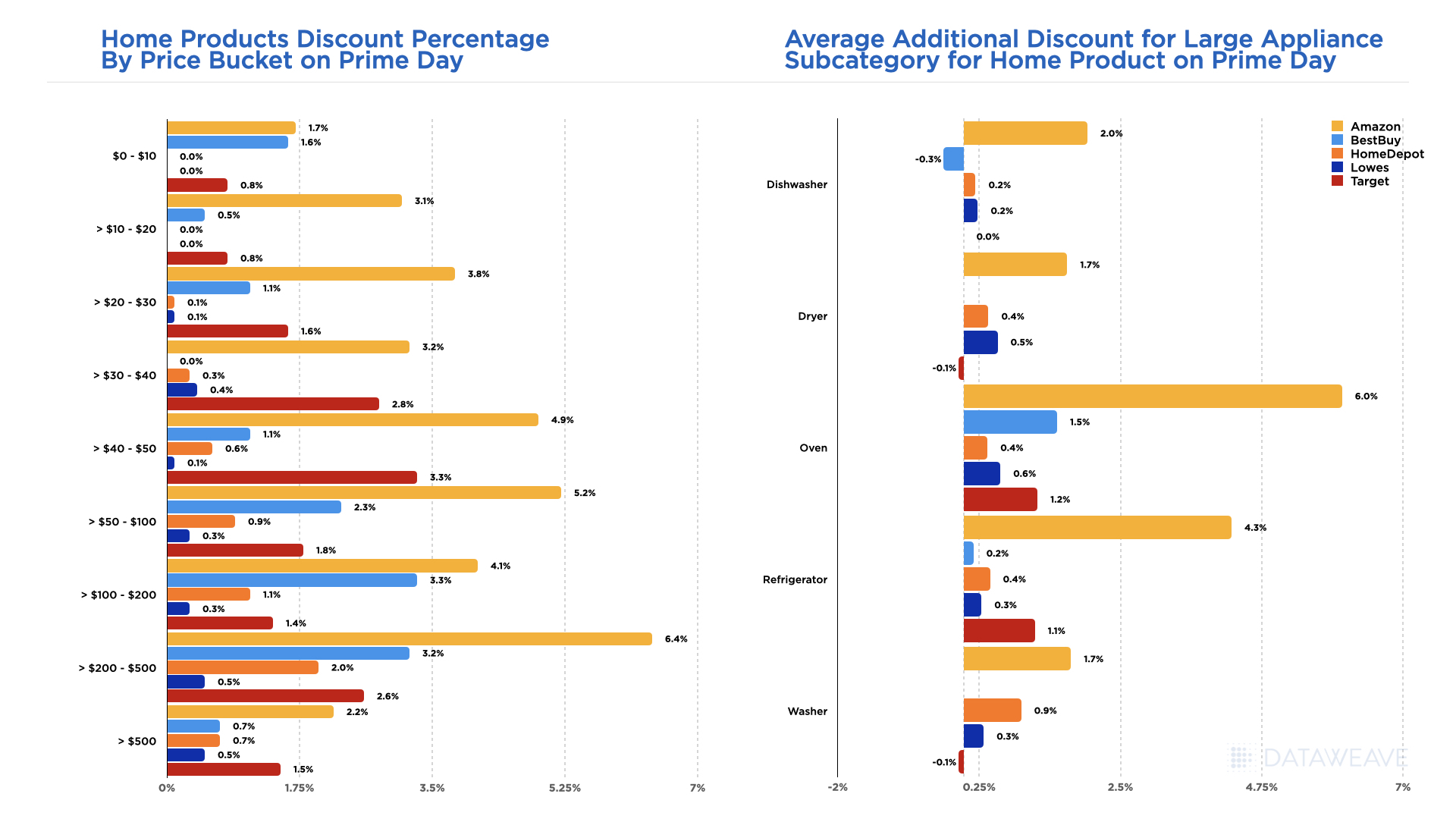

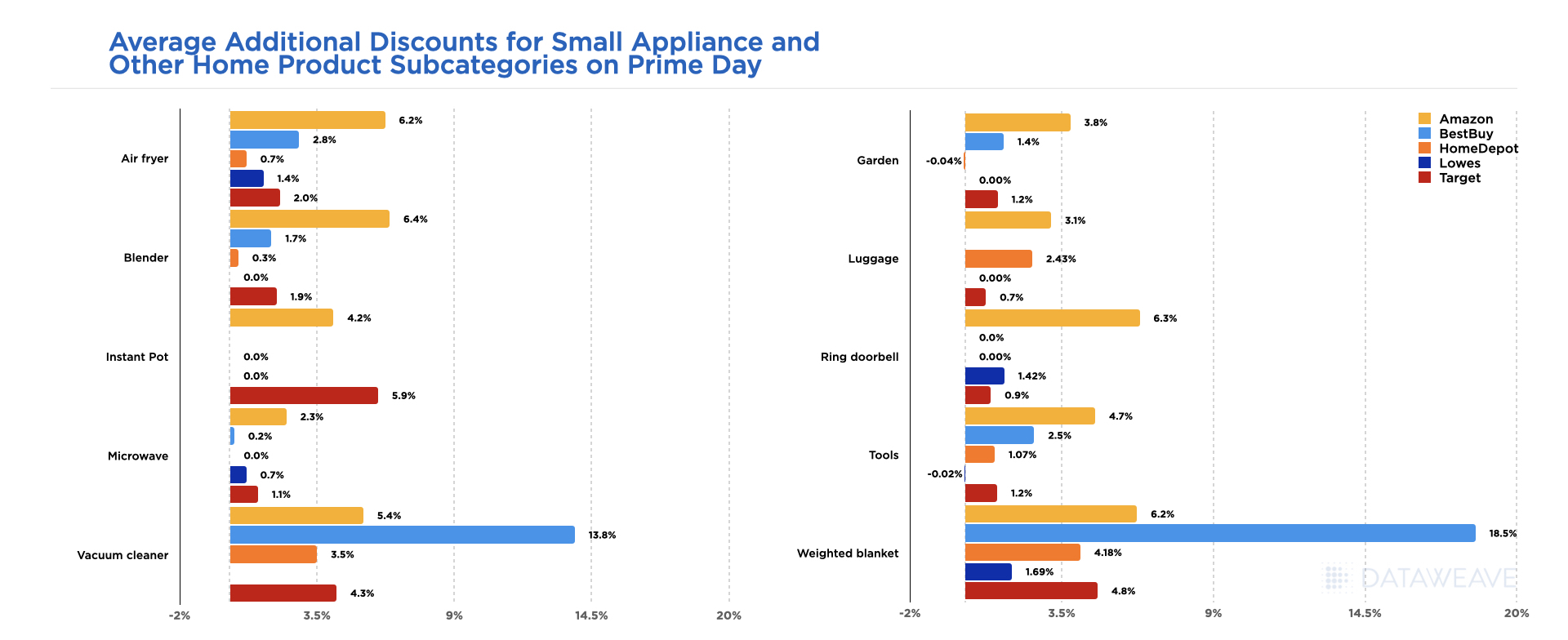

- When holiday price decreases start to accelerate

- How quickly a retailer responds to cost increases (especially at the category or item level)

- The cadence of seasonal campaigns and their impact on pricing behavior

When we move beyond the numbers, these patterns tell a story about how to win in today’s competitive retail landscape. After all, pricing isn’t just a standard reporting tactic. In its truest form, it’s a strategy rooted in understanding the bigger picture of your consumers, competition, and the economy.

Actionable Intelligence Framework

With a practical system to turn insights into action, your company’s pricing strategy is much more likely to drive actual results. Merely collecting data and churning out out-of-date reports won’t cut it. Instead, begin to identify patterns and insights for accurate competitive intelligence. Use this simple framework to start setting up a comprehensive competitive intelligence process.

- Setting up monitoring systems: Leverage technology to monitor and aggregate data on your competition, market trends, and consumer behavior. Ensure the system chosen can clean and refine the data along the way so it’s ready to be analyzed.

- Creating action triggers: Define clear thresholds and triggers based on key insights. These can be things like price changes of a certain amount, competitor moves, assortment changes, or regional and geographic trends. These triggers should prompt specific, pre-planned actions for your team to capitalize on opportunities.

- Response protocol development: Change management is easier with a plan. Work on building out and training your teams on protocols for specific triggers. When something arises, they know the protocol to take advantage of the opportunity or mitigate the challenge effectively.

- Performance measurement: Measure the impact of your team’s protocol-based actions with the help of pre-determined KPIs and then hone your approach to competitive intelligence based on the results.

Competitive Intelligence at Your Fingertips

Shifting from a latent standard reporting and price monitoring mindset to a growth mindset centered around competitive intelligence doesn’t need to be a struggle. The key is to lean on the tools that will accelerate your company’s journey to finding the right insights and putting action behind them quickly.

Start by conducting a competitive intelligence maturity assessment to evaluate your organization’s current state and identify areas for improvement. Then, create a capability development roadmap for your company to track efficacy and progress toward your goal.

Want to talk to the experts in competitive pricing intelligence? Click here to speak with the DataWeave team!