The retail landscape has reached a point where traditional strategies are no longer enough. Tariff shocks are driving up costs in categories like electronics and apparel, while freight disruptions are extending lead times. Retail executives are now operating in an environment of unprecedented complexity.

In response, many of the world’s largest retailers and brands are shifting critical operations to Global Capability Centers (GCCs) in regions such as India, East Asia, and Africa. Once focused on back-office support, GCCs are rapidly evolving into strategic intelligence hubs powering high-impact decisions on pricing, assortment, content, analytics, and more. These decisions consistently influence both top-line growth and bottom-line performance for multibillion-dollar enterprises.

At DataWeave, we’ve been working closely with GCCs to help them achieve technical, tactical, and strategic advantages through actionable market intelligence. To further engage with the community and exchange ideas, we recently hosted our first GCC VIP Roundtable in Bengaluru. Leaders from organizations including JC Penney, Lowe’s, Kenvue, and ARKO joined us for a series of candid and insightful discussions on retail’s most pressing challenges and the evolving role of GCCs in driving leadership amid disruption.

In this article, we share the key themes, challenges, and solutions that emerged from these conversations.

Where GCCs Are Facing the Biggest Challenges

The Adoption Lag Challenge

A recurring concern among GCC leaders at the roundtable was the delay in translating insights into action. As one leader noted, “We have the data and insights at our fingertips, but it can take our internal teams an entire quarter to respond.” Others agreed with this sentiment, recognizing that such adoption lags create a competitive risk.

The pattern is consistent across organizations, while GCCs excel at generating insights, real-time responsiveness at the store level remains aspirational due to change management challenges and operational inertia.

The Integration Imperative

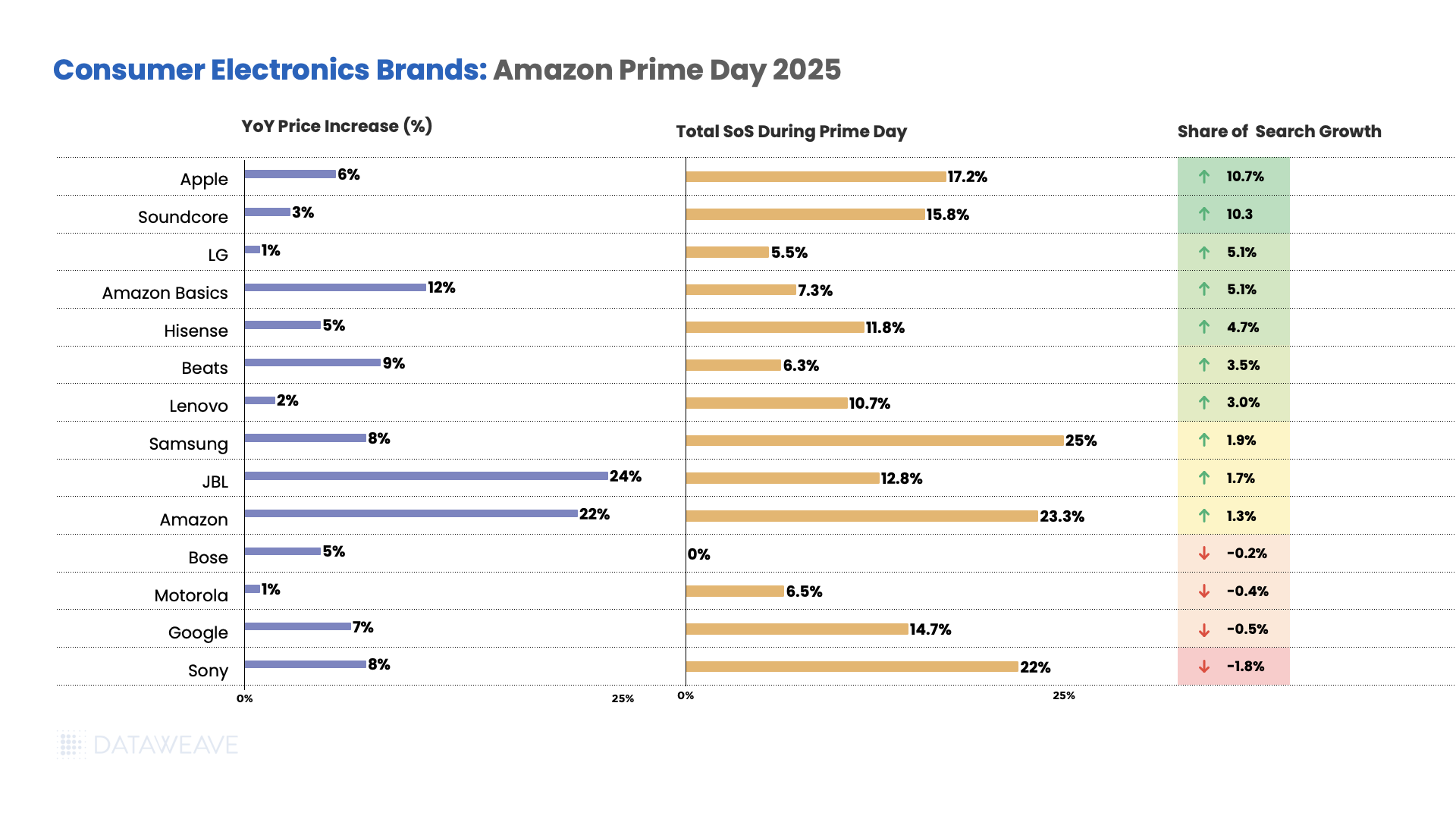

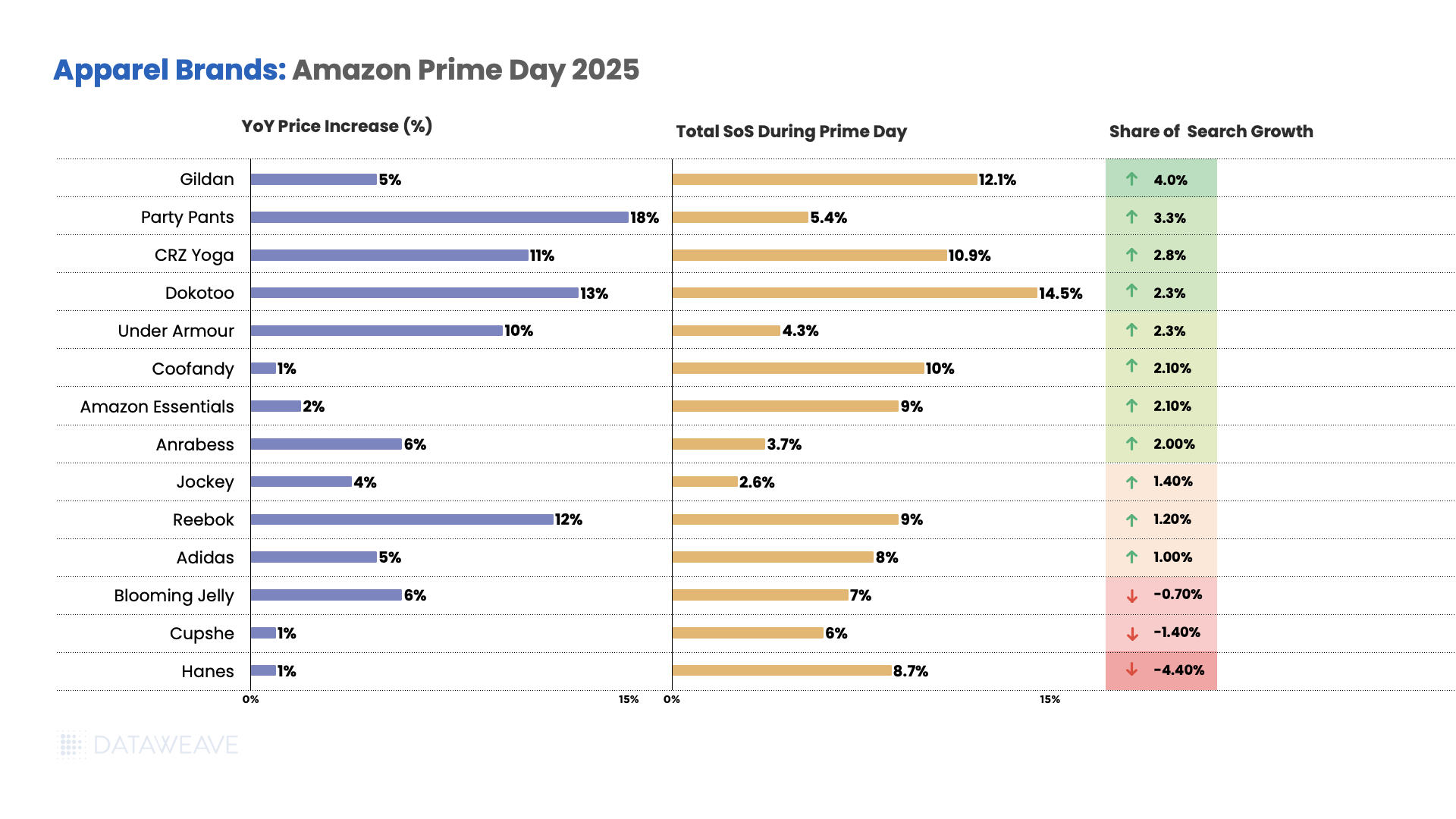

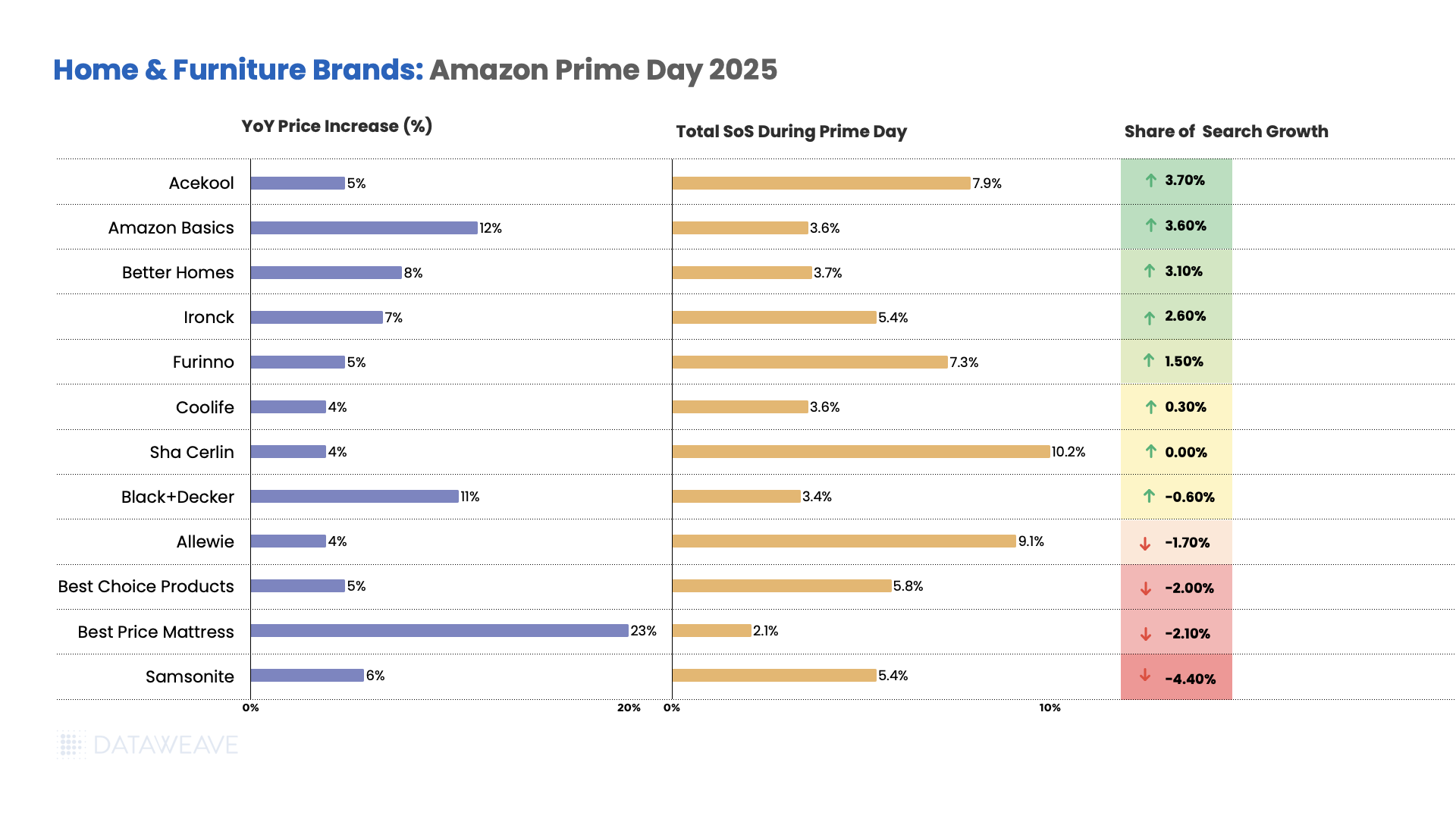

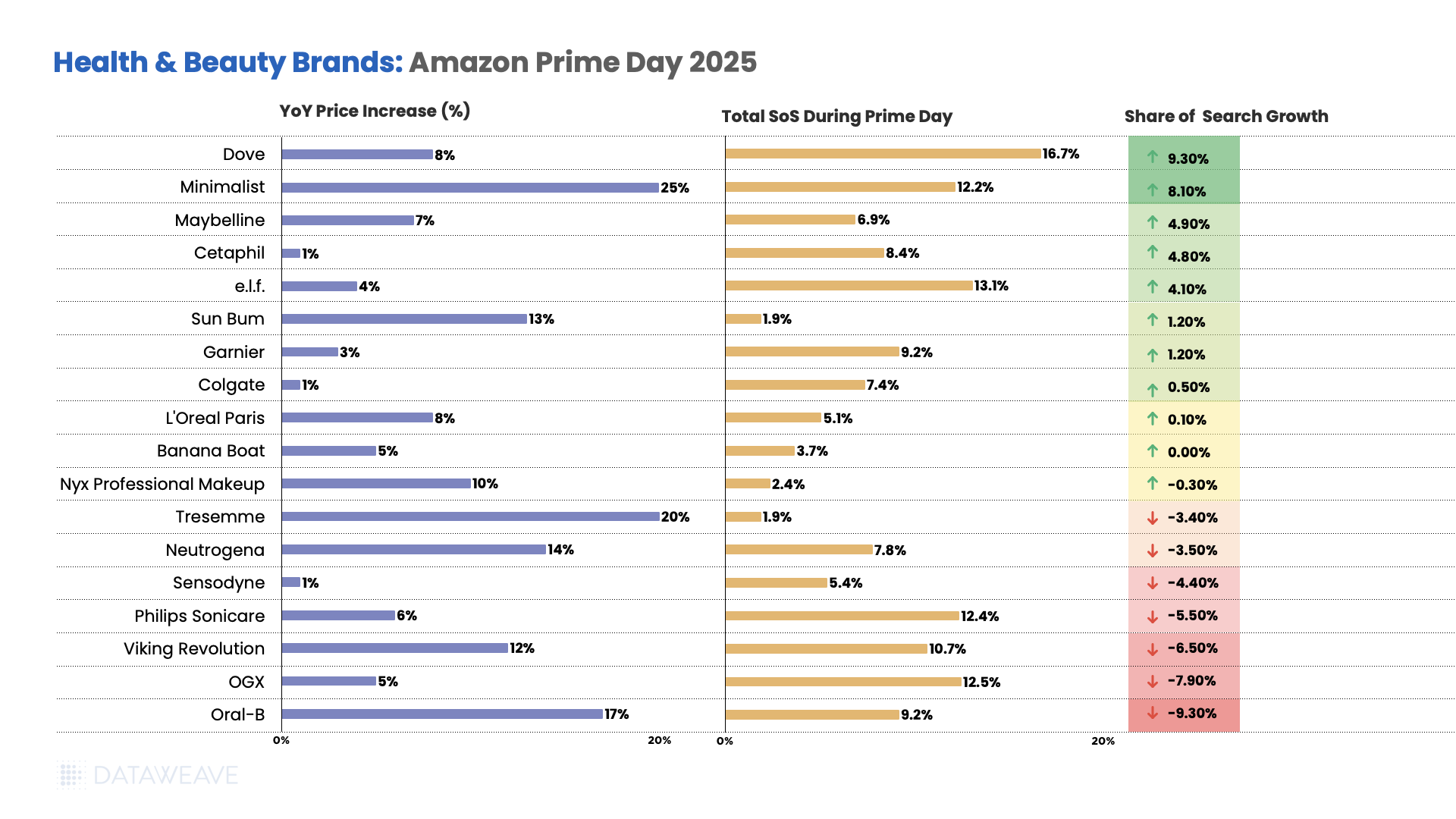

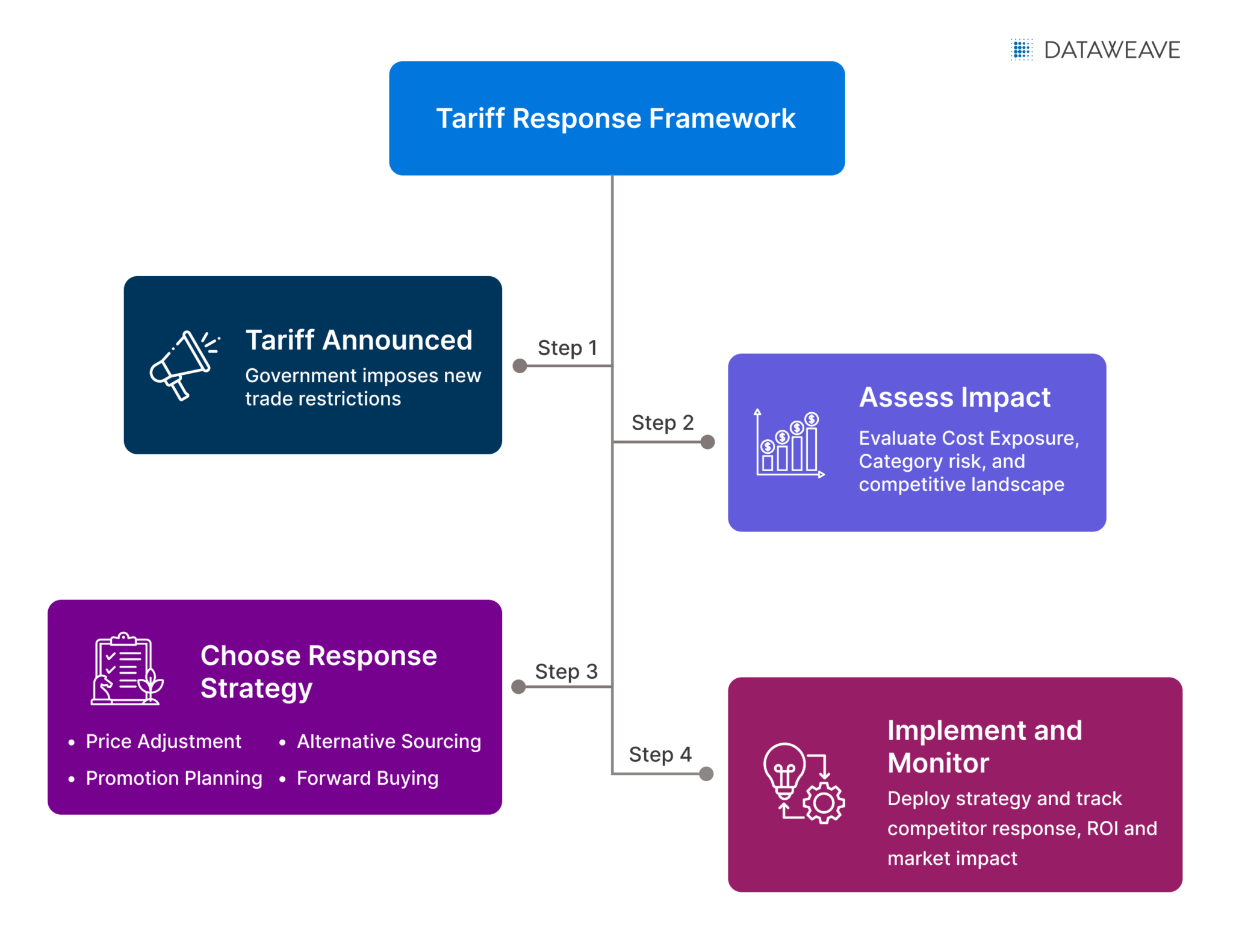

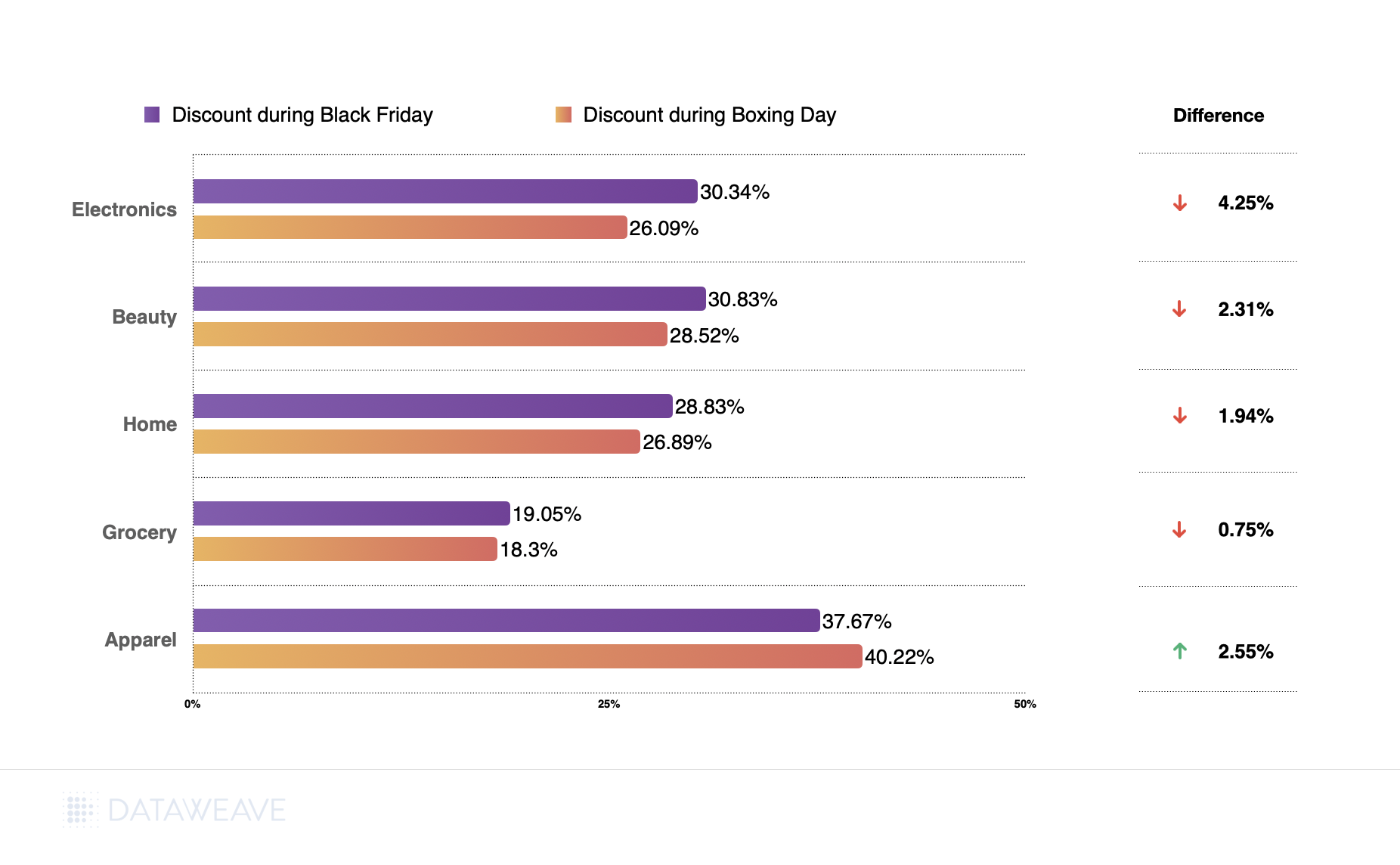

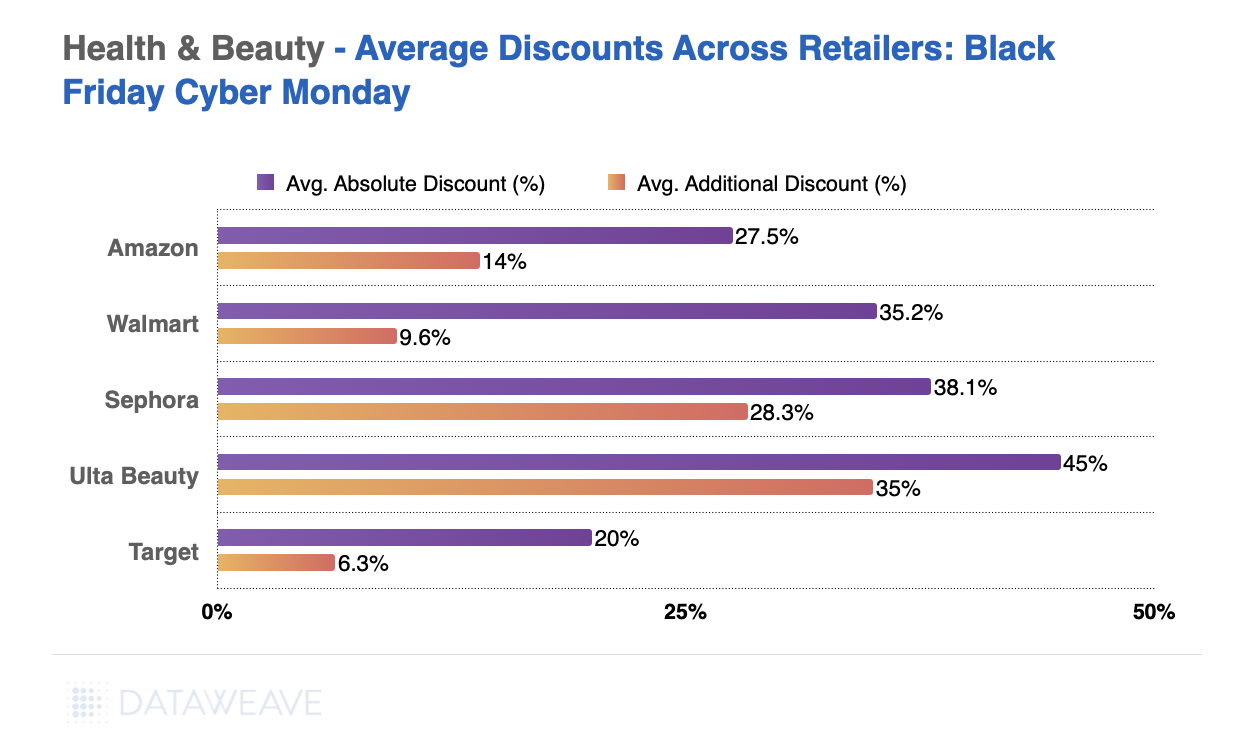

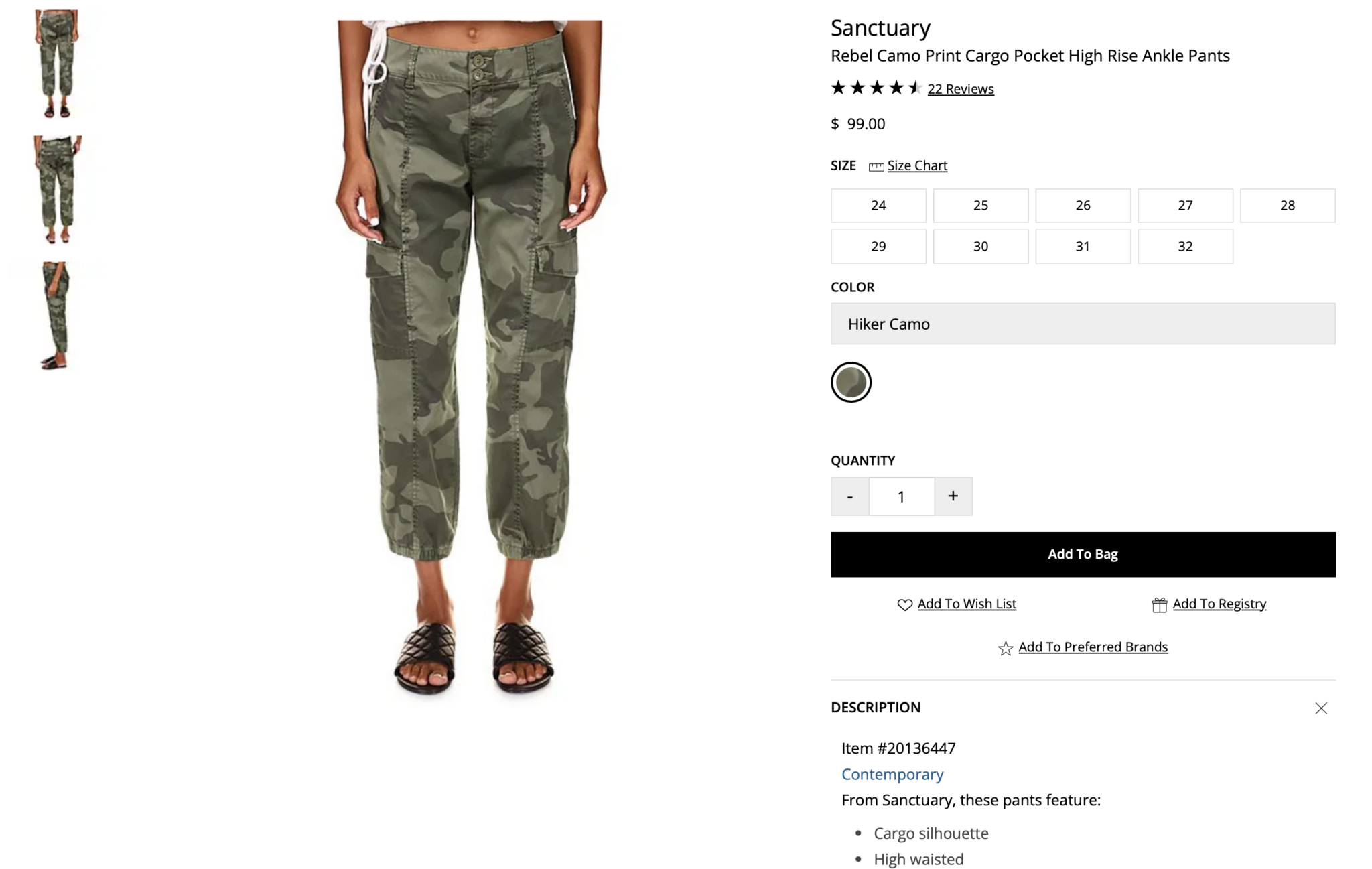

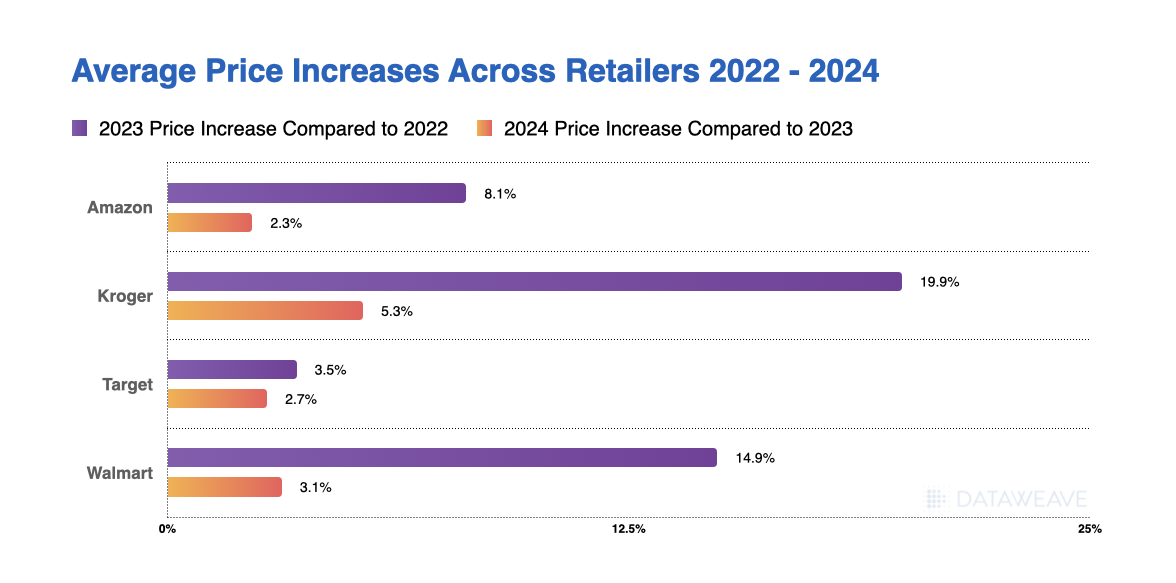

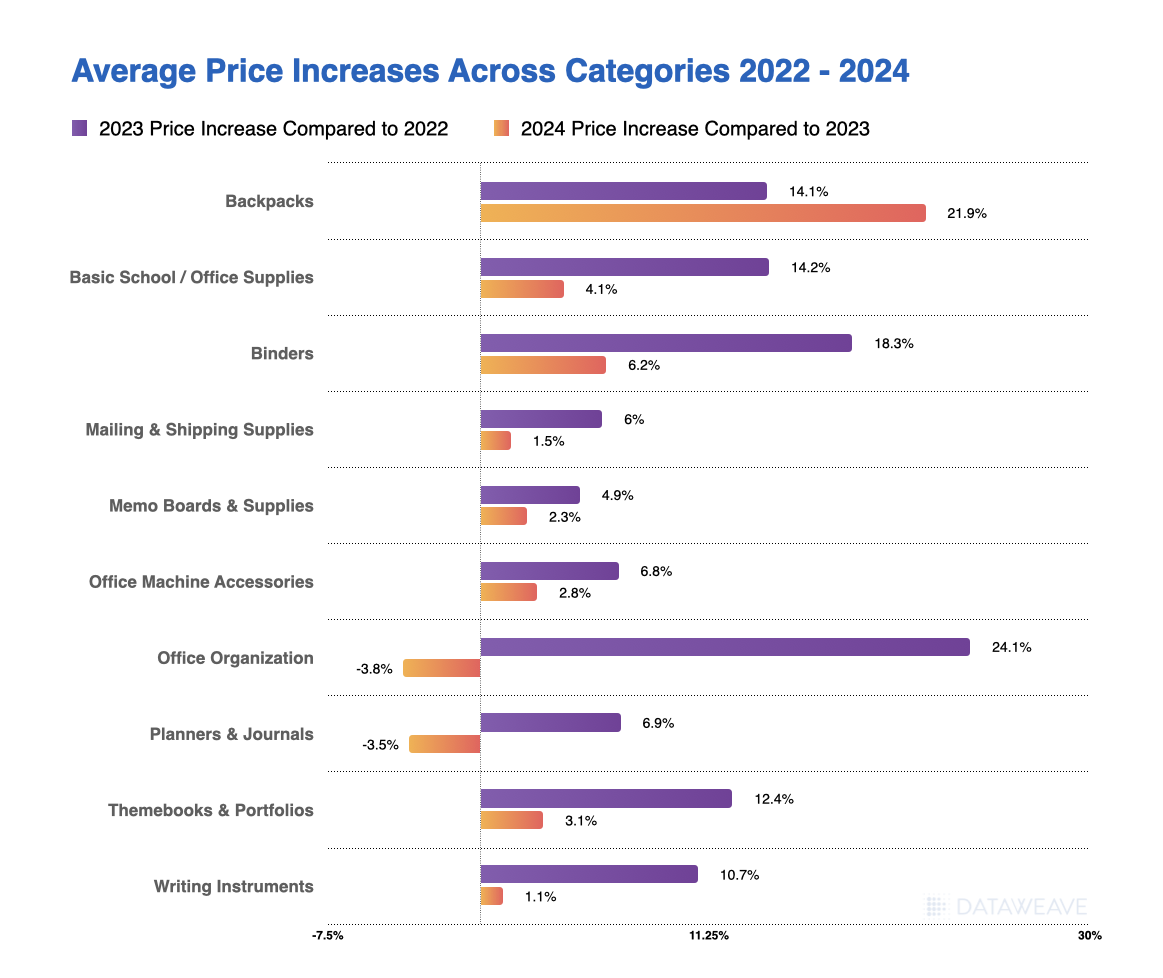

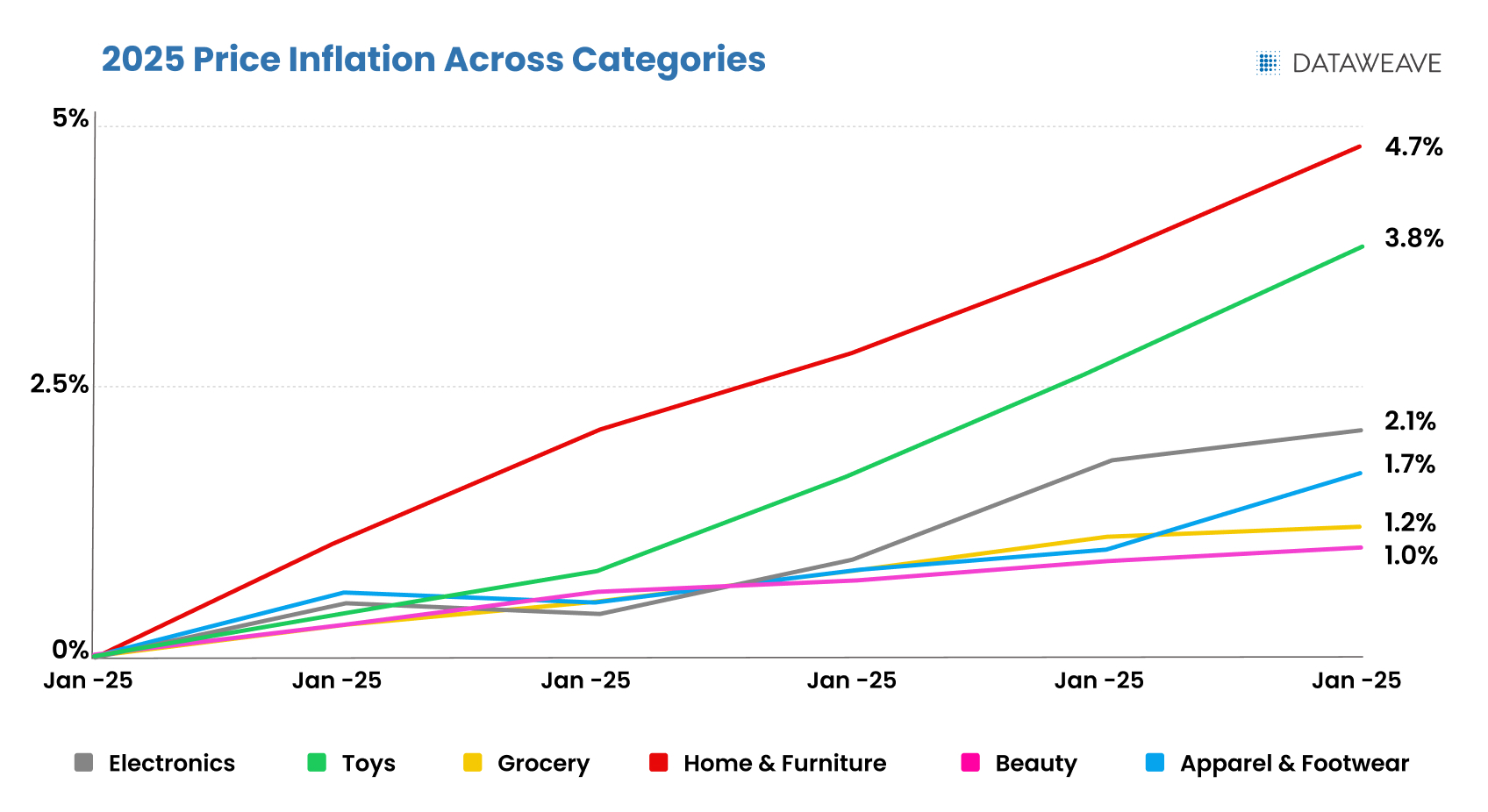

Our discussion with GCC leaders coincided with creeping evidence for the impact of tariffs across retail categories. Managing competitive intelligence is a difficult enough challenge. Now, pricing strategies must account for not just competitive positioning, but also rapid cost structure changes that vary dramatically by product origin and category.

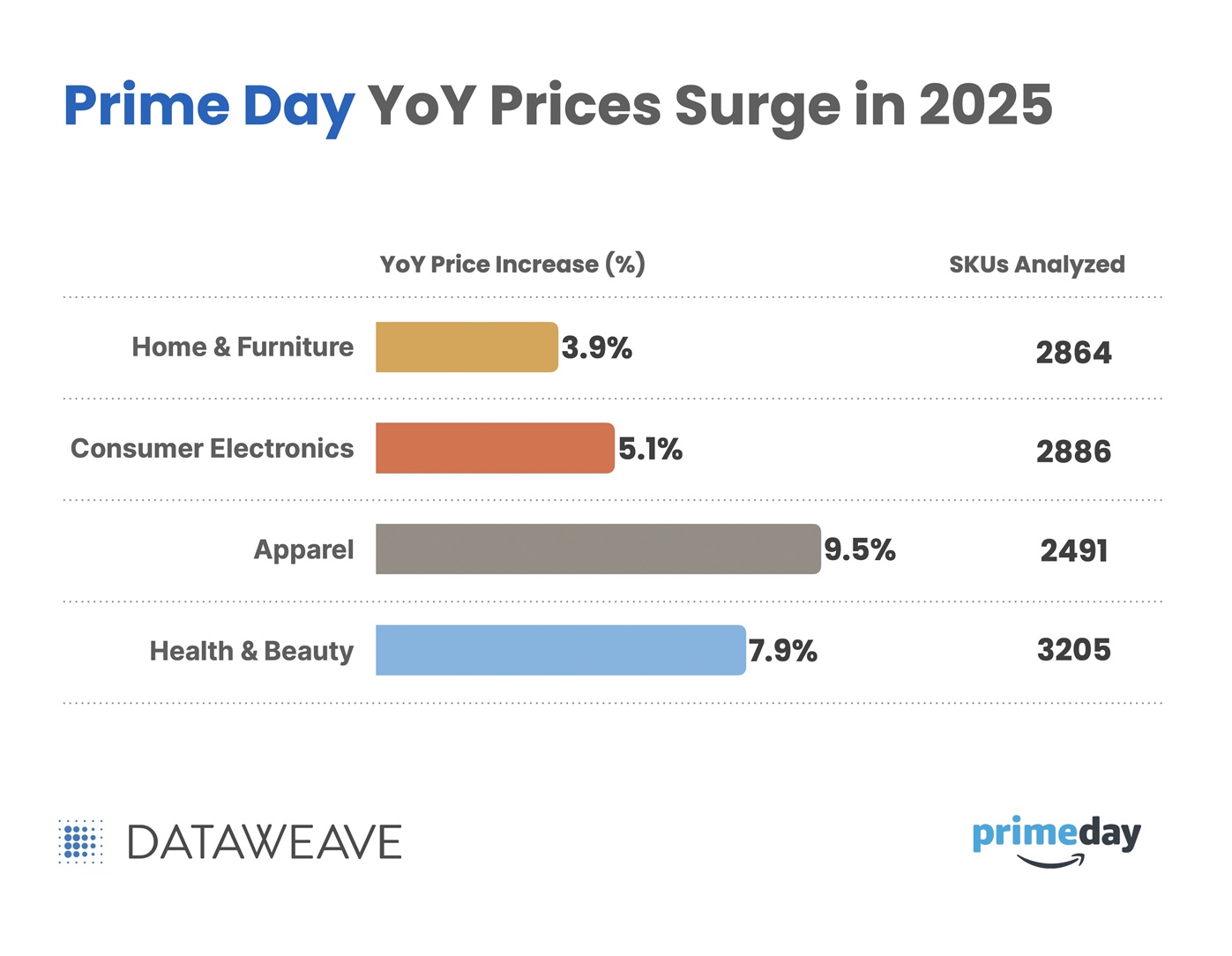

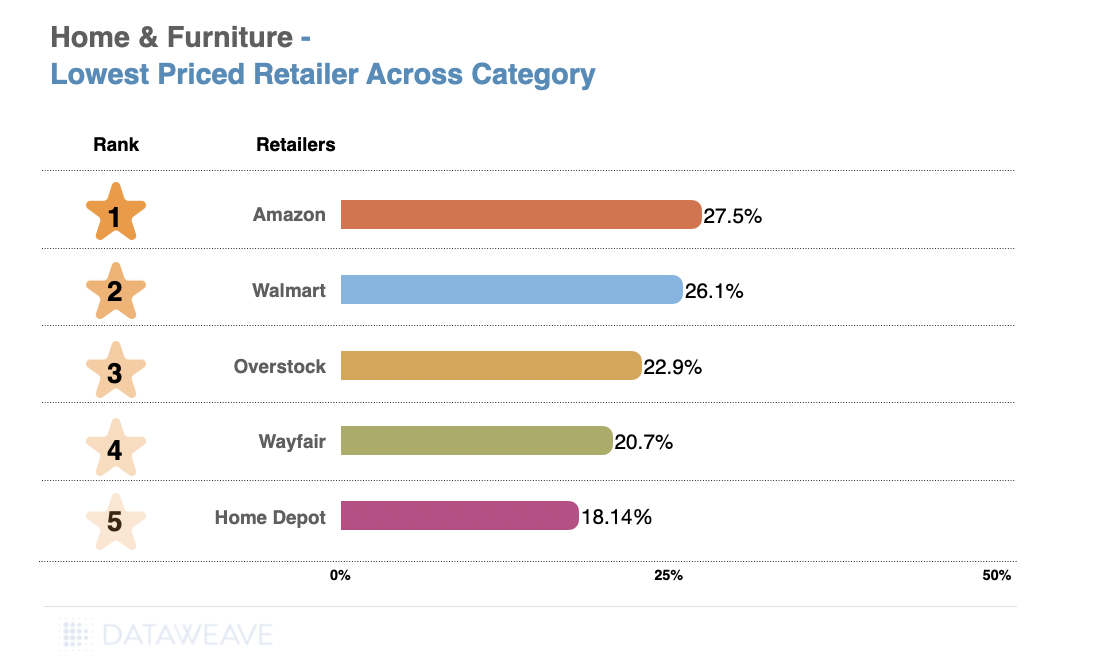

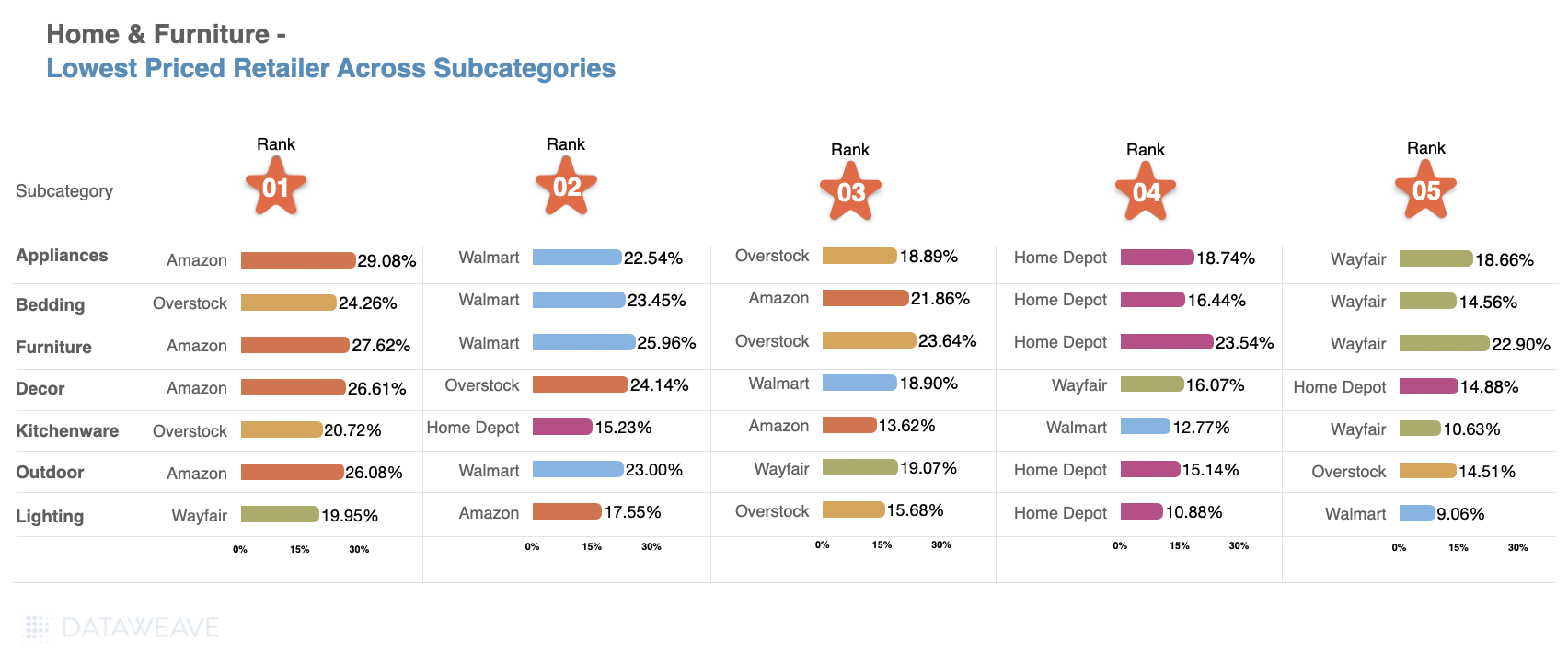

- Home & Furniture categories are experiencing the steepest price inflation trajectory, with increases reaching 4.7% by mid-2025.

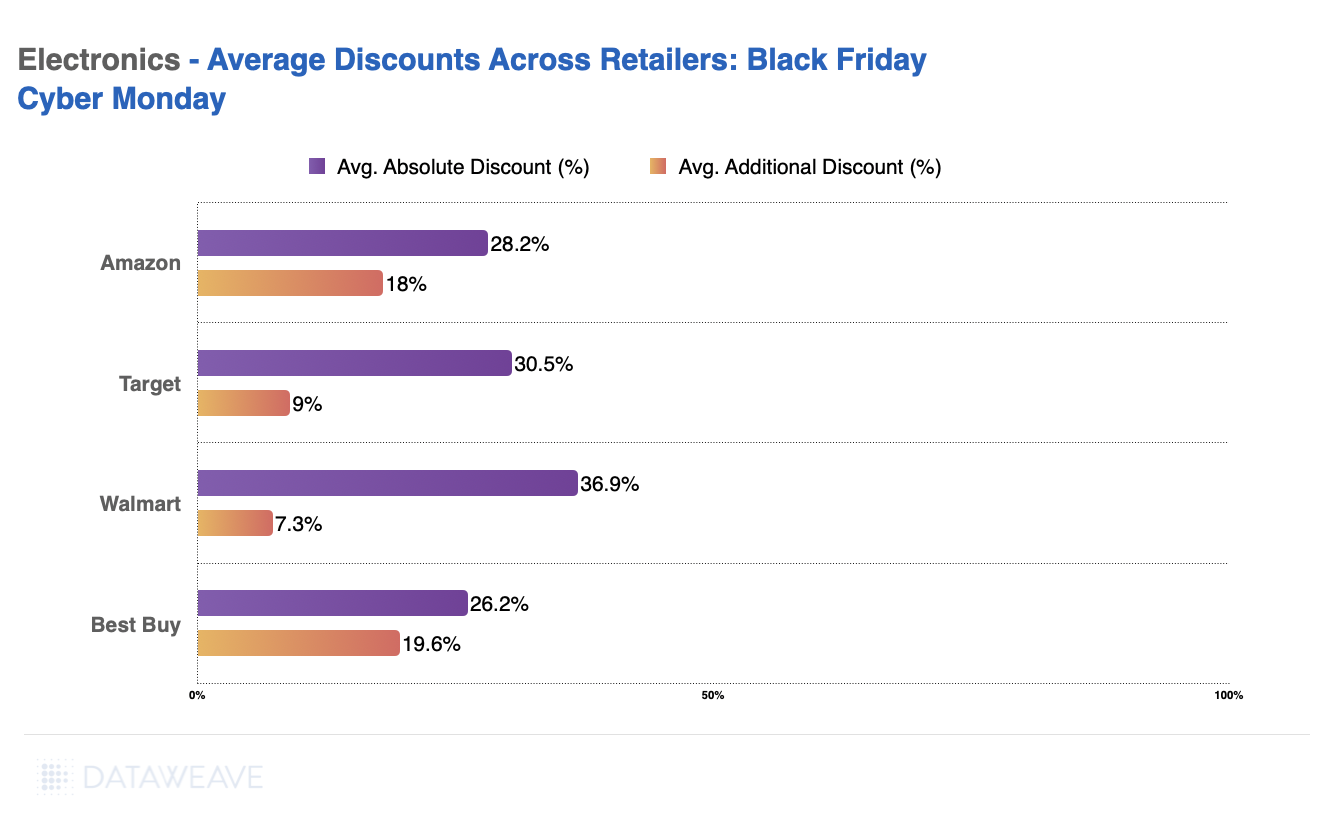

- Toys and Electronics follow closely at 3.8% and 2.1% respectively, both heavily dependent on international supply chains.

The Strategic Intelligence Evolution

Leading GCCs are responding by reimagining their role around critical capabilities:

Beyond Traditional Competitive Intelligence

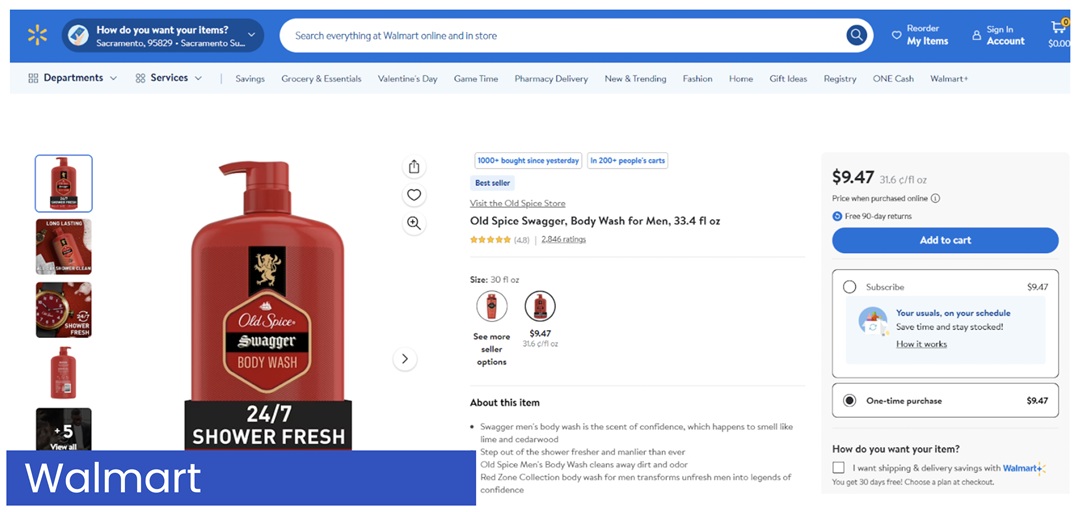

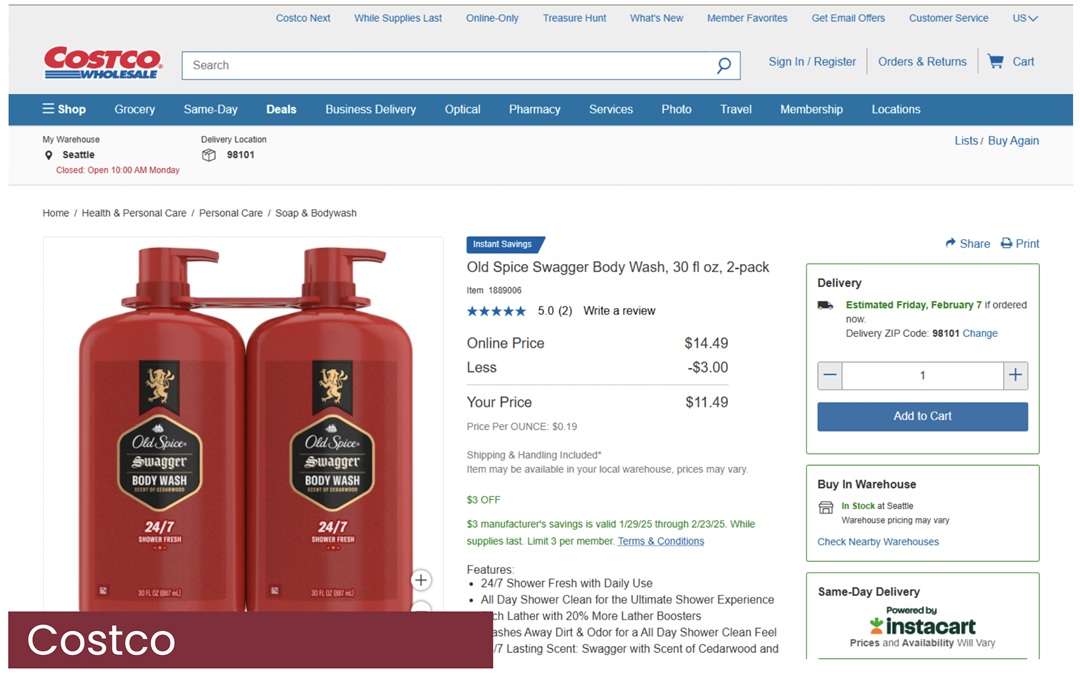

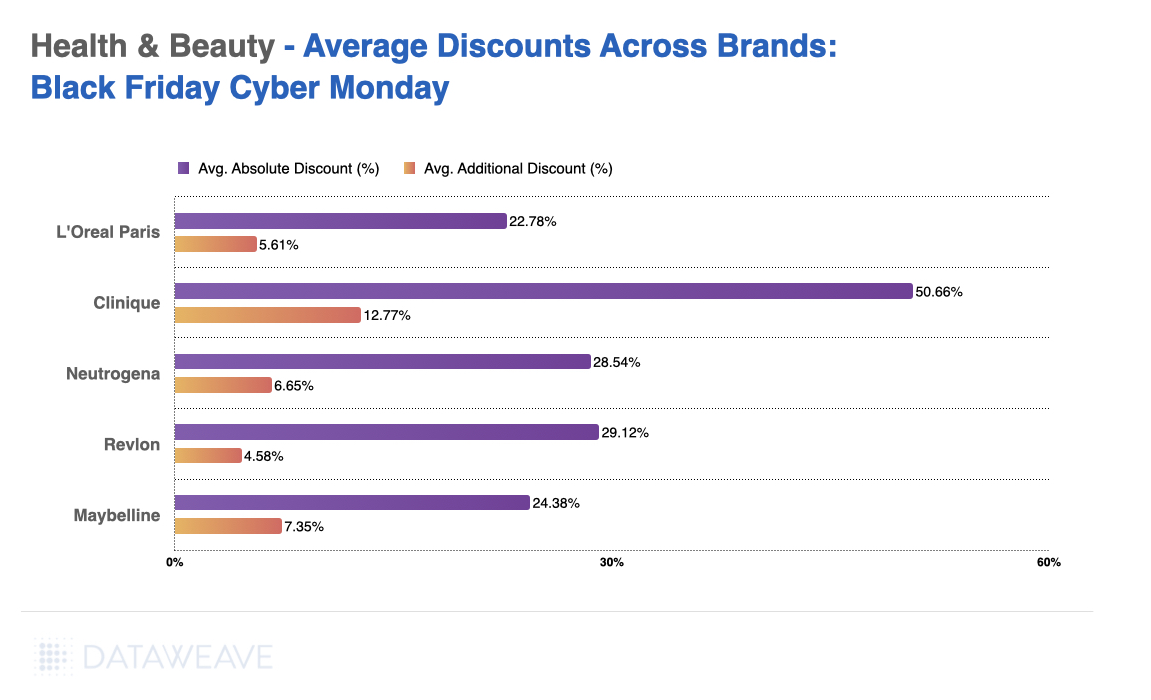

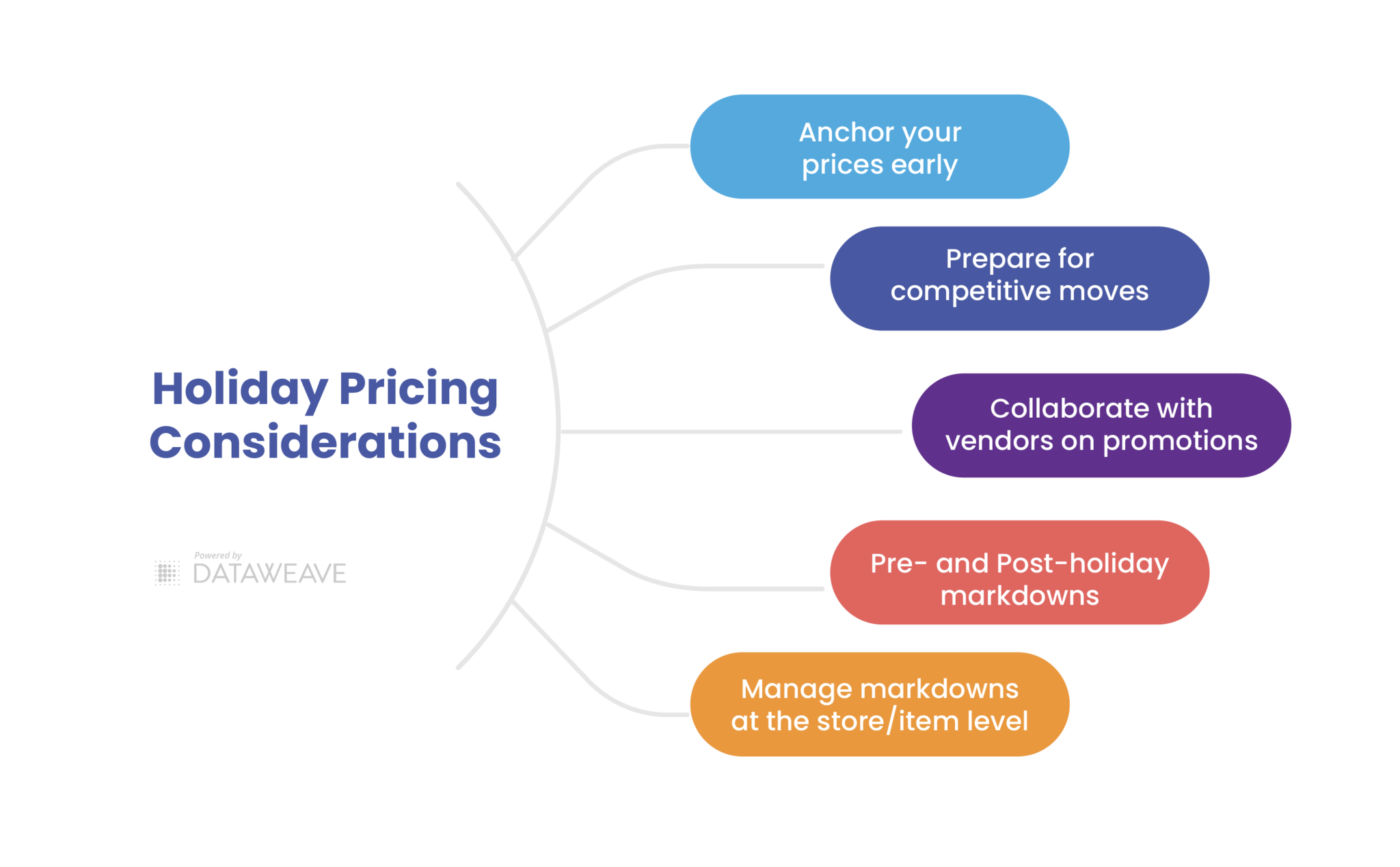

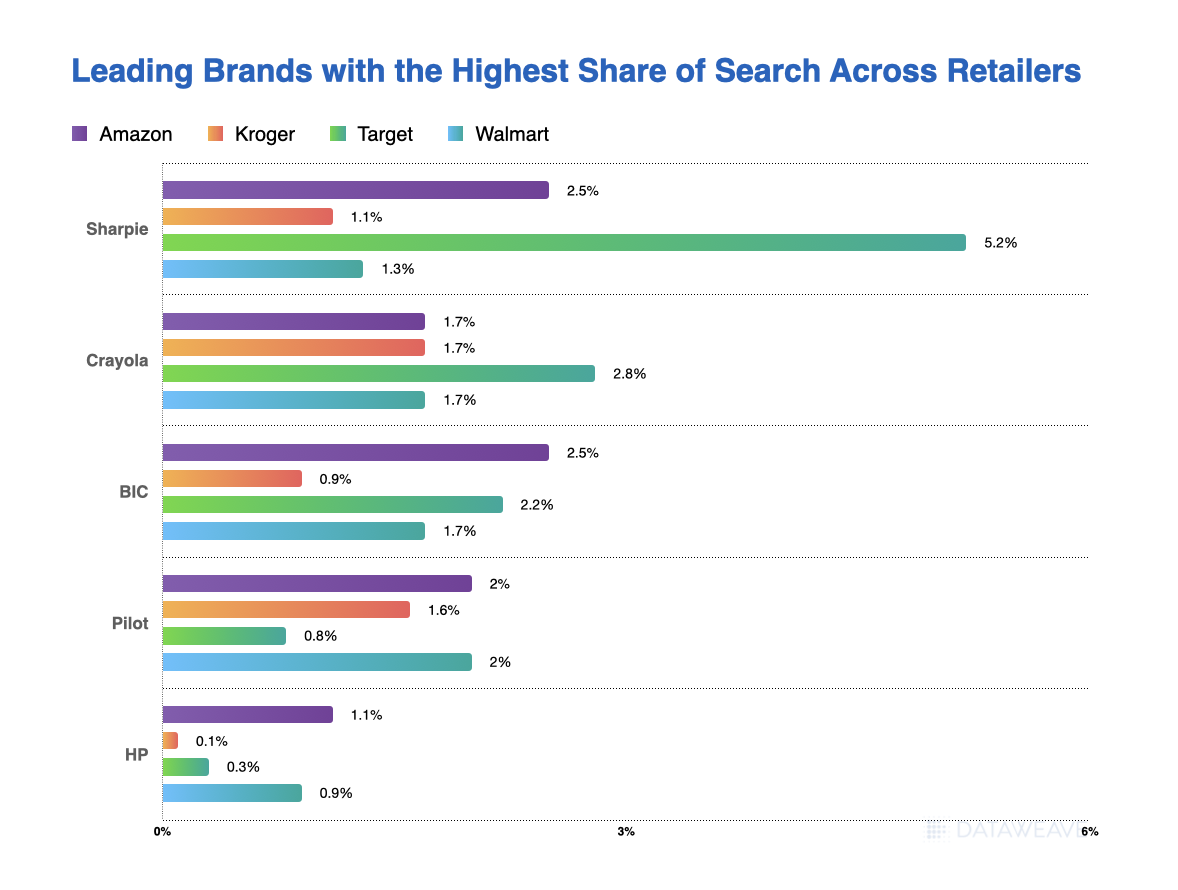

Pricing and content strategies now require integration of multiple variables:

- Category-specific trends

- Tariff impacts

- Competitive positioning

- Broader macroeconomic factors

Traditional pricing models that worked in stable environments are proving inadequate for this new reality.

Real-Time Responsiveness as a Competitive Edge

The shift from periodic reporting to always-on intelligence systems emerged as a critical theme. GCC leaders discussed the need for:

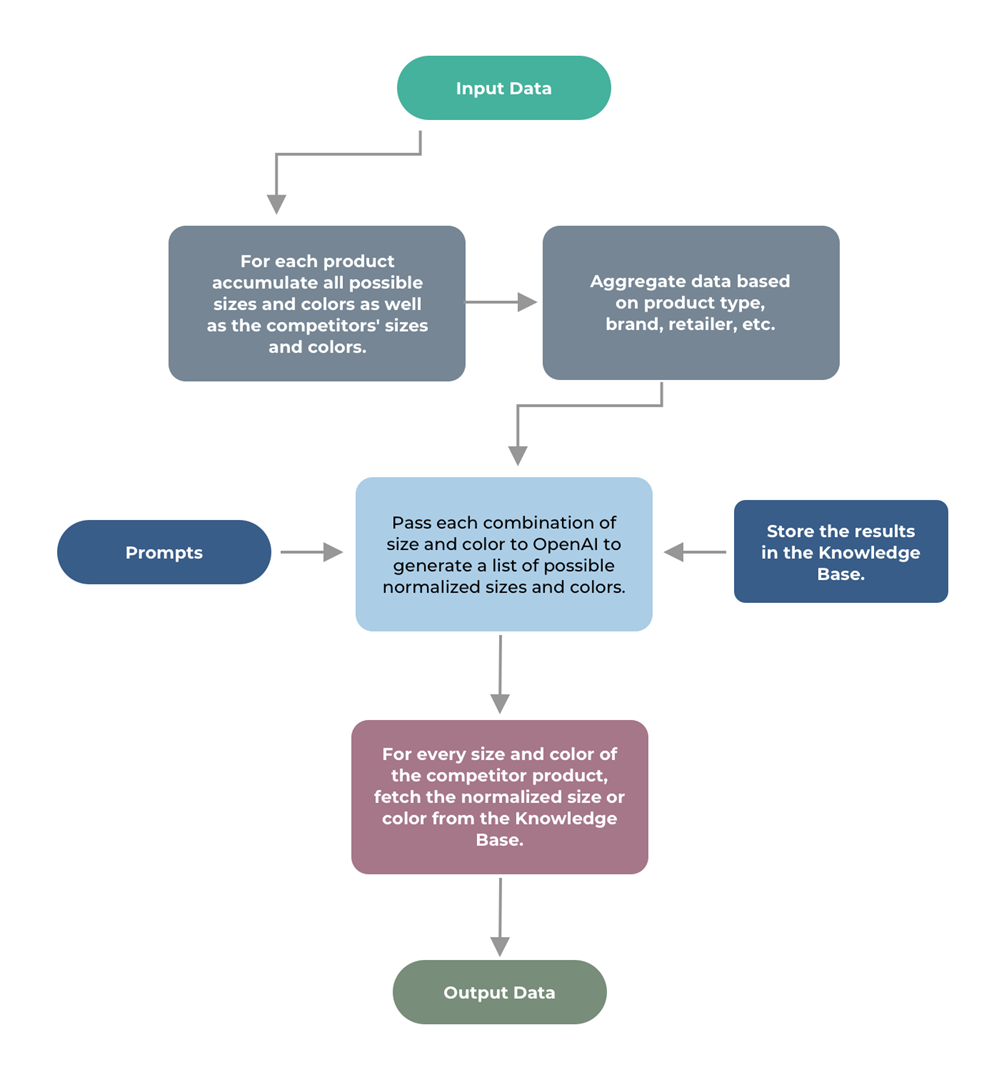

- Technical Infrastructure: Moving from batch processing to streaming data architectures, handling millions of SKUs daily

- Analytical Capability: AI-driven data refinement, including computer vision and natural language processing

- Organizational Agility: Breaking down silos between marketing, merchandising, and operations

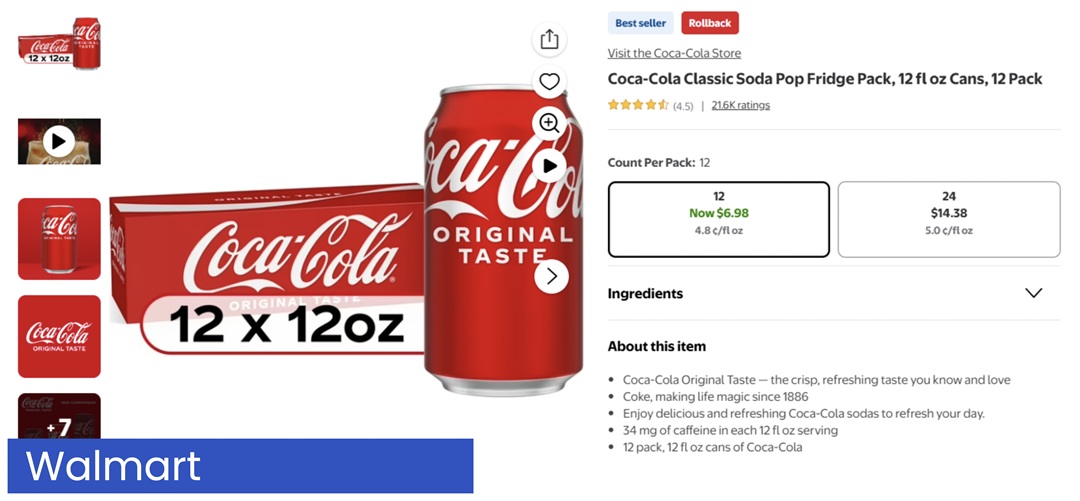

Regional Complexity Management

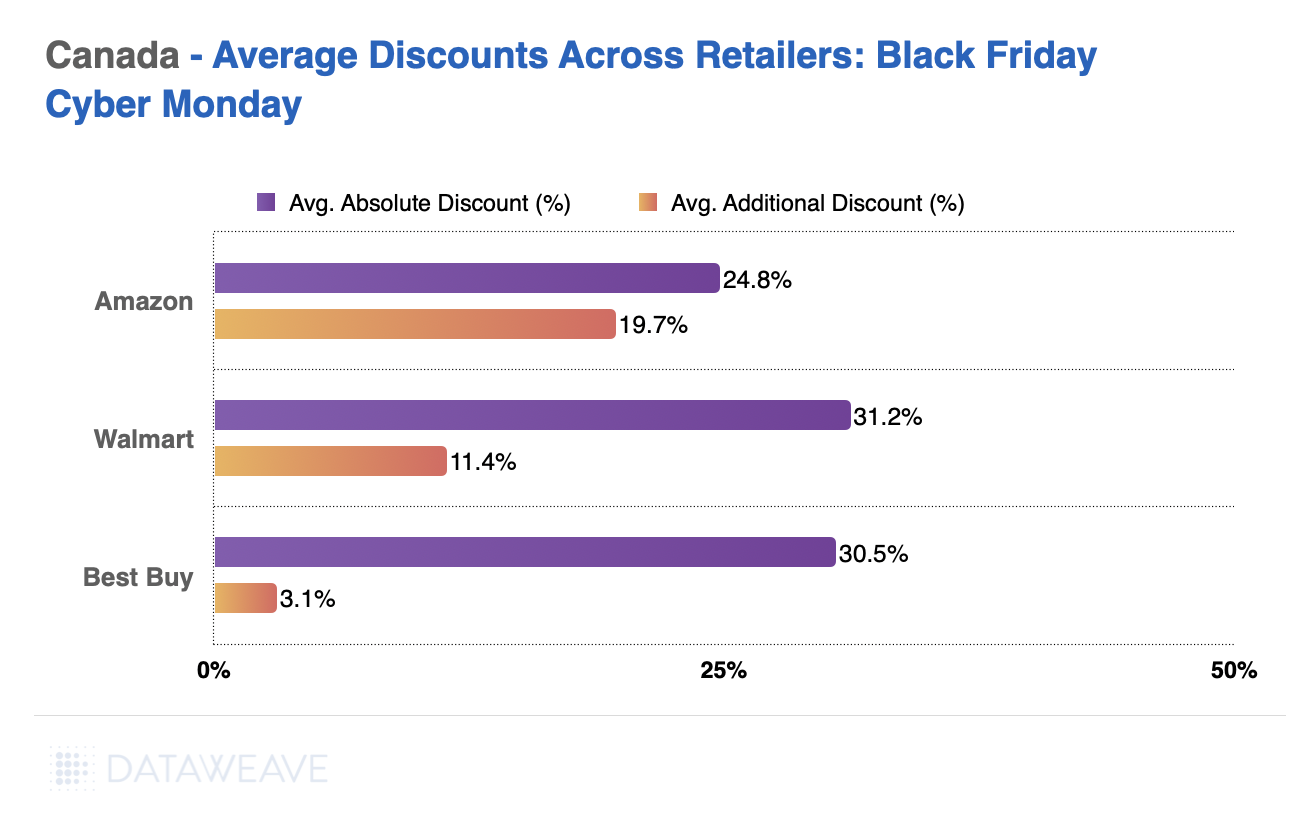

The group highlighted a key gap in the competitive intelligence data they receive. Insights often overlook region-specific nuances such as local competitive landscapes, regulatory requirements, and consumer preferences. They stressed that effective pricing strategies must go beyond base pricing to also factor in card-linked offers, loyalty programs, and delivery options.

Operational Challenges

Several technical and operational issues emerged during discussions:

- Data Quality and Accessibility: Questions around whether platforms provide pre-refined data or raw dumps, and the availability of implementation layers for easy visualization

- Change Management: The persistent challenge of translating insights into action at operational levels

The Path Forward: Building Intelligence-Driven GCCs

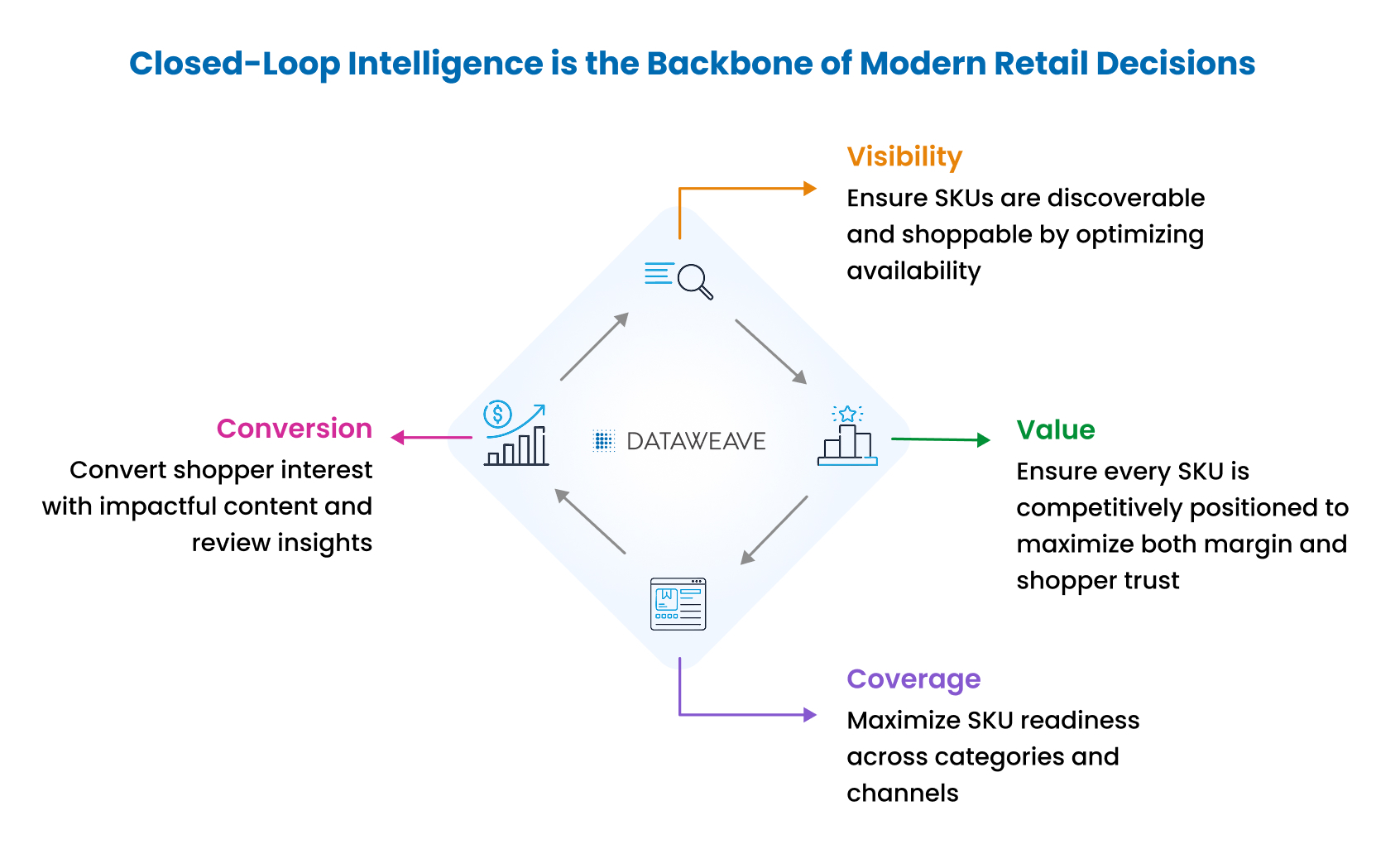

The most successful GCCs of the future will deliver what our attendees called “closed-loop intelligence.” These insights will not only inform decisions but also continuously improve through feedback and results tracking.

This is something that DataWeave excels in.

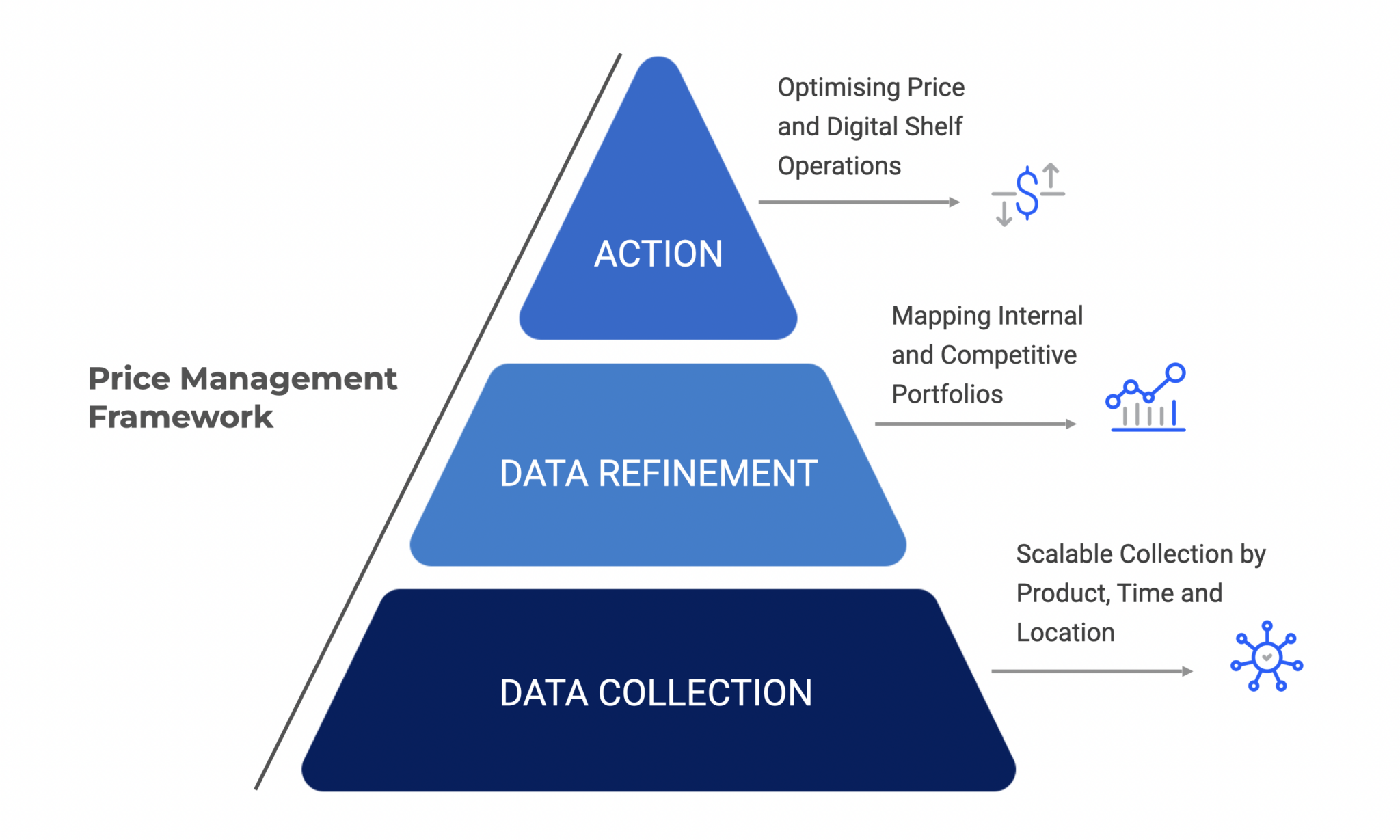

This requires investment in three core areas:

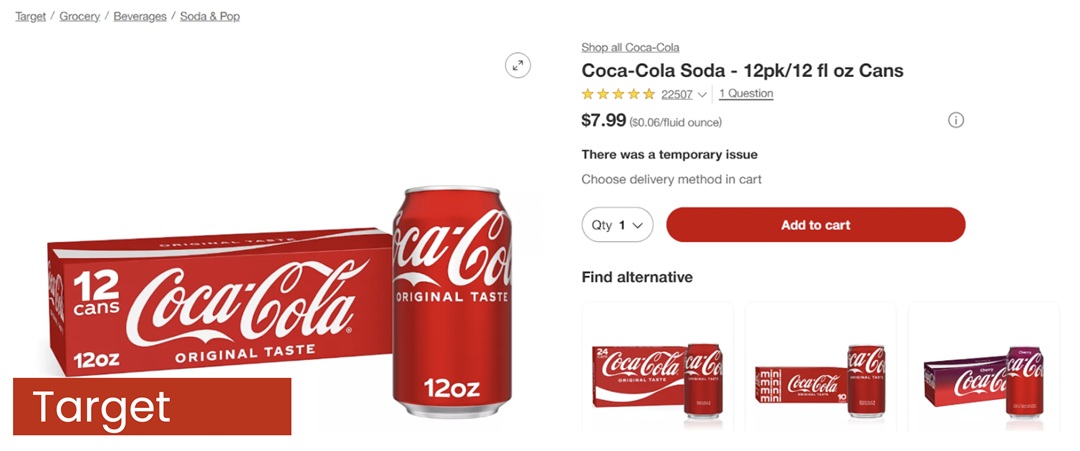

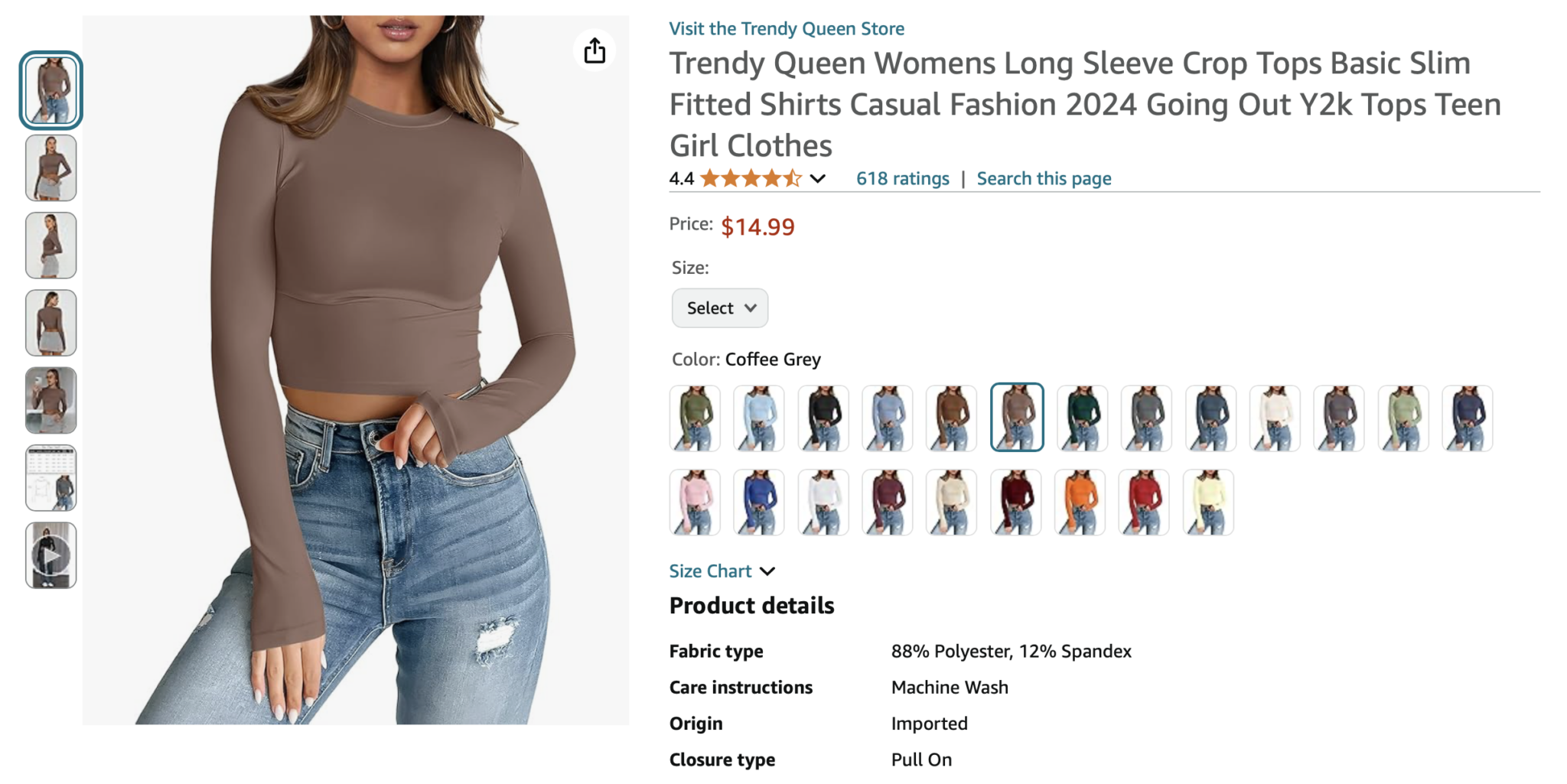

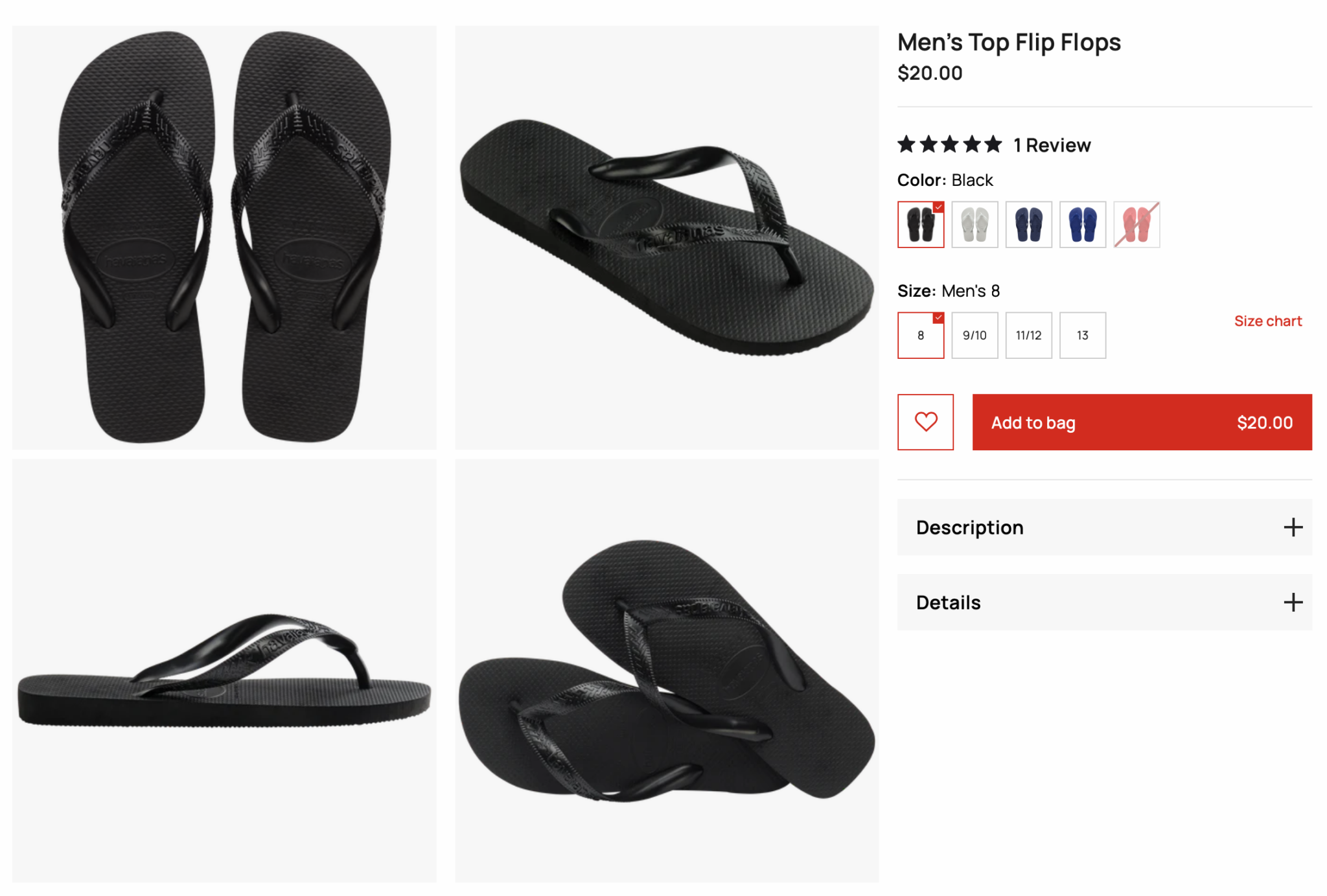

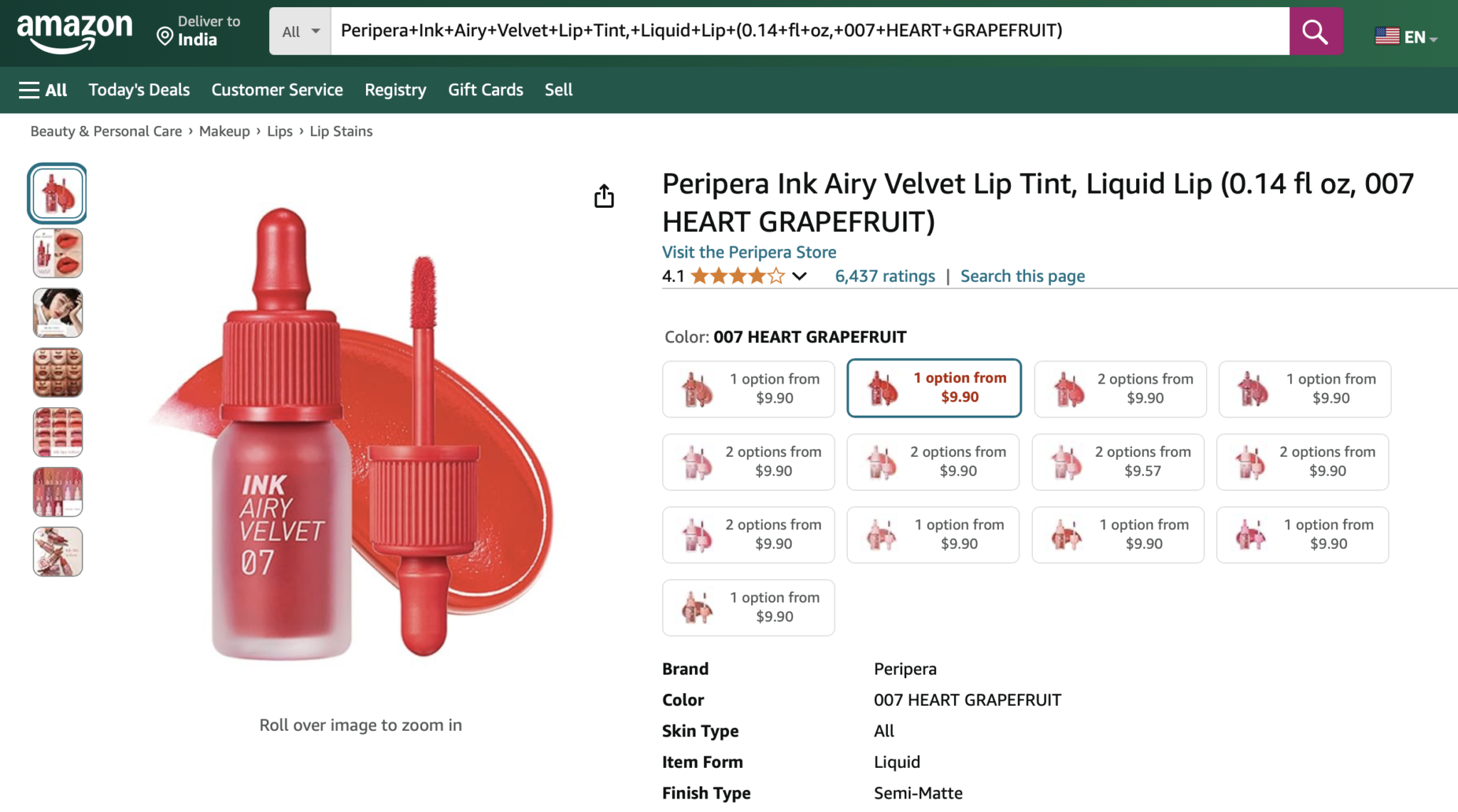

- Data Acquisition: Comprehensive, timely product and pricing data collection across retail platforms

- Intelligence Refinement: AI-powered transformation of raw data into meaningful relationships across retailers, brands, categories, and competitive landscapes

- Insight Delivery: Flexible output capabilities serving everything from executive dashboards to automated pricing systems

Key Takeaways for GCC Leaders

Our roundtable revealed that successful GCCs share common characteristics:

- Proactive Decision-Making: Moving beyond reactive responses to anticipate market changes

- Integrated Intelligence Systems: Combining traditional competitive data with modern digital signals, including social media trends

- Cross-Functional Impact: Establishing strategic partnerships with business units rather than transactional service relationships

- Measurable ROI: Proving value through pricing strategies that demonstrably improve margins

The retail industry will likely become more complex, not less, in the coming years. The GCCs that invest in sophisticated competitive intelligence capabilities today will be the ones helping their organizations not just navigate this complexity, but thrive within it.

The depth of insight and openness in the discussions during the event underscored the value of bringing this community together. As we continue to strengthen our connections with GCC leaders, we look forward to hosting more such forums.

If you’d like to be part of the conversation, reach out to us today!