Over the last decade, the proliferation of e-commerce and the consequent surge in competitiveness among retailers has brought focus to one of the most critical drivers of success in online retail: pricing. According to McKinsey, an average 1% increase in price can translate into an 8.7% increase in operating profits (with the assumption that there’s no loss of volume). Yet, the company estimates that up to 30% of pricing decisions fail to provide the best price – every year. That’s a potential impact of millions in lost revenue for most modern-day retailers, a fact only made worse by the irony that in today’s times of automation and big data, there’s no shortage of intelligence to facilitate the best decision-making.

What you need is the ability to gather and rationalize all the data out there – of competitor prices, price perceptions, market dynamics, buyer behavior, etc. – in good time to price your products just right for maximum margin and revenue. The best part? Effective product pricing contributes significantly toward fostering a great customer experience, too.

Once you have your intel in place, there are plenty of eCommerce pricing strategies to choose from – it’s only a matter of identifying the metrics that matter the most to your business goals. That said, there are several models that have gained widespread popularity and acceptance over the years, like the following six:

1) Introductory pricing

This is a common marketing strategy used in the e-commerce space, where you draw consumer focus to a newly launched product or service, or the fact that you’re a new entrant in a market. There are two ways to do this – one is to start with steep discounts (particularly during sale events, and often in partnership with the consumer brand) with the aim of winning over more market share. At the other end is the strategy of setting relatively high initial prices. This works best for “exclusive offer” or “limited edition” opportunities; for instance, the opportunity to be the first to own the latest iPhone model.

2) Cost-linked pricing

In this method, you calculate how much it costs to sell a product and add a pre-determined margin to the final cost. In the world of online retail, product cost amounts to a lot more than the mere sum of manufacturing costs. For instance, it includes the procurement, labor, software, sales and marketing, shipping, and overhead costs that contribute to the total cost of housing it as long as it’s unsold. Therefore, all these costs need to be factored when determining the final product price. While the advantages of this model are its simplicity and the promise of guaranteed returns for each product sold, the flip side is that it doesn’t factor in the competitive landscape. The trick, therefore, lies in finding the balance between higher margin and sell-through rates, particularly given the aggressively competitive nature of online retail.

3) Competitive pricing

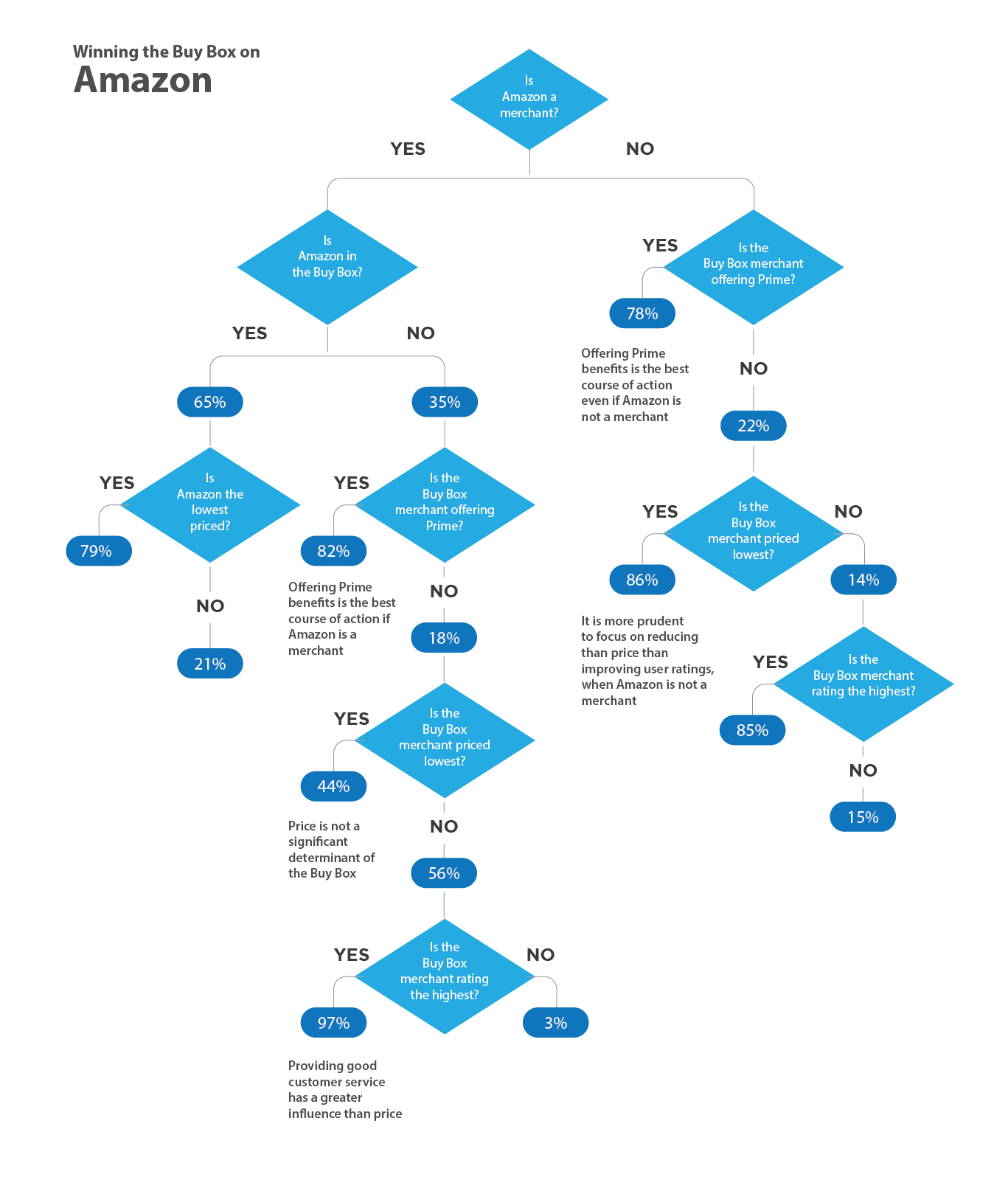

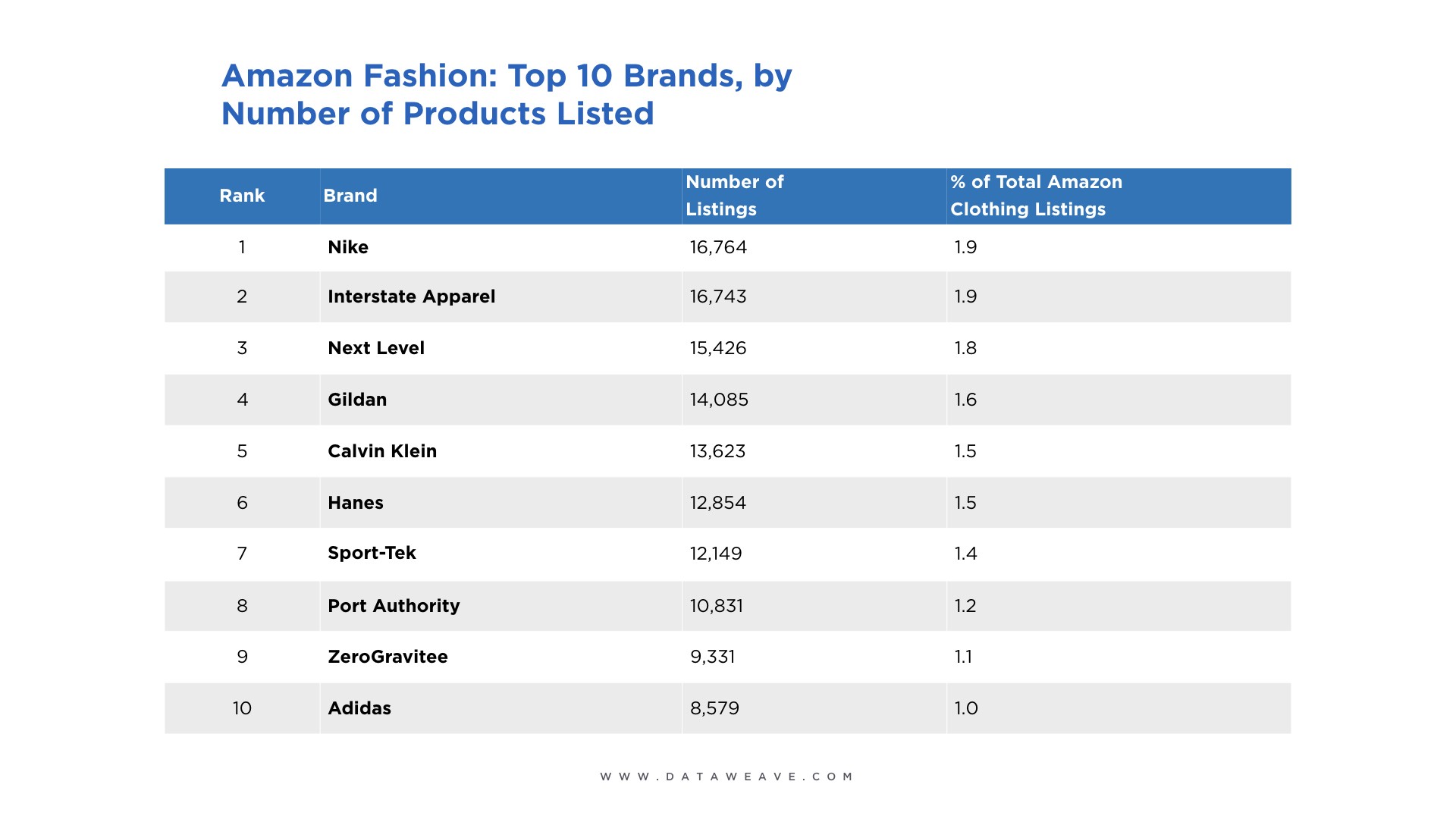

Today’s digitally savvy customers are forever comparing prices across several websites in the quest for the lowest prices. In fact, price is among the most critical factors that influences purchase decisions across products as well as categories. The competitive eCommerce pricing strategy, therefore, determines product price based on how the same products are priced by various competitors. While this model allows you to modify prices as frequently as necessary to drive efficient pricing and maximize revenue and margin, the complexity lies in ensuring consistent access to competitor prices, particularly in today’s highly dynamic e-commerce environment. DataWeave’s Pricing Intelligence platform helps eCommerce businesses overcome this challenge by helping them identify price improvement opportunities based on timely competitive intelligence at a massive scale.

4) Dynamic pricing

This model takes into account competitor prices, demand, and inventory levels, which are set up as triggers for automated pricing rules. While this results in sustained competitiveness, it requires a price optimization model that determines the optimal price in real-time response to fluctuations in demand and competitive prices – all the time ensuring alignment with your business goals. In other words, this model allows you to ensure consistently competitive yet optimized prices, thus acquiring and retaining a competitive edge in the market.

5) Price perception management

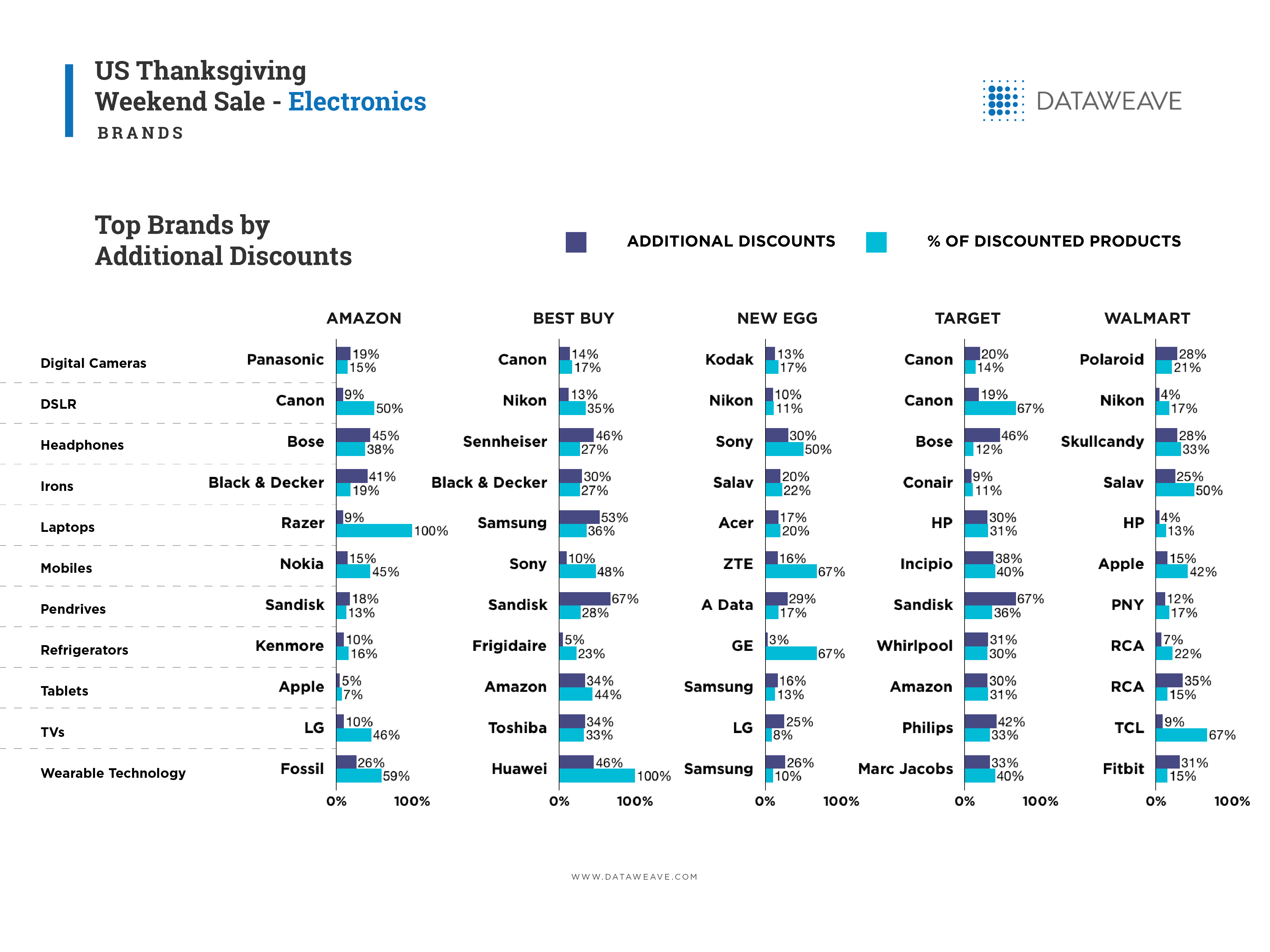

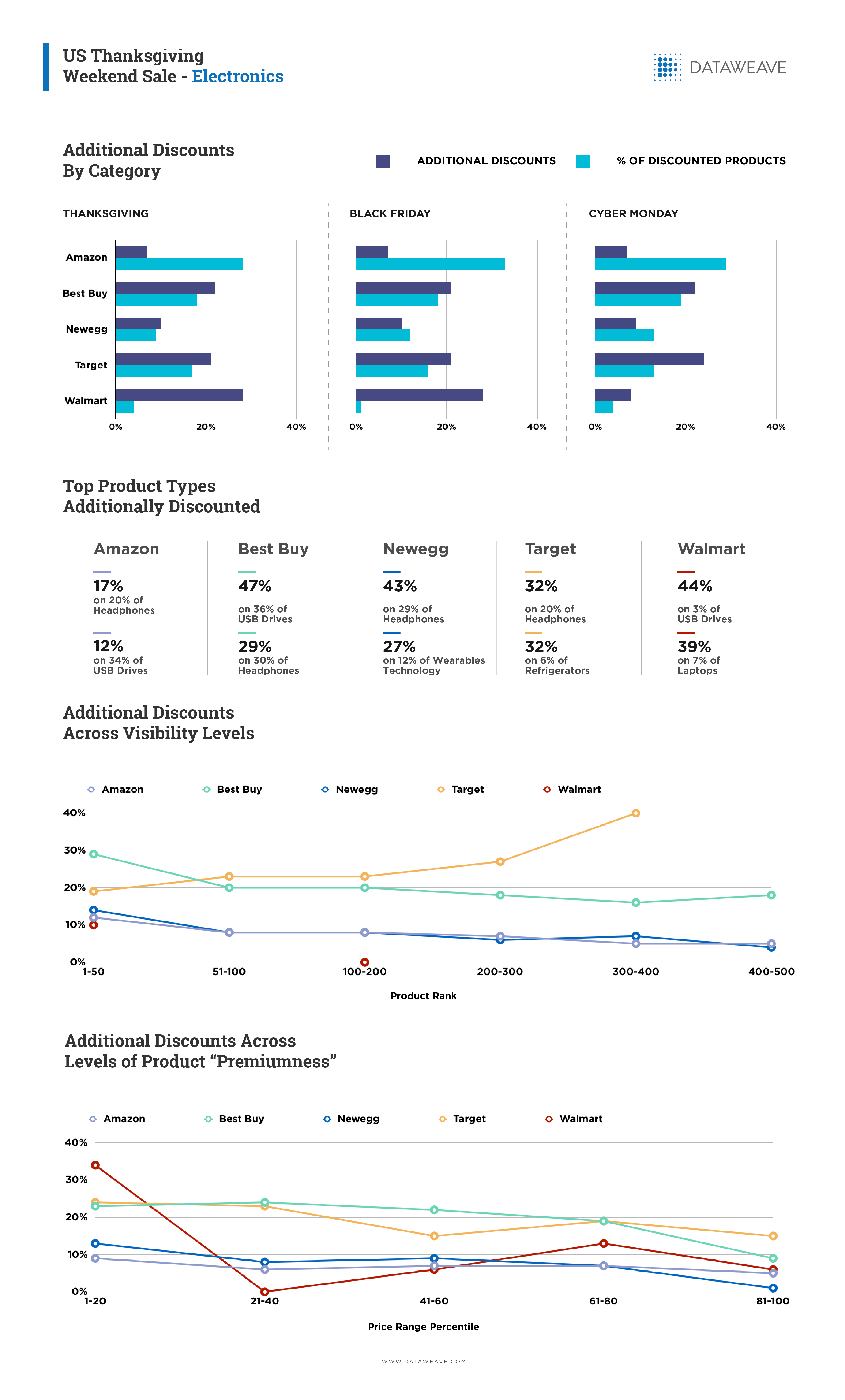

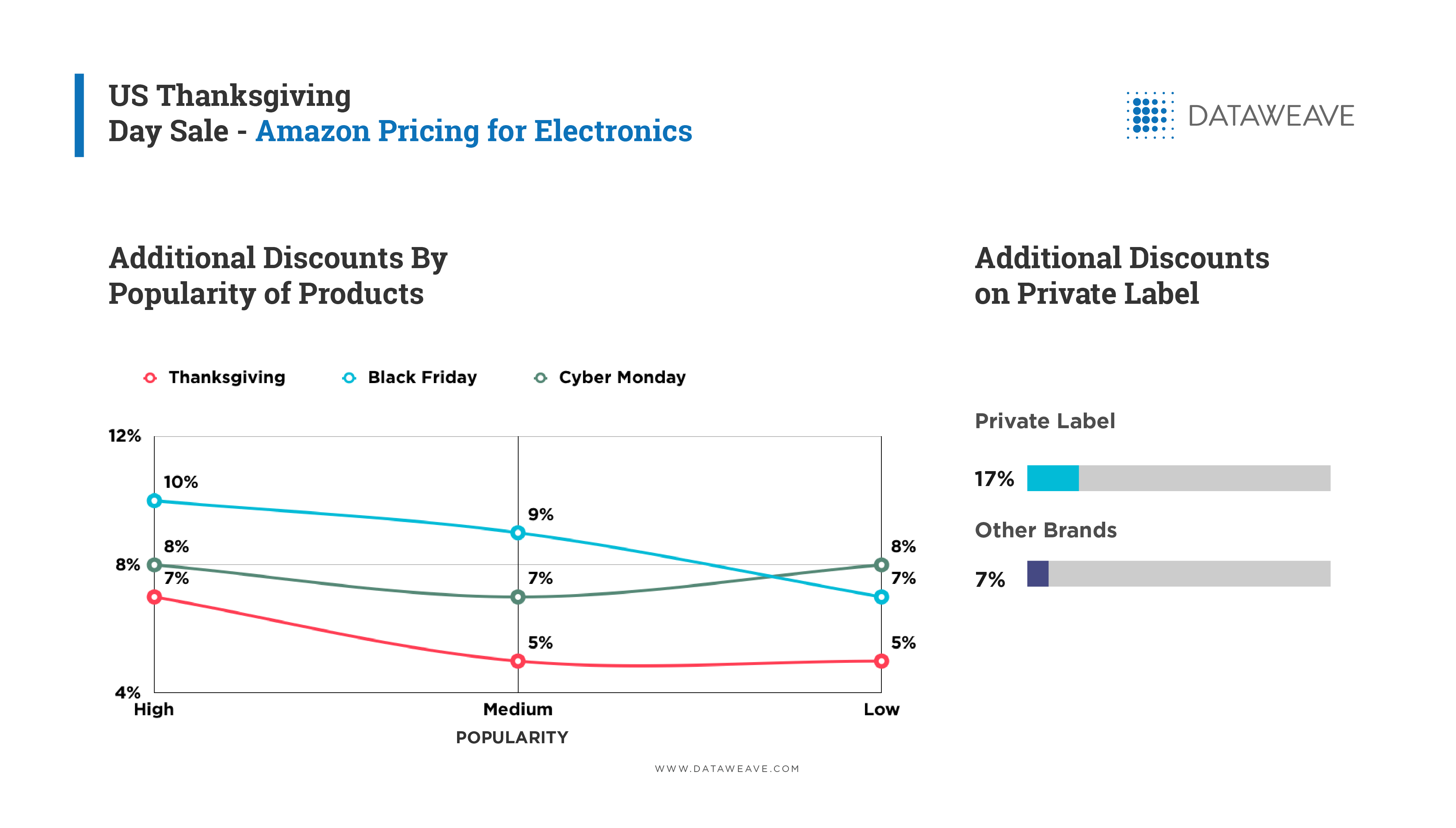

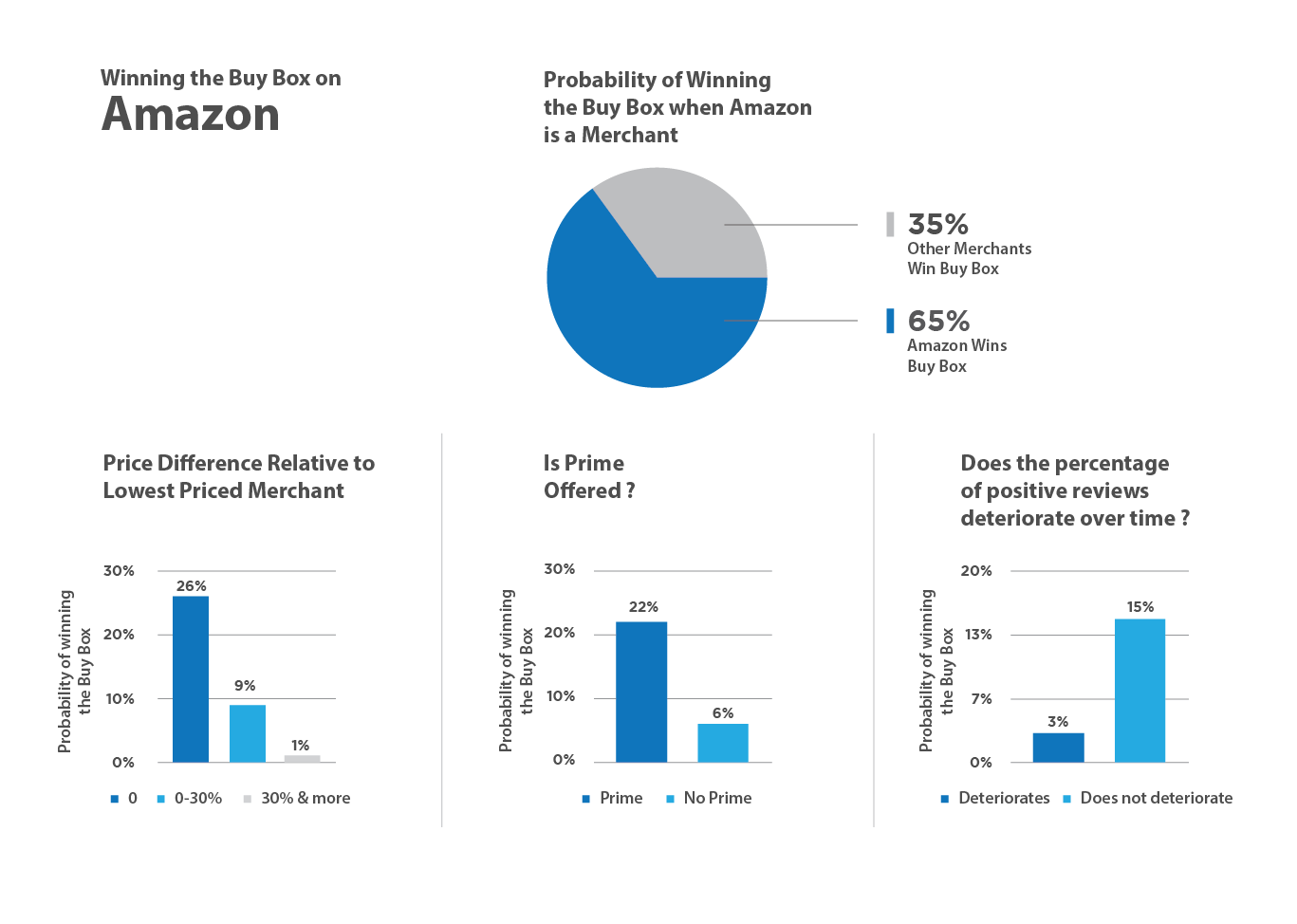

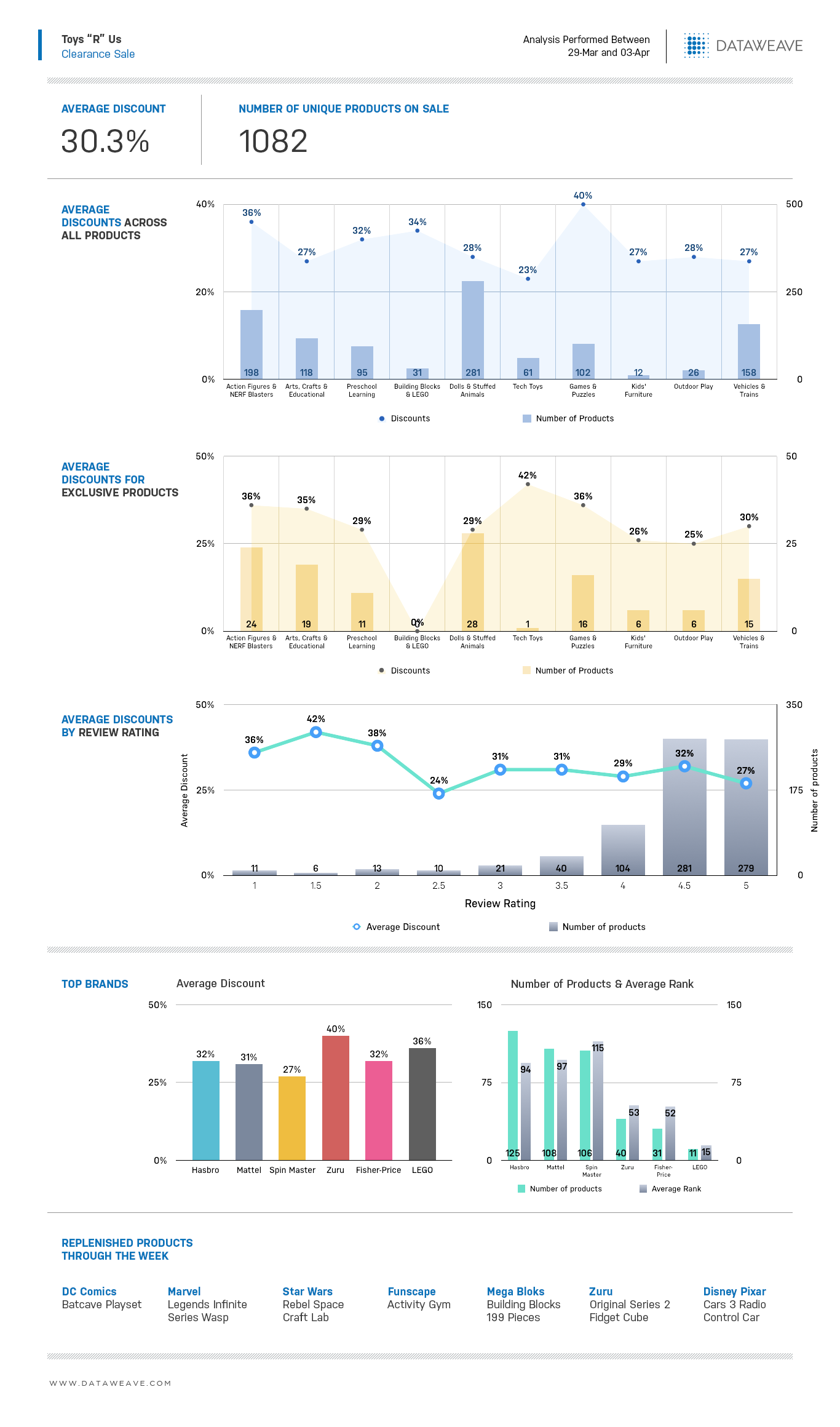

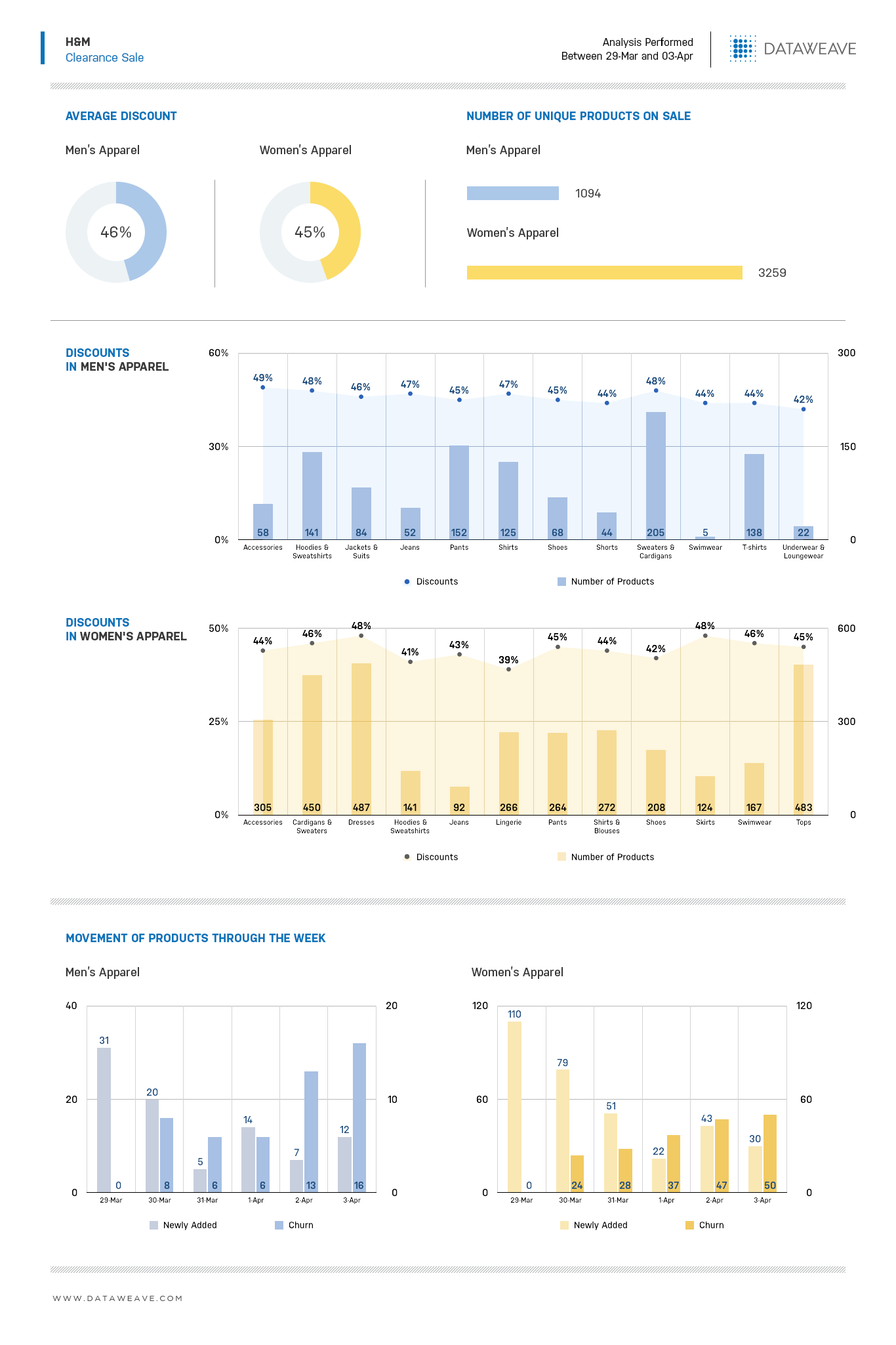

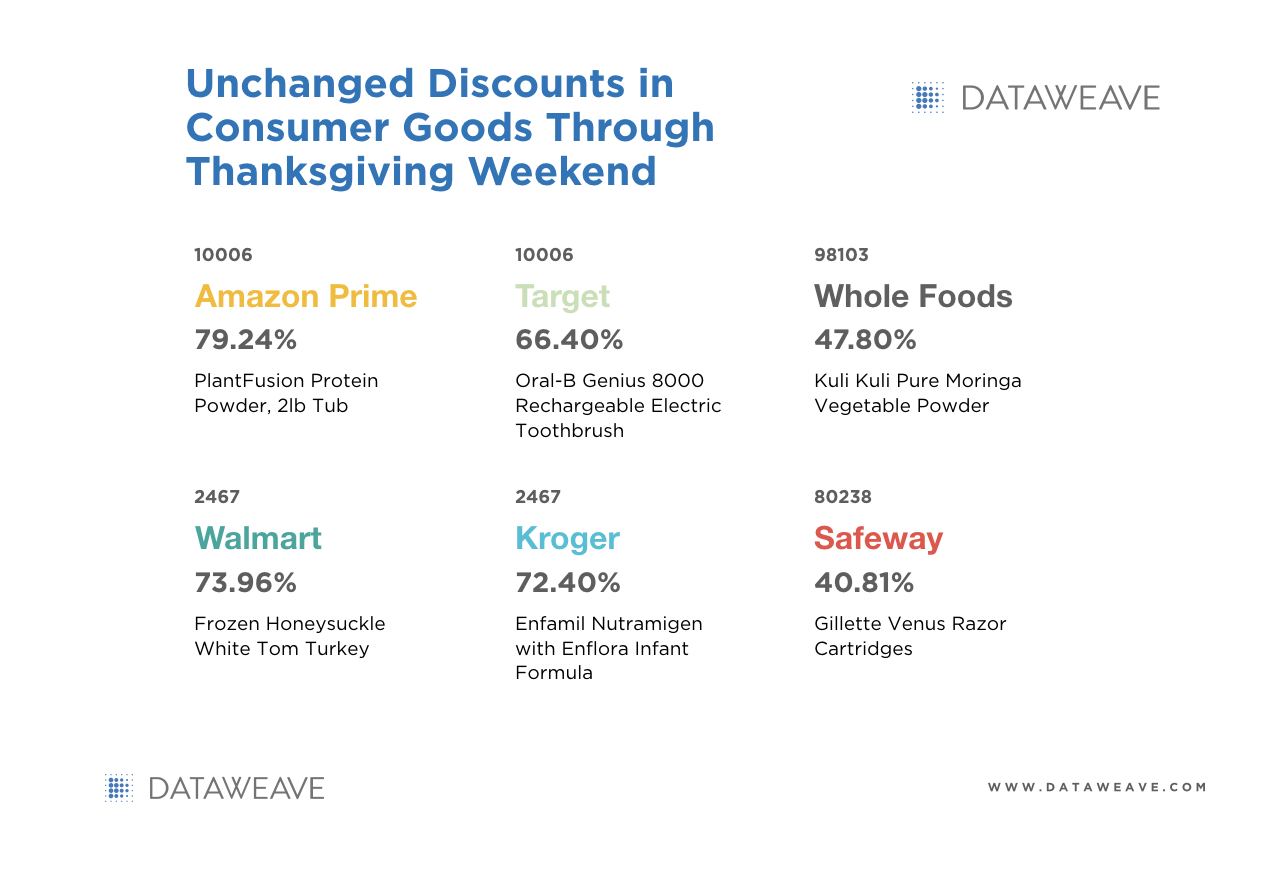

The company most famous for following this strategy is Amazon. The retail giant frequently identifies its most popular products and offers its largest discounts on them, often undercutting competitors. In other words, in this model, you “invest” in customer acquisition through excessively aggressive discounts on a select group of products – following which, you can cross-sell or up-sell other higher-priced products. Thus, you boost your perceived value to customers. Another way to drive a positive perception is to display discounted products at higher ranks on featured listings. For instance, in a recent study that we conducted, we found that 9 out of 10 leading US retailers’ top 50 ranked products (in each category) were significantly cheaper than the rest of their products.

6) Bundle pricing

The principle for this model is simple. You sell a number of the same products (or a range of complementary ones) for a combined, economical price. This is different from customers adding products individually to their cart as it works on the consumer psyche, which is more likely to favor a purchase that offers considerable perceived value. Thus, not only are you offering enhanced value to your customers (and in turn improving overall customer experience), you’re also actually increasing sales. Bundle pricing works best for products that are likely to involve repeat purchases (such as batteries, cereal boxes, or socks), and also for those that may need accessories (for instance, a food processor with various attachments). However, for bundle pricing to be effective, it’s also important to understand how your competitors are bundling their products.

Granted, it isn’t easy to identify the perfect pricing strategy for you. As customers increasingly engage with you at every stage of their decision-making process and market dynamics become exceedingly complex, pricing as a function has to keep pace. As a retailer, your objective is to unearth the actionable insights hidden in your big data and leverage the resulting opportunities to drive the maximum possible revenue and margin – without getting lost in the flood.

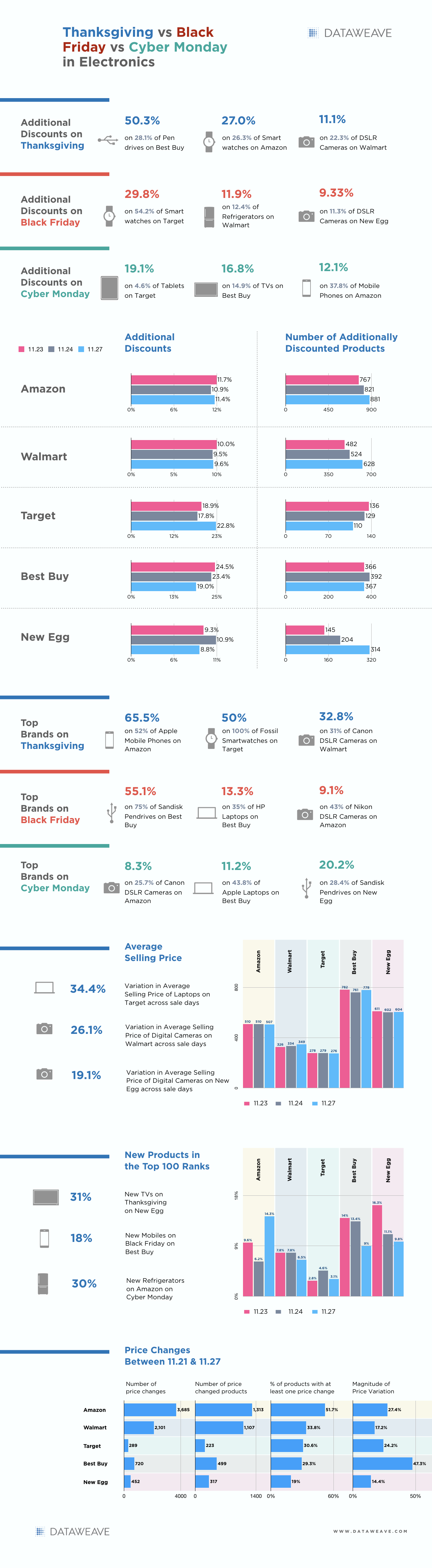

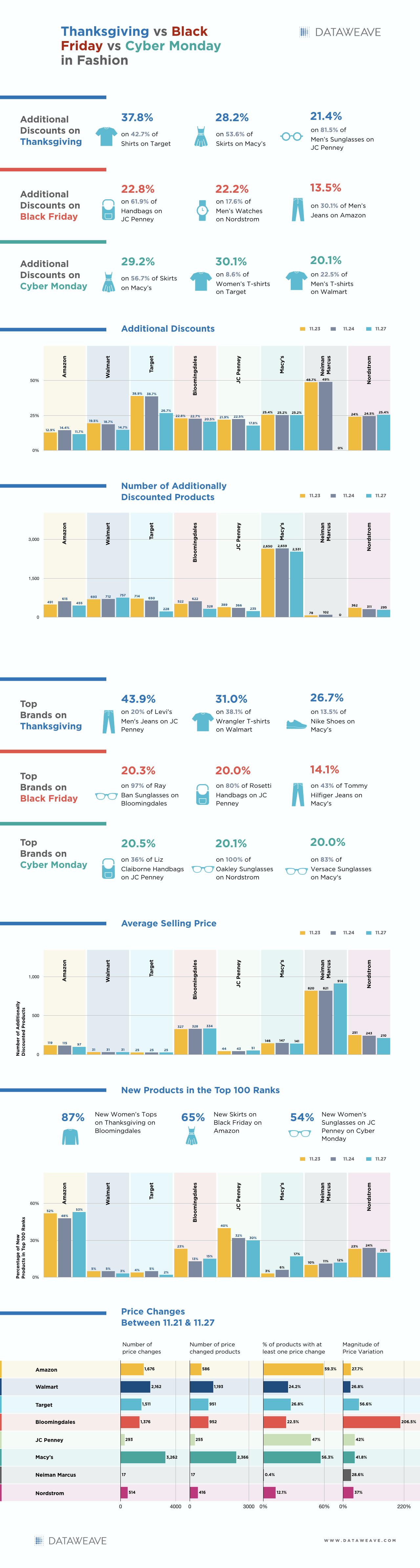

![[INFOGRAPHIC] Thanksgiving vs Black Friday vs Cyber Monday: The Electronics Price War Heats Up](https://stage-cdnblog.dataweave.com/wp-content/uploads/2018/09/a4-e1688041211819.jpeg)