The U.S. health and beauty retail sector shows remarkable resilience amid economic uncertainties, with the skincare market projected to hit $21.83 billion in 2024. Black Friday data reinforces this trend, with health and beauty products seeing a 14.6% surge in web traffic compared to last year.

At DataWeave, we conducted an in-depth analysis of Black Friday discounting trends in the U.S. health and beauty sector. DataWeave’s AI-powered pricing intelligence platform was used to monitor pricing and discounts across Sephora, Ulta Beauty, Walmart, Target, and Amazon during Black Friday 2024. The study covered 19985 SKUs from November 10-29. We focused on the top 500 products ranked for each search keyword on each retail site, using targeted terms aligned with categories like “skincare” and “fragrance”.

The results? Beauty leads across categories in discount depth this year, with some retailers offering significant markdowns.

The Beauty Boom: More Than Just Looking Good

If there’s one thing the pandemic taught us, it’s that self-care isn’t just a luxury – it’s a necessity. This Black Friday proved that beauty has become an indispensable part of consumers’ lives, with retailers offering unprecedented discounts and crafting strategic promotions to capture the growing demand.

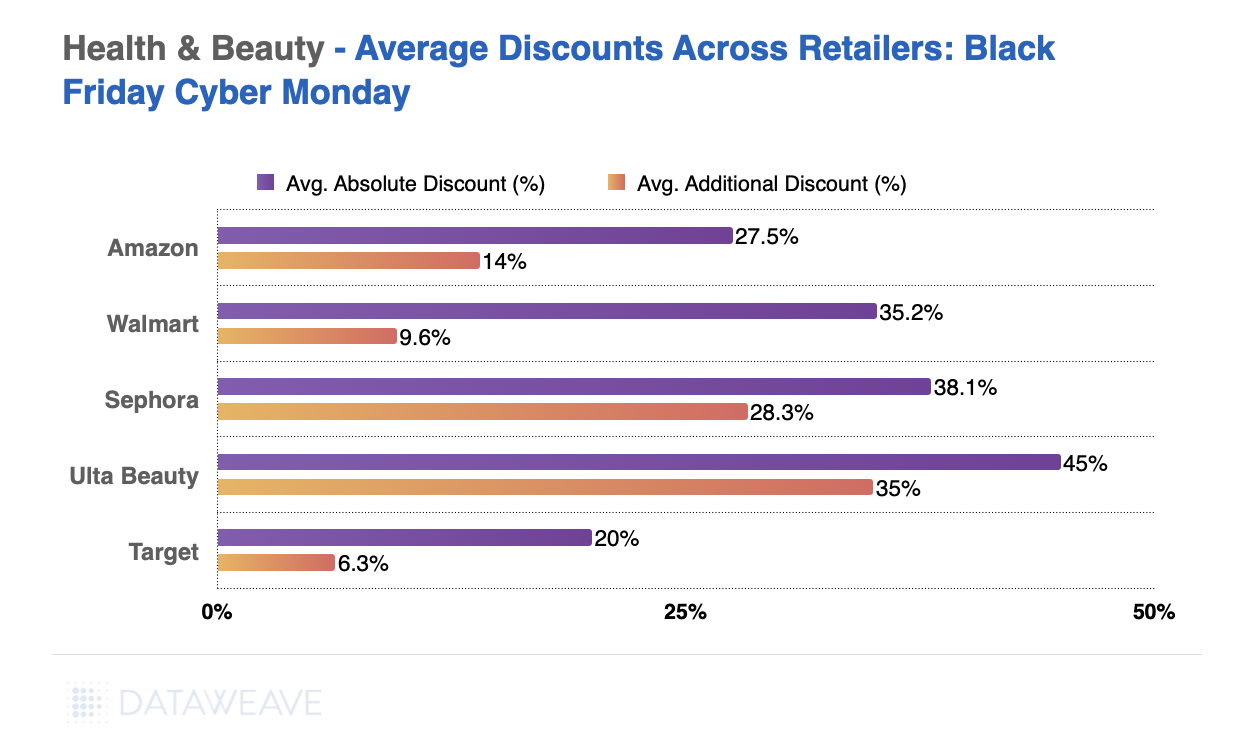

The Absolute Discount represents the reduction of the selling price compared to the Manufacturer’s Suggested Retail Price (MSRP). The Additional Discount reflects how much lower the selling price is during Black Friday compared to its price a week before the sale. This metric reveals the actual or effective value of the sale event, beyond the standard discounts typically offered.

Ulta Beauty led with 45% average discounts, followed by Sephora at 38.1% and Walmart at 35.2%. In terms of additional Black Friday discounts, Ulta maintained dominance at 35%, with Sephora following at 28%.

Hair care emerged as the standout category, with Ulta Beauty offering up to 56% discounts, reflecting sustained demand for at-home beauty routines. Skincare saw fierce competition, with Sephora emphasizing premium discounts (37%) while Walmart focused on value pricing (32.5%).

Fragrance and Makeup attracted consumers with targeted promotions from Walmart and Ulta Beauty, signaling strong demand for gifting items.

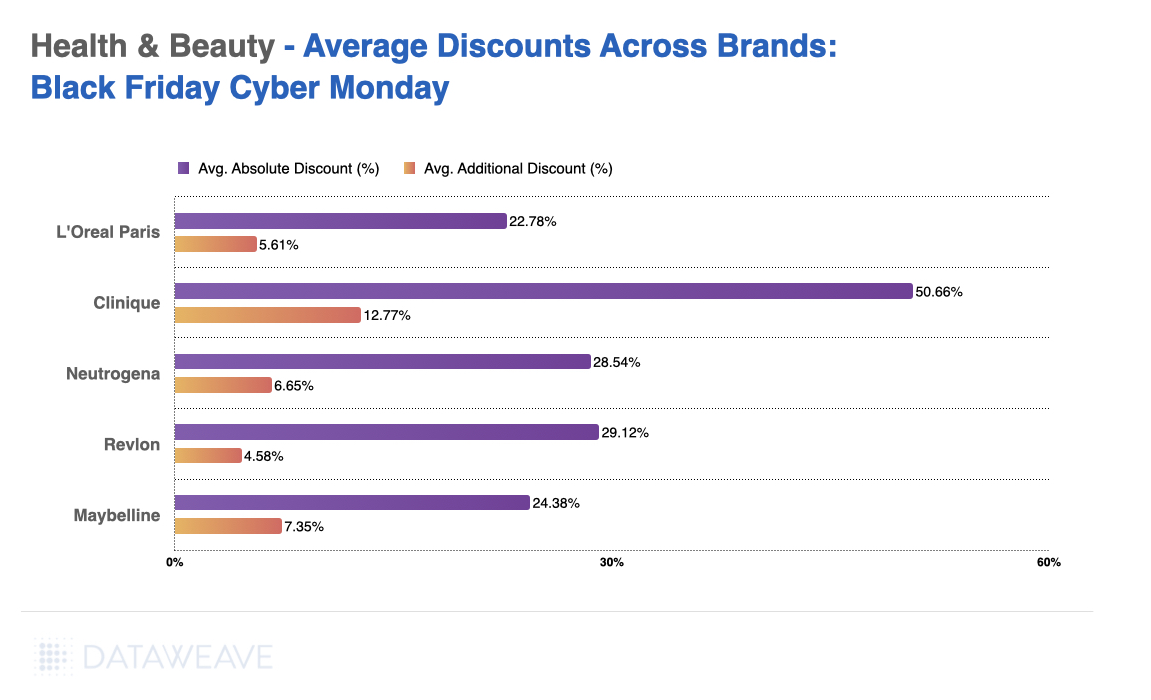

Major beauty brands echoed the sentiment. Premium skincare brand Clinique leads with 50.6% average discounts. Meanwhile, drugstore staples like Revlon (29.1%) and Maybelline (24.4%) balanced accessibility and affordability, driving mass-market appeal. Popular beauty and makeup brand L’Oreal Paris also offered a modest 22.8% average discount, reinforcing its position as a value-oriented brand.

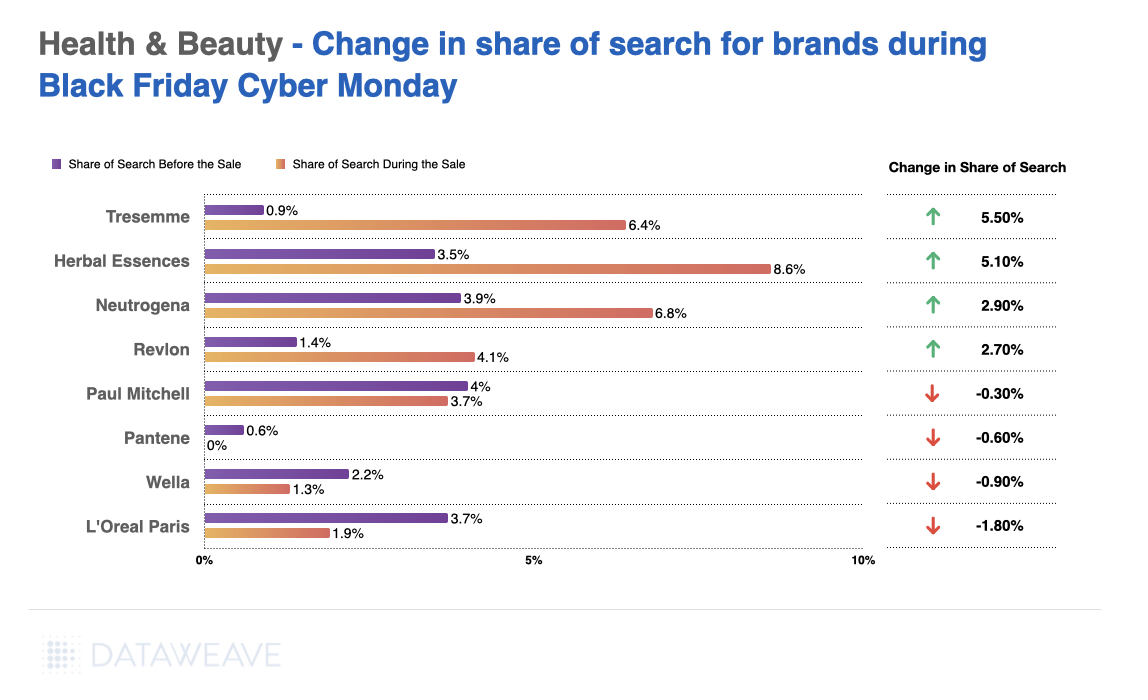

The more interesting story? The massive shift in brand visibility, as our share of search rankings denote:

- Shampoo and hair care brand Tresemmé saw an unexpected 5.5% jump in the share of search results

- Beauty brand Herbal Essences gained 5.1% in share of search well

Declines in share of search were noted for brands like L’Oreal Paris (-1.8%) and Pantene (-0.6%), indicating missed opportunities in promotional visibility.

Insight: What’s driving this beauty boom? TikTok and social media continue to fuel beauty purchases, with viral products driving significant search and sales spikes. Plus, the “skinification” of hair care has turned basic shampoo shopping into a full-blown beauty ritual.

Who Offered the Lowest Prices?

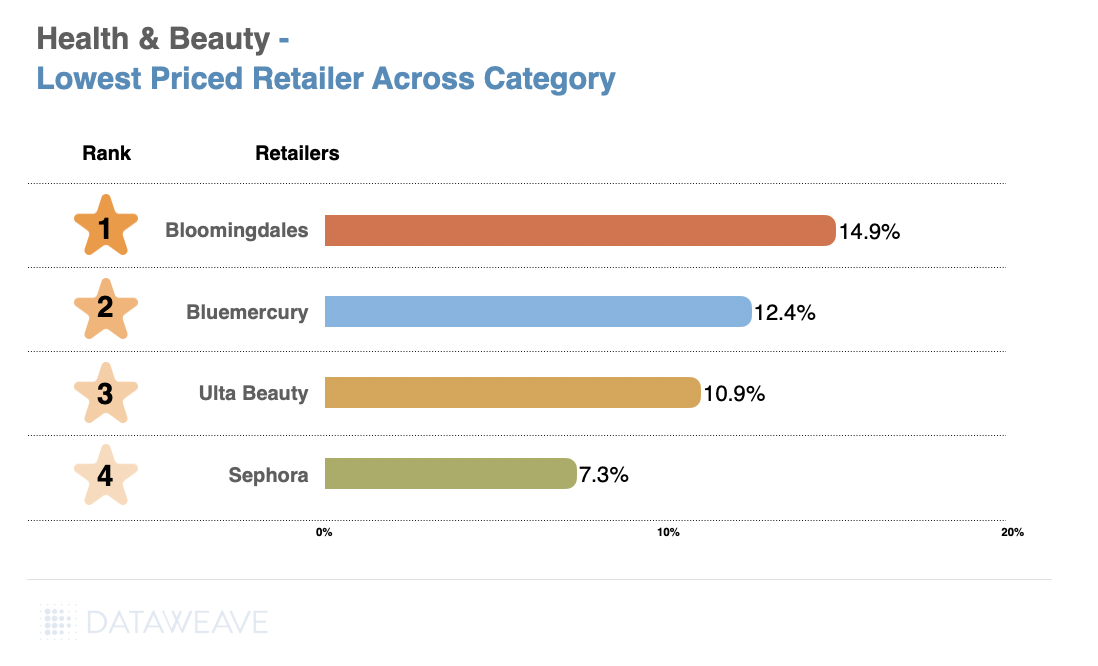

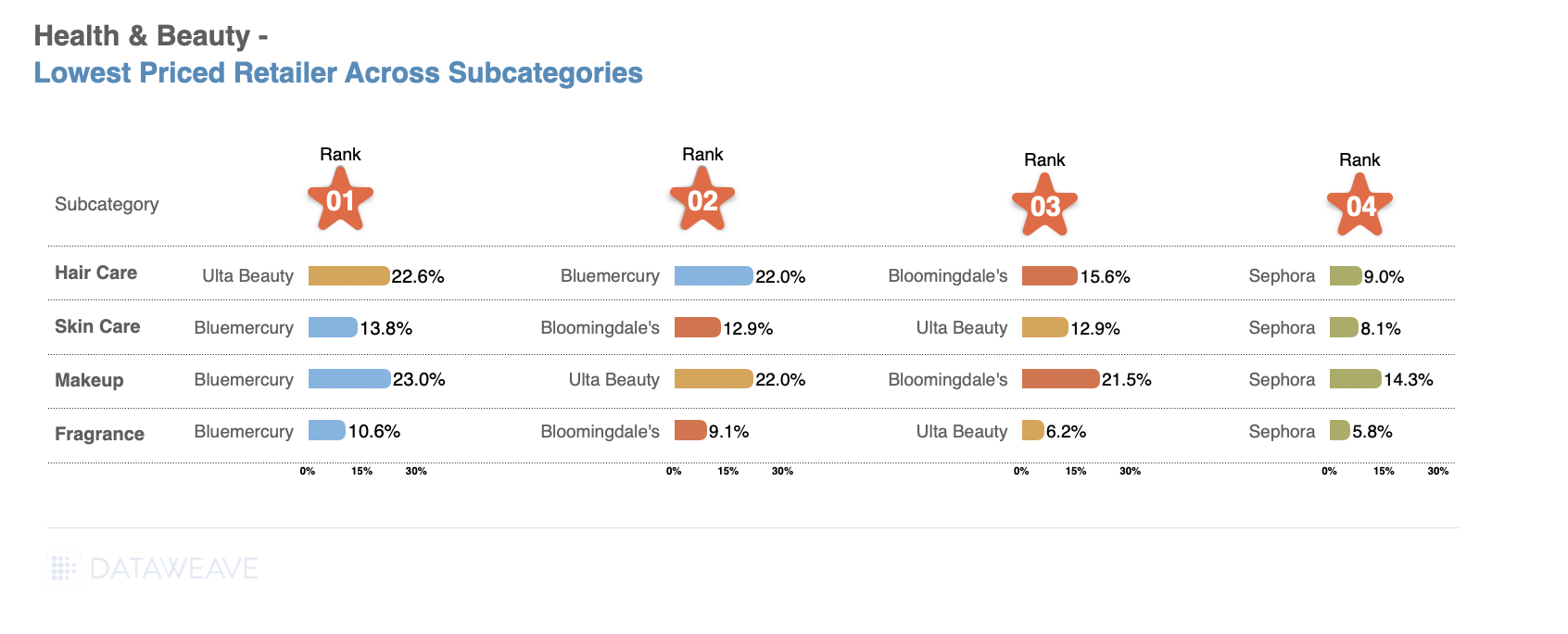

In the previous analysis, we focused on the top 500 products within each subcategory for each retailer, showcasing the discount strategies for their highlighted or featured items. However, to identify which retailer offered the lowest or highest prices for the same set of products, it’s necessary to match items across retailers. For this, we analyzed a separate dataset of 1133 matched products across Health & Beauty specific retailers to compare their pricing during Black Friday. This approach provides a clearer picture of price leadership and competitiveness across categories.

Here are the key takeaways from this analysis.

- Bloomingdale’s emerges as the overall leader, offering the highest average discount of 14.87%, closely followed by Bluemercury (12.41%).

- Ulta Beauty ranks third (10.94%), demonstrating competitiveness across key subcategories, while Sephora trails with the lowest average discount (7.33%), reflecting a more premium positioning.

- Ulta Beauty leads in Hair Care with the highest discount (22.62%), while Bluemercury dominates in Skin Care (13.81%), Makeup (22.98%), and Fragrance (10.6%).

- Sephora consistently offers the lowest discounts across all subcategories, reflecting their premium positioning.

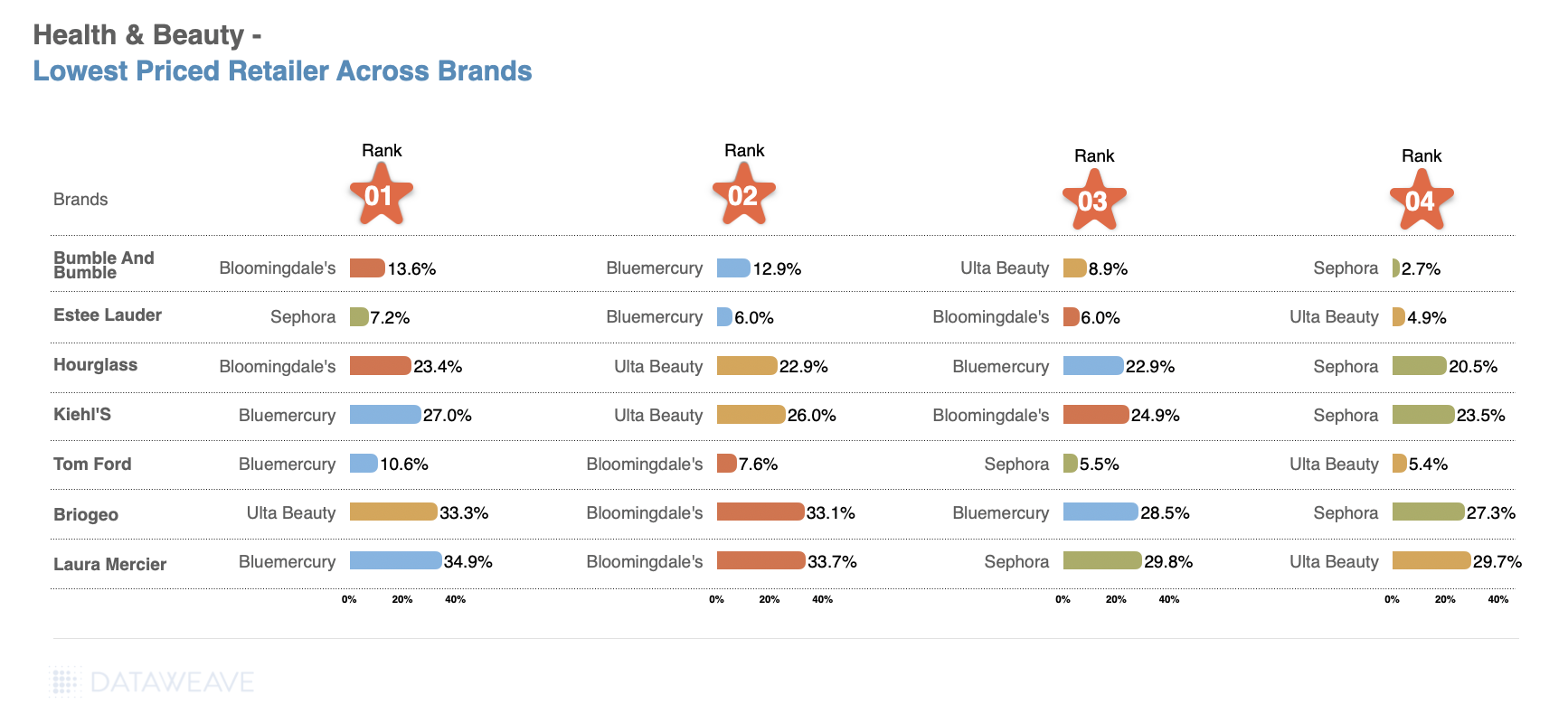

- Bluemercury offers the lowest prices for luxury brands like Kiehl (27.02%) and Laura Mercier (34.87%), with Bloomingdale’s closely trailing.

- Bloomingdale’s leads for Bumble and Bumble (13.59%) and Hourglass (23.41%), showcasing strong promotional efforts.

- Sephora maintains a more restrained discount strategy, with notable leadership only for Estée Lauder (7.18%).

- Ulta Beauty shines in offering the steepest discount for Briogeo (33.26%), emphasizing competitiveness in key brands.

What’s Next for Holiday Discounting?

For retailers, the message is clear: traditional holiday playbooks need a serious update. For shoppers, it means unprecedented opportunities to score deals in categories that traditionally held firm on pricing.

Want to stay ahead of retail trends and optimize your holiday shopping strategy? DataWeave’s commerce intelligence platform helps brands and retailers strategically navigate these shifts. Contact us to learn more about how we can help you make data-driven decisions in this rapidly evolving retail landscape.

Stay tuned to our blog for forthcoming analyses on pricing and discounting trends across a spectrum of shopping categories, as we continue to unravel the intricacies of consumer behavior and market dynamics.