Confidence amongst retailing analysts was rocked last month by two successive announcements.

H&M’s most recent quarterly report, which revealed it had accumulated over $4.3 billion in unsold inventory, shocked retail analysts. In an era of on-the-fly inventory replenishment where stocks are closely matched to sales, a spike in unsold inventory is a strong indicator of trouble ahead. The news left analysts questioning H&M’s competitiveness in the fiercely contested global apparel category, where ever-changing consumer preferences demand agility in managing inventory levels.

In the other major announcement, Toys “R” Us officially closed its doors to shoppers. The retailer’s losses continued to pile up and the chain groaned under a mountain of debt, leaving it little choice but to close down. “The stark reality is that the (chain is) projected to run out of cash in the U.S. in May,” it said in its bankruptcy filing.

While the emergence of the online shopping phenomenon hasn’t helped Toys “R” Us, its ongoing afflictions largely reflect strategic missteps that predated the online shopping boom. In a category where the shopping experience is all, the retailer failed to adapt to changing consumer expectations. The warehouse context which shaped the retailing did little to promote toys sales or communicate the sheer breadth of inventory carried by Toys “R” Us.

So, as Toys “R” Us begins to wind down its operations, the company has shuttered its online store and is channeling customers to its remaining physical retail outlets. However, prior to the closure, shoppers enjoyed some amazing bargains during their clearance sale.

H&M’s problems appear less terminal. Its management claim to have implemented a strategy to slash its accumulated inventory and reign in its aggressive store expansion strategy.

At DataWeave, we leveraged our proprietary data aggregation and analysis platform to analyze the clearance sales of both H&M and Toys “R” Us. We tracked the pricing, product categories, discounts, review ratings, stock status and more between 29-Mar and 3-Apr.

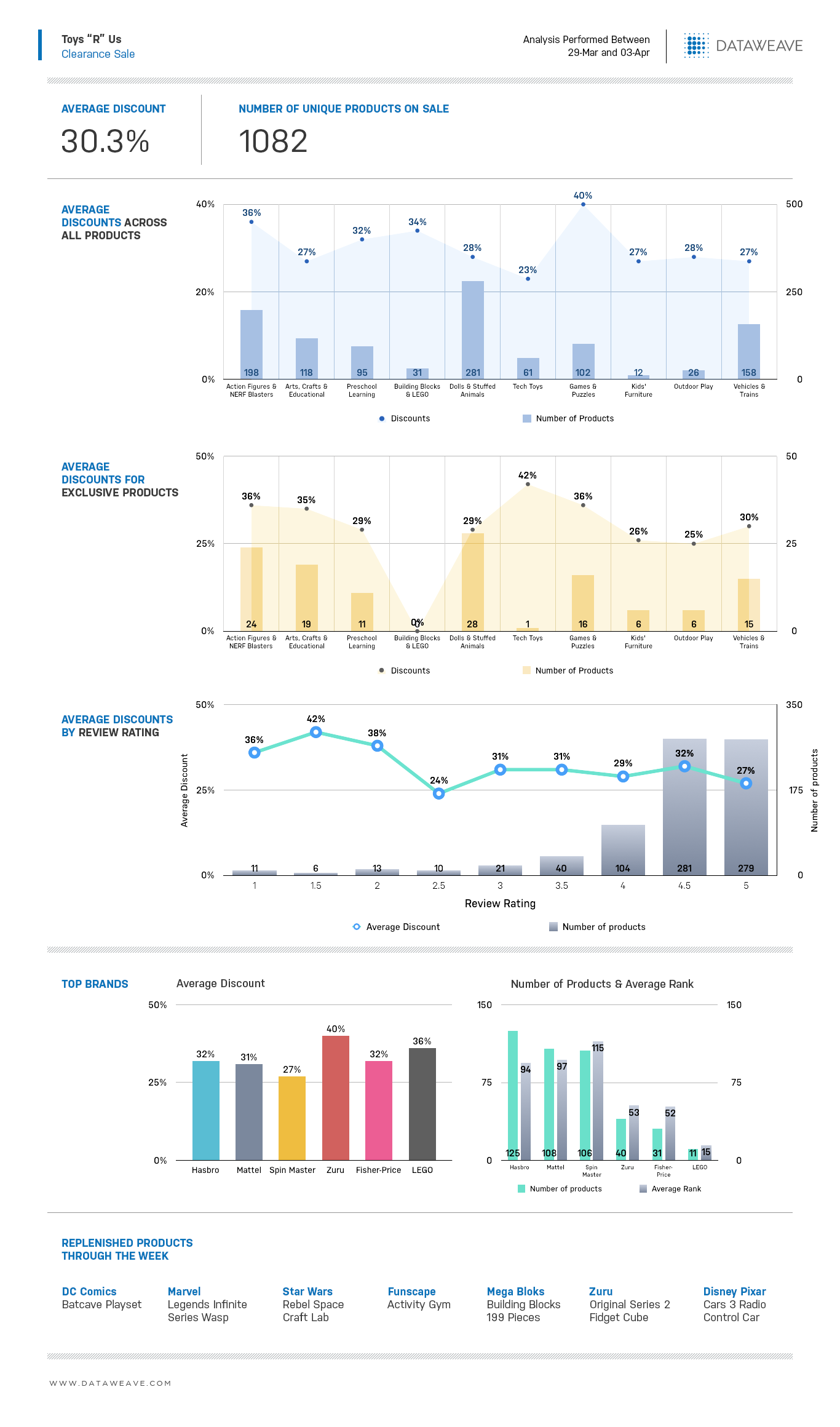

The Toys “R” Us Sale

Although the dolls and stuffed animals category carried the most products, its average discount was along the mid-range point for the sale at 28 percent. Games & Puzzles and Action Figures and NERF were the most heavily discounted categories at 40 percent and 36 percent respectively.

As anticipated, products with lower review ratings were sold at slightly higher discounts. However, even exclusive products were sold at comparatively high discounts. Not surprising, given this was effectively a clearance sale.

Hasbro, Mattel, and Spin Master were the highest represented brands during the sale, while for their part, Kid’s Furniture and Outdoor Play had fewer products participating in the sale. Other popular brands such as Fisher-Price and LEGO had a presence during the sale but offered fewer products.

Zuru was the most aggressive in offering discounts with Spin Master the least aggressive. The remaining brands offered discounts of between 30 and 36 percent.

Reports suggest that last year, toymakers Mattel and Hasbro each sold around $1 billion worth of their toys at Walmart, more than the volume they achieved selling through Toys “R” Us. Strategically, these leading brands seem to have their bases covered even though Toys “R” Us is closing down.

Interestingly, some products were seen to go out of stock during the sale week, only to be replenished a day later, as illustrated in the above infographic.

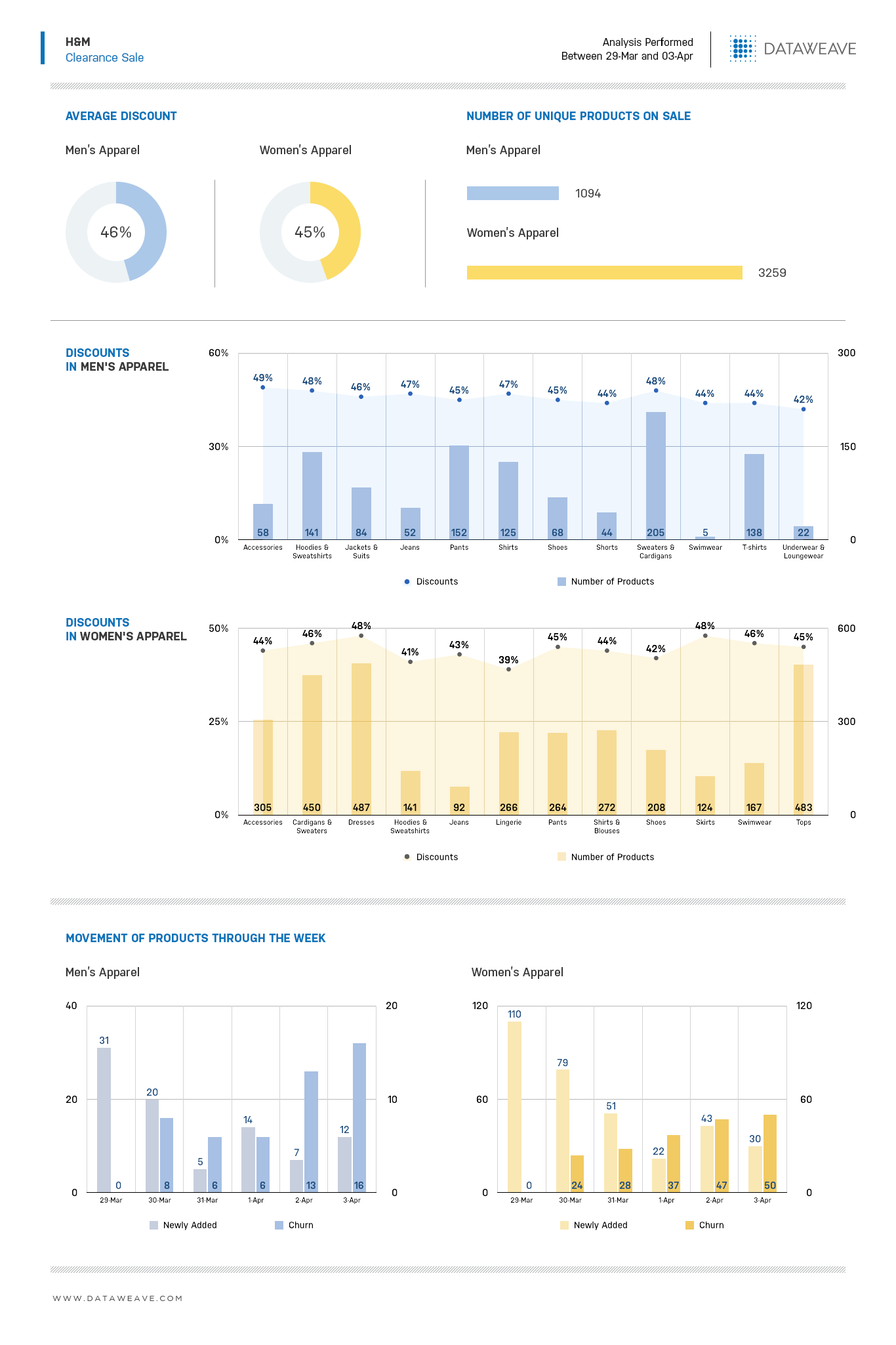

The H&M Sale

Overall, H&M’s clearance sale was more aggressive in Women’s Apparel with three times more products on offer than for Men’s Apparel. However, there wasn’t much difference between the two in terms of the discounts on offer which hovered around the 45 percent range. Women’s Tops, Cardigan’s and Sweaters offered discounts on the most products during the sale period.

Little difference was observed tactically, between how the different product categories, were handled.

We saw a significant movement of products in Women’s apparel during the week, with over 330 newly added products and close to 200 products that were effectively churned. This pattern indicates H&M achieved a faster shelf velocity for this category than for Men’s, possibly due to a more aggressive approach to the selection of items on sale.

Customer focus is key

Reports indicate that despite a series of widespread and aggressive markdowns as shown in the analysis above, H&M is struggling to sell off its mountain of accumulated merchandise. Changing consumer tastes and increasing competition seem to have taken their toll on the once agile Swedish retailer. If it is going to weather this storm, H&M needs to revisit its fast fashion approach to assortment and inventory management. The retailer would also appear to need to improve its demand forecasting expertise.

The bankruptcy filing by Toys “R” Us presents yet another lesson for eCommerce and bricks-and-mortar retailers alike, to address evolving consumer expectations and focus closely on the customer experience aspect of their business, which are supported by appropriate pricing and product assortment strategies.

At DataWeave, our technology platform enables retailers to do just that, through comprehensive and timely insights on competitive pricing, promotions, and product assortment. Check out our website to find out more!