2020 onwards, the South African economy was crippled due to the pandemic and lockdowns. However, according to StatsSA, South Africa’s online retail market share grew to 2.8% in 2020, double that in 2018. After the pandemic, South Africa’s eCommerce industry grew by 66% in 2020 compared to the year before. This increase was primarily because of restrictions on traditional stores that led to a 30% reduction in in-store purchases.

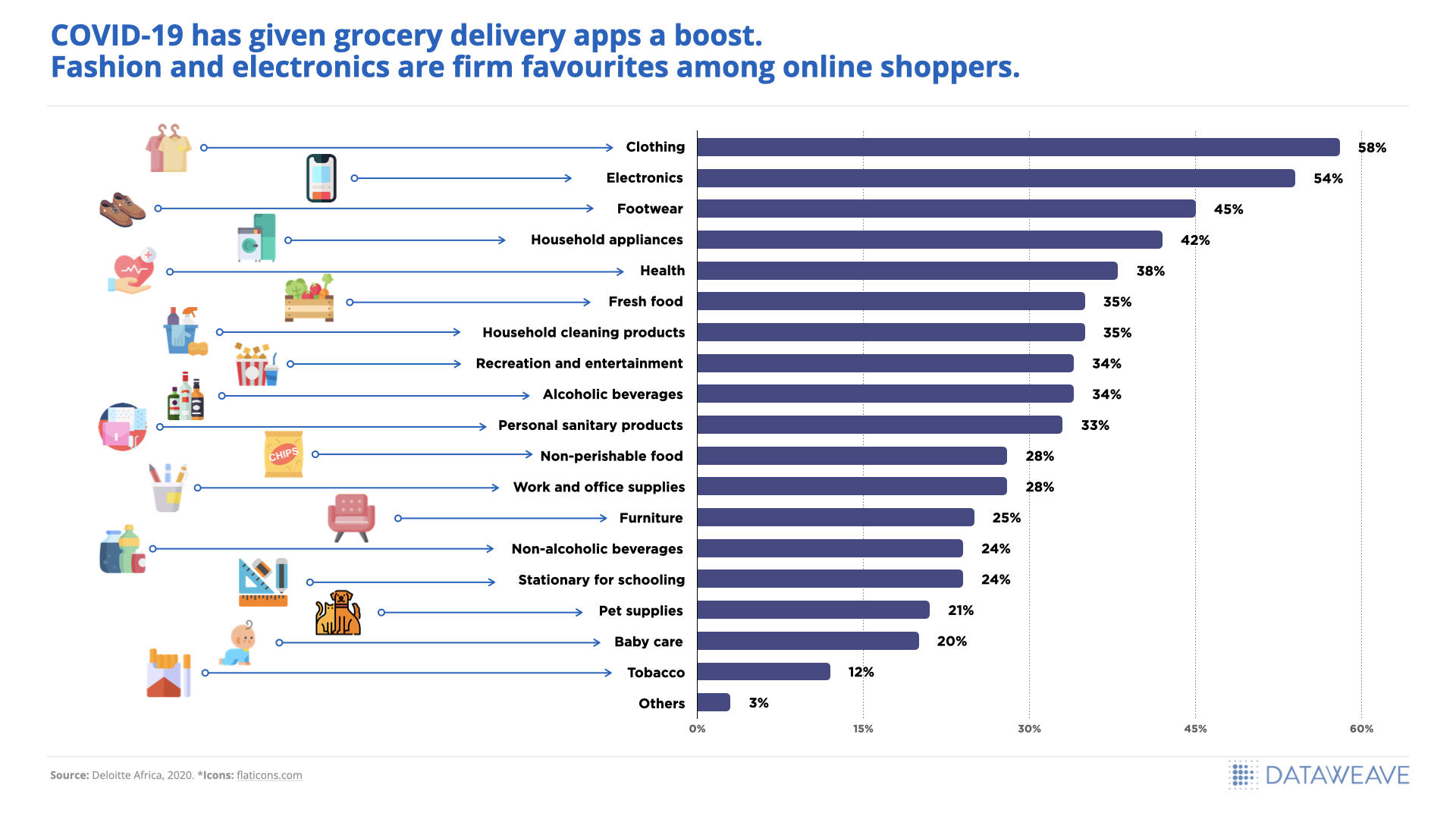

According to a Deloitte study, over 70% of South Africans shop online at least once a month because of convenience. Household appliances, footwear, clothing, electronics, and health products are the most popular categories among South African online customers.

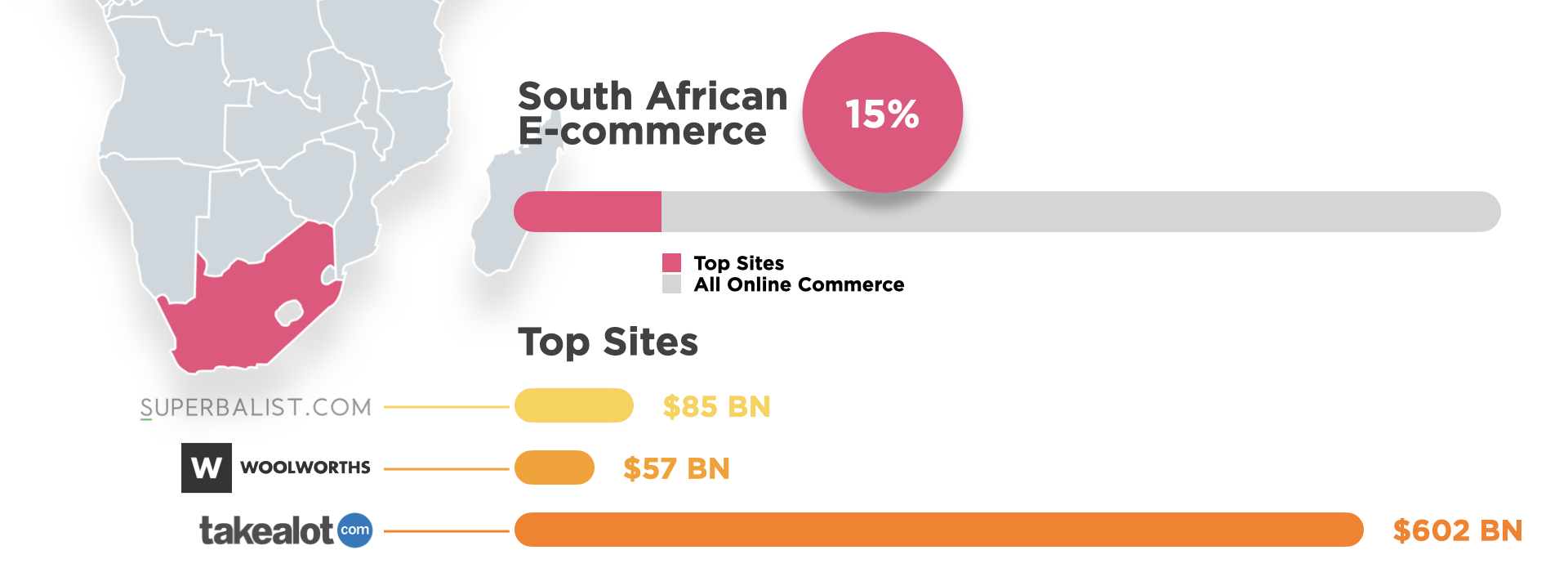

These eCommerce stores account for 15% of online revenue in South Africa

- Takealot.com: Revenue US$602 million

- Superbalist.com: Revenue US$85 million

- Woolworths.co.za: Revenye US$57 million

In this blog, we will discuss emerging eCommerce trends in South Africa and their impact on the various retail segments.

Trends to watch in 2022

1. Quick commerce

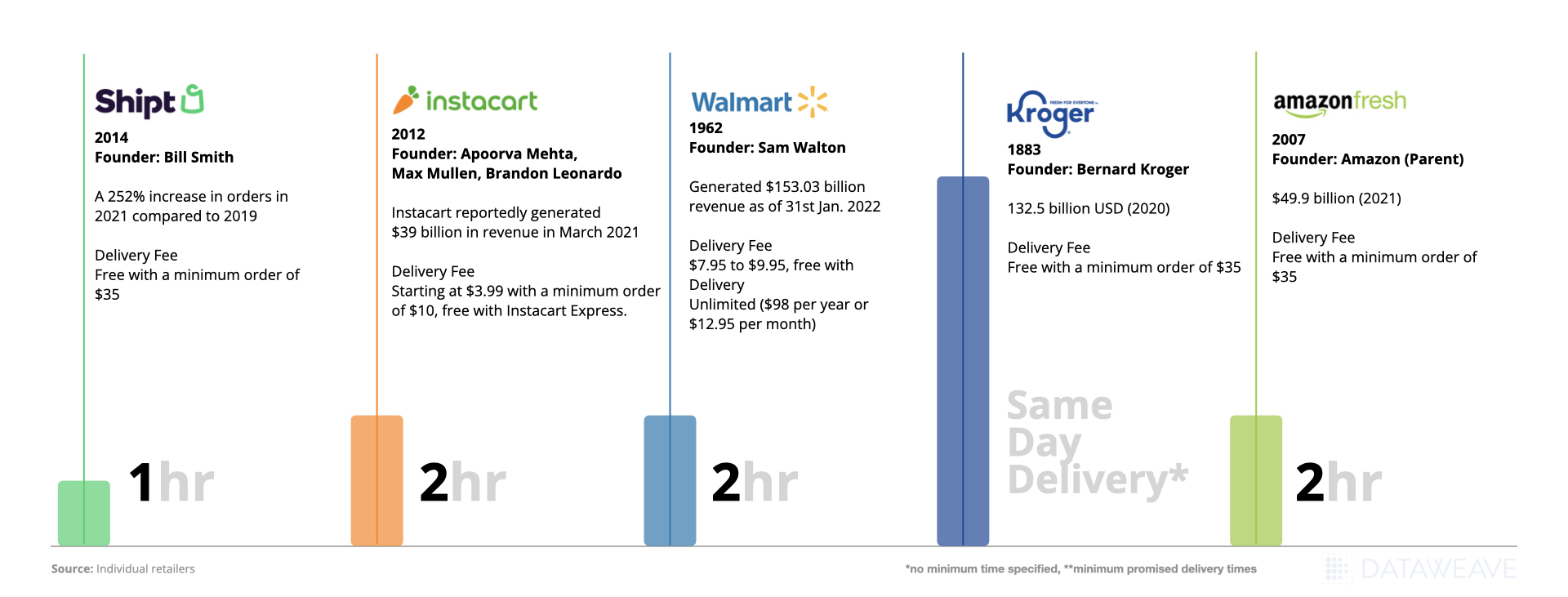

Quick delivery, especially when it comes to groceries, medicines, and food has become a customer expectation now. Q-commerce, a trend that capitalizes on optimizing delivery time, has become common in food tech companies and is now gaining traction in grocery delivery too, especially after the pandemic. UberEats, Checkers, Pick ‘n Pay, and Jumia is some of the country’s biggest Q-commerce players.

2. Omnichannel eCommerce

Omnichannel experience has taken center stage for retailers in South Africa after the pandemic. According to Nielseniq’s study, 30% of South African consumers indicated they had shifted their shopping habits to online shopping from in-person grocery store visits between March 2021 and 2022.

3. Digital Payment Trends

The digital payment ecosystem in South Africa has seen a massive growth trajectory after the pandemic. Customers seamlessly use digital payments across shopping, entertainment, groceries, food, health, and wellness – a trend we suspect is here to stay.

4. Buy Now Pay Later

Buy now pay later is an interest-free mode of payment that is popular worldwide for helping customers who cannot make high-value purchases. Consumers don’t have to pay any price upfront and pay off the amount in interest-free installments over a predefined period. The BNPL is forecasted to account for 13.6% of global eCommerce payments by 2024.

5. Chatbots

Quick response to customer queries and problems is instrumental in increasing conversion rate and sales. However, it can be difficult to respond to emails and instant chat 24/7 for small businesses. This is where automated chatbots are helping South African retailers answer customer questions promptly and correctly.

The 4 Fastest-Growing Retail Segments

1. Online Retail

eCommerce & online retail grew 20% YOY after the pandemic. Retailers saw a huge increase in the adoption of online shopping by consumers. Traditional brick-and-mortar stores looked for omnichannel opportunities to keep up with online retailers. Mr. Price, a clothing retailer in South Africa, saw a surge in online sales by a massive 90% between April and June 2020. There is a similar success story where OneDayOnly, another South African online retailer, saw 40% growth during the same period.

… but this growth surge brought in some challenges for retailers too. With more and more customers shopping online, competition increased. Price-sensitive customers would constantly compare prices across online retailers before making a purchase. It became critical for retailers to price their products right to beat the competition & win the sale, without hurting their margins!

2. On-Demand Grocery Delivery

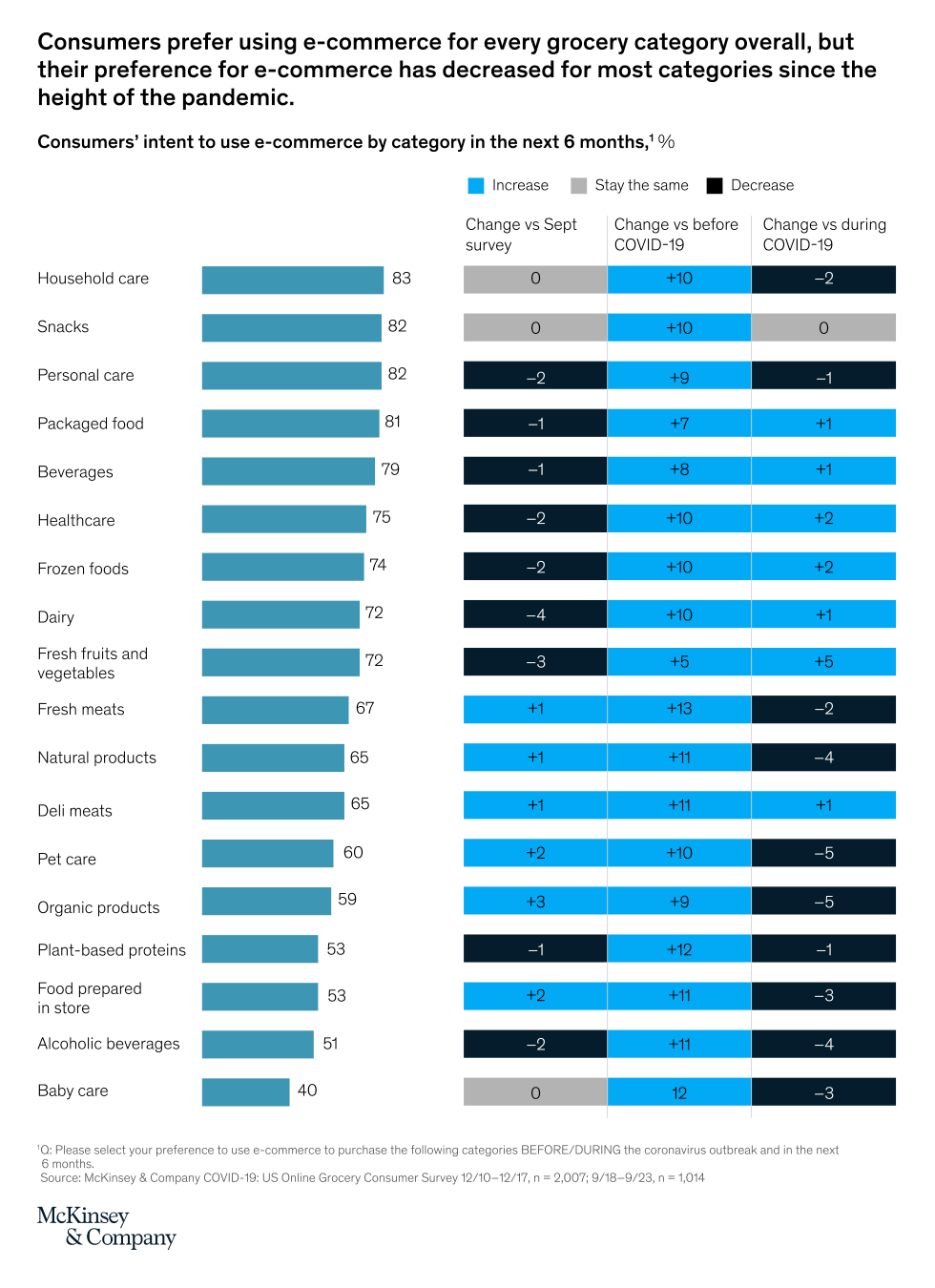

Groceries saw an increase of 54% from 2019 driven by the pandemic & lockdown restrictions.

South African eCommerce companies offer a wide range of on-demand services, from taxi rides and grocery orders to liquor delivery. Retailers fulfill orders from stores to offer affordable rates and quick delivery across South Africa. It replicates the instant gratification of purchasing products from brick and mortar stores and the added benefits of the hyper convenience of shopping from a mobile or a computer.

Read quotes from our customers at Talabat, Glovo & Grab Food – we worked closely with them & helped them in their efforts to scale through this global Q-Commerce boom.

3. Online Food Delivery

According to Statista, revenue in the online food delivery segment in South Africa is projected to reach US$0.87bn in 2022. As competition heats up and more and more players enter the market, staying competitive is becoming increasingly challenging for food delivery businesses.

Bolt Foods SA said they grew 50% month on month in mid-2021 and said they had to bet on making sure they were offering competitive prices in order to get ahead. Additionally, in their quest to have a stronger competitive advantage, Bolt Food says it is also offering customers a very low delivery fee, lower than Uber Eats & Mr. D since delivery costs are a major consideration for customers when using food delivery apps.

The right price, product assortment, delivery fee, and delivery eta are critical to scaling a Food Delivery business. If you’re in the food-tech business, reach out and we can tell you how DataWeave’s Food Delivery Intelligence can help you scale quickly and profitably!

4. Social Commerce

With approximately 41.19 million South African customers engaging in online activity, there is a huge shift in user behavior as customers get comfortable purchasing directly via social platforms instead of online retailers or physical stores. Social commerce uses networking websites such as Facebook, Instagram, and Twitter as vehicles to promote and sell products and services.

What matters to South African online shoppers?

Between June and November 2020, South African consumers mostly used online retailers monthly (42%), food delivery services weekly (36%), and online classifieds less than once a month (34%).

Here is a summary of things that matter to South African shoppers when they shop online:

1. Easy product discovery and competitive pricing

Most customers start their online shopping with a product in mind and look for discounts and sales across retailers. More than 67% of respondents of a survey have said that they go to a specific online store and search for the product they want. Almost the same share of consumers said they compare online stores to find offers for products they want. Price plays an important part in product selection.

In order to offer the most competitive pricing, retailers in South Africa need to keep a keen eye on competitor pricing. They need to identify gaps and opportunities to make price changes to not only offer the most attractive price to customers but also drive more revenue and margins by pricing products right.

2. Reliable Delivery time

81% of South African consumers say that unreliable delivery time is one of the reasons that affect their choice of an online store. Quick delivery time has become a differentiator in the eCommerce space, where ‘next day delivery or even ‘same-day delivery’ have become the norm. South African online shoppers want reliable delivery times that suit their busy schedules.

Read more here, about how DataWeave helped an America QSR understand the correlation between their delivery time & sales volumes!

3. Low delivery fee

86% of South African customers believe that high delivery fees impact their online stores’ choices. The high delivery cost is a problem for low-income customers and customers who shop daily.

If you want to track how your delivery fee compares to your competition and how it’s impacting your sales, our Food Delivery Intelligence solutions are for you!

4. Customer Service

Your company’s customer service should be responsive, smooth, omnichannel, and hassle-free. 78% of South African customers are frustrated with delays in customer support from online retailers. Slow response times and lack of communication in case of delays, delivery, and refunds hamper the customer experience drastically.

Conclusion

eCommerce in South Africa is growing at unprecedented rates. There has been a surge in the appetite of South Africans for online shopping and online retailers across the board are gearing up to meet this demand.

If you’re an online retailer in South Africa & need insights on staying competitive with the right pricing, product assortment, delivery time, delivery rates, and the other key influencers that affect customers’ choice of online retailers, sign up for a demo with our team at DataWeave to know how can help!