In 2025, both consumers and retailers continue to prioritize better health – albeit with evolving definitions and expectations.

The pandemic fundamentally transformed how consumers approach wellness, with this shift becoming entrenched in shopping behaviors years later. As shopping habits have permanently altered, retailers now face increased pressure to rapidly adapt their assortments with in-demand health and wellness products that enhance customer experience across various channels – online and offline.

Let’s explore how leading retailers are keeping consumers – and their own bottom lines – healthy by responding effectively to market trends to drive online sales and market share.

Health & Wellness Influence The Product Mix Across Categories

Consumption habits have changed dramatically since the onset of the pandemic. A McKinsey study shows that 82% and 73% of US, and UK consumers respectively now consider health & wellness a top priority. Typically shoppers adjust grocery shopping and meal planning at the start of the year, with many focusing on fresh, organic, and nutrient-rich foods.

The influential health and wellness mega-trend spans diverse retail channels, including grocery, pharmacy and mass. It extends across numerous categories like:

- Food and beverage (natural, organic, vegan, plant-based food)

- Health and personal care

- Beauty

- Cleaning products

- Fitness equipment

- Athleisure (apparel)

- Consumer electronics like health wearables.

Today’s health movement is so powerful and compelling that retailers have revised their business strategies to better serve health-conscious consumers. For instance, drugstores are reinventing themselves as healthcare destinations, with CVS and Kroger expanding into personalized care delivery and value-based clinics to enhance their health offerings.

Major retailers like Amazon, Walmart, and Target report robust sales in health and wellness categories. For example, Walmart saw a 4.6% increase in comparable sales in early 2024, driven significantly by grocery, consumables, and health-related products.

New product categories are gaining traction:

- Functional foods and beverages are seeing unprecedented growth, with Target launching over 2,000 wellness items in the category, including exclusive products priced under $10.

- Personalized nutrition and mental health products are surging, including tailored dietary solutions and stress-reducing items.

- Health wearables and wellness tech continue to rise in popularity, with over 150 new wellness tech items launched at Target this year, including innovative red-light therapy devices.

- Transparency and sustainability certifications like organic, non-GMO, and vegan labels are increasingly driving purchasing decisions.

- Clinically proven benefits offered by health & wellness products are gaining traction among Gen Z.

Retail’s Survival Of The Fittest Moves Online

As the omnichannel retail sector continues to grow, more shoppers now make purchase decisions within minutes using just a few clicks rather than physically visiting brick-and-mortar stores. In some cases, AI agents like Operator from Chat-GPT or Gemini (Google’s Chatbot) even make personalized, curated lists and reduce the time taken to make purchase decisions. Traditional retail paradigms are rapidly becoming obsolete as consumers grow savvier, more empowered, and better informed than ever before.

To stay competitive, more retailers are embracing AI-driven data insights to adjust their assortments to reflect consumer demand for health and wellness products.

According to industry experts, data insights have emerged as a critical retail strategy that continues to gain momentum. This is because retailers can no longer afford to guess how to approach their omnichannel strategy. They need the accuracy, clarity, and efficiency of data insights to guide their assortment and pricing decisions to outmaneuver competitors, maximize sales, and win market share as shopping evolves online.

Among its retail best practices, Bain & Company recommends retailers “lead with superior assortments that use a customer-centric lens to reduce complexity and increase space for the products customers love.” Insights can help retailers discover the optimal mix of national brands, private labels, limited-time offers, and value-added bundles.

“Lead with superior assortments …

increase space for the products consumers love“

~ Bain & Company

Determining the optimal mix of products also includes bestsellers and unique items that help retailers distinguish their offerings. Assortment insights help retail executives track competitors’ assortment changes and spot gaps in their own product assortment to adapt to emerging consumer trends and in-demand products.

Why Effective Assortment Planning Matters

Assortment planning sits at the heart of retail success, directly influencing profitability, customer satisfaction, and competitive differentiation. In today’s health-conscious market, getting your assortment right means:

- Meeting Customer Expectations: Today’s health-conscious consumers expect relevant, high-quality products that match their wellness goals. A well-planned assortment signals that a retailer understands its customers’ evolving needs.

- Optimizing Inventory Investment: Strategic assortment planning ensures capital is allocated to products with the highest return potential while minimizing investments in slow-moving items.

- Creating Competitive Advantage: A distinctive assortment that includes popular health and wellness products alongside unique offerings helps retailers stand out in a crowded marketplace.

- Reducing Lost Sales: Effective assortment planning minimizes the risk of stockouts on high-demand health and wellness items, preventing customers from shopping elsewhere.

- Supporting Omnichannel Strategies: Well-executed assortment planning ensures consistency across physical and digital touchpoints, creating a seamless customer experience.

- Improving Operational Efficiency: A thoughtfully curated assortment reduces complexity throughout the supply chain, from procurement to warehouse management to in-store operations.

As health and wellness continues to drive consumer spending, retailers who excel at assortment planning can capitalize on these trends more effectively than their competitors, turning market insights into tangible business results.

AI-Powered Assortment Analytics Driving Retail Success

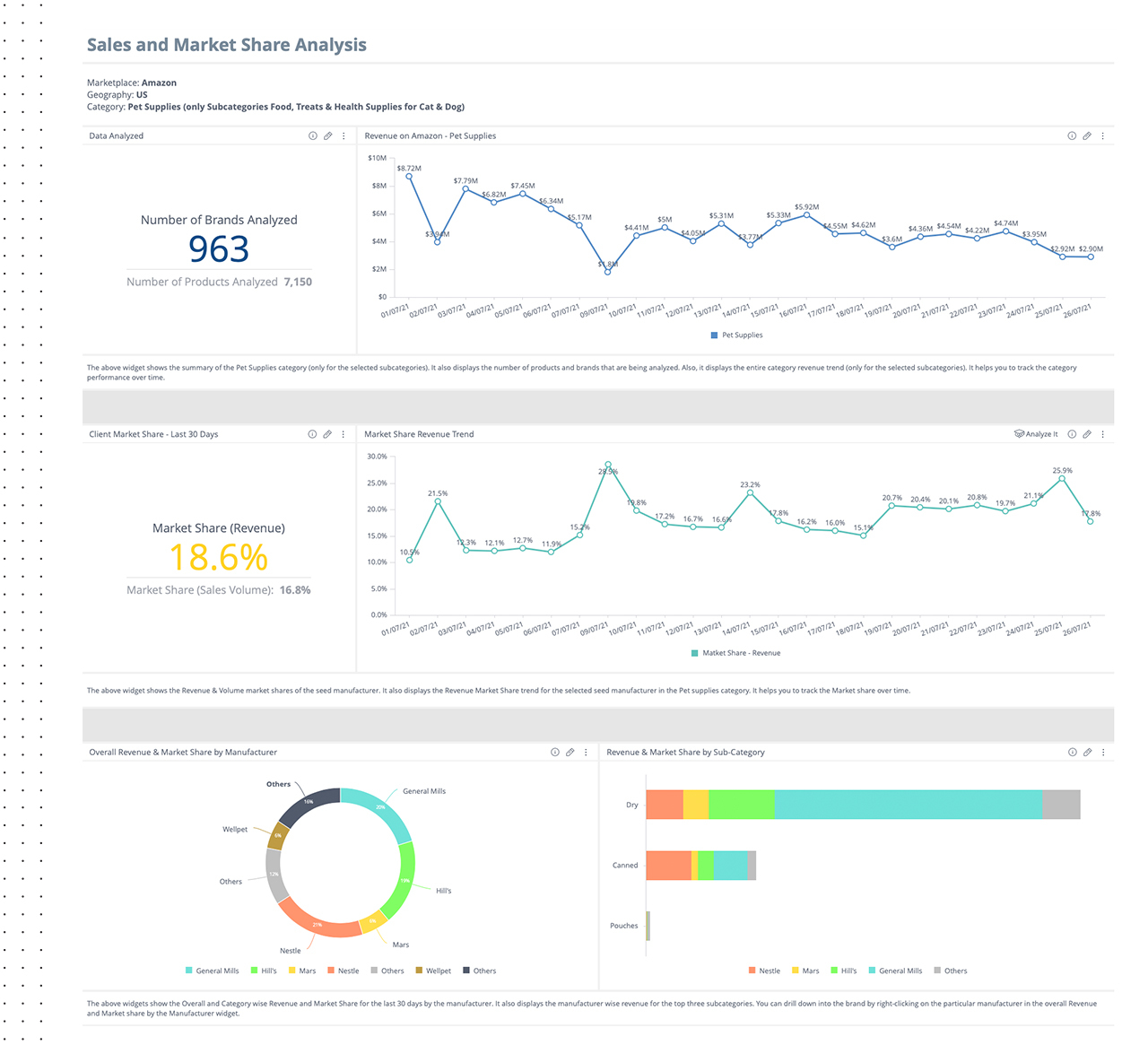

The synergy of AI and data analytics into retail assortment planning is changing how businesses approach inventory management. Retailers using AI-driven predictive analytics have achieved a 36% SKU reduction while increasing sales by 1-2%, showcasing the efficiency of data-driven approaches according to a McKinsey report.

Retailers face several challenges that can hinder strategic assortment planning:

- Limited Understanding of Competition: Retailers struggle to gain comprehensive insights into their product assortments relative to competitors, often lacking visibility into their strengths and weaknesses across categories.

- Data Overload: Assortment planning involves handling vast amounts of data, making it challenging for category managers to extract actionable insights without user-friendly tools and visualization.

- Cross-Channel Consistency: With omnichannel retailing, ensuring consistency across physical stores, e-commerce, and other channels is complex. Misalignment can lead to customer dissatisfaction and loss of loyalty.

- Adapting to Changing Market Trends: Identifying top-selling products and tracking consumer preferences is challenging. Balancing the right mix of products is crucial; without analytics, retailers risk lost sales or excess slow-moving inventory.

- Scalability and Efficiency: As retailers expand into new markets or categories, scaling their assortment planning processes efficiently becomes a challenge. Legacy systems and manual methods often fail to support the agility needed for quick decision-making at scale.

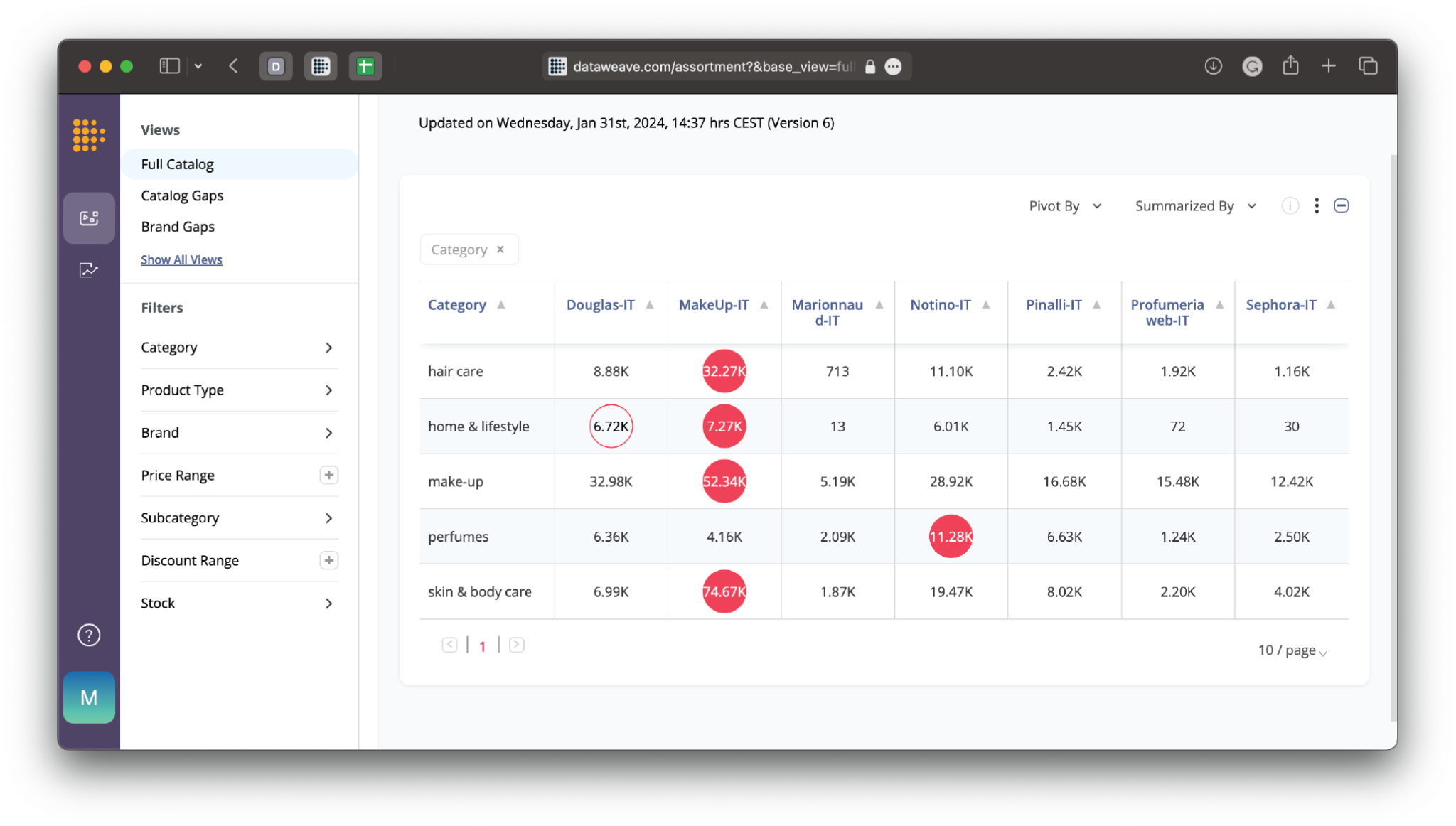

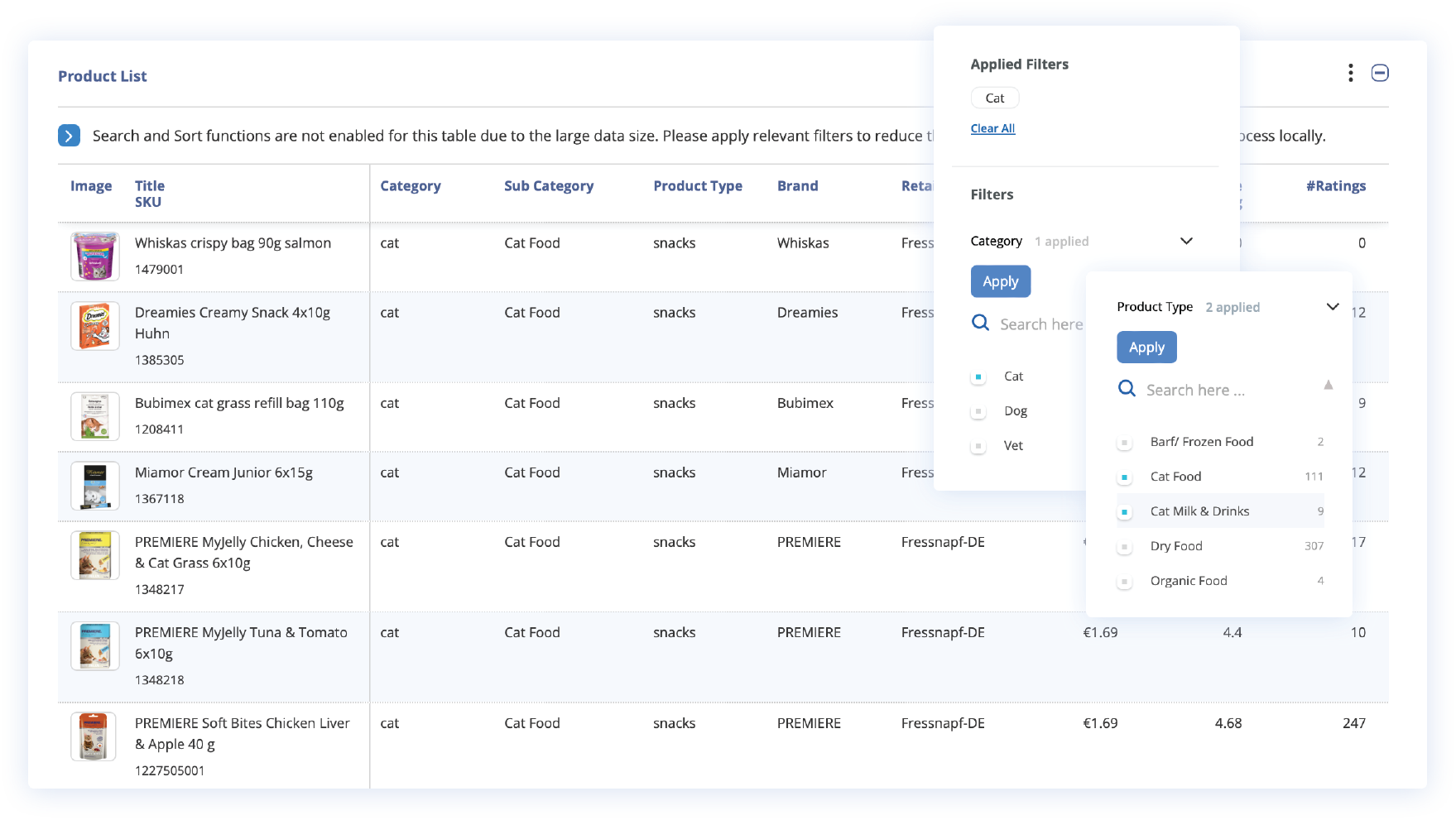

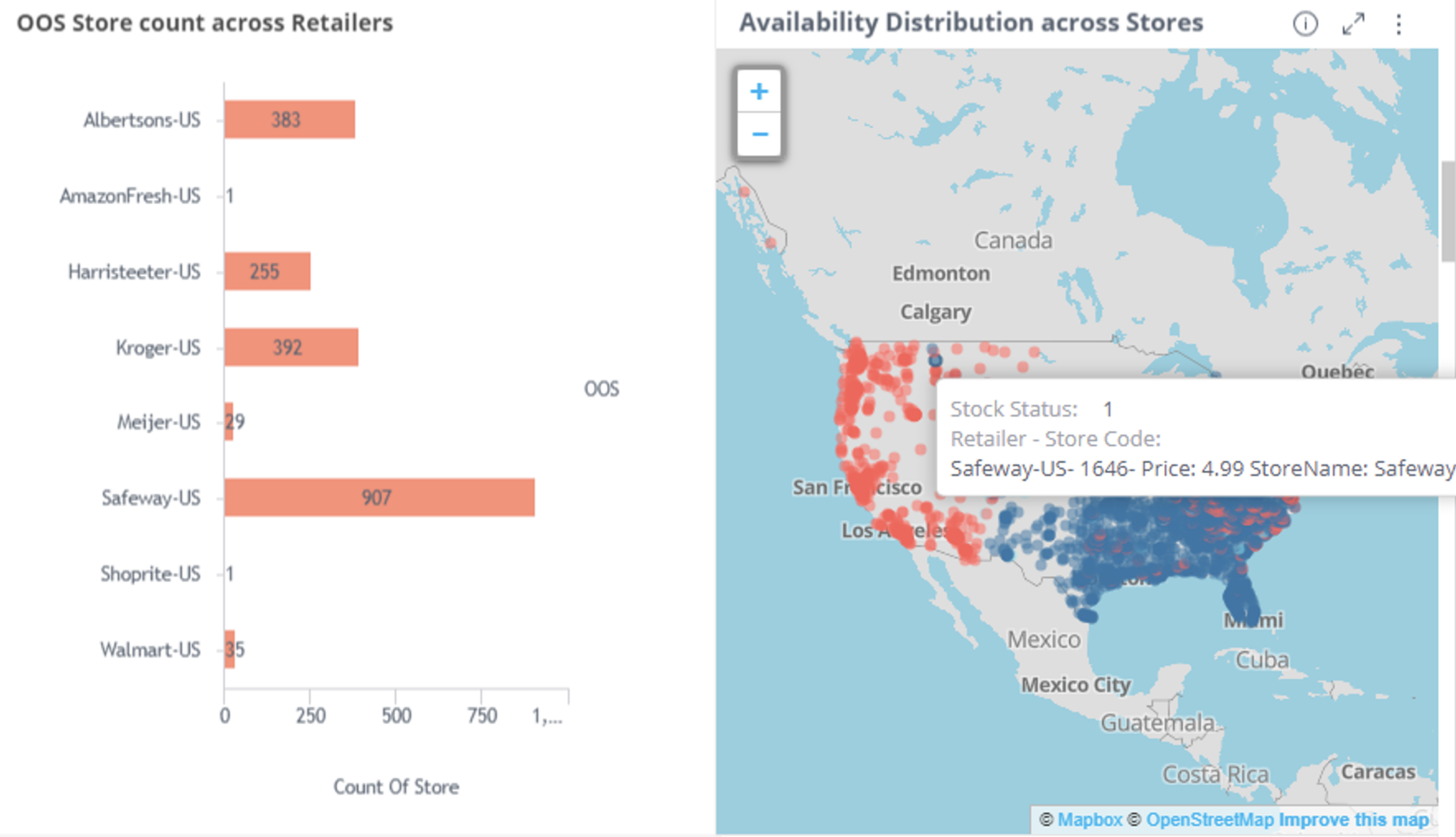

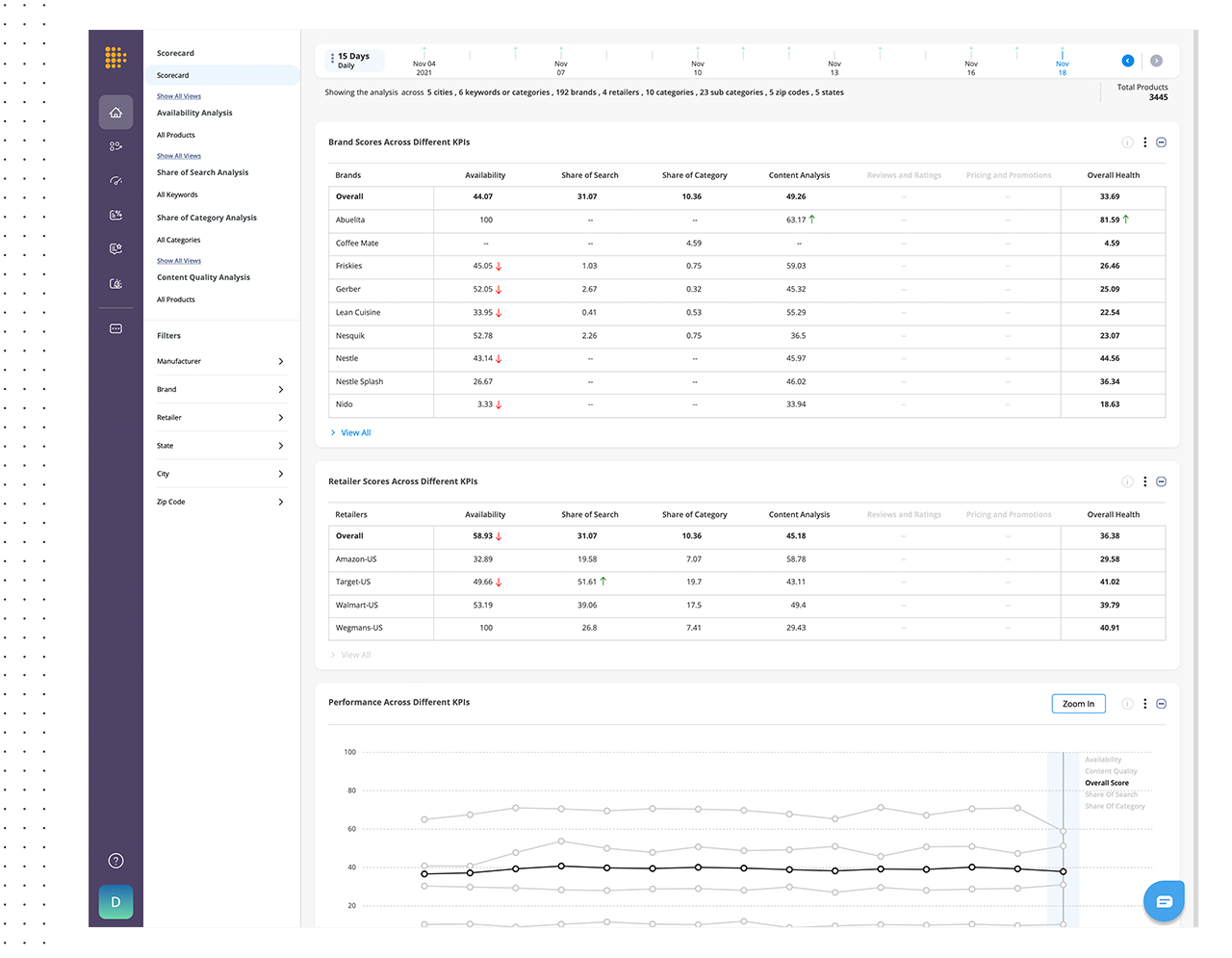

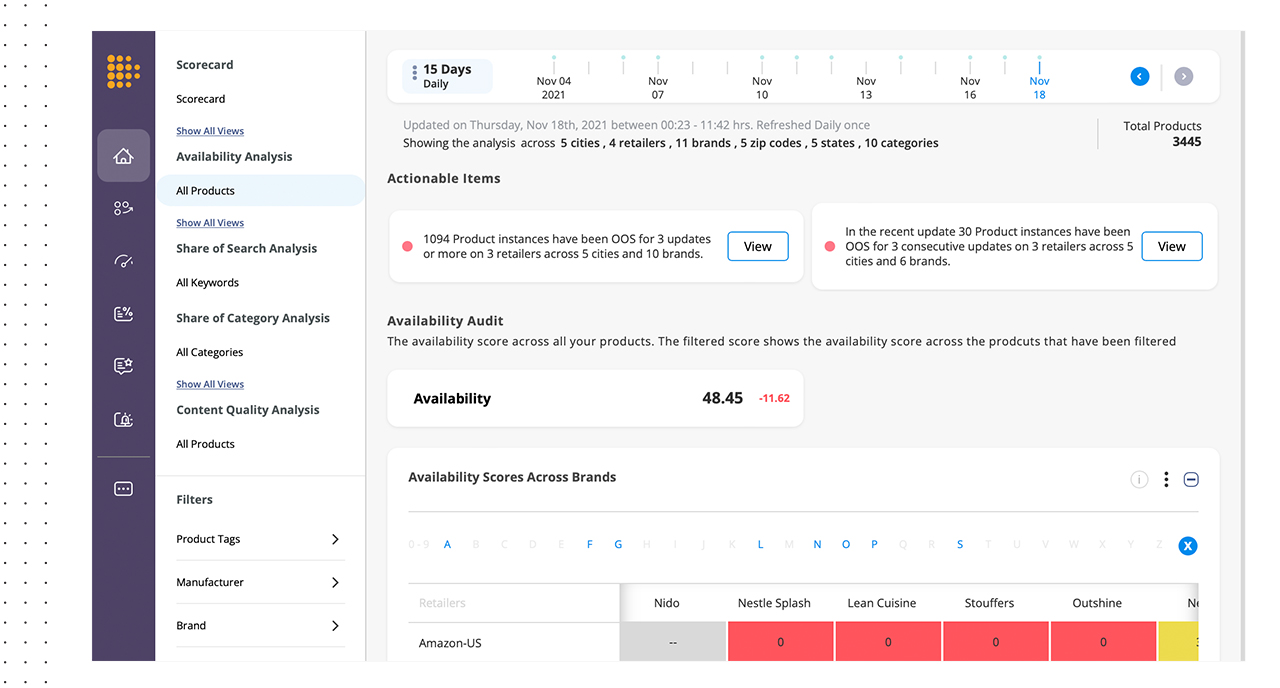

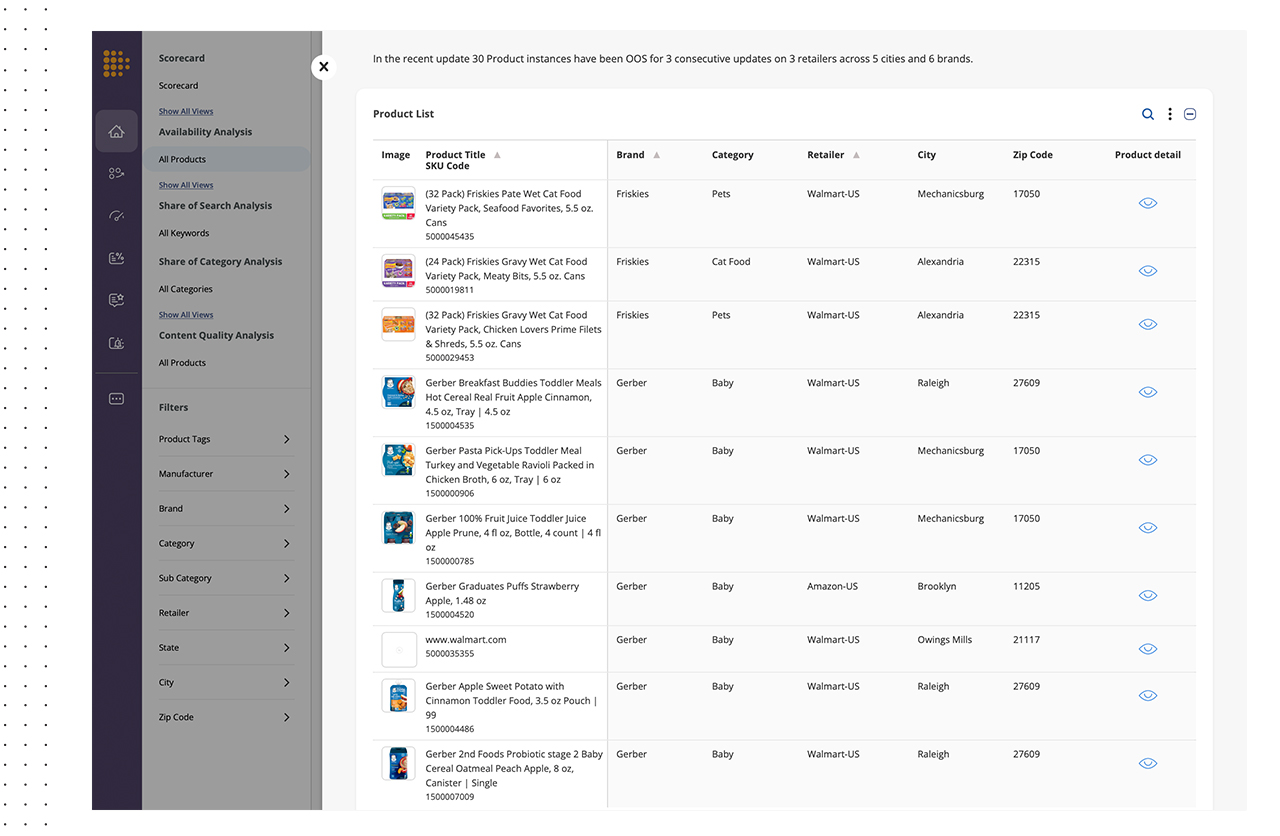

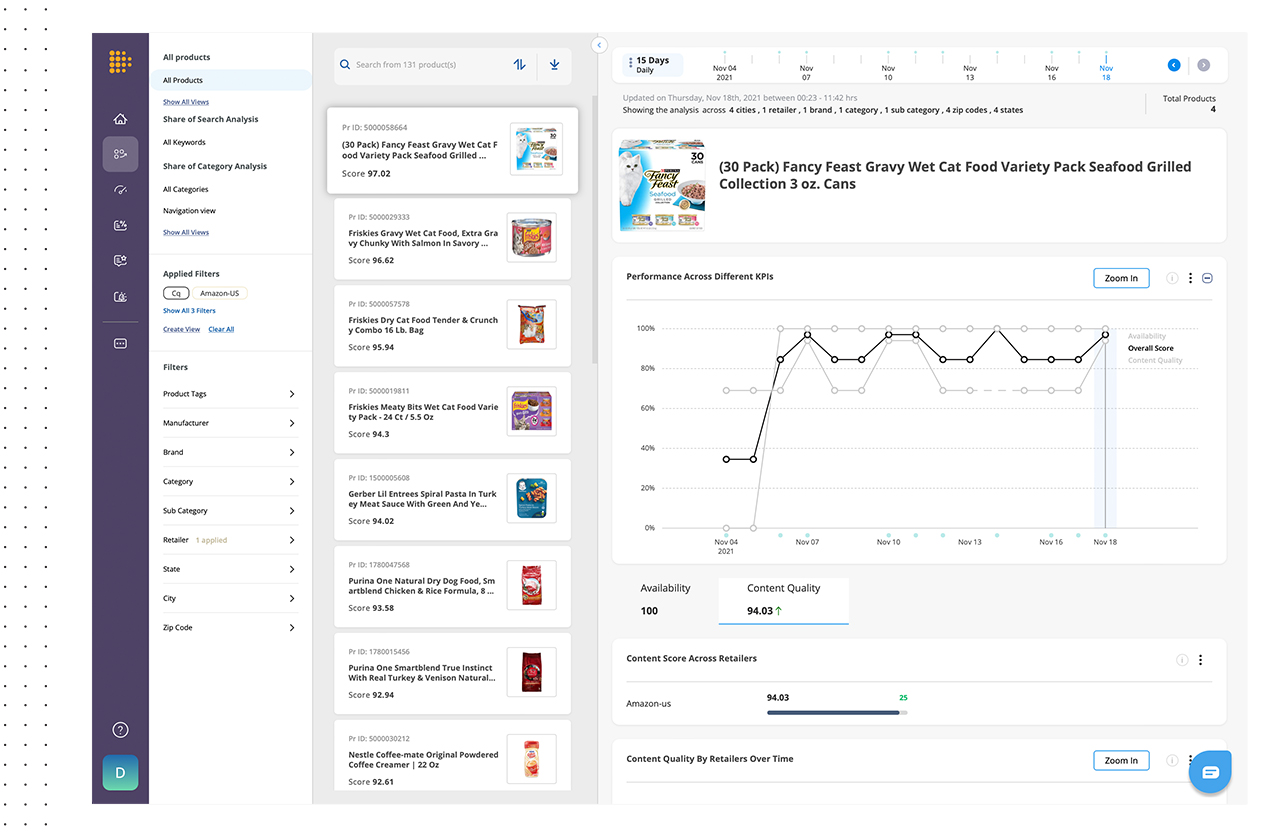

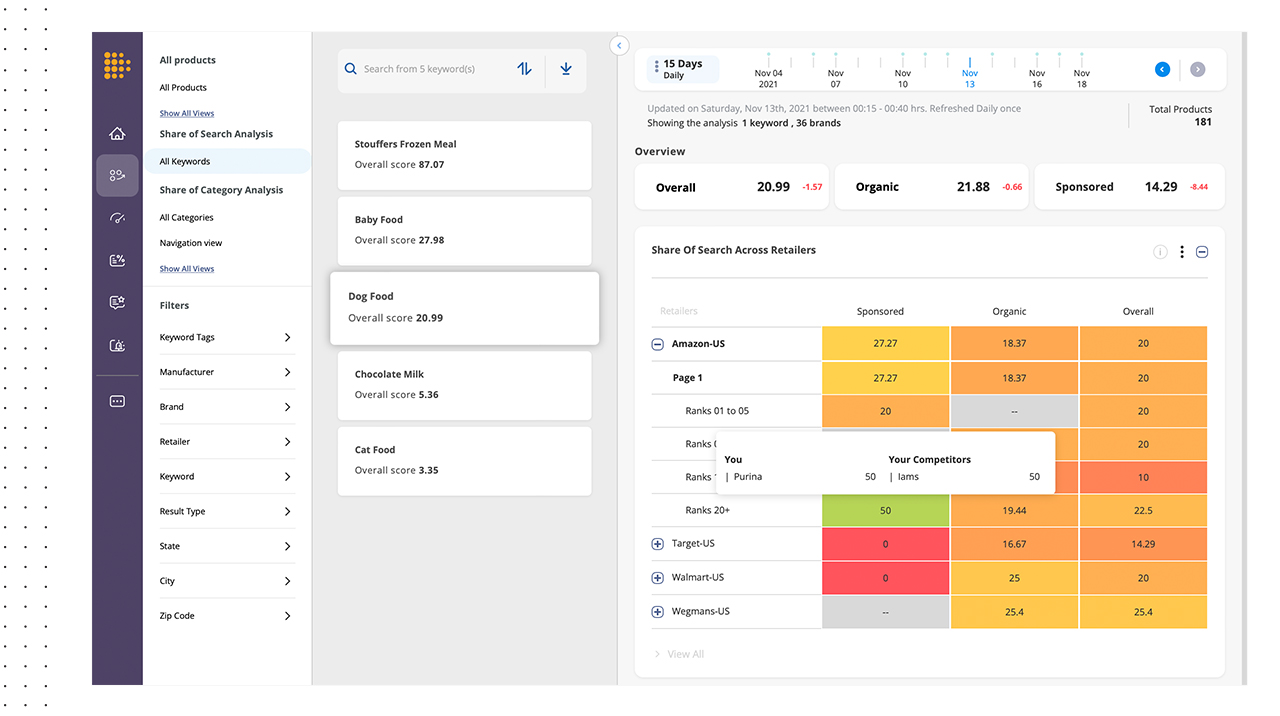

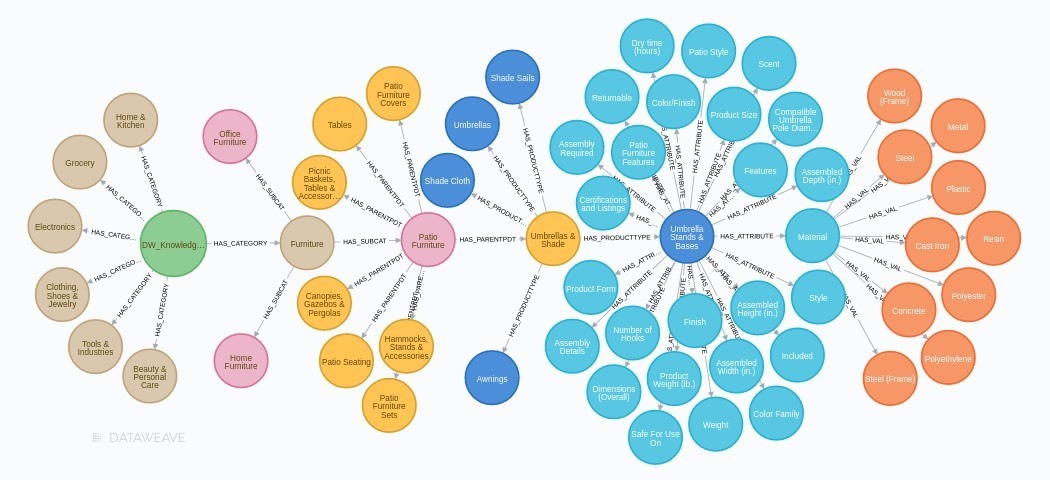

DataWeave’s Assortment Analytics helps retailers address these challenges by providing a robust, easy-to-use platform that delivers actionable insights into product assortments and competitive positioning. With AI-driven, contextual insights and alerts, retailers can effortlessly identify high-demand, unique products, capitalize on catalog strengths, optimize pricing and promotions, improve stock availability, and refine assortments to maintain a competitive edge.

Beyond Data: Actionable Insights That Drive Results

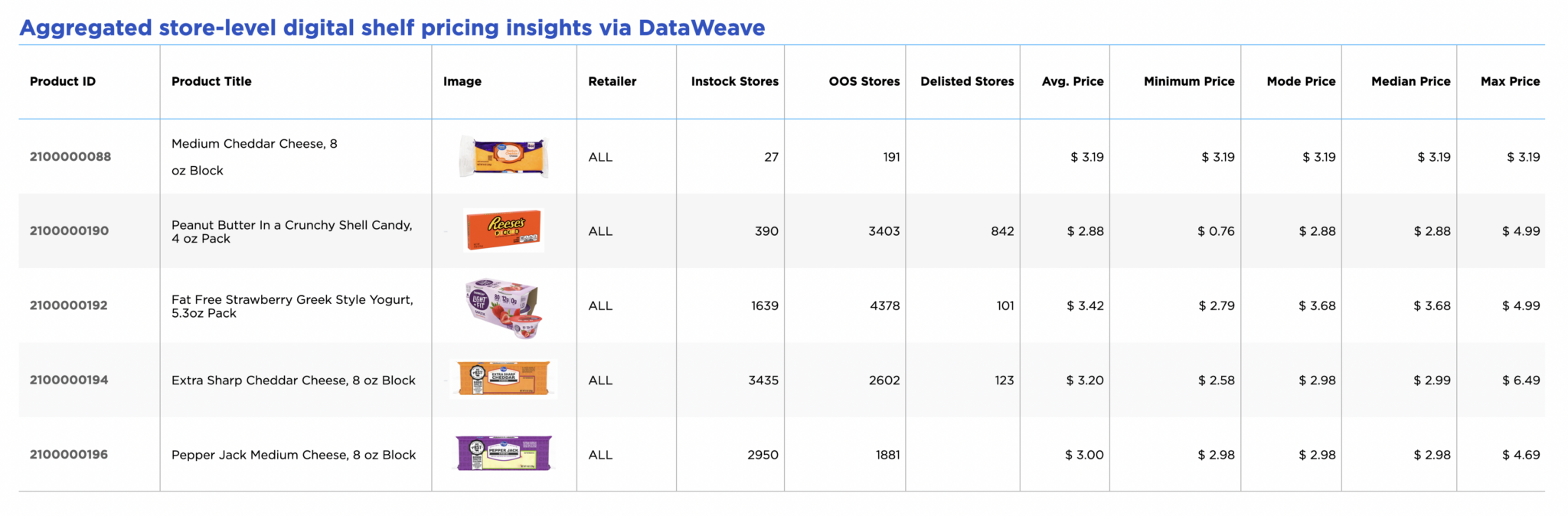

DataWeave’s platform provides a comprehensive, insight-led view into assortments through several key dimensions:

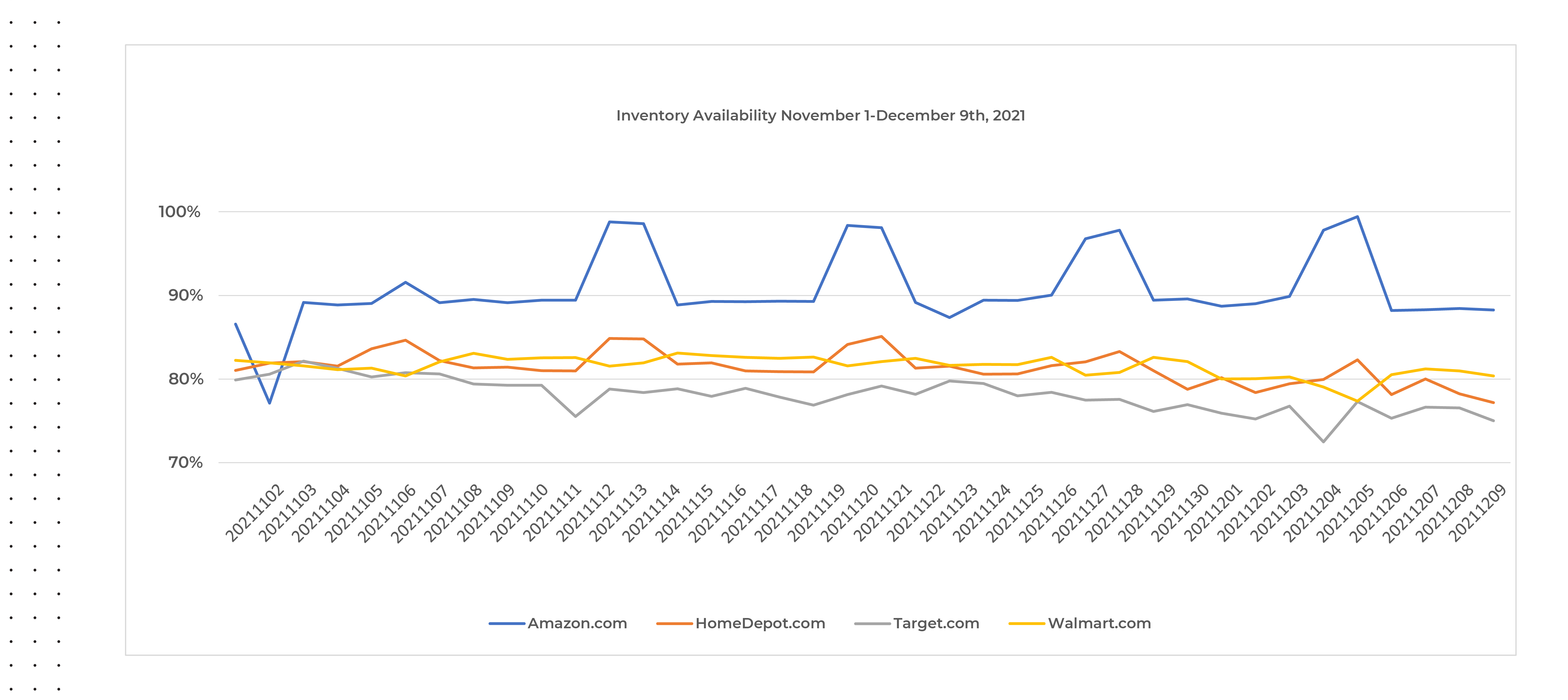

- Stock Insights: Monitor stock changes across retailers to stay updated on availability.

- Category and Sub-Category Insights: Analyze assortment changes, identify newly introduced or discontinued categories, and track leading retailers in specific segments.

- Brand Insights: Identify newly introduced, missing, or discontinued brands, as well as leading brands within chosen categories.

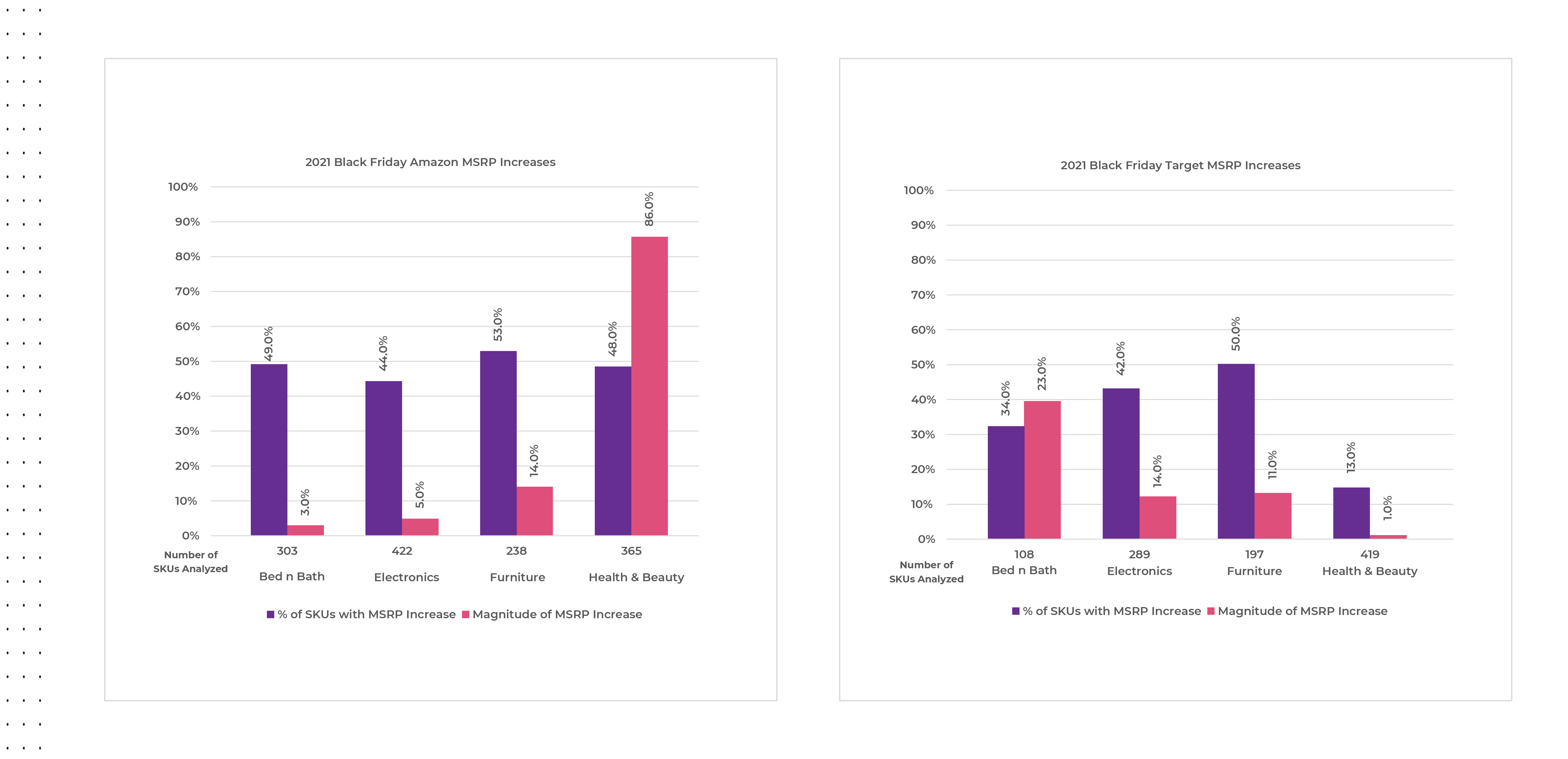

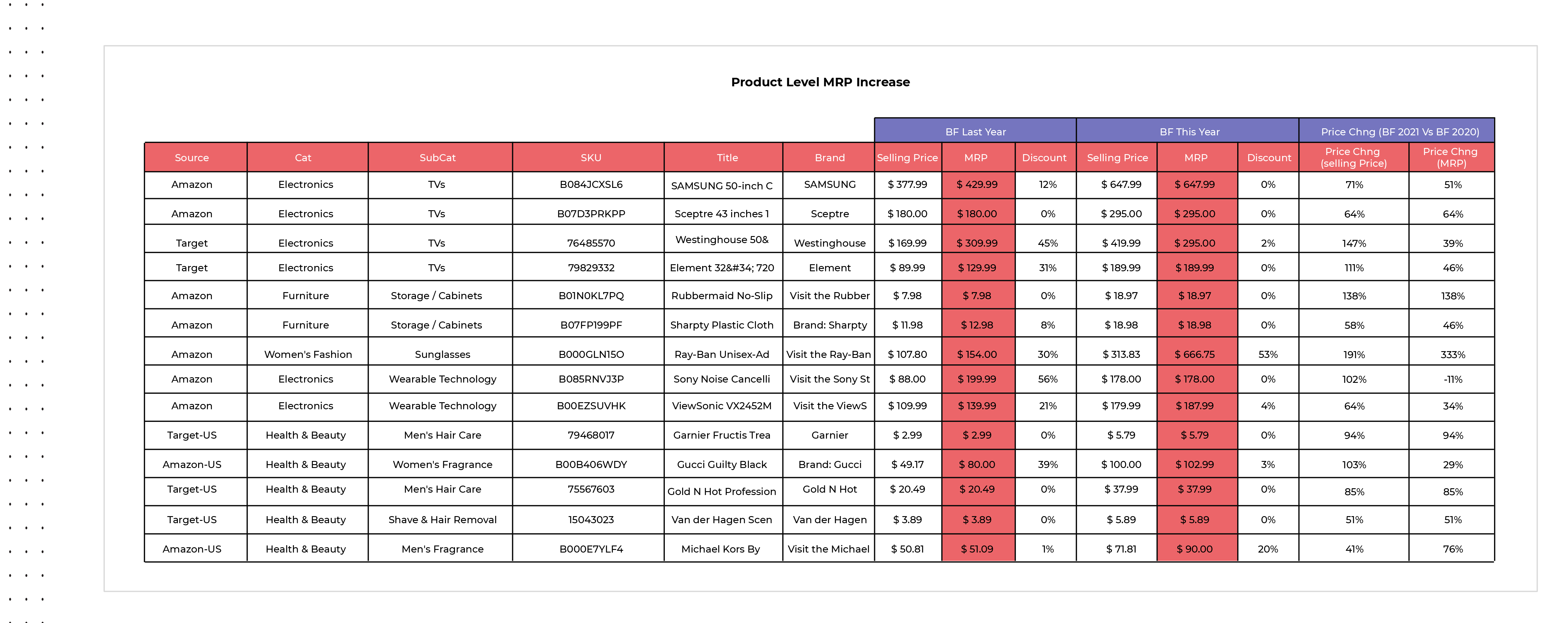

- Product Insights: Identify bestsellers and evaluate their impact on your portfolio, analyzing pricing and promotions.

- Personalized Recommendations: Receive suggestions tailored to your behavior and user profile to refine decision-making.

- User-Configured Alerts: Stay informed with alerts designed to highlight significant changes or opportunities.

The platform addresses data overload by providing an intuitive, insight-driven view of your assortment. Category managers gain a comprehensive, bird’s-eye perspective of key changes within specified timeframes, allowing them to focus on what matters most.

Preparing for the Future of Retail Health

To avoid supply chain bottlenecks, inventory shortages, and out-of-stock scenarios, retailers are strategically using data insights to anticipate fluctuations in demand and proactively plan how to manage disruptions that could affect their assortments.

For variety that satisfies consumers’ diverse product needs, retailers are using data insights to determine whether to collaborate with nimble suppliers to promptly fill any gaps.

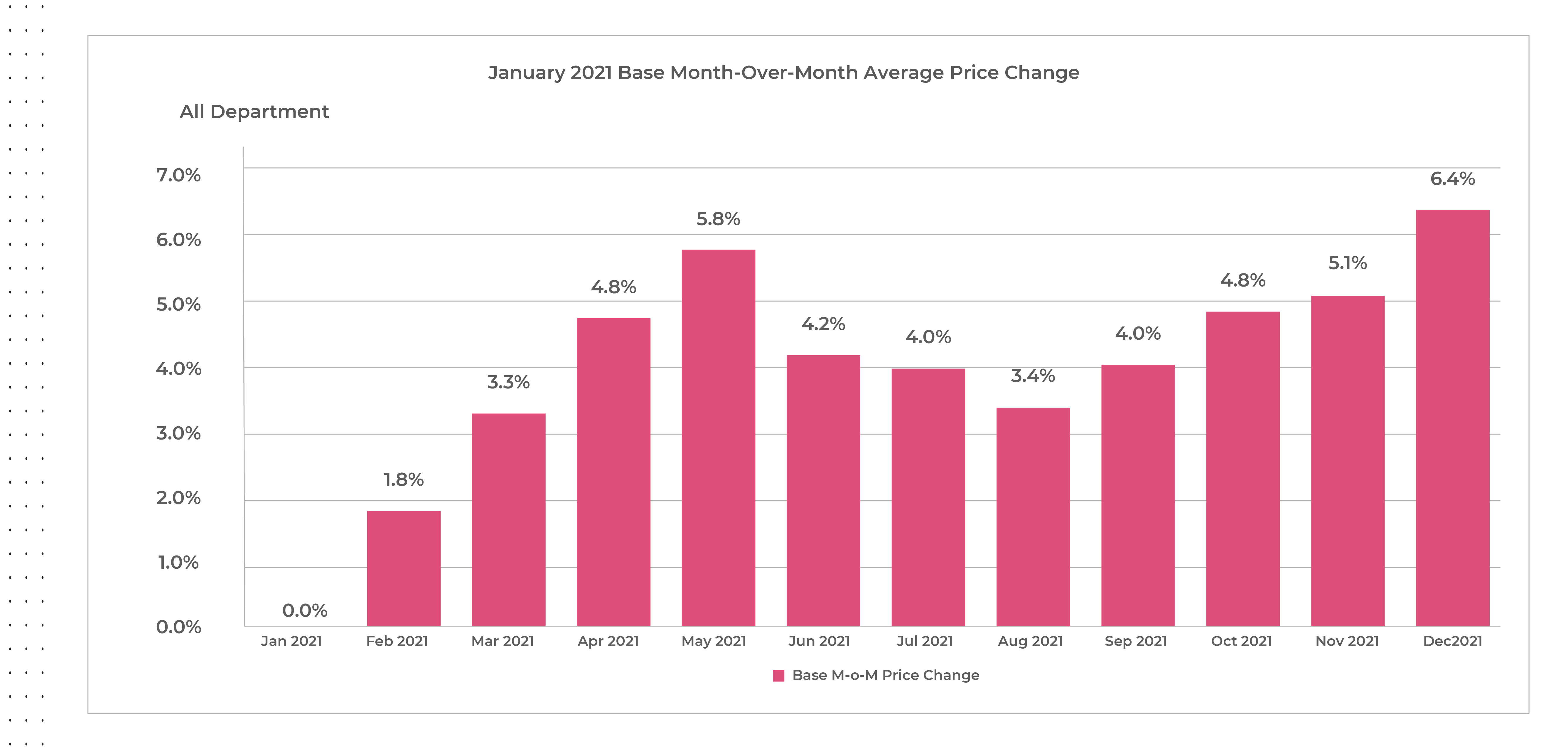

To further strengthen their assortments’ attractiveness, retailers are using AI-powered pricing analytics to offer the right product at the right price. These analytics help retailers know exactly how they compare to rivals’ pricing moves with relevant data so they can keep up with market fluctuations and stay competitive by earning consumer engagement, sales, and trust.

To Conclude…

Like nourishing habits that improve consumers’ health, data insights improve retailers’ e-commerce health. Advanced assortment and pricing analytics, powered by artificial intelligence, help retailers make better decisions faster to boost their agility, outmaneuver rivals, and fuel online growth.

In a retail landscape where consumer preferences for health and wellness continue to evolve rapidly, the retailers who thrive will be those who leverage data and AI to understand, anticipate, and meet these changing demands with the right products at the right time. Reach out to us to know more.