Stock availability is the degree to which a brand or retailer has inventory of all their listed items to meet customer demand. Product availability becomes even more critical when they have to respond to unforeseen changes in demand and supply. To maintain the ideal stock availability levels for all items, they need robust inventory management tools to ensure real-time updates on current stock and accurate insights into upcoming demand.

However, managing stock availability is not a clear-cut science. Retailers must balance the change in demand and keep stock availability in check.

Why Stock Availability Matters

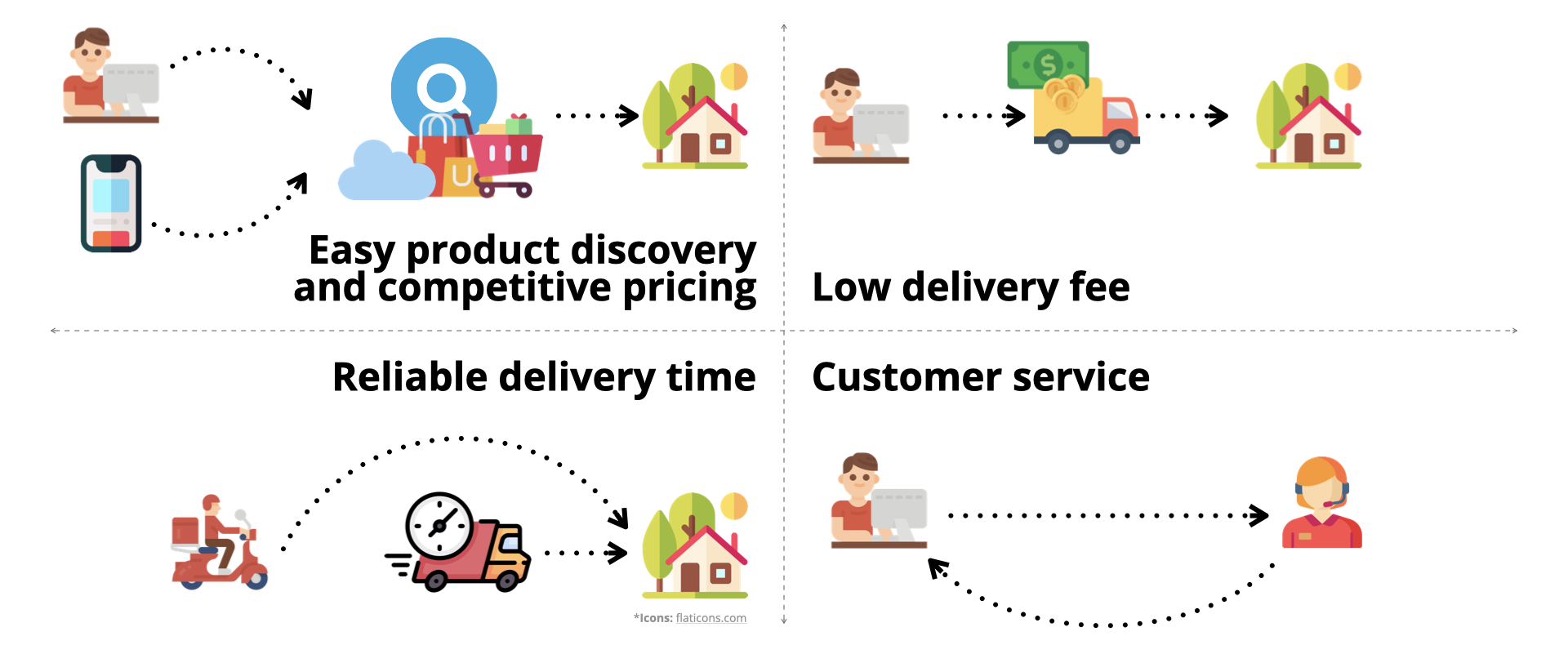

One of the challenges of running a retail business is to optimize inventory and associated costs. Maintaining stock availability in stores is critical for offline retail businesses. And when selling online, making sure products are available across different retailers and marketplaces can have a huge impact on sales and conversions.

- Understocking: It’s when a brand’s product fails to meet consumer demand. If this happens often enough, customers may not return to the brand’s website or app because of the initial experience. Understocking is not a brand’s fault entirely since they might not always be able to anticipate a change in demand. However, it’s about a their ability to adapt to a quick change in the market trends through historical analysis and accurate forecasting.

- Overstocking: It’s when a company orders too much inventory. Holding too much stock will lead to higher storage costs, shrinkage, and obsolescence losses. Another loss occurs if the brand can’t quickly sell the items — diminishing the value of the products.

We gathered data to see the impact of a short-term stockout on Amazon for one of our customers. Read more about what we uncovered & how deep the damage was, here.

7 Ways to improve stock availability

1. Collect Accurate Data

When multiple items are moving through a supply chain, companies can easily run into inventory inaccuracies. Discrepancies between the values of your system and the actual inventory of products can lead to understocking or overstocking. The best way to avoid discrepancies in inventory is to invest in an inventory management tool that gives you real-time updates on your stock. This is applicable for offline retail businesses.

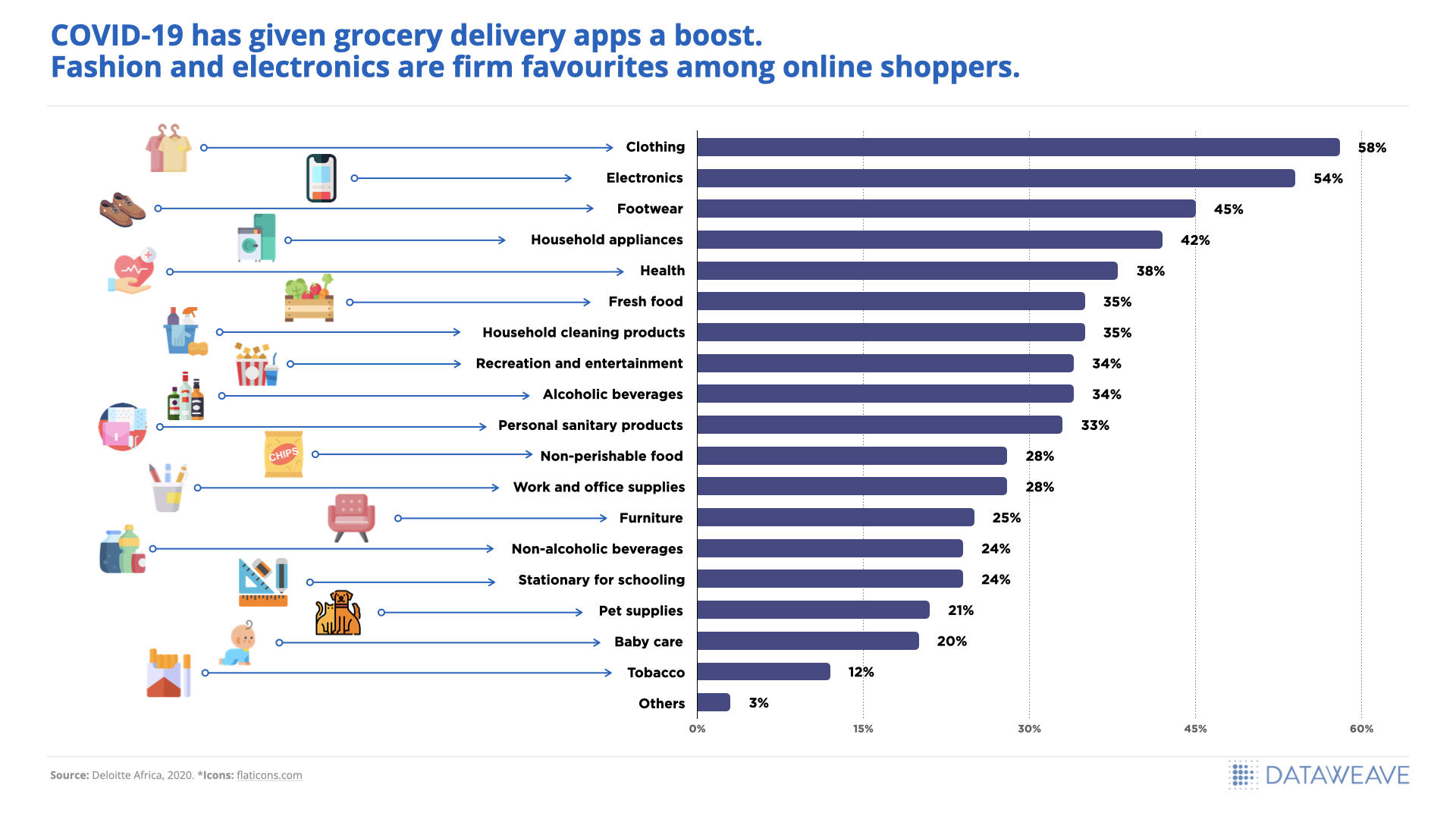

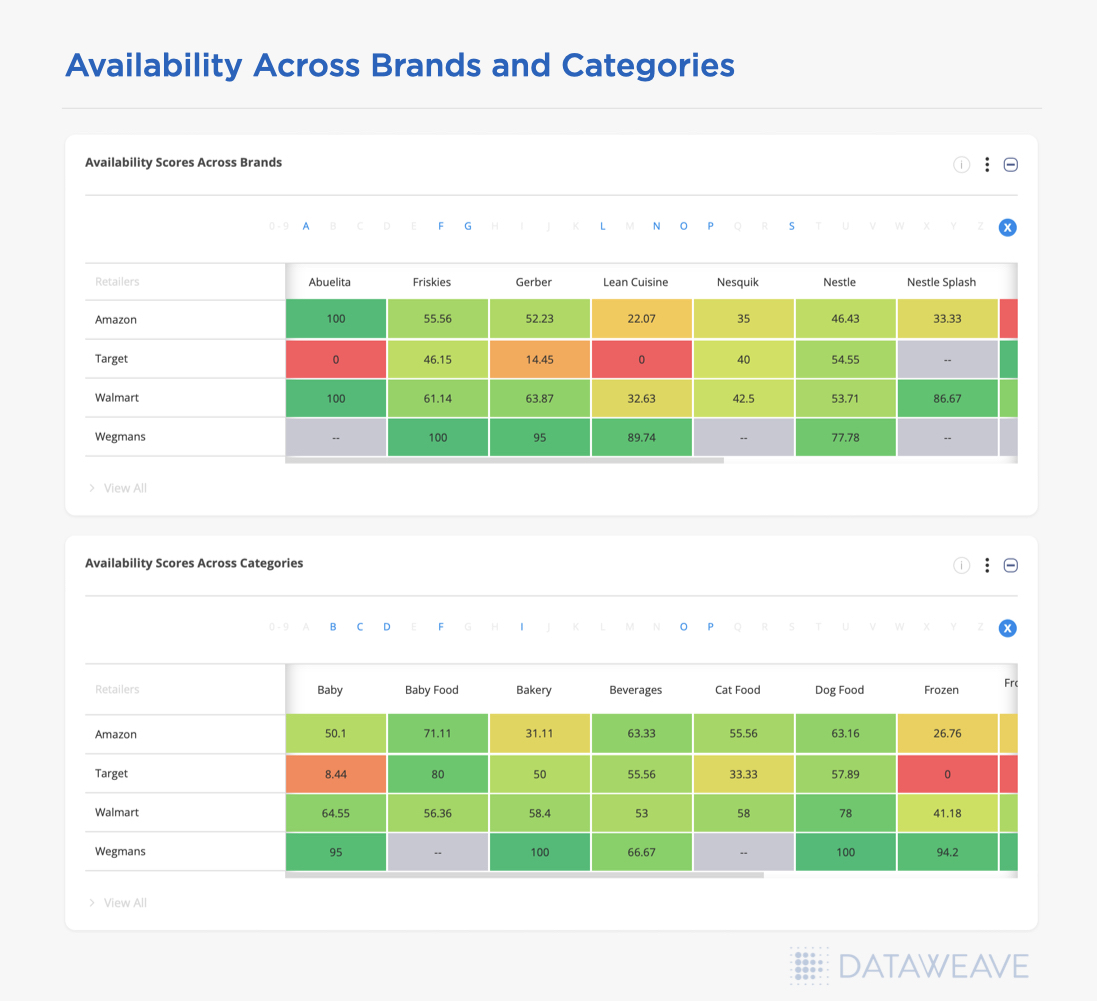

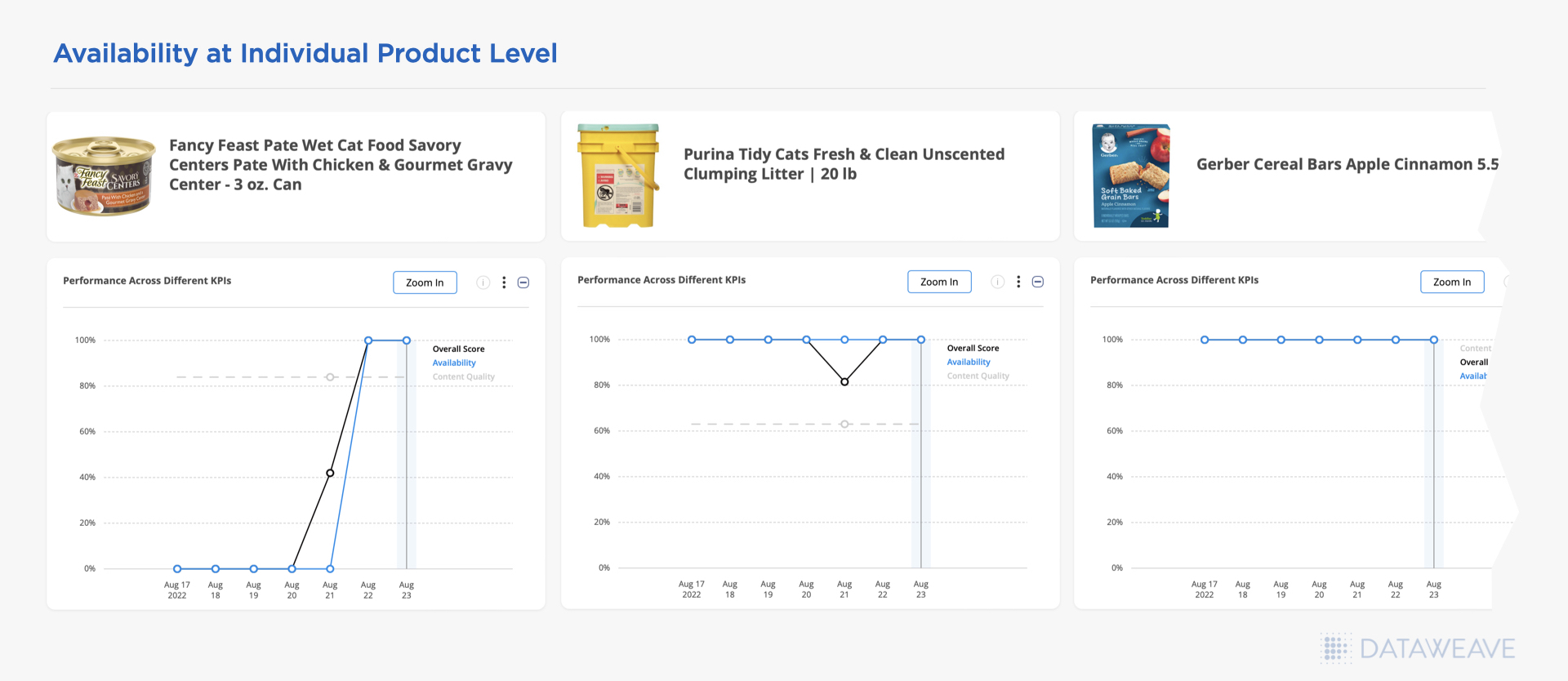

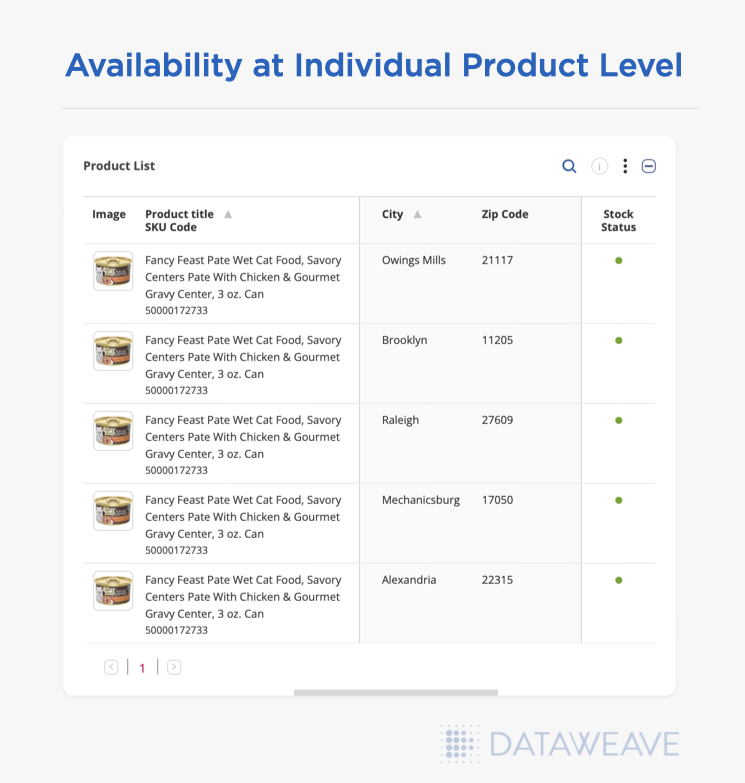

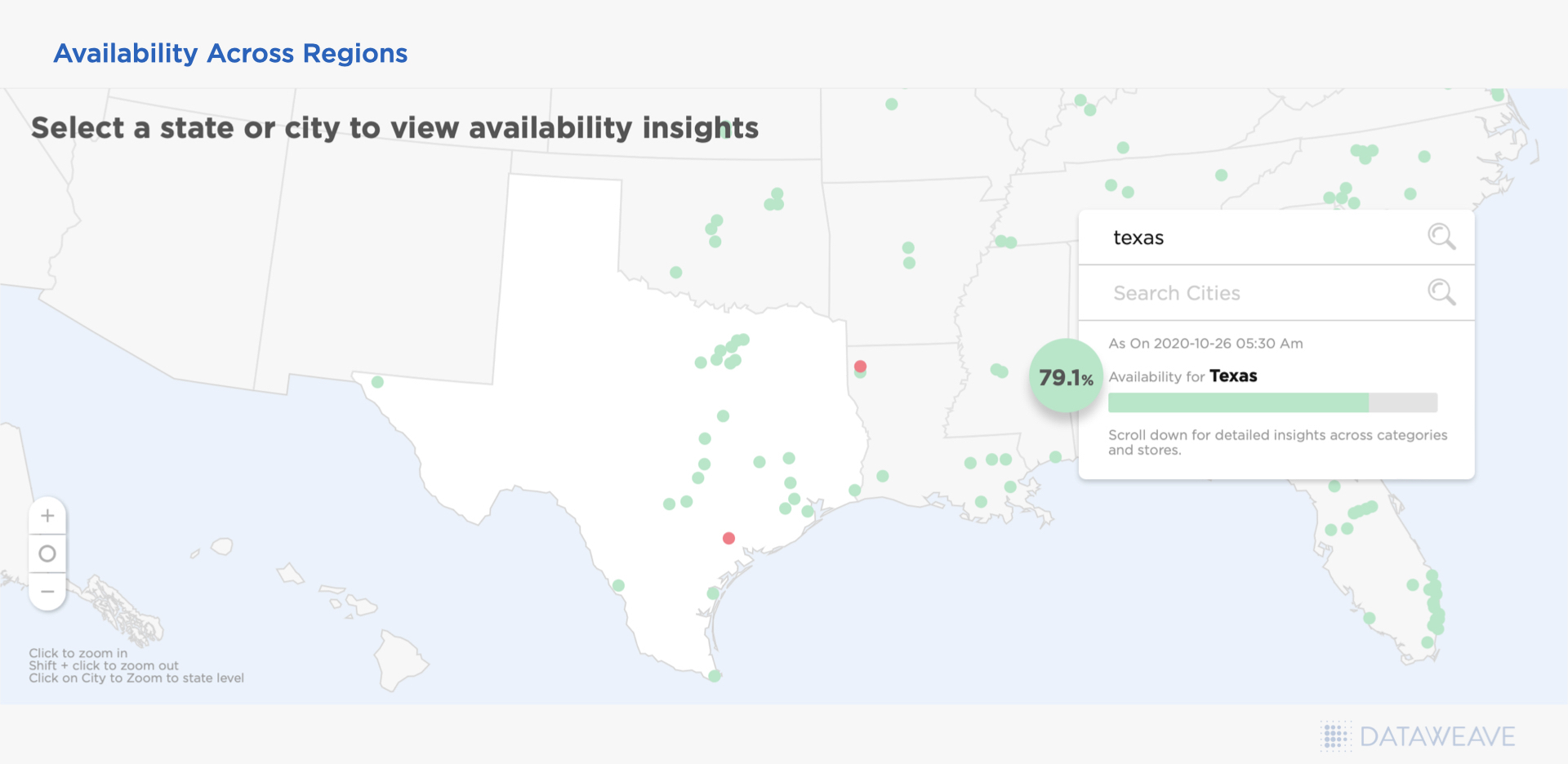

2. Managing eCommerce inventory

Effective eCommerce inventory management is as important as making sure products are available in stores. Keeping track of your inventory levels and ensuring that you’re always well-stocked can avoid lost sales and keep your company running smoothly. Brands must ensure their stock is available across all the online platforms they sell. Access to real-time inventory data can help to keep a close eye on stock status across all marketplaces & retailers the product is available. Retailers also need to keep track of market trends to ensure they have the right inventory assortment to match customers’ demands.

3. Understand Consumer Demand

The only way to accurately predict future demand is to rely on historical data about your customer purchase trends. What do your customers purchase during holiday seasons? What are the upcoming trends in your category? Having data-backed answers to such questions will help brands and retailers properly stock up their inventory.

4. Adequate forecasting

Anticipating demand will help determine which products should be stocked during which seasons. Tracking past sales and metrics such as economic conditions, seasonality, peak buying months, and promotions will help brands predict demand. Analyzing such statistics will also help you get insights into the target market.

5. Improve supplier relationships

It’s important to rely on a supply chain that delivers your shipment promptly. In fact, you should foster close relationships with your suppliers to trim costs and improve stock availability. You should be able to share key details such as future demands, so suppliers can ensure timely delivery.

Consequences of Inefficient Inventory Management

What are the effects of overstocking?

Tied-up cash: Money spent on overstocking is tied-up money that your company could have put to better use. You can use it to pay off debts, wages, and rent. Inventory often has a limited shelf life due to material degradation, changing consumer trends, spoilage, and obsolescence.

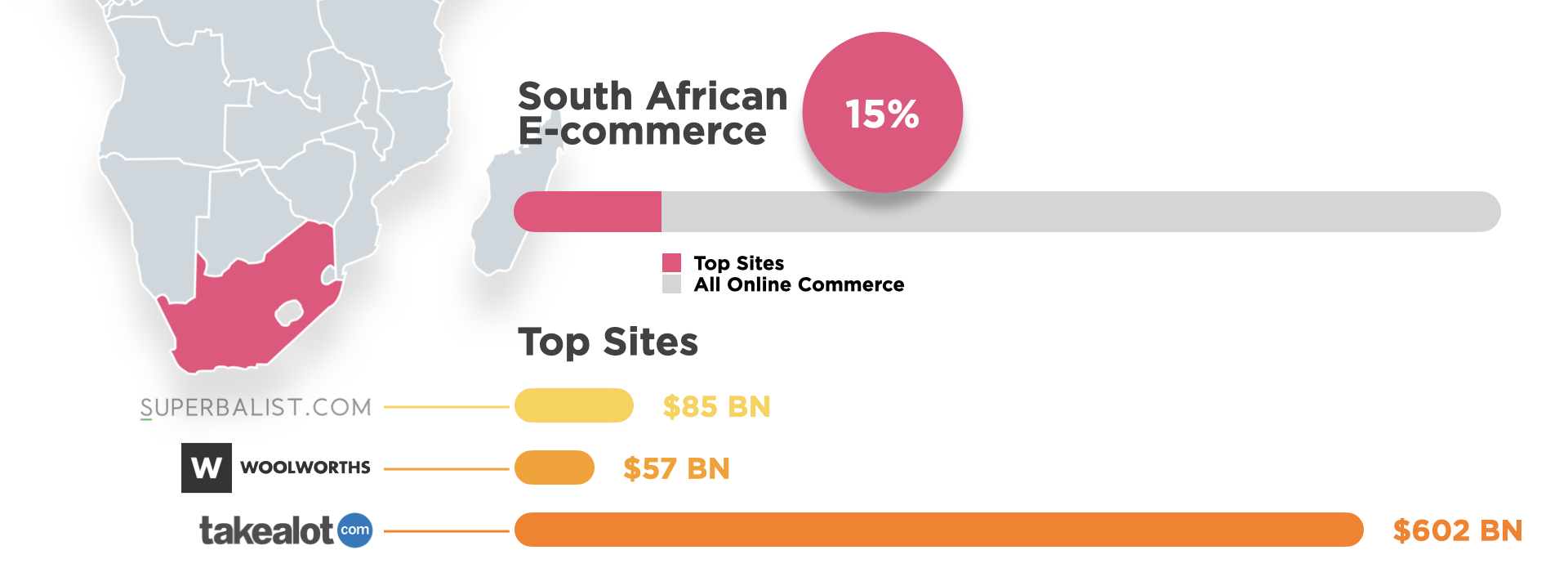

Product expiration: If your brand offers time-sensitive goods or perishable items, overstocking can lead to product obsolescence and expiry. eCommerce platforms that also sell time-sensitive goods or grocery delivery apps are forced to sell products at below-margin prices to free up resources, leading to losses.

What are the effects of understocking?

Poor customer experience: Poor product availability will lead to low customer satisfaction & dropping customer loyalty.

Missed sales: Customers could gravitate towards the competition to make their current purchase if a product is unavailable at your online store. The more freequent the stockouts, the more lost sales.

Conclusion

To avoid the knock-on effects of overstocking and understocking, companies need a real-time view of their inventory, both online & offline. At DataWeave, we help companies decrease their latency period between stock replenishment and efficiently plan their supply chain. If you need help tracking your eCommerce product availability, reach out to the experts at DataWeave to know how we can help!