Recently, Karthik Bettadapura, Co-founder & CEO at DataWeave, was interviewed by Vishal Krishna, Business Editor at YourStory, in the Bay Area, California. They discussed DataWeave’s focus on the US market, challenges that retailers face today, DataWeave’s technology platform and hiring practices, and more.

The following is a transcript of the interview.

(The transcript has been edited for clarity and brevity)

Vishal Krishna (VK): You left India to come and conquer America, why is that?

Karthik Bettadapura (KB) : Just a bit of history — we started in 2011 and product development and research was based in Bangalore, and still is. At the end of the first 5 years, we realized that we built great technology, but we were not able to scale beyond a certain point [in India]. If we had to build a growing business, we had to look at other markets as well.

VK: Quickly, can you tell me what DataWeave does?

KB: We provide Competitive Intelligence to retailers and customer brands. We work with some of the largest brands and retailers out there and we provide them with analyses to compete profitably.

VK: You said you had marque clients in India, yet you didn’t want to stay there because you wouldn’t have scaled beyond a particular point. Why is that?

KB :The ticket size in India is still on the lower side. If you must build a sustainable business, you need access to a much larger customer base and we found that in the US.

VK: Let’s start from the basics. What are a few things that a startup should decide to do when coming to America?

KB: A few things:

- A good understanding of the market

- Learn fast about the market

- Build a team here, or a have a team here already doing some work initially

- Consider how your team back in India will go about doing things in your absence

- The last one is about your own personal journey. I was so used to walking into an office and interacting with people. You come here, and you are all alone!

VK: It’s a lonely journey. Doors don’t open all that easily and you’ve got to hustle. Why?

KB: For people here, you are an unknown entity. Why should they be trusting someone who does not have enough customers here or has not raised money here? We had two US-based customers when we came in. It’s an uphill task to ensure that customers trust you.

VK: Who was the first customer you personally met here and why was that meeting so important?

KB: The first customer I met here was a large, big box retailer, and the meeting was primarily focused around why they should trust us — how can they know that we would survive and serve them, as well as how we are better than some of the other guys out there.

VK: Can you tell us what DataWeave does for US retailers?

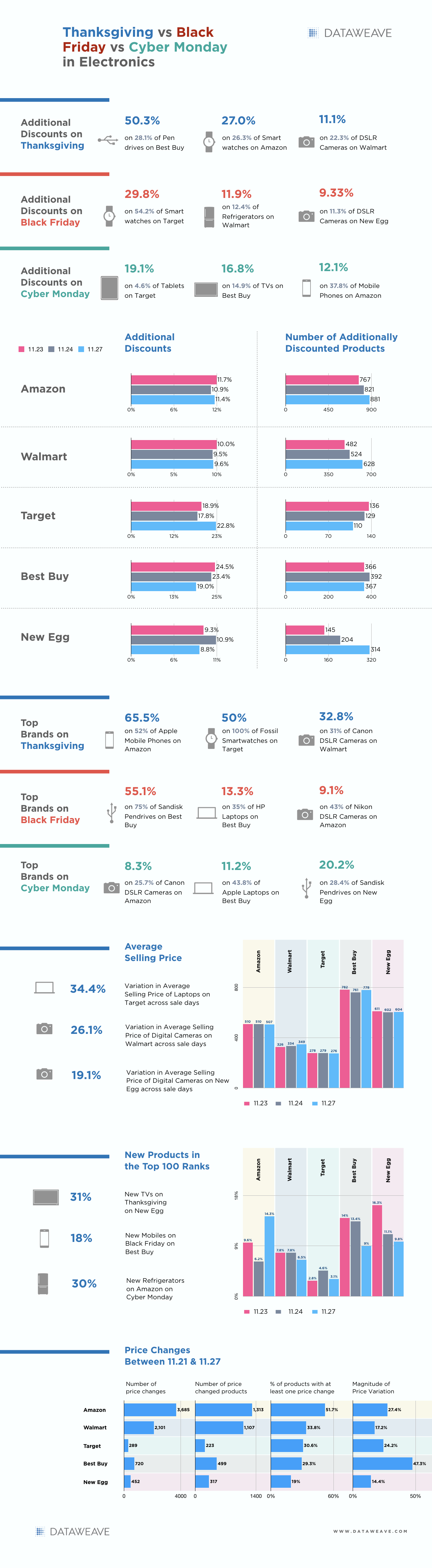

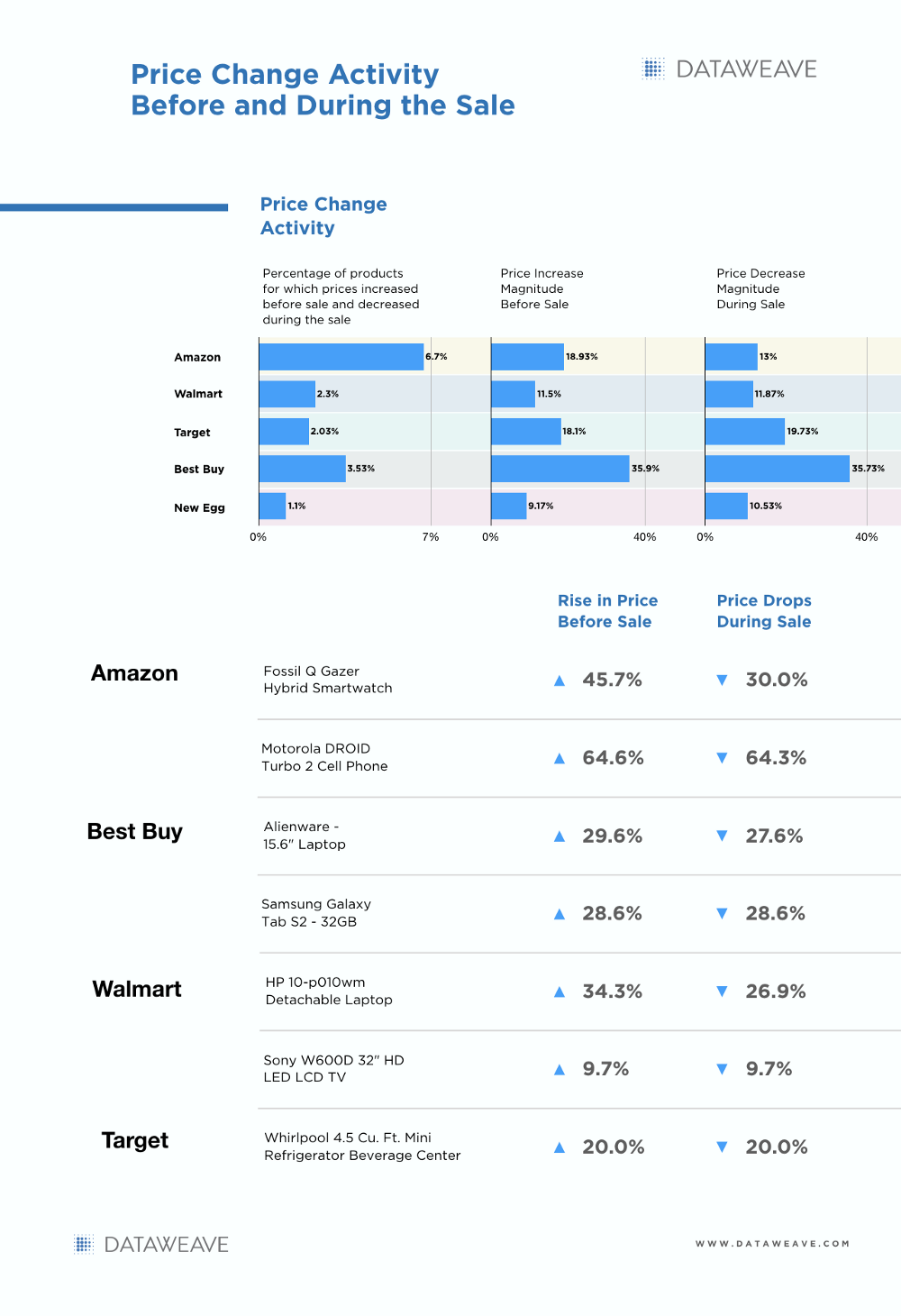

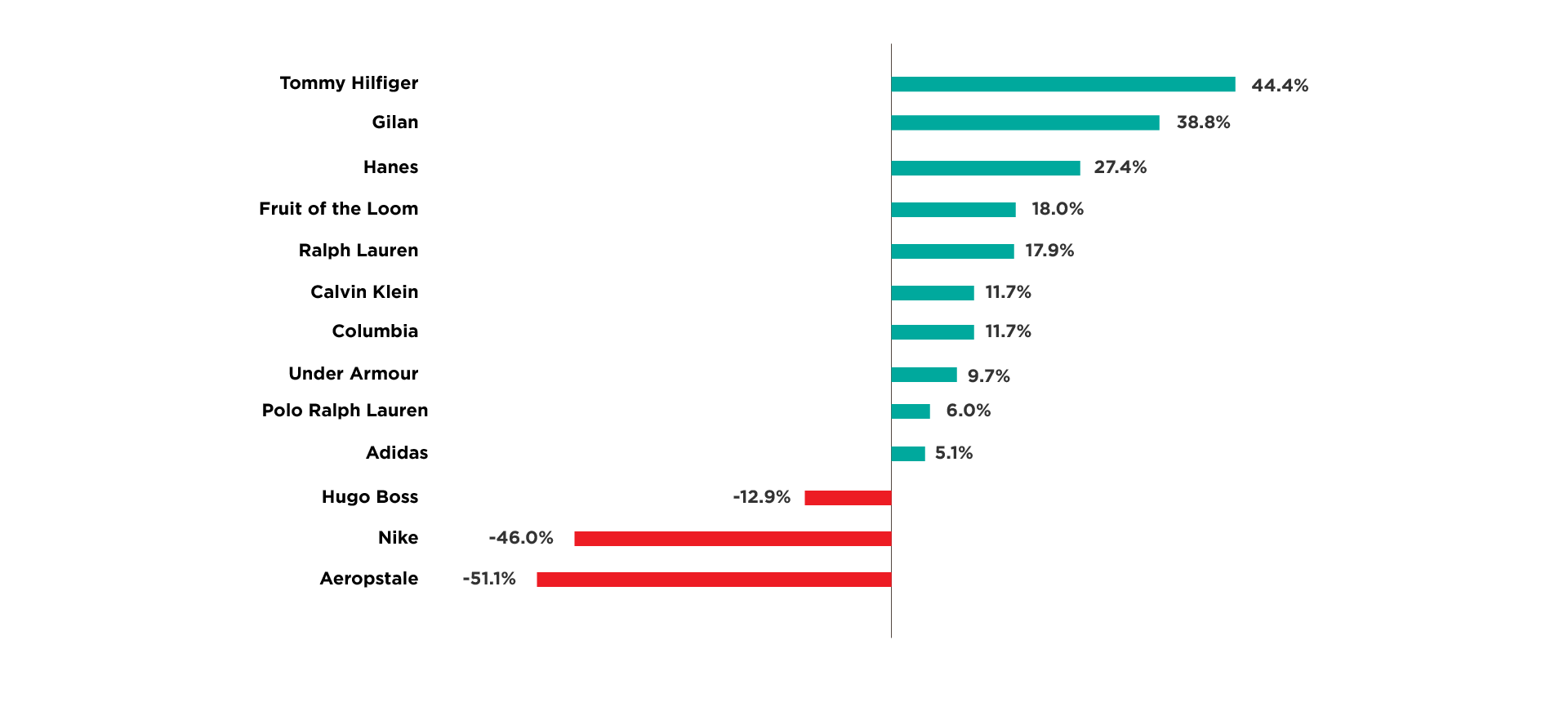

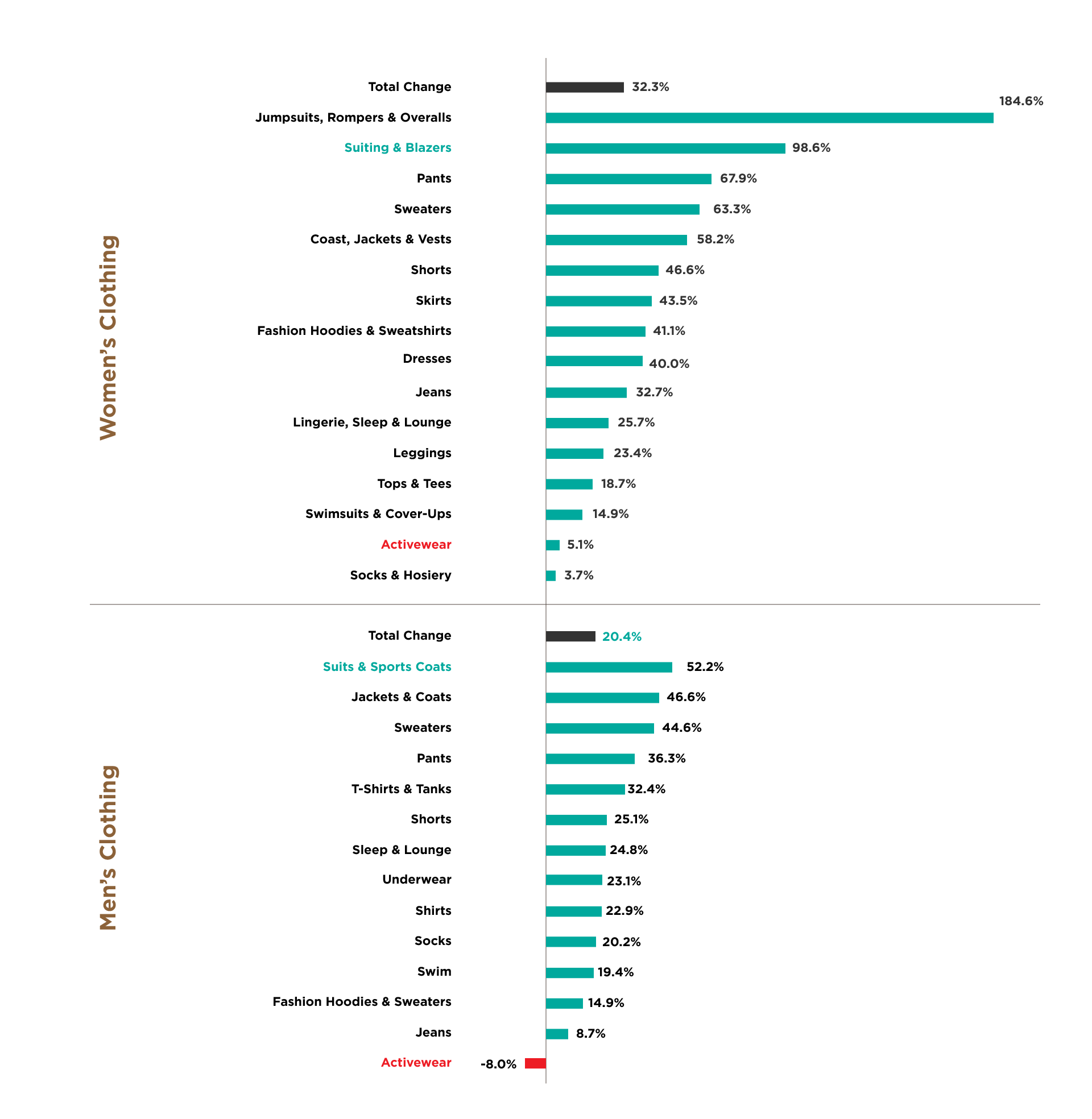

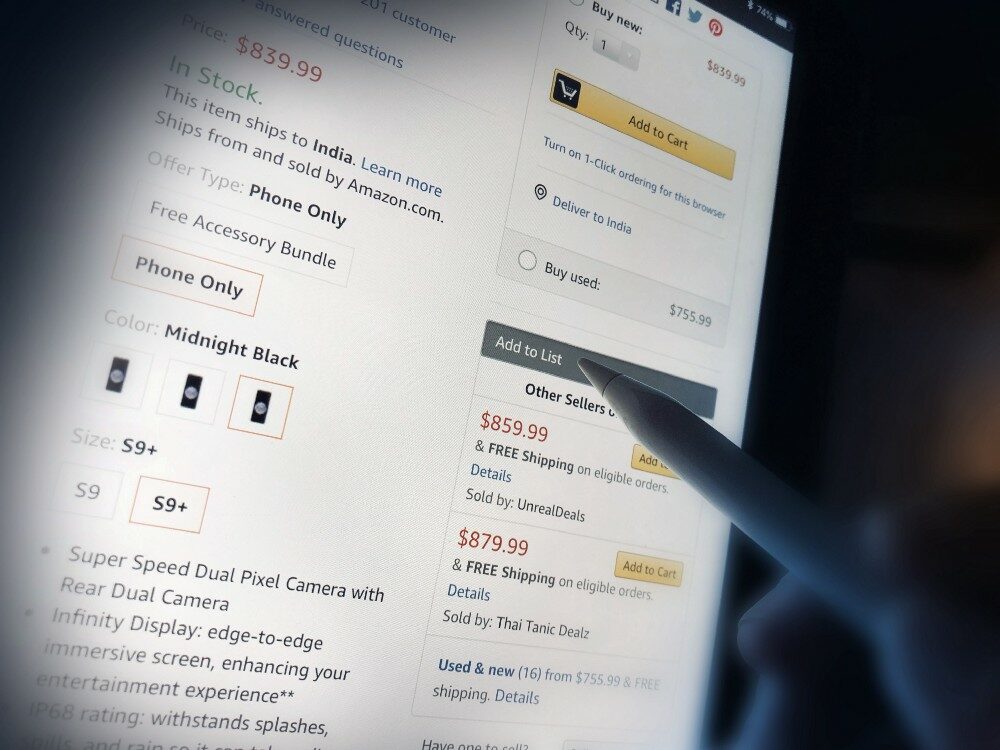

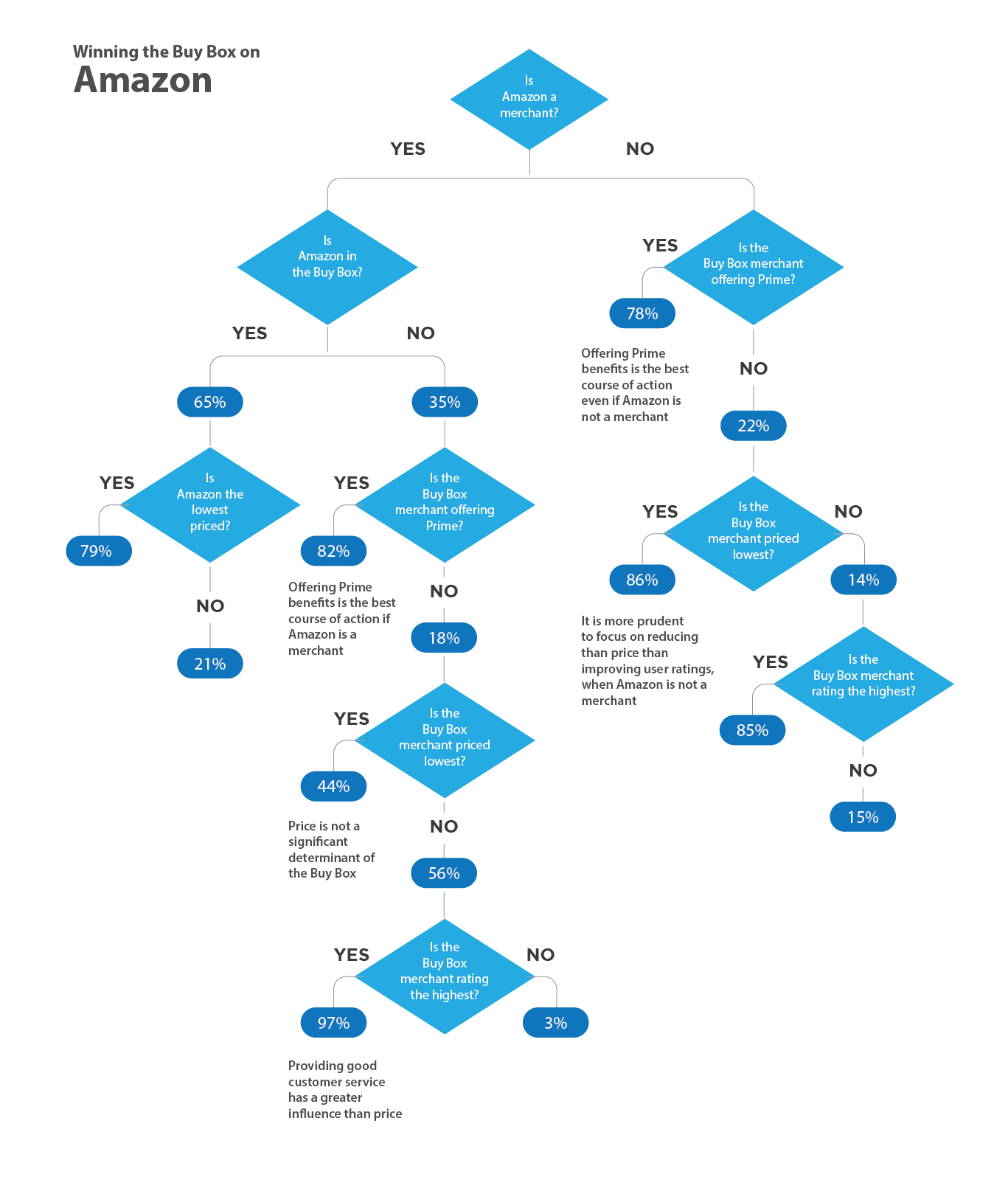

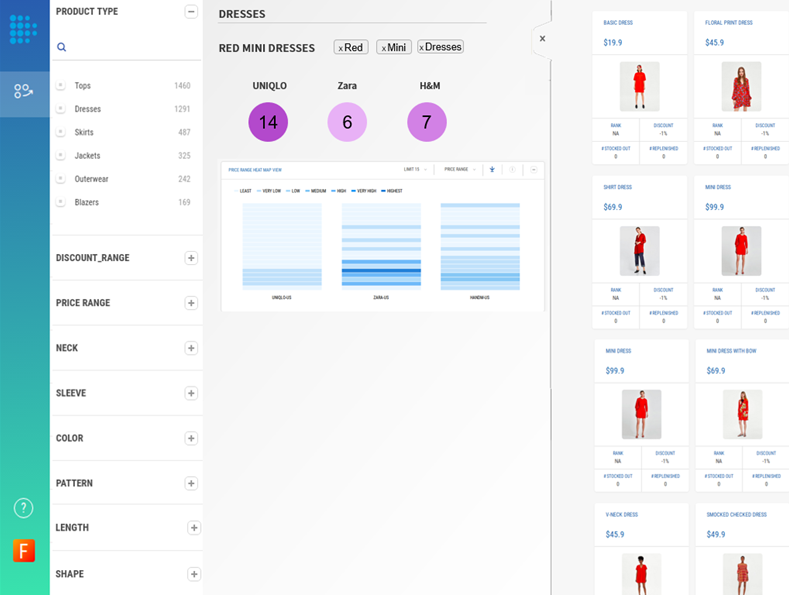

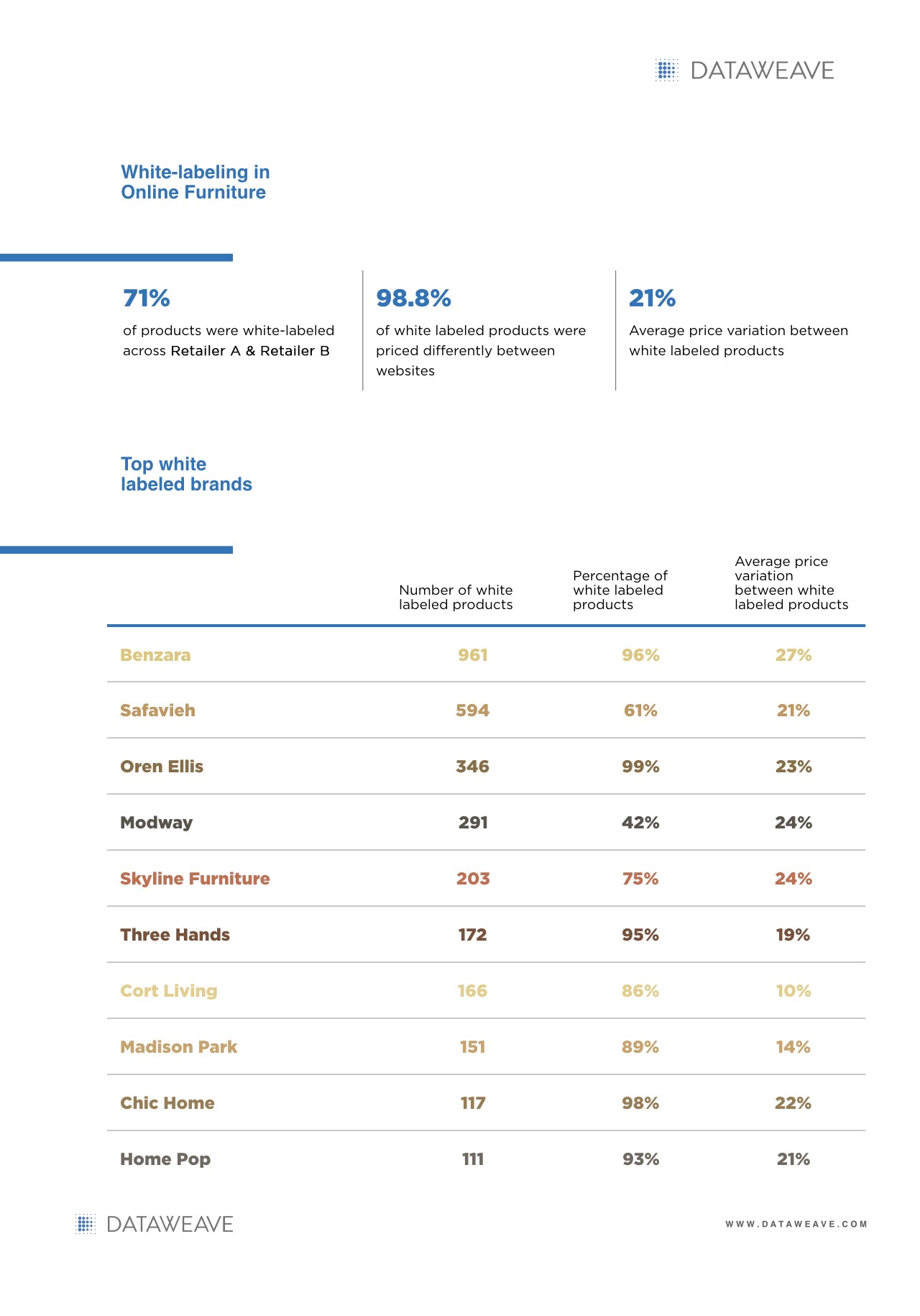

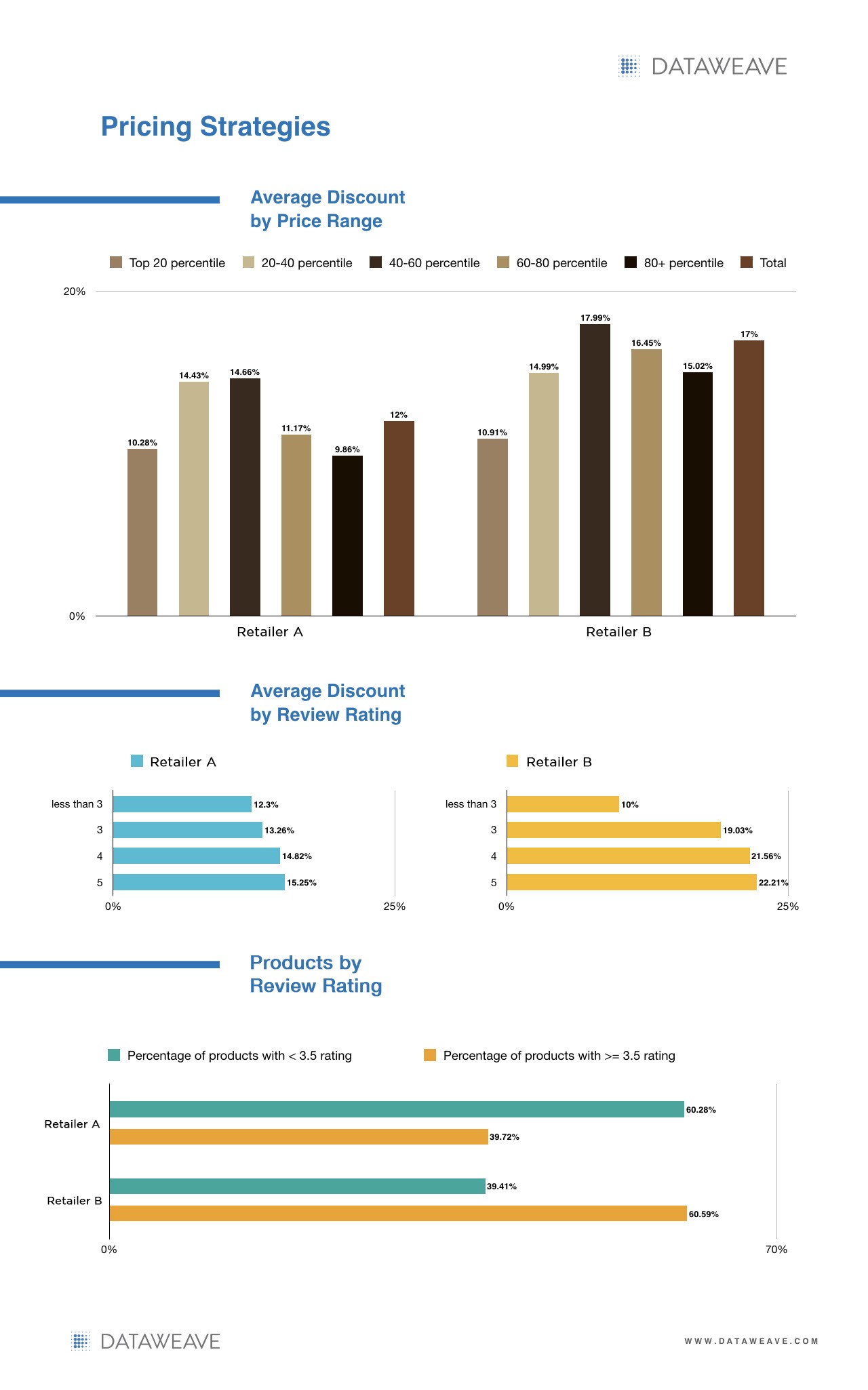

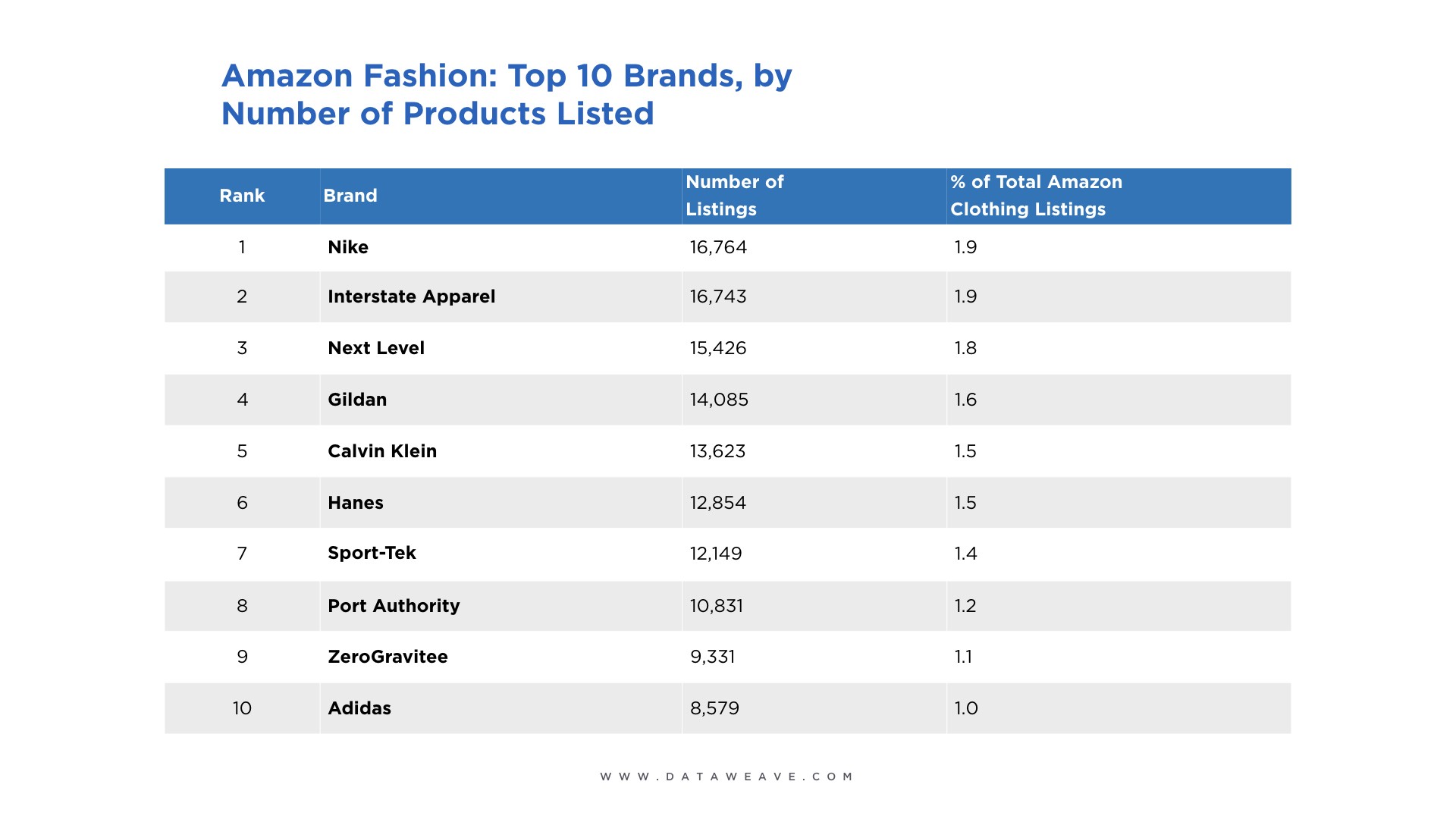

KB: For retailers, we provide competitive intelligence, primarily around pricing optimization and assortment analytics. In the US, a lot of retailers are shutting shop and filing for bankruptcy.

VK: Yeah, we saw Sears go through something like that.

KB: The reasons fall broadly into 3 categories:

- They failed to compete profitably with a lot of these new age businesses.

- The new age retailers offer superior customer experience. They have figured out a better assortment/product strategy.

- The third one is ‘Price’ — price is such an important feature.

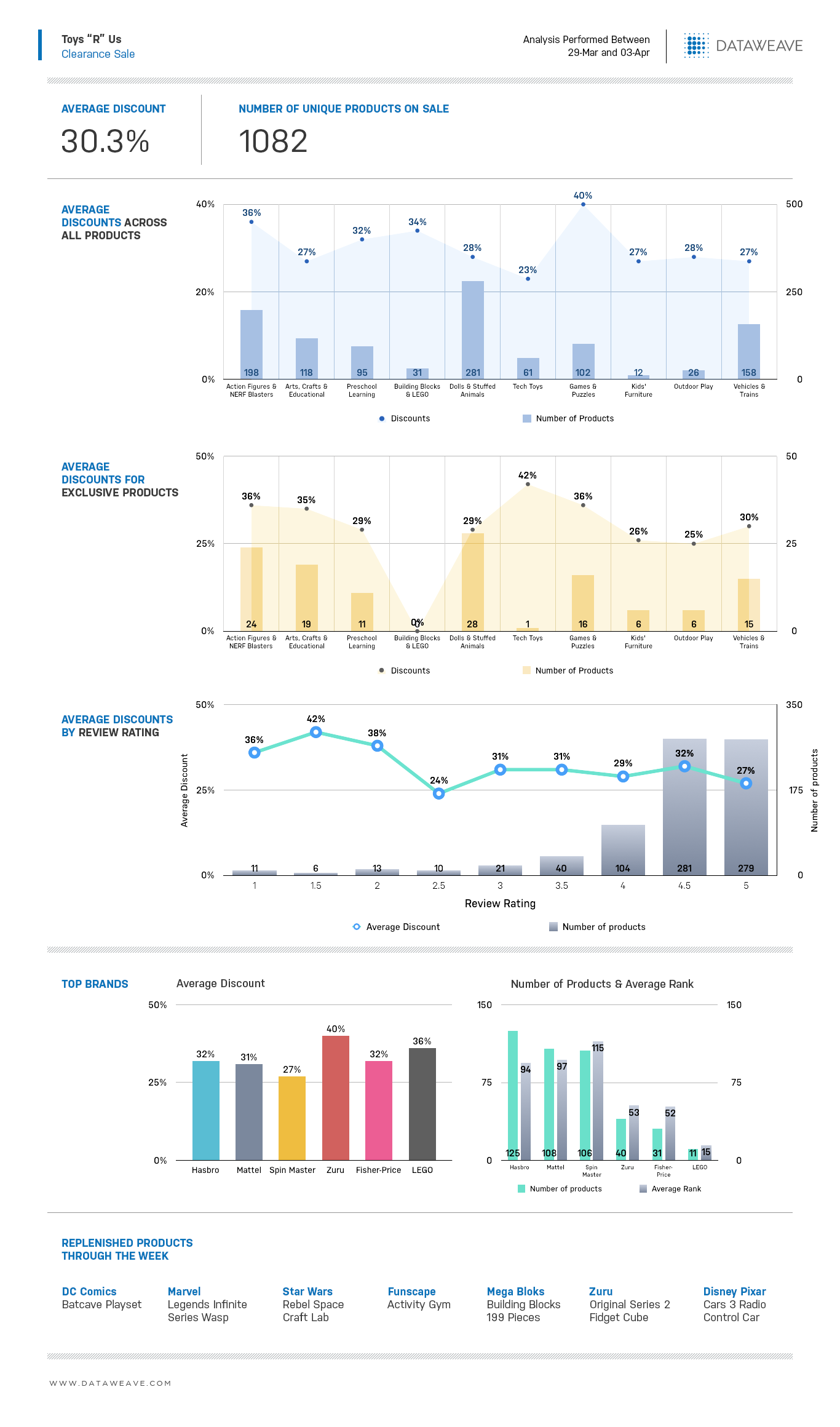

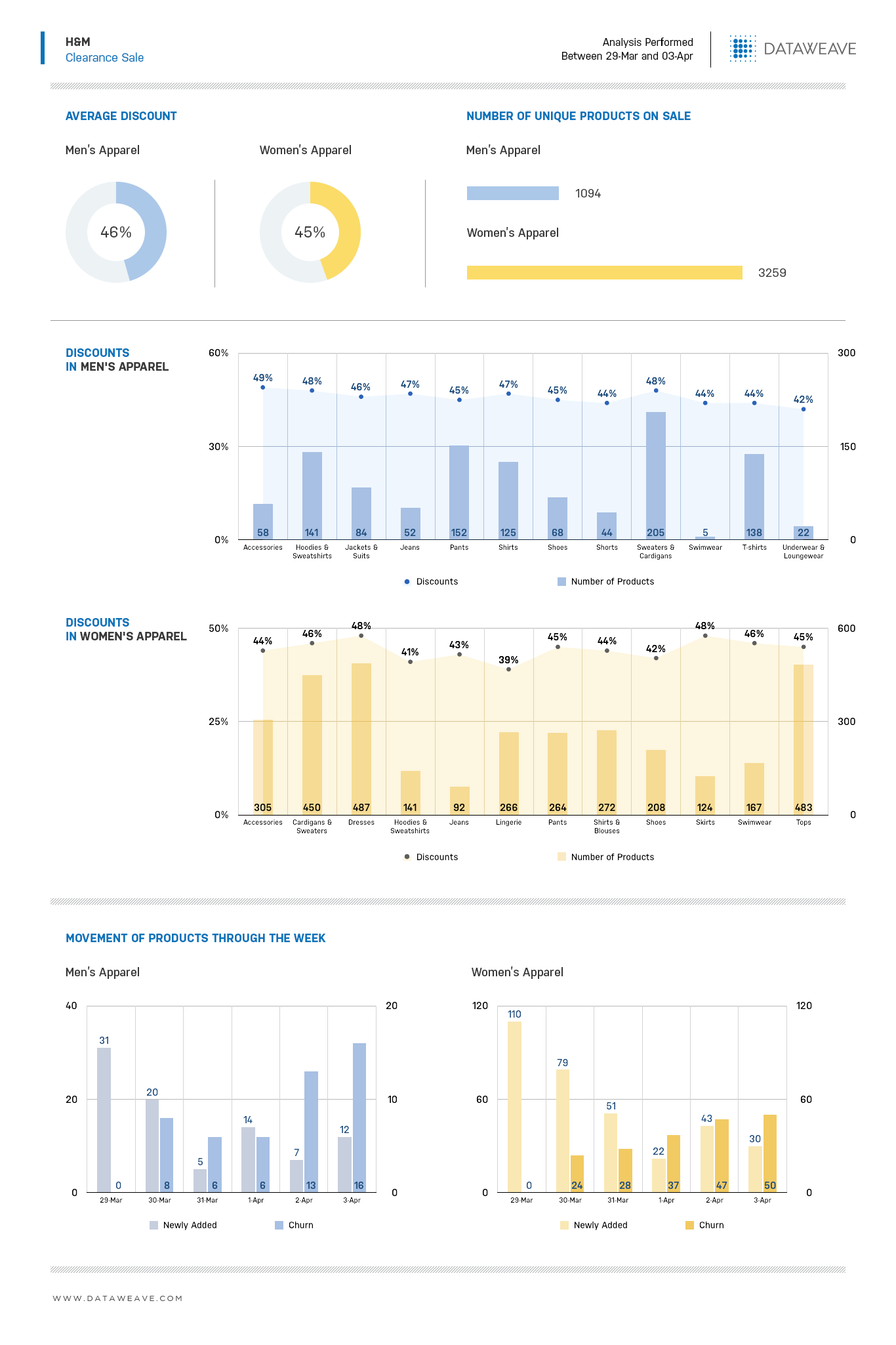

What we do is help these retailers optimize their strategies around pricing, assortment and promotions, eventually enabling them to compete profitably.

VK: Typically, customers pay you on the outcome, pricing, license or subscription?

KB: It’s a subscription-based model. There is a one-time setup fee and an ongoing subscription fee.

VK: So you plug into their data management system?

KB: Yes, but we can also have our product sit independently. Sitting out of their internal systems is a benefit for us as we don’t have to get into the entire loop of integrations into their internal systems right from Day 1. We prove our product works and then we integrate with their systems.

VK: How do you integrate? Is the CIO your target?

KB: No, we don’t sell to the CIO world. We sell to analytics, pricing, and merchandising teams.

VK: Can pricing alone give retailers a competitive edge?

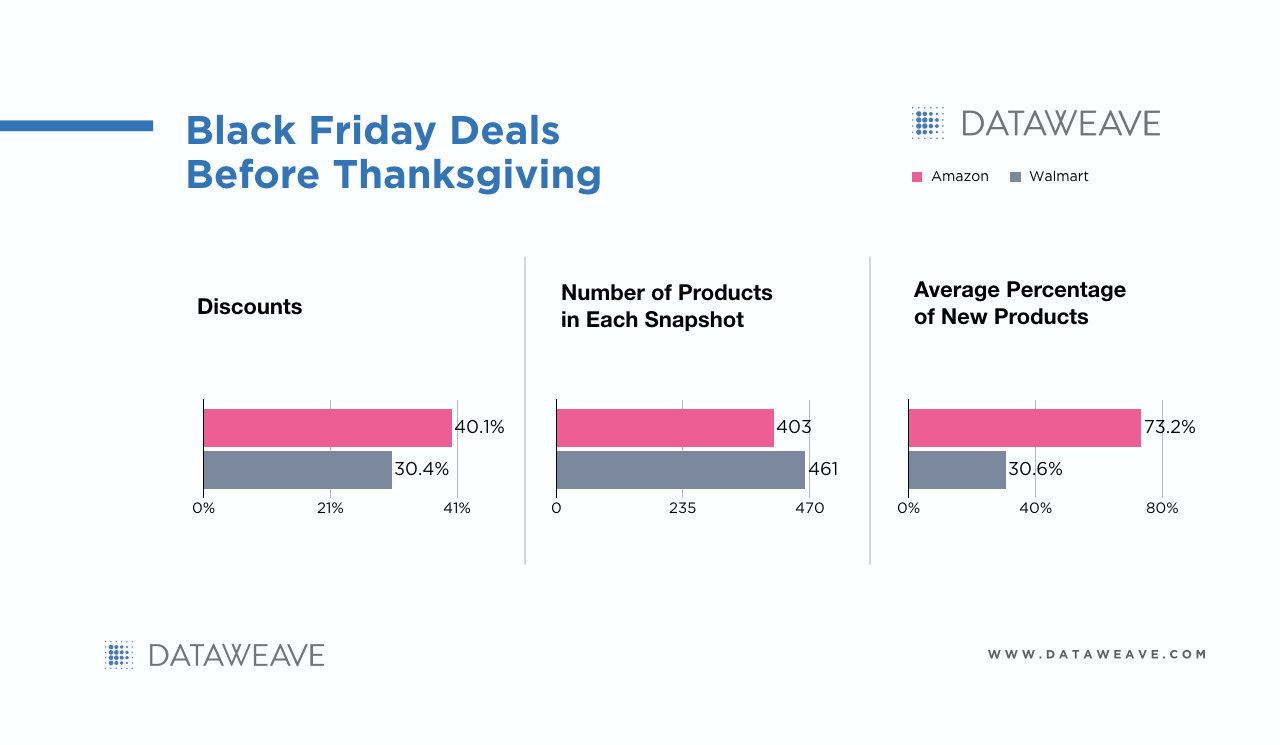

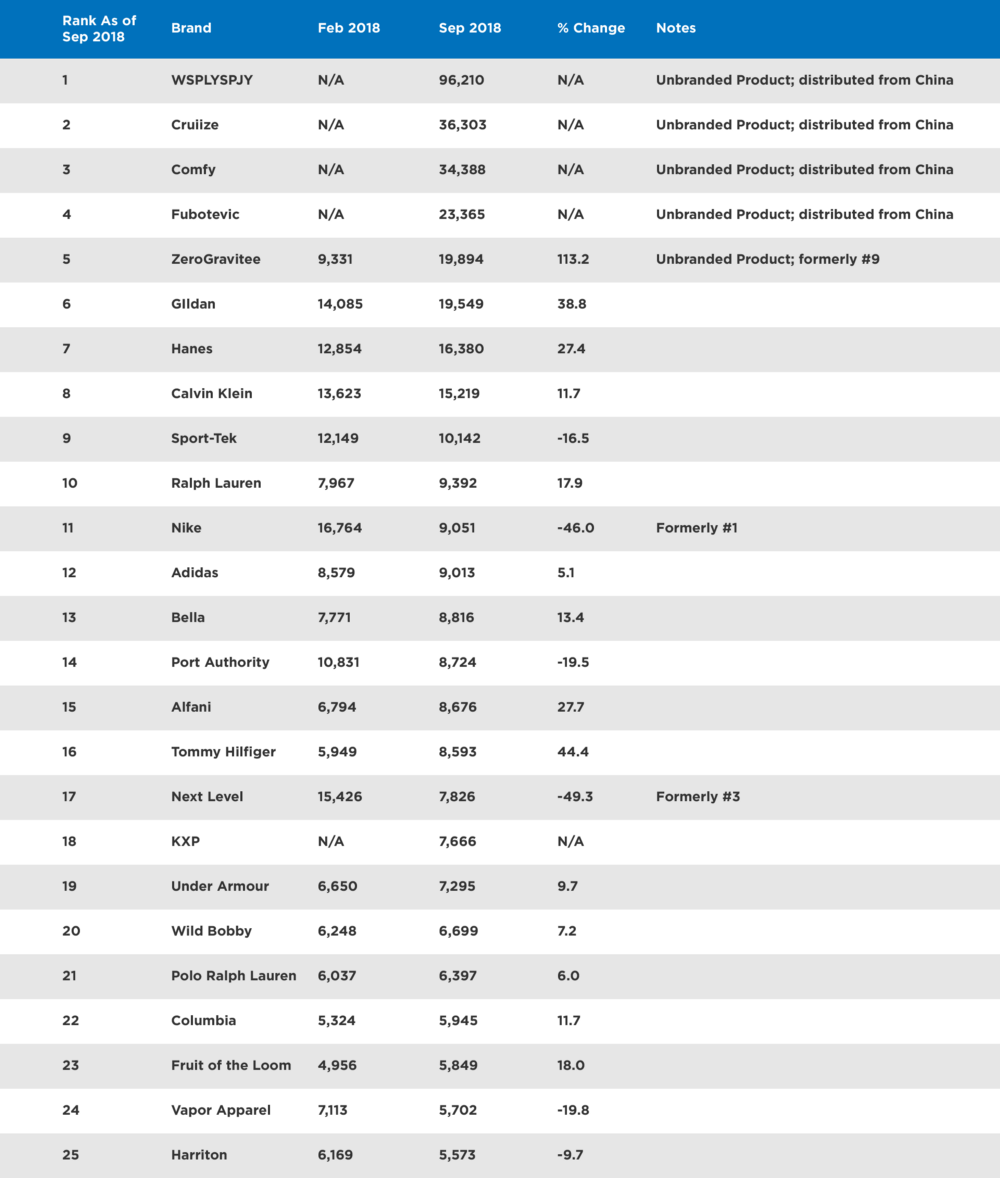

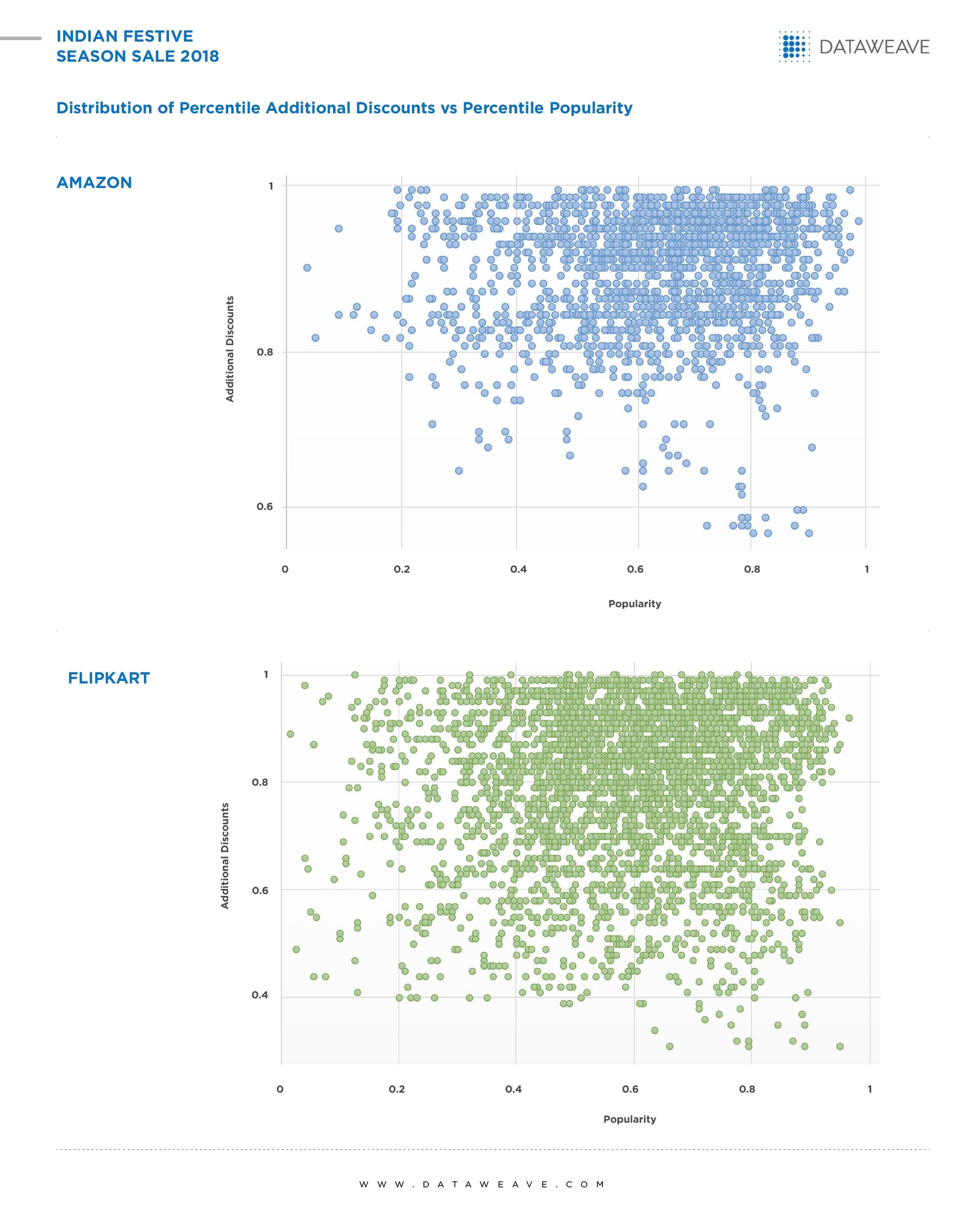

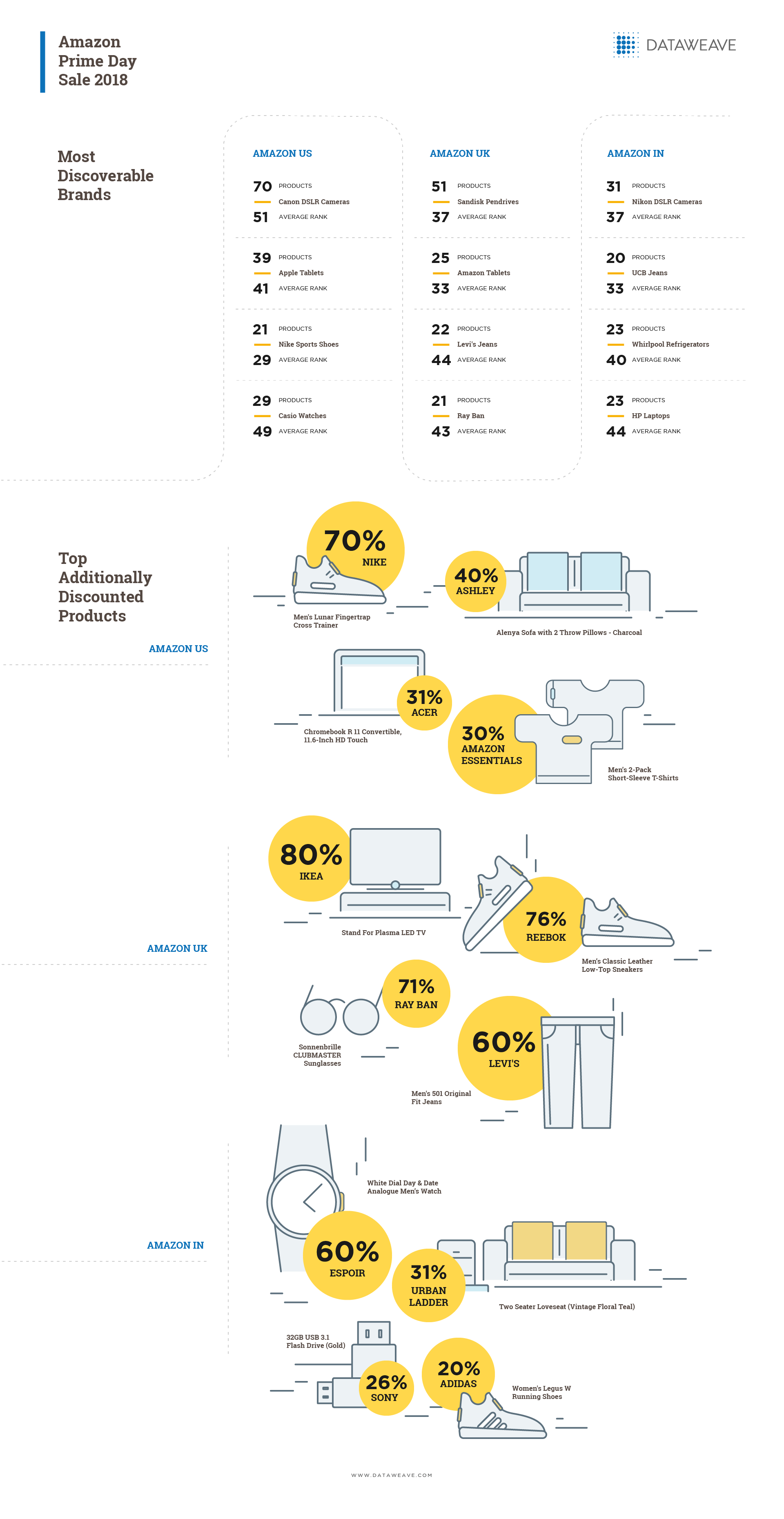

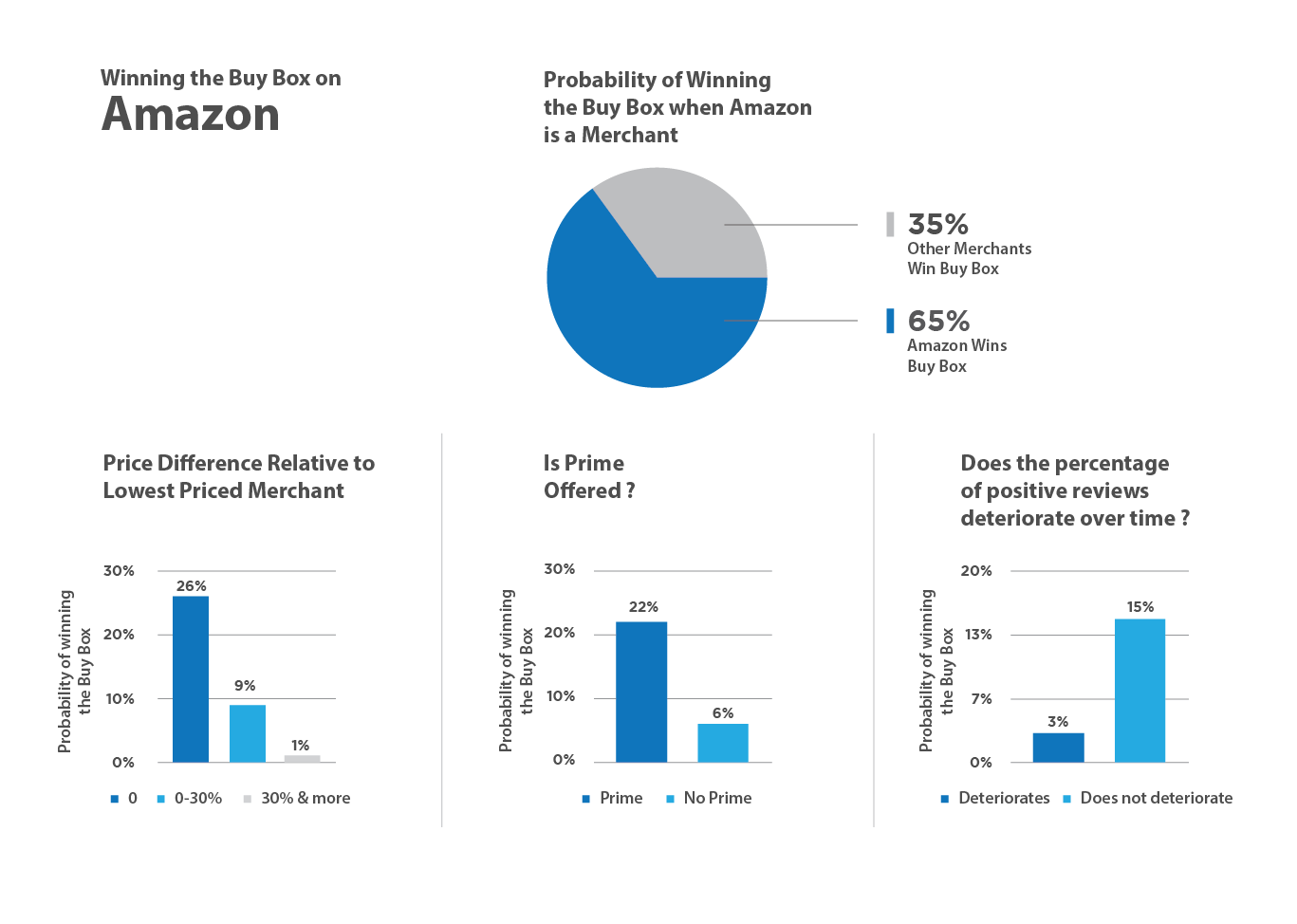

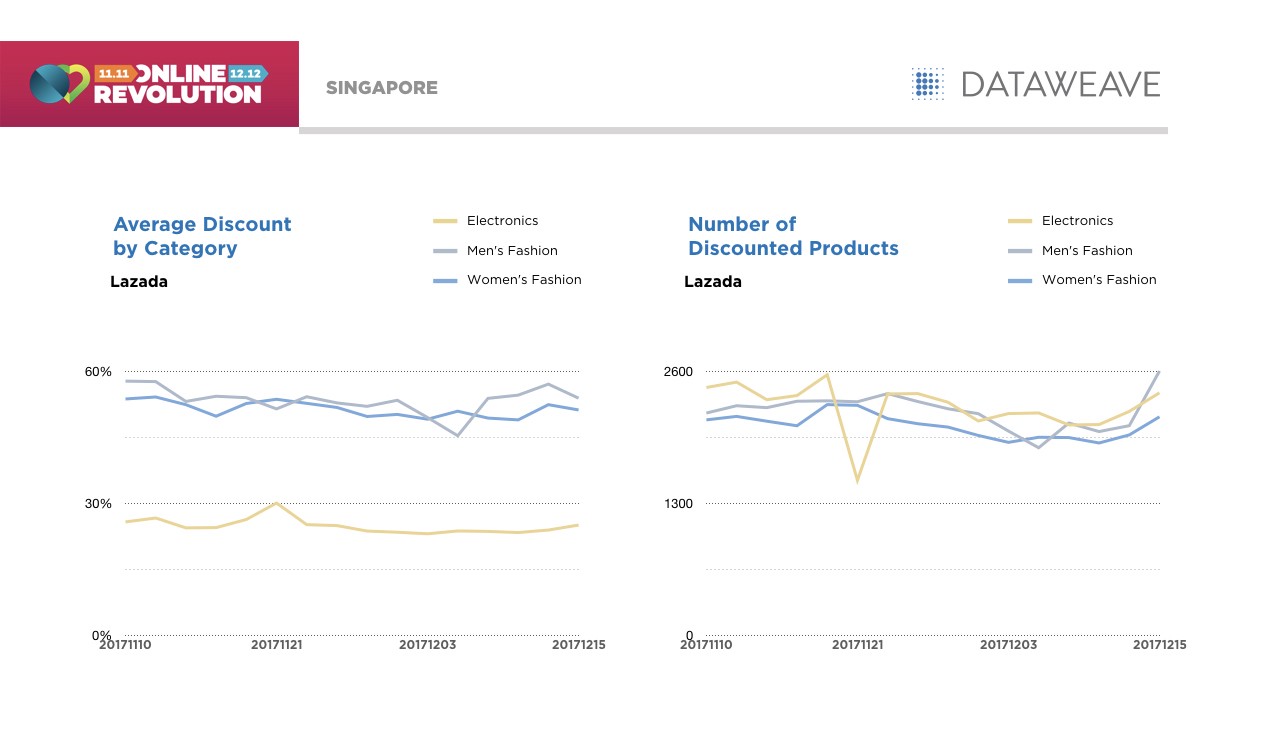

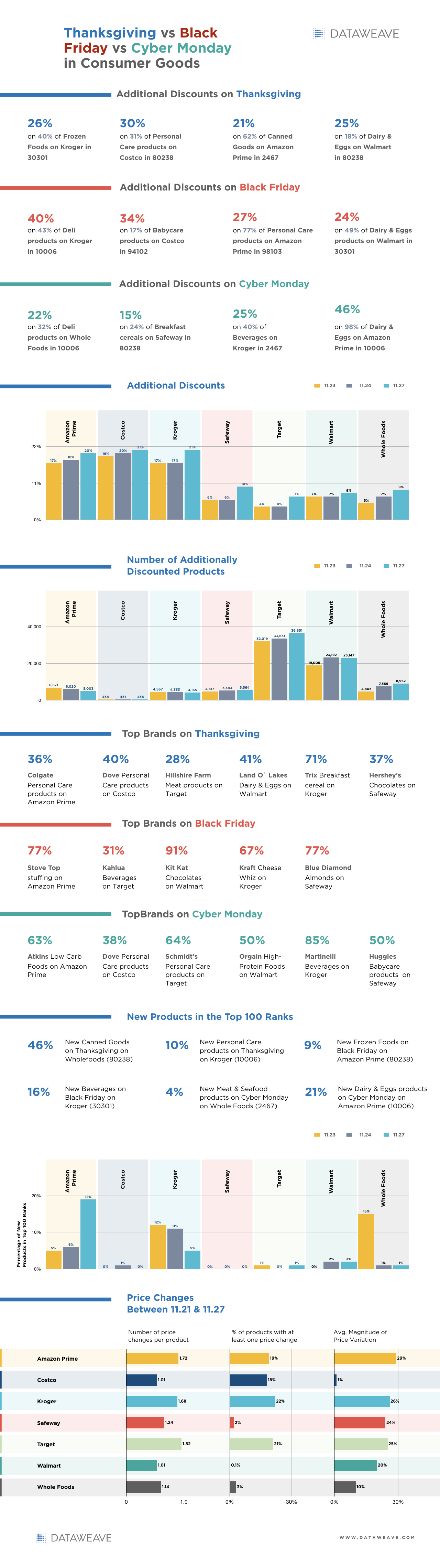

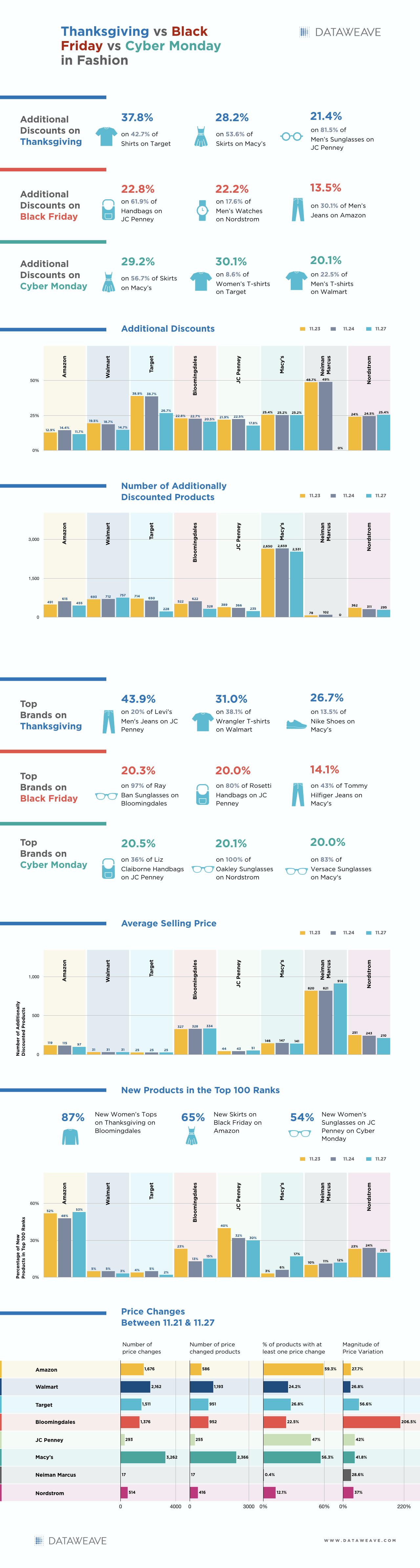

KB: Yes, pricing is a big lever that retailers use. For example, last holiday season’s sale, Amazon and Walmart made 120 million price changes in just 2–3 days.

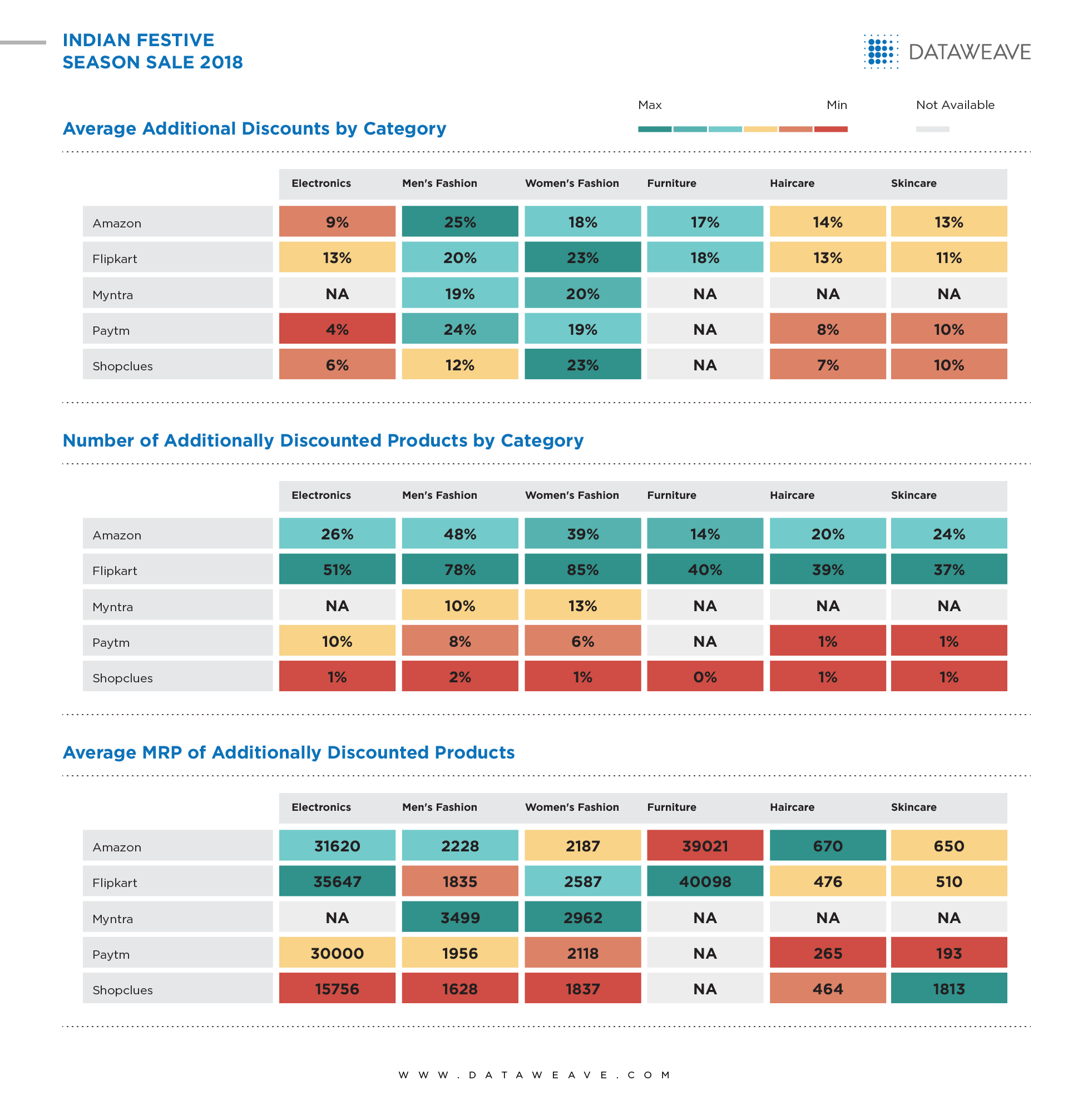

VK: So they change the prices so dynamically to compete with each other. Is this price war coming to India?

KB: It is happening in India already.

VK: How much data can DataWeave’s infrastructure ingest?

KB: We are a global platform — we have customers across the globe, not just the US or India. So, on a daily basis, we process data on around 120 million products.

VK: Talk a little bit on R&D quickly. Do you have your marketing team in the US?

KB: We have marketing teams in the US and India.

VK: And the engineering team?

KB: The engineering team is in Bangalore.

VK: For people who want to work in your company, what kind of talent are you looking for?

KB: We look at 4 broad talent areas:

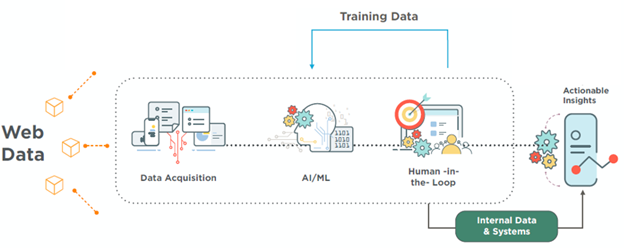

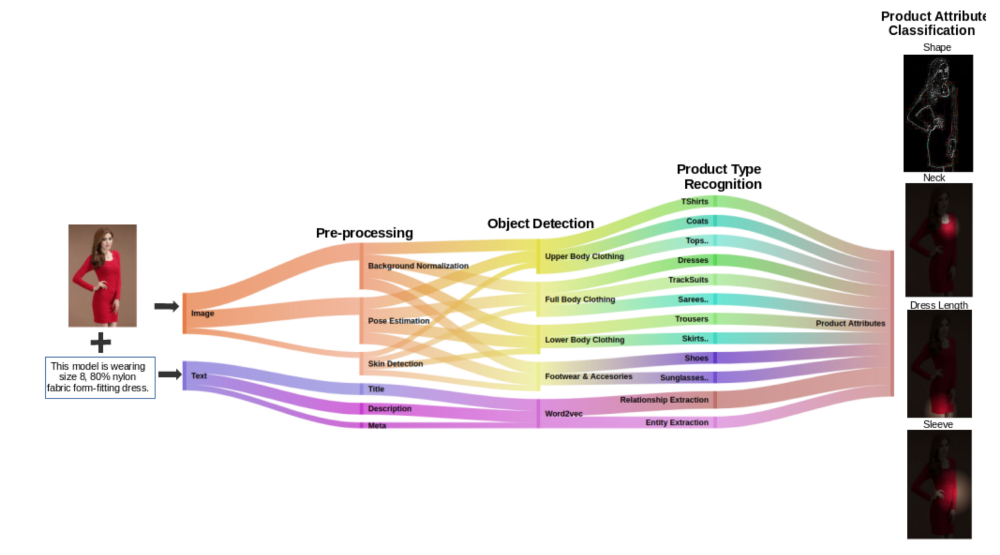

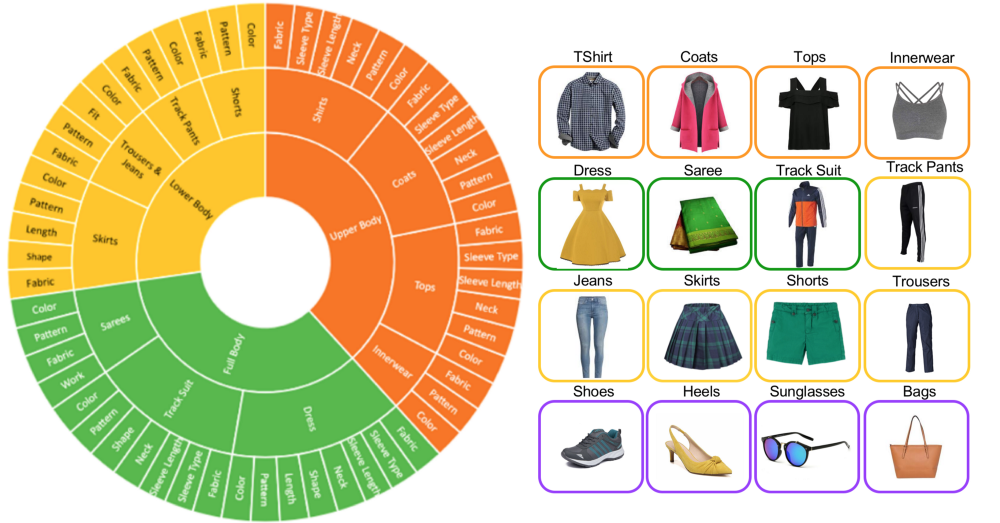

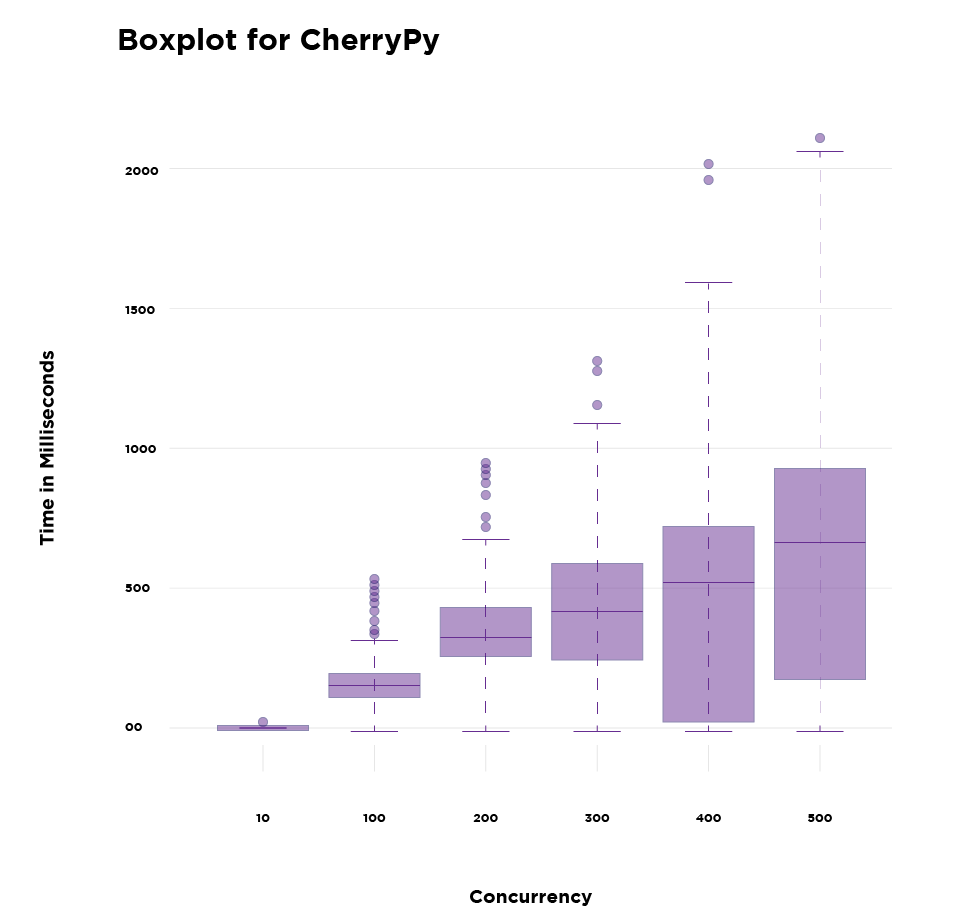

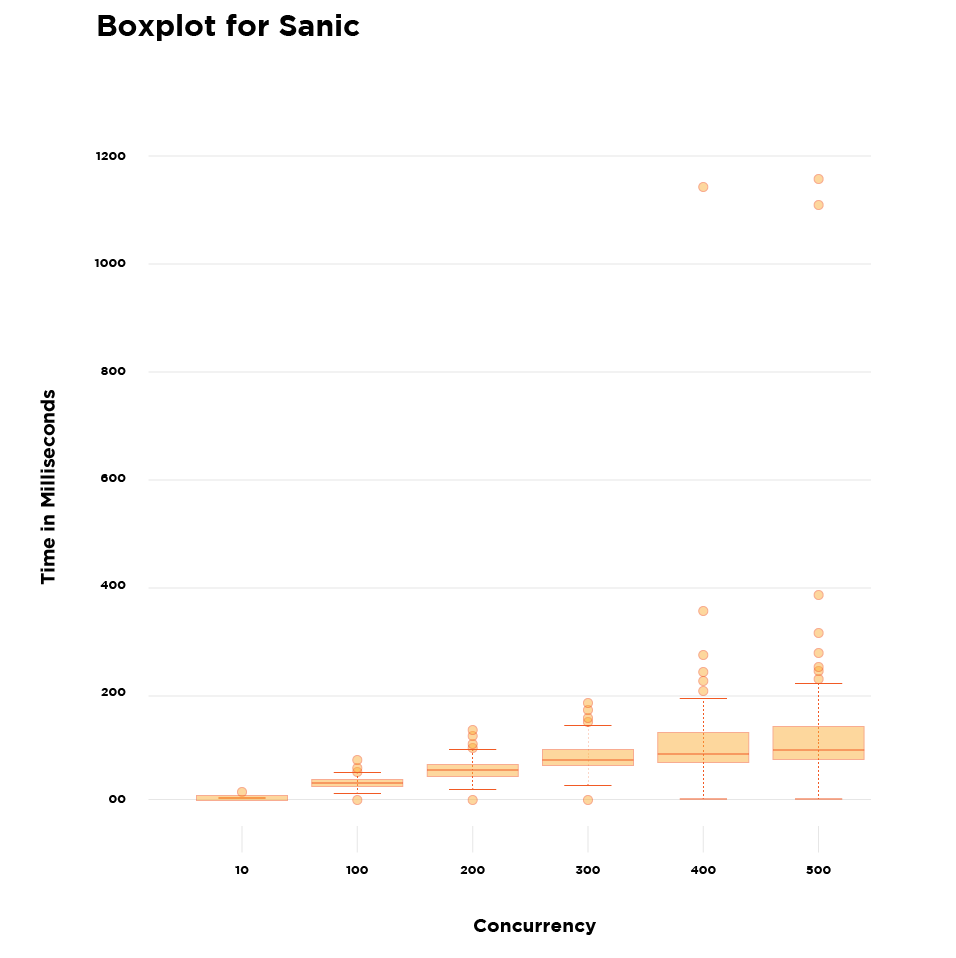

- One is in the world of data acquisition, which addresses issues like how data can be aggregated from thousands of websites and millions of pages on an ongoing basis, and how this data can be stored.

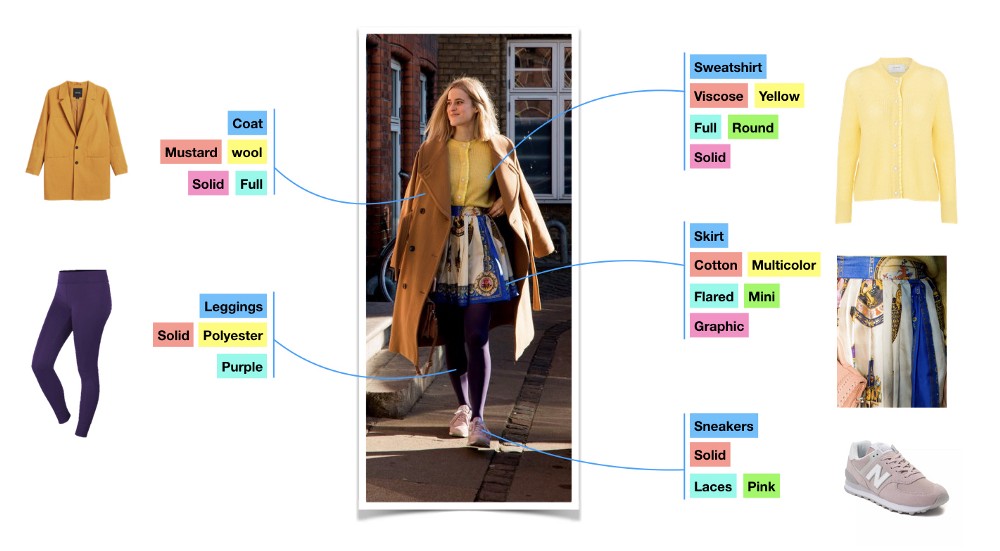

- The second area is on what kind of insights can be generated using this data. This could be done using text analytics, image analytics, and other technologies. This includes process optimization, in terms of building efficient and scalable systems.

- The third area is on how well the data can be represented if we have a customer who wants 60–70 million data points to be consumed on a weekly basis.

- And the last area is on data modeling — what kind of insights can we eventually give to the customer? And, when I say insights, I mean specific actions.

VK: You want people who can handle massive scale and for that they should be good at linear regression.

KB: We value people who write good code. We primarily work in Python, and we use a lot of optimization techniques in the middle of the stack to help us scale.

VK: Would you do something for supermarkets?

KB: Absolutely. The largest offline supermarket in India is our customer.

VK: So what can you do for supermarkets?

KB: Offline retailers across the world are facing something that’s called showrooming. This is when a shopper walks up to a store, looks at and feels a product, then searches online to see it’s available at a better price. So we have retailers who are wary of this phenomenon. We also have retailers who are wary of diminishing customer loyalty. So they have to constantly ensure that they are priced better in the market and are not losing customers because of [online] pricing.

VK: How powerful are your algorithms?

KB: There is a dedicated team that works on our algorithms. These fall into several buckets. One is pure data scale algorithms — how do you build systems which ensure that you are able to efficiently query them in real time and get the desired output. The second one is — how do you keep improving your machine learning algorithms. For example, computer vision algorithms, text analytics algorithm, etc. The third — how do you keep experimenting effectively.

VK: What role can an MBA degree holder play in DataWeave?

KB: We have people who hold MBA degrees and are working in customer success, delivery management, marketing, and sales.

VK: Do you spend time in training?

KB: You do have some lead time if you are a fresher, but if you are a lateral hire, its expected that you keep the ball rolling. They should be able to learn and learn fast — learning is more important than knowing. So, we give a lot of importance to people who can learn and pick up things quickly – about our product, handling customer objections, etc.

*

Watch the whole video here or check out DataWeave’s website to know more about how we use data engineering and artificial intelligence to enable retailers and brands to compete profitably in the age of eCommerce.

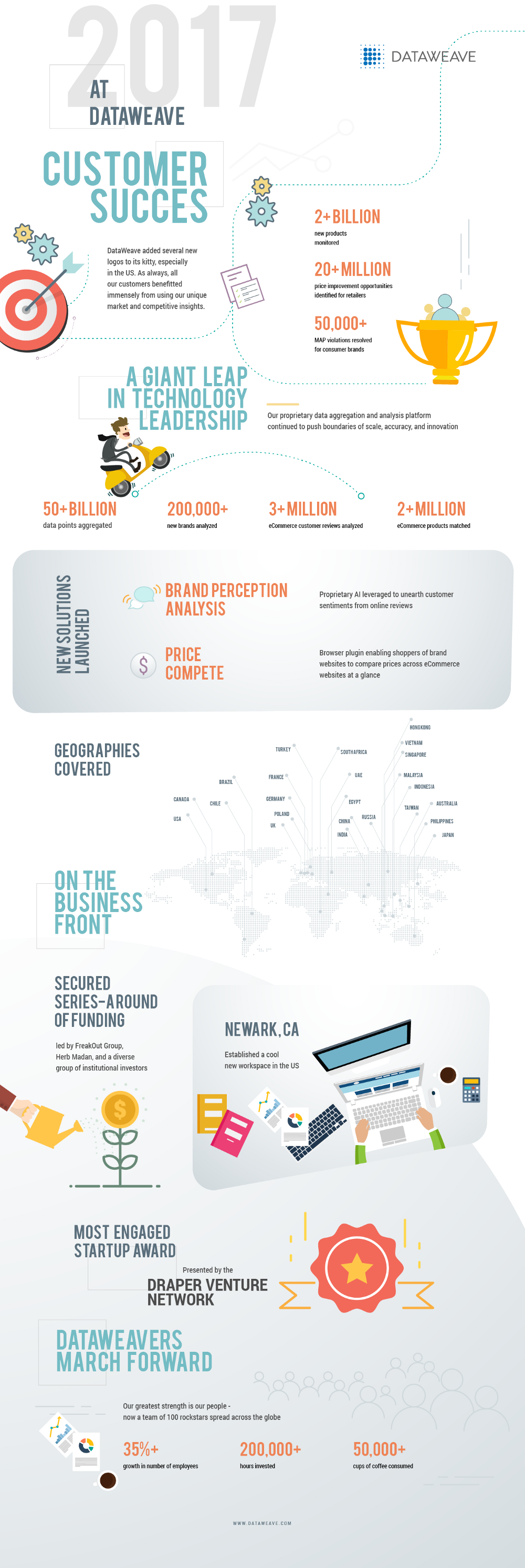

![[INFOGRAPHIC] 2017 at DataWeave: A Year in Retrospect](https://stage-cdnblog.dataweave.com/wp-content/uploads/2018/09/pic3-e1688040963744.jpeg)

![[INFOGRAPHIC] Thanksgiving vs Black Friday vs Cyber Monday: The Electronics Price War Heats Up](https://stage-cdnblog.dataweave.com/wp-content/uploads/2018/09/a4-e1688041211819.jpeg)