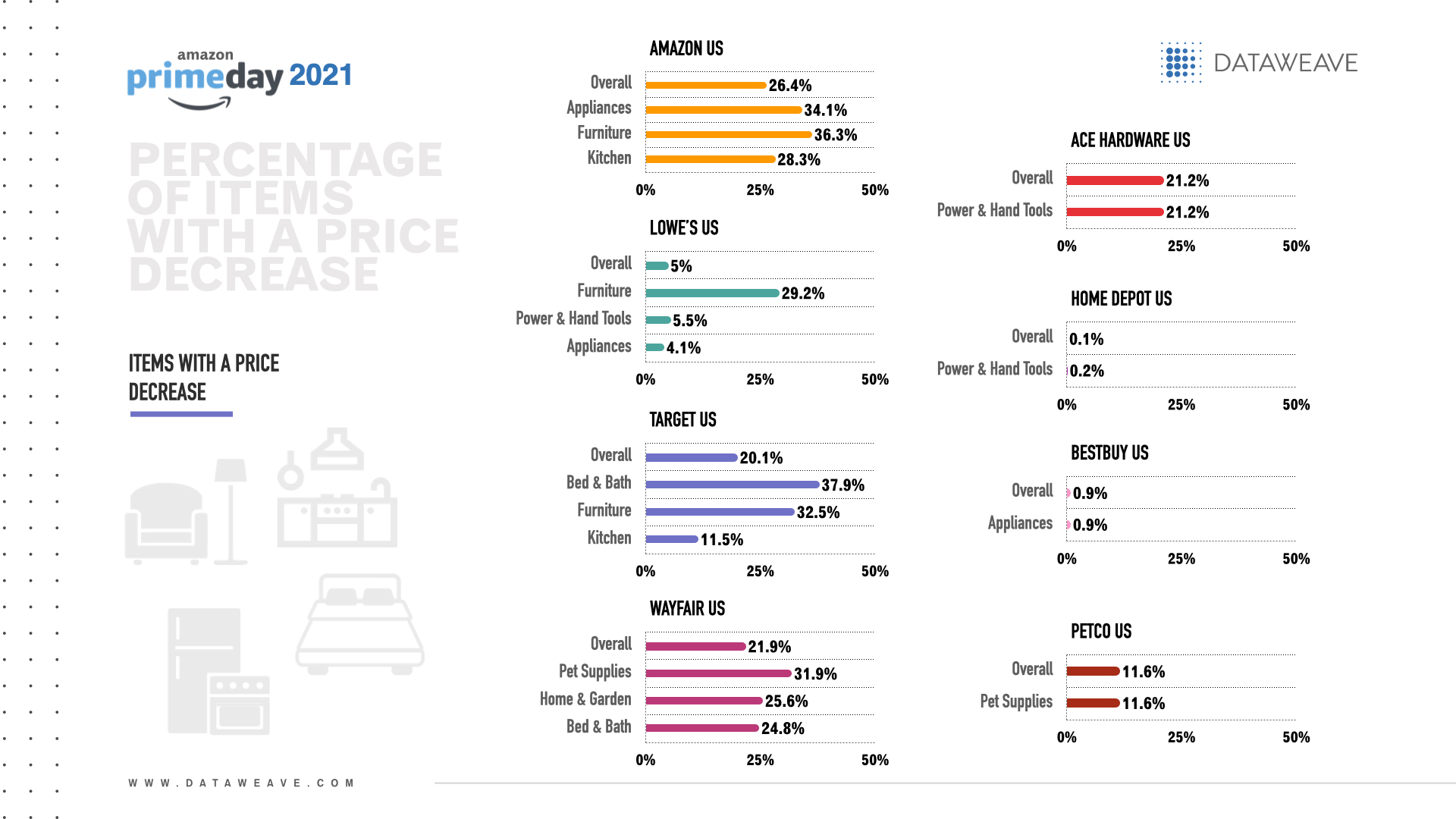

Competition is a fundamental and healthy part of commerce that protects customers by keeping prices low and the quality of services (and choice of goods) high.

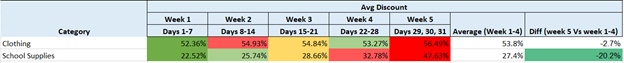

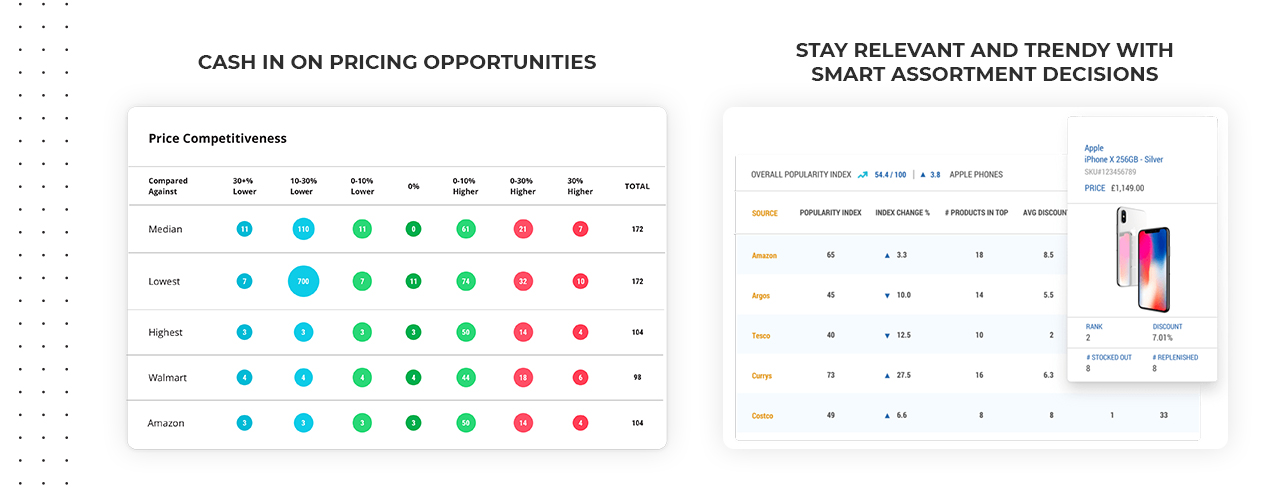

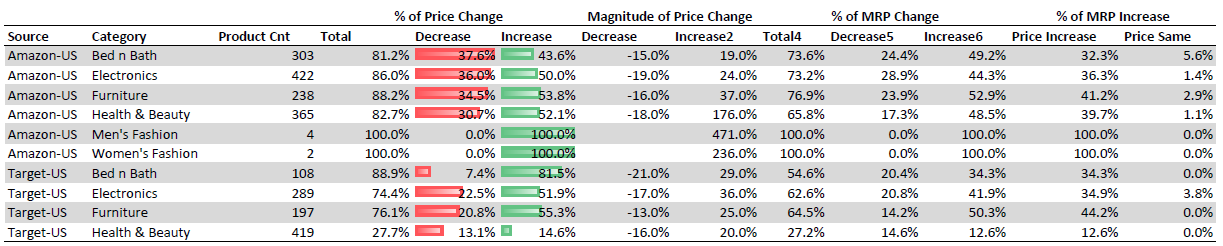

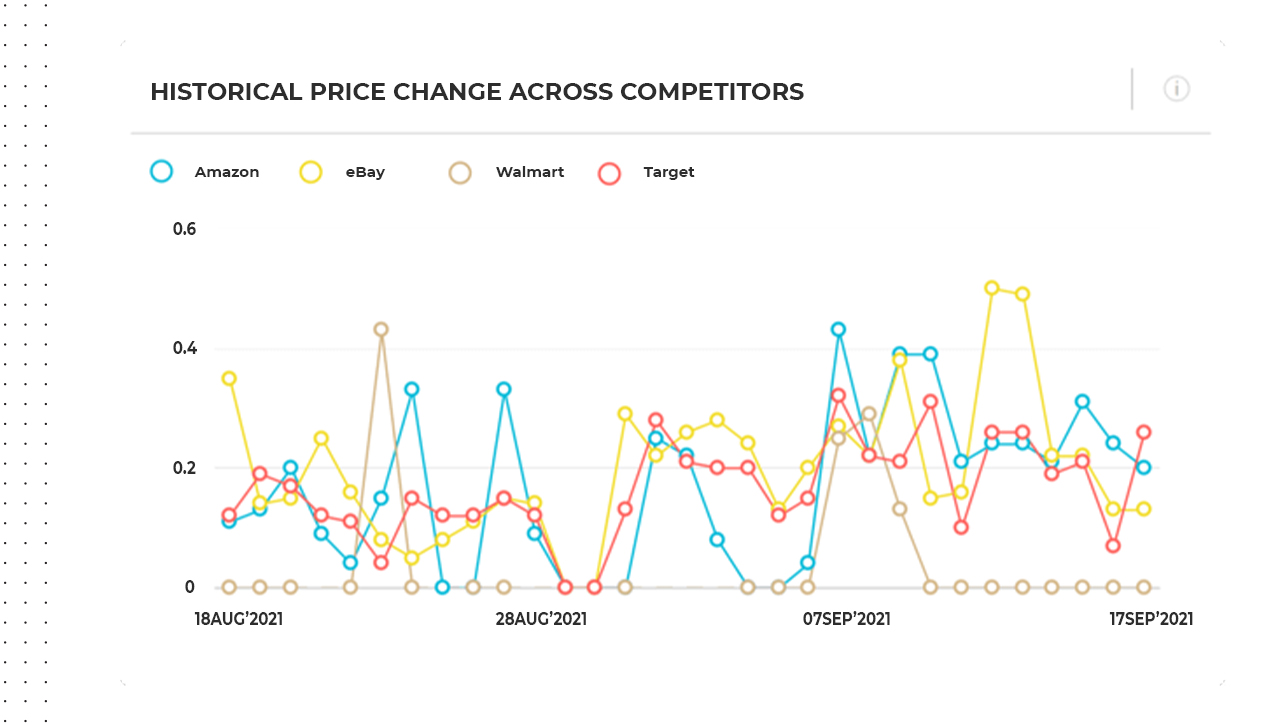

Healthy competition drives prices down, but it can harm brands and their reputation without a pricing policy. The manufacturer or brand designs MAP or Minimum Advertised Pricing policies to stipulate retailers’ lowest price point to advertise the product. It is an agreement between distributors and manufacturers about the minimum price that retailers and resellers can advertise the product for sale.

Most legitimate brands have a MAP policy, especially brands that rely heavily on brand identity. It becomes critical that they maintain price parity across retailers. When a retailer violates MAP policies, brands can penalize them under the agreed-upon terms or terminate contracts.

In this blog, you will learn about MAP policy, its benefits, and tips on tackling MAP violations.

1. What is a MAP policy?

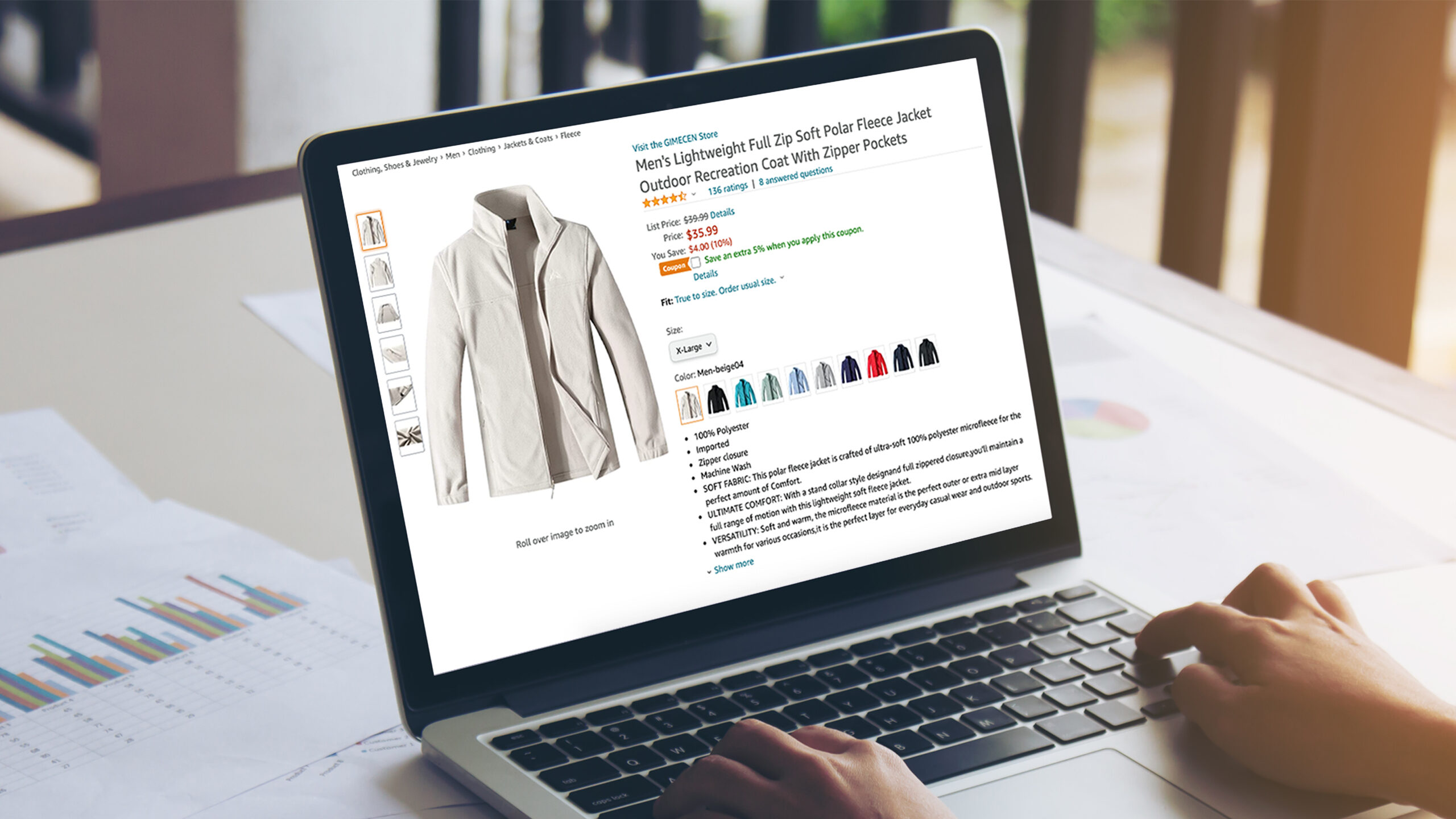

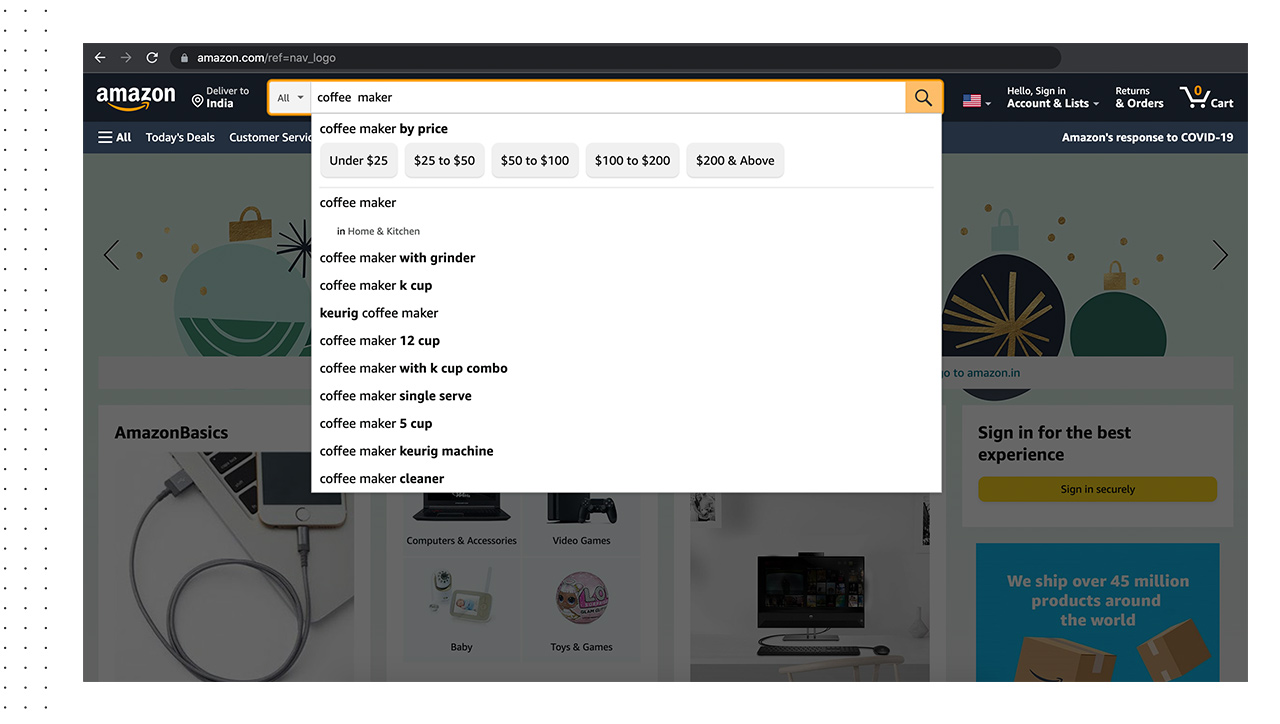

MAP stands for Minimum Advertised Price, and brands create MAP policies to ensure that retailers don’t advertise their products below the specified price. However, it only controls advertised prices, ensuring the retailers don’t display a lower price in online listings or advertisements. Since it doesn’t cover the checkout price, retailers can sell products at a lower price through promotional offers like discounts and cashback during checkout.

MAP policies ensure a price war between eCommerce platforms does not devalue products and that an even playing field is set among retailers that allow everyone to drive margins. Brands have a legal right to withdraw products if a retailer advertises products below the minimum advertised price. Brands can also restrict future sales or refuse to replenish products after the current stock has sold out if an eCommerce platform, reseller, or distributor violates MAP policies.

In the U.S., MAP policies fall under federal antitrust law since they restrict advertisement pricing rather than the last sales price. However, in the UK and the EU, violation of minimum advertised pricing is an infringement of current competition laws.

2. Why Does Having a MAP Policy Matter?

Having a MAP policy protects both brands and retailers while ensuring consumers get the best-priced items. Following are the benefits of having a MAP policy:

a. Prevent margin erosion

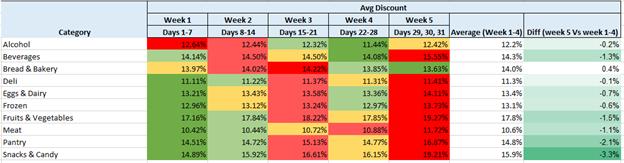

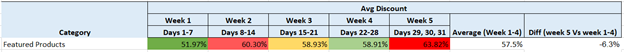

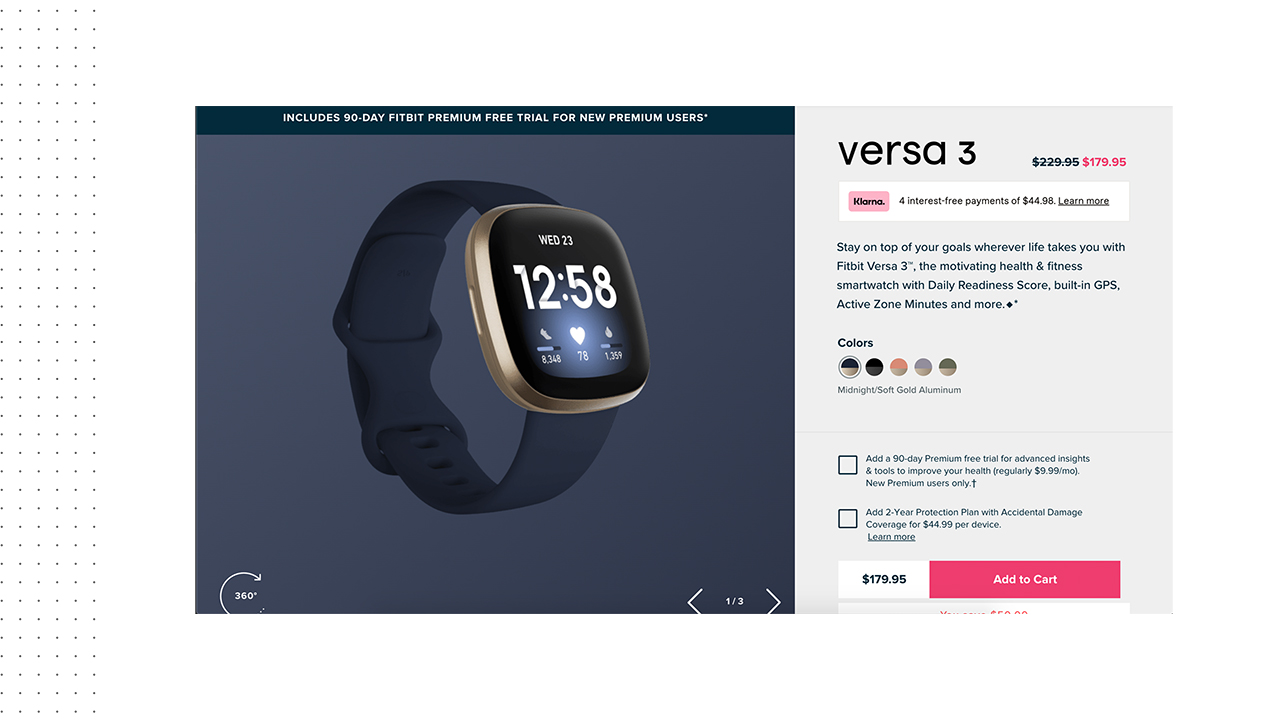

Although online retailers are willing to take a margin cut to attract traffic, selling products below MAP can significantly hurt a brand’s bottom line. Setting a minimum advertised price benefits both parties. It allows shoppers to purchase products at the best-valued price & also creates a balanced economy and prevents hyper-competition of products between retailers. However, manufacturers must set a realistic pricing policy that matches current market demand, ensuring eCommerce platforms implement MAP while taking care of the margins.

b. Retain brand identity

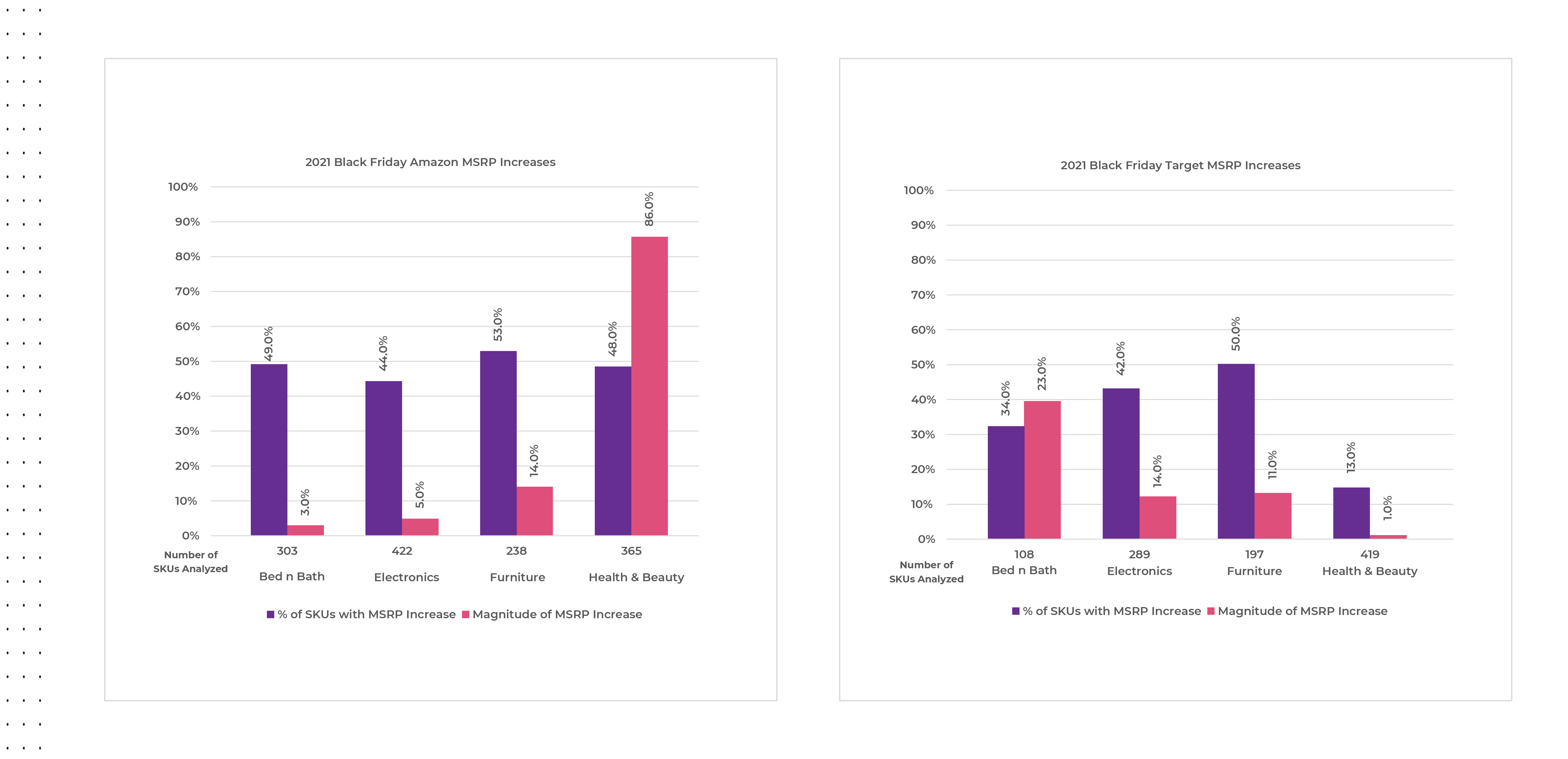

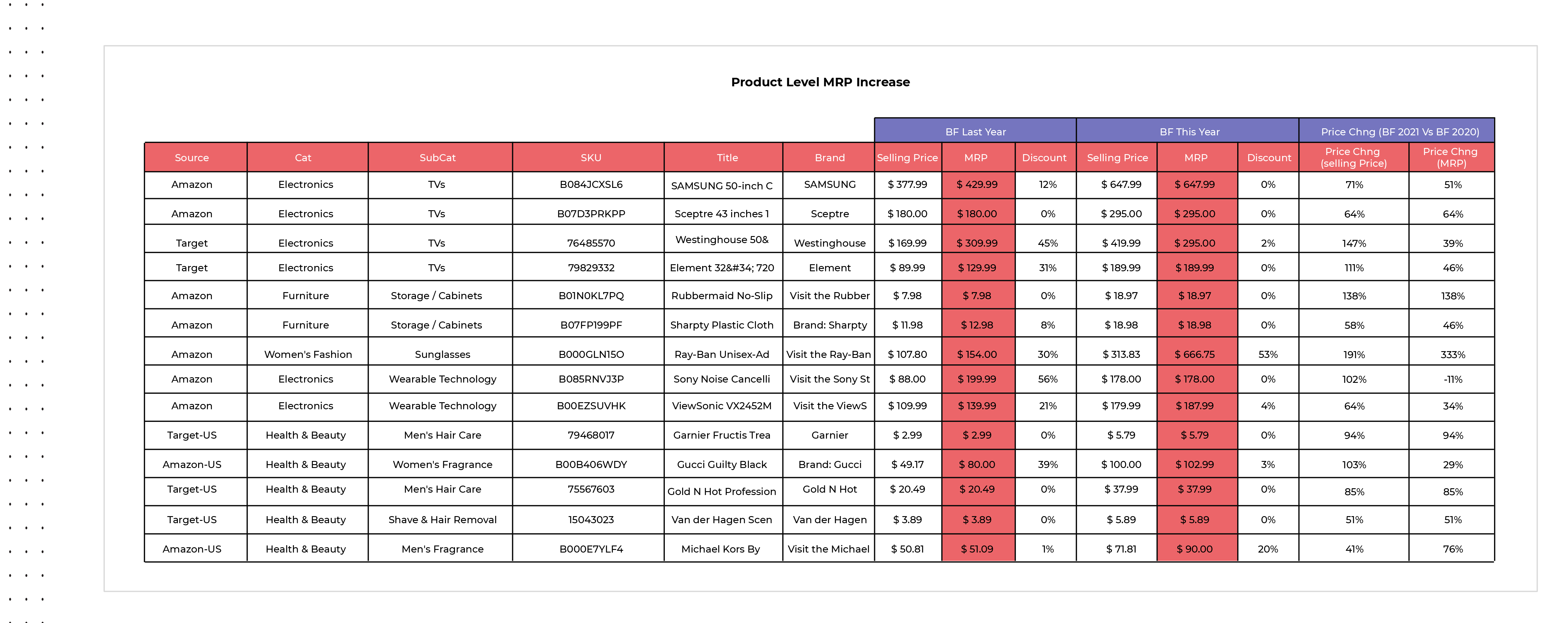

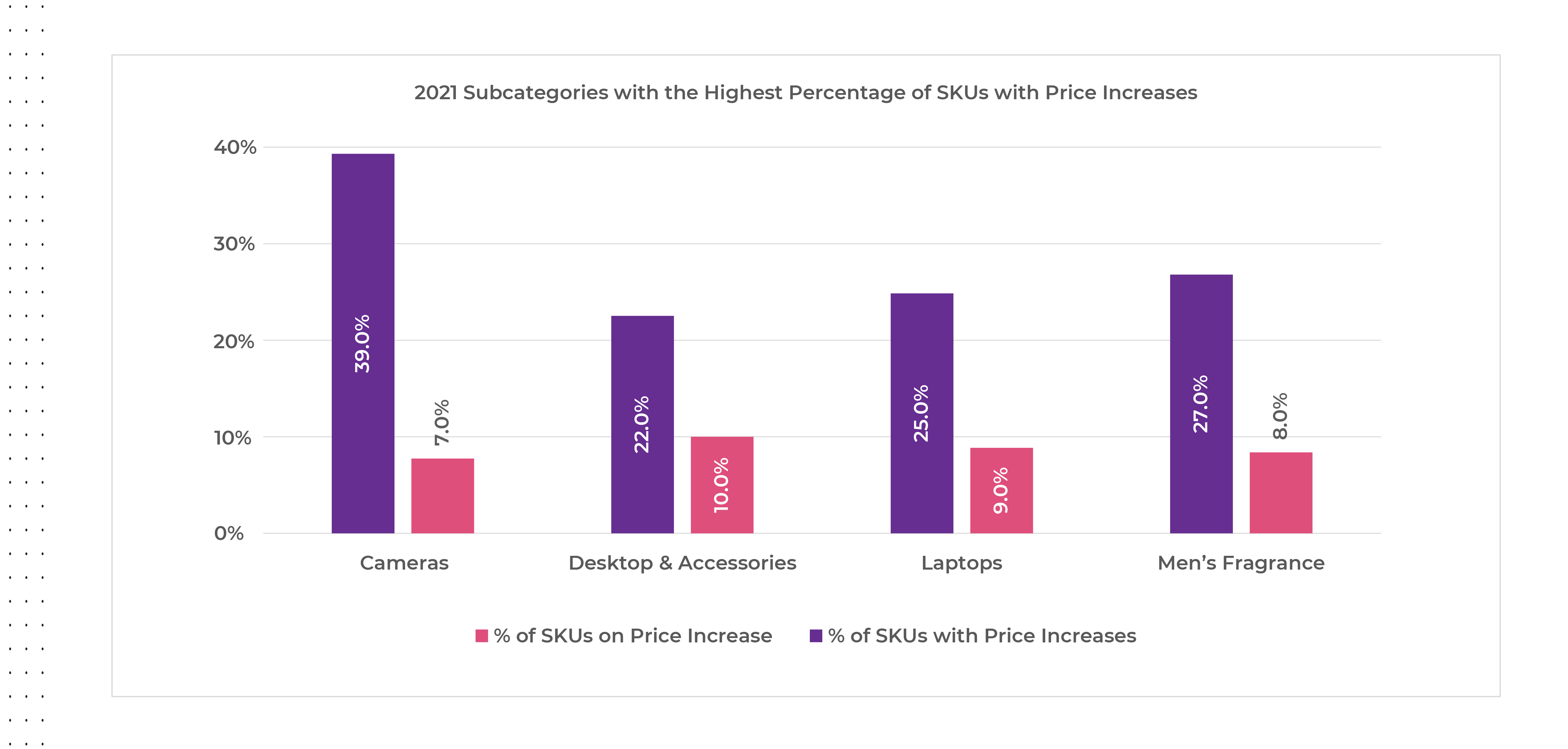

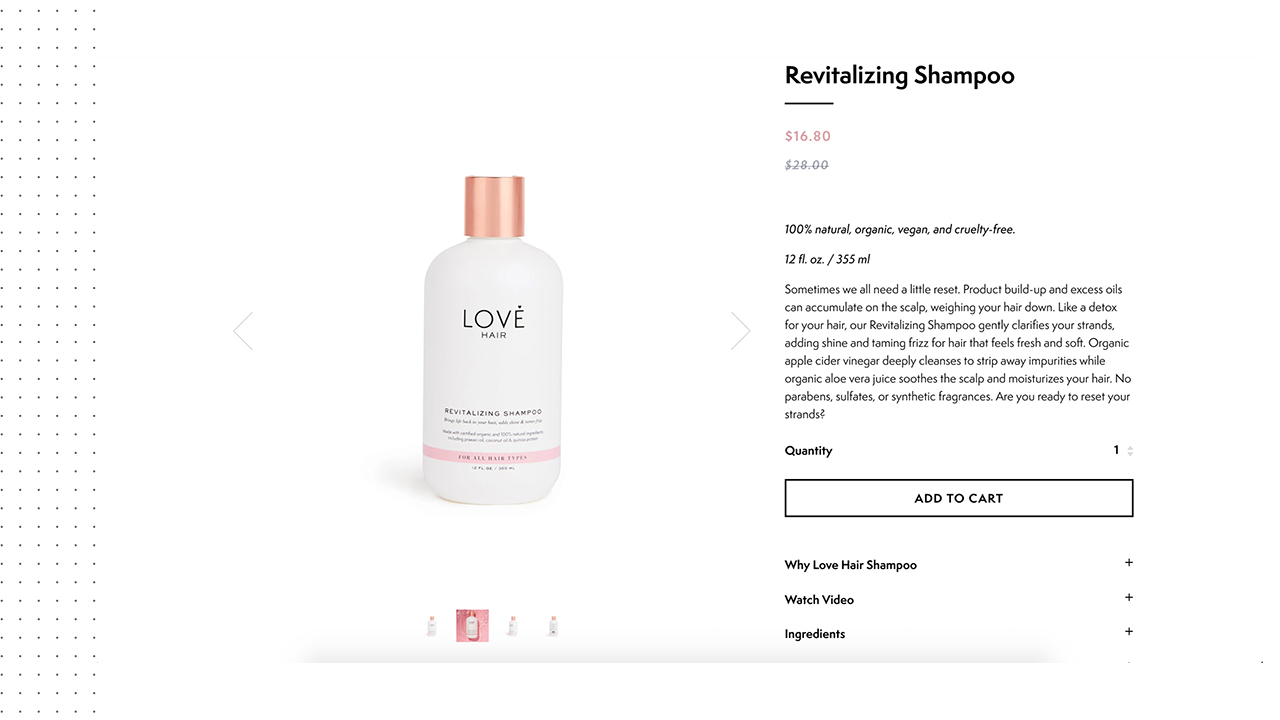

Price is one of the essential indicators consumers use to determine the authenticity and value of a product. Constant price fluctuations can negatively impact a brand’s reputation. Brands need to safeguard their pricing to create a consistent price perception. Price changes often make the buying decision complex since consumers no longer have a clear reference of prices. It also shifts purchasers’ attention from the brand and product features to its price. With price fluctuations, brands that were used to be differentiated for their features can be seen as commodities.

Low prices & MAP violations on an online platform can even be a sign of counterfeit products or unauthorized sellers. However, customers might hold the brand responsible if they purchase counterfeit products from a retailer at lower prices. A negative product experience with a retailer will also reflect the brand’s reputation. An effective MAP policy that enforces consistent pricing will ensure that customers hunting for the best deals will stick with the most legitimate retailers.

Read how DataWeave helped Classic Accessories, a leading manufacturer of high-quality accessories detect counterfeits and identify unauthorized sellers.

c. Ensure price parity across retailers

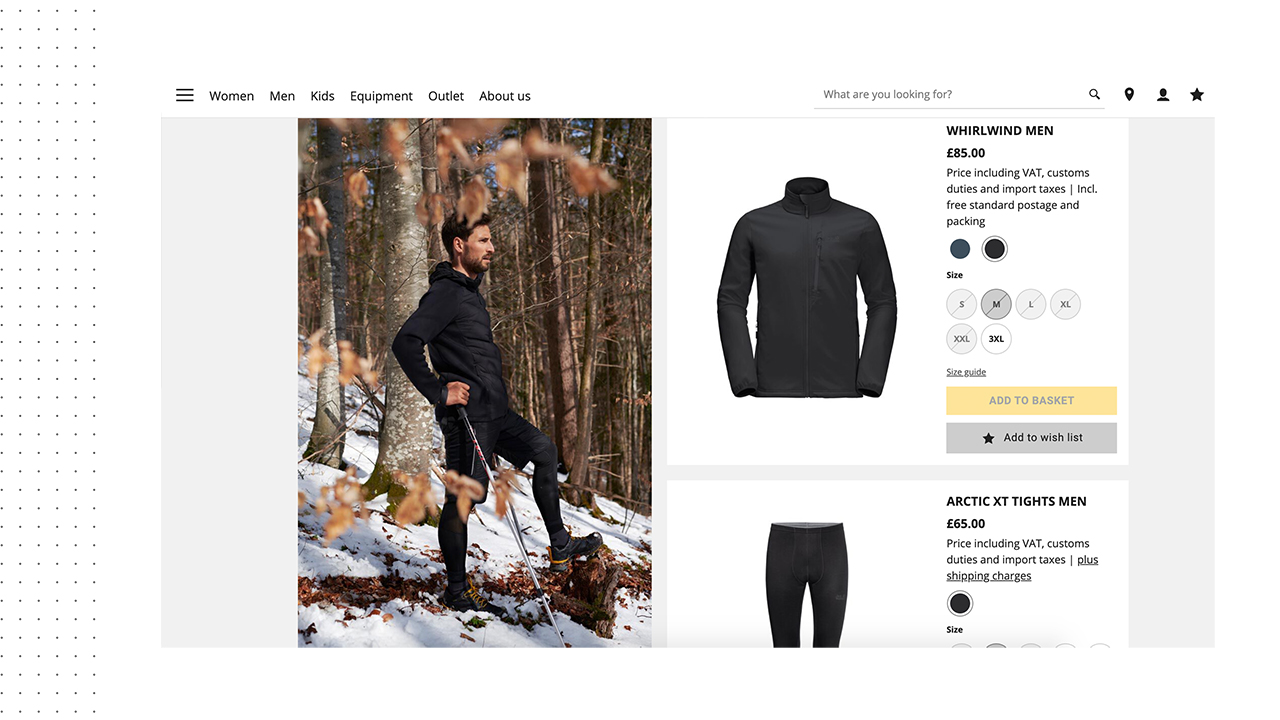

Comparing prices has become an essential and common milestone in every consumer’s purchasing journey. It’s imperative that a brand ensures price parity across platforms and stores because substantial pricing variations on different platforms can make customers suspicious of a brand. Consistent pricing across eCommerce platforms ensures brands maintain their identity. MAP policies also allow retailers to maintain profit margins while avoiding price wars.

d. Combat revenue loss from illegitimate sales

While most authorized sellers or distributors comply with pricing policies, unauthorized sellers or grey market sellers have no obligation to follow a brand’s MAP pricing infrastructure. Brands can reduce risk with an authorized seller badge on retailer websites. This will help customers to verify authorized retailers and resellers of your products & help safeguard your brand equity online.

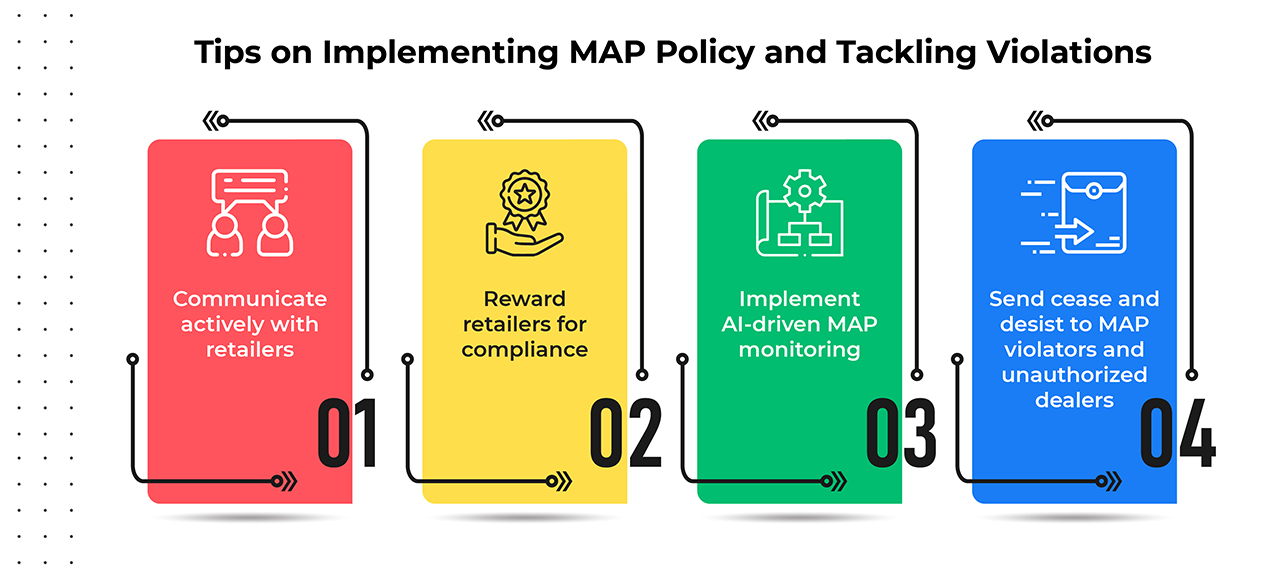

3. Tips on Implementing MAP policy and Tackling violations

Enforcing and tackling MAPs comes down to two things: monitoring the market for infringements and then acting on those violations. Here are a few tips for tackling MAP violations:

a. Communicate actively with retailers

To maintain a positive relationship with retailers and avoid confusion, brands should create proper communication strategies and channels to accompany the launch of the MAP policy. The policy should be easy to understand, but legal advisors are necessary to understand the jargon of the document. Brands can use checklists, videos, and well-briefed brand reps to communicate their policy clearly with retailers.

b. Reward retailers for compliance

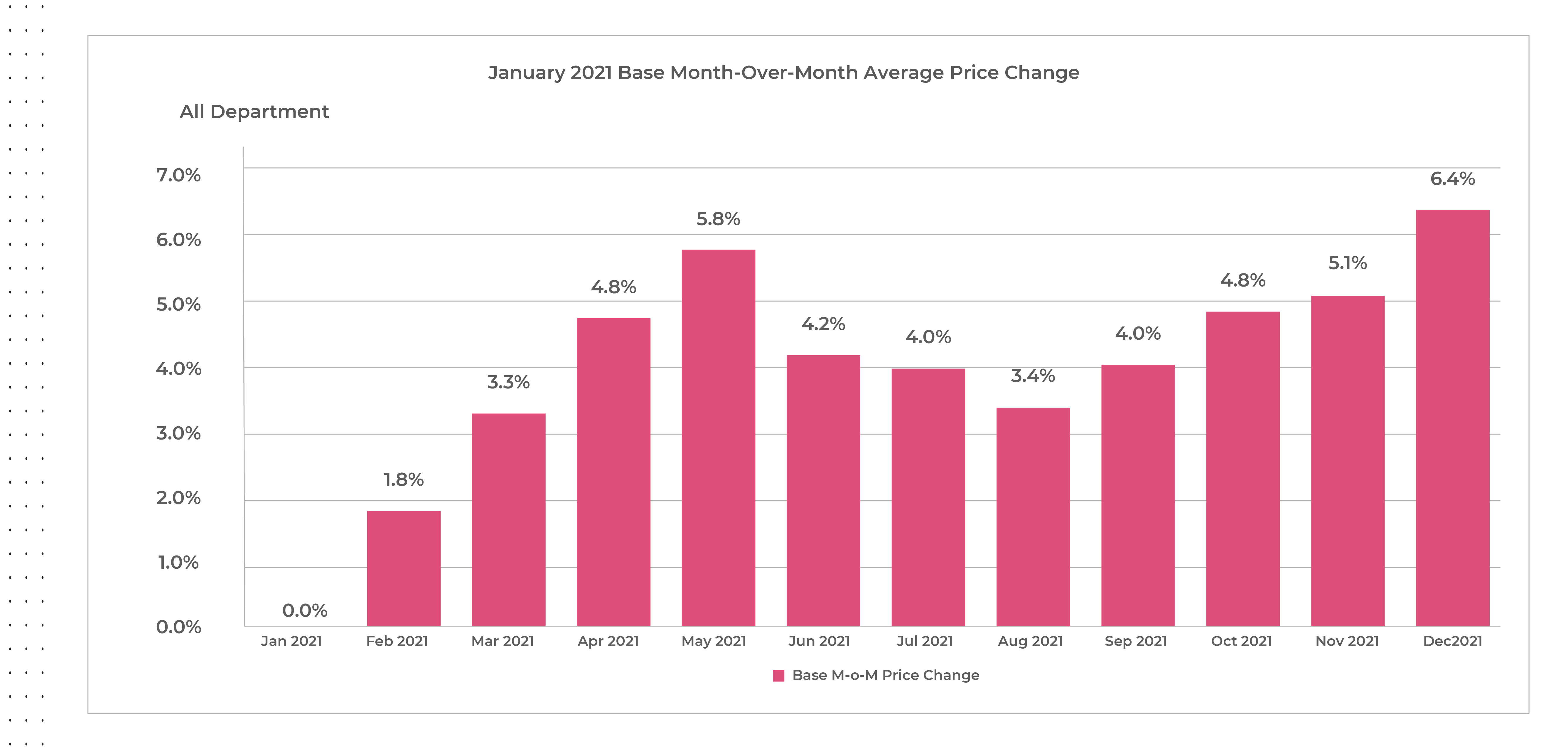

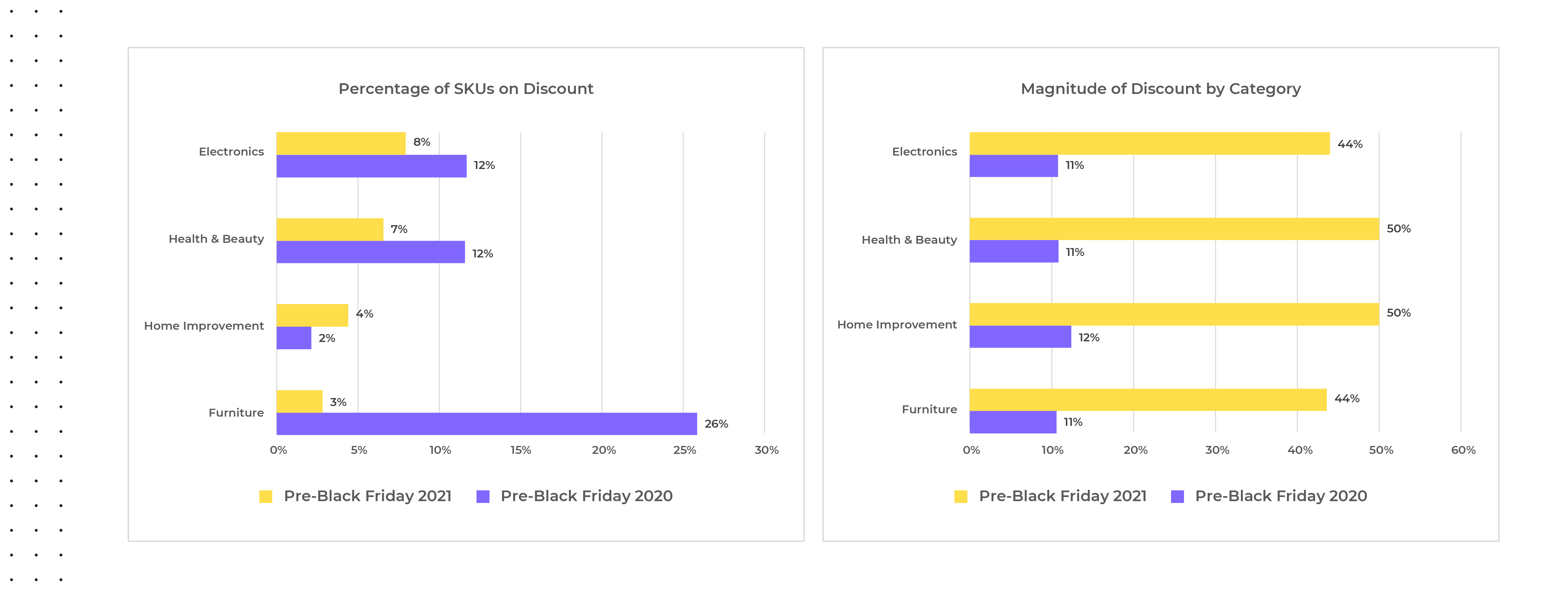

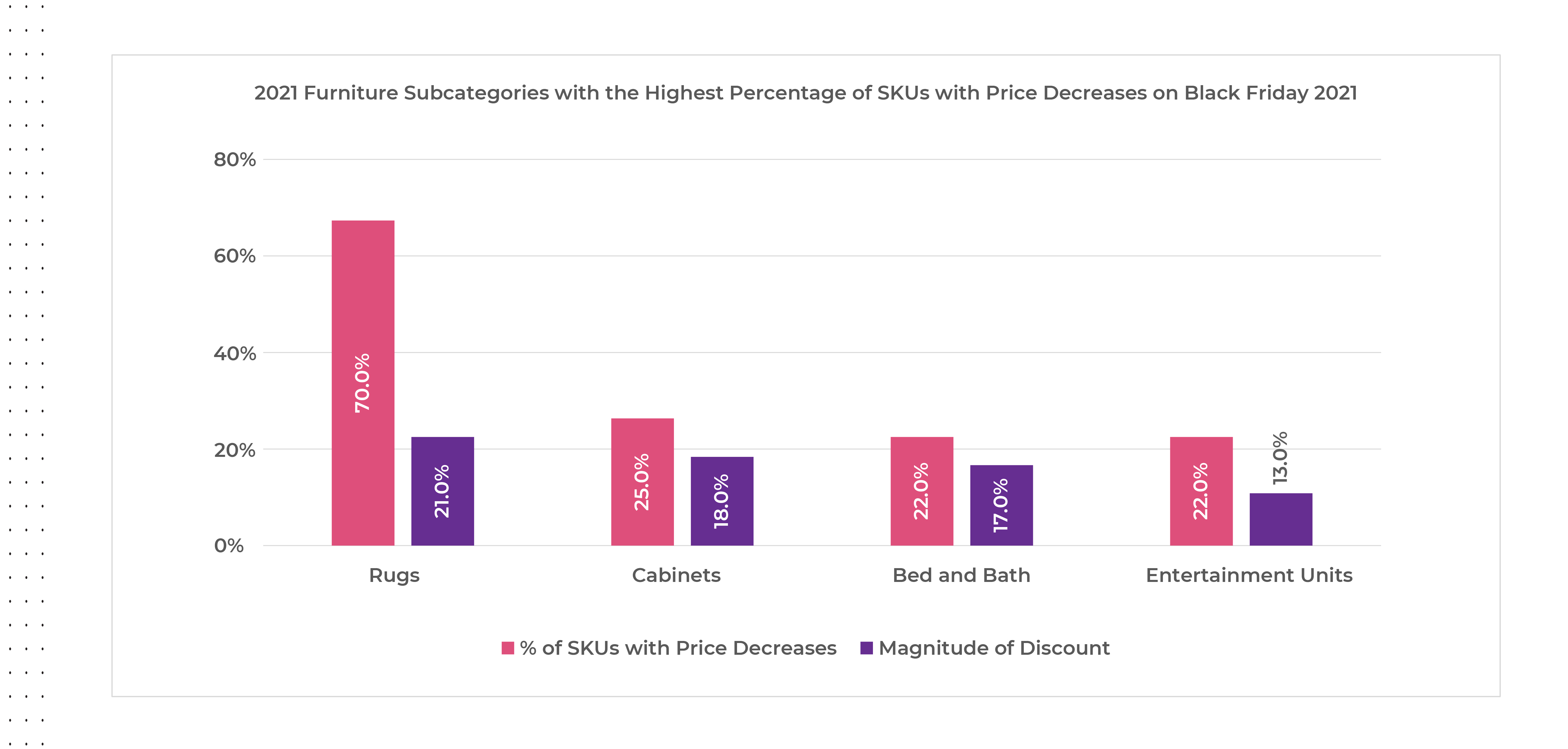

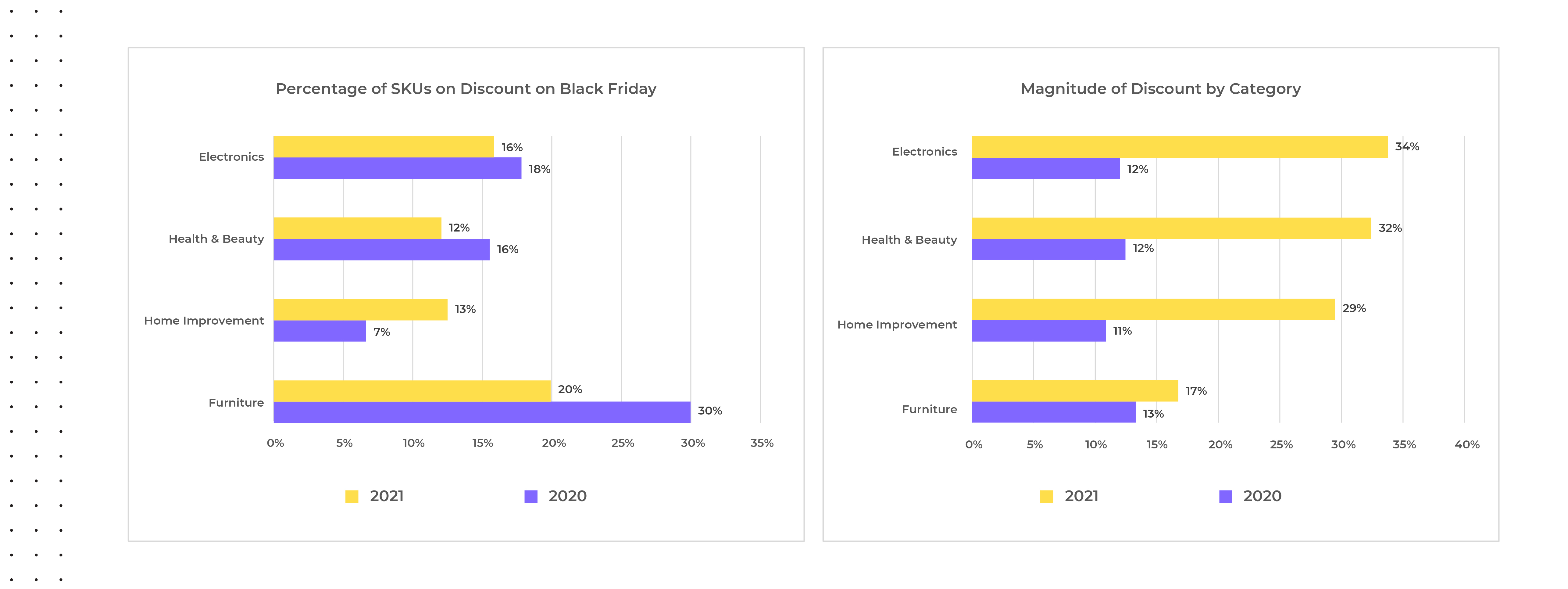

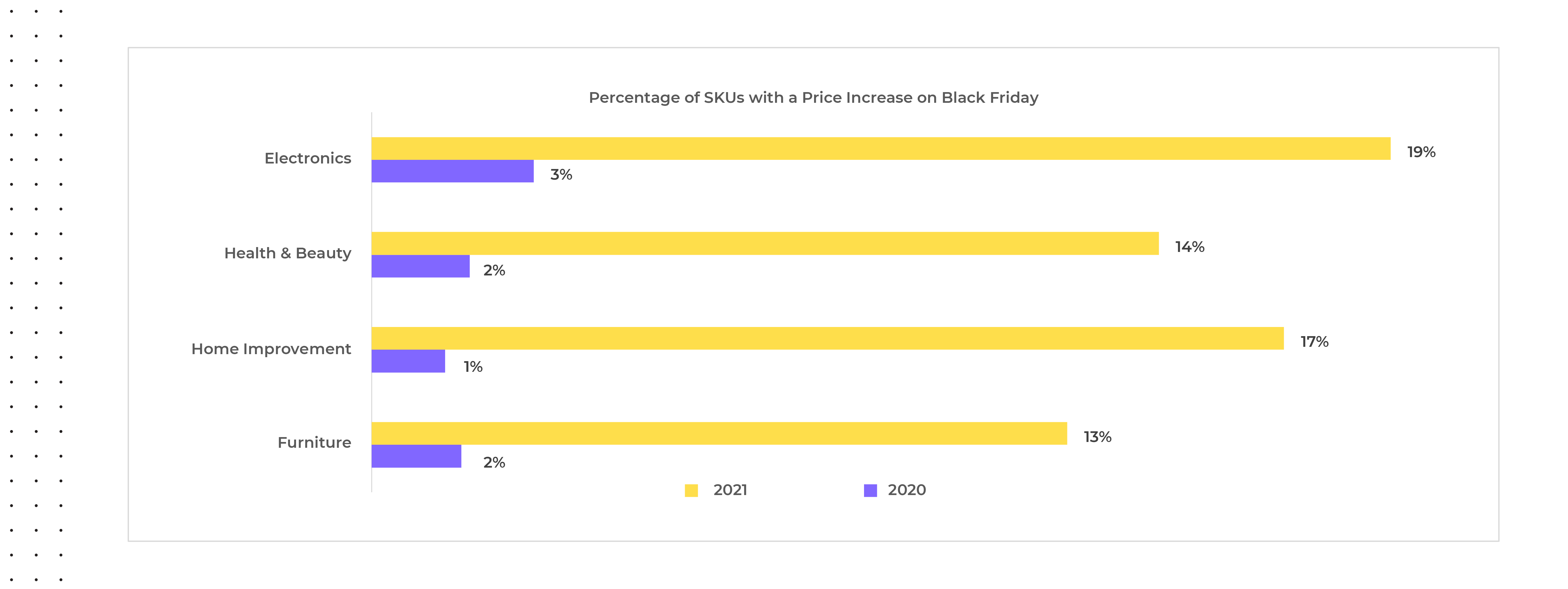

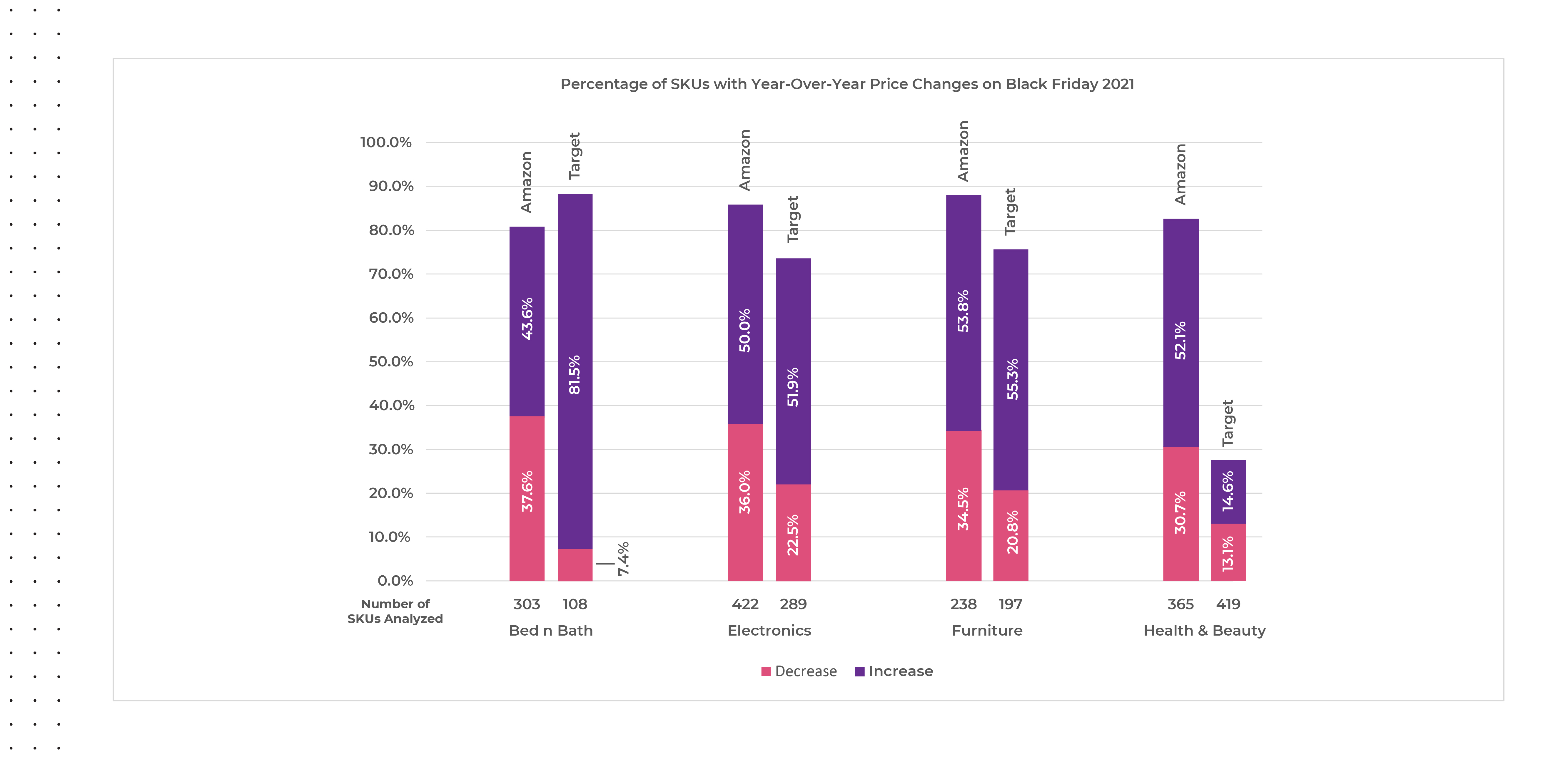

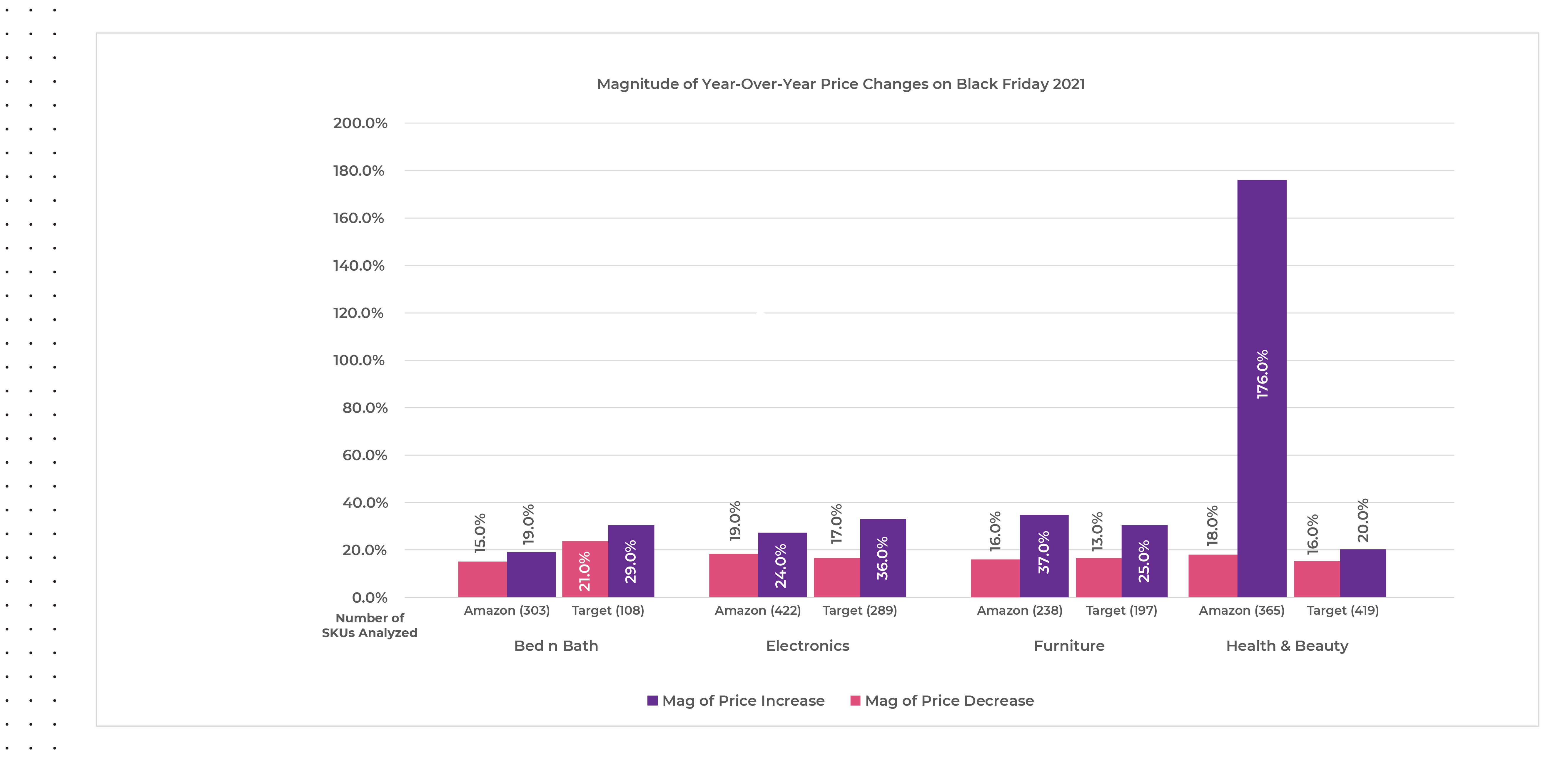

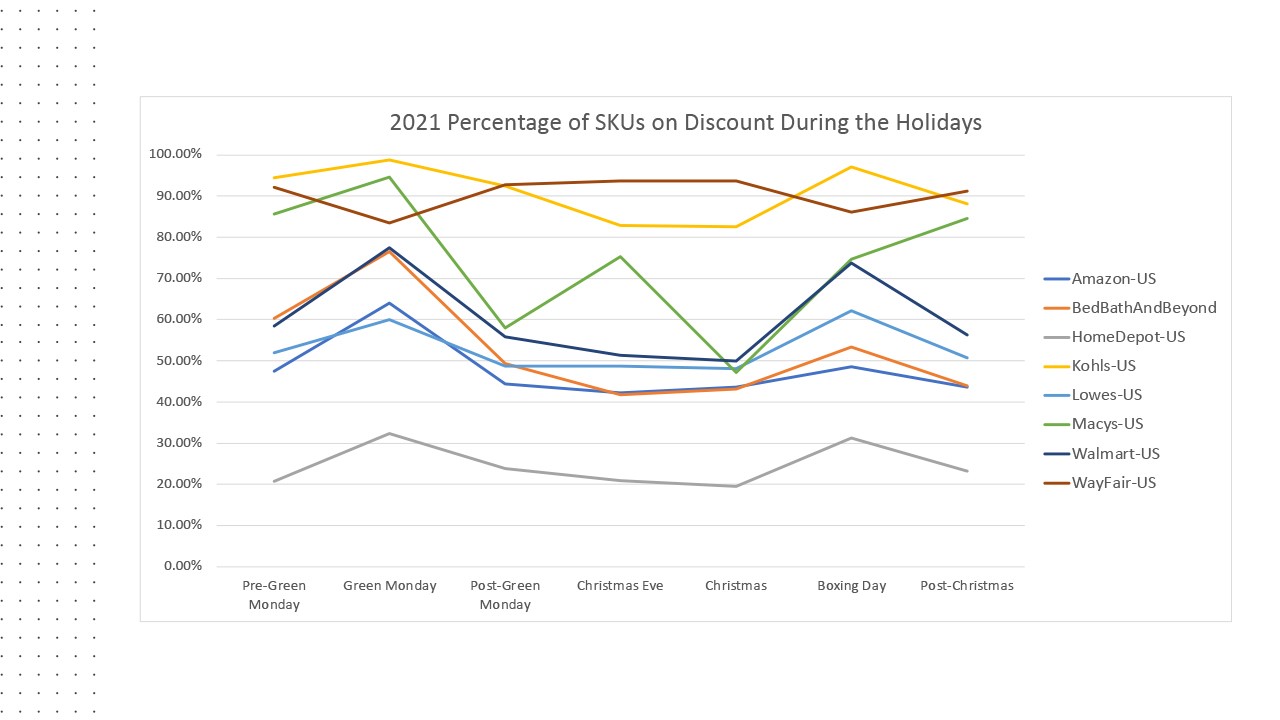

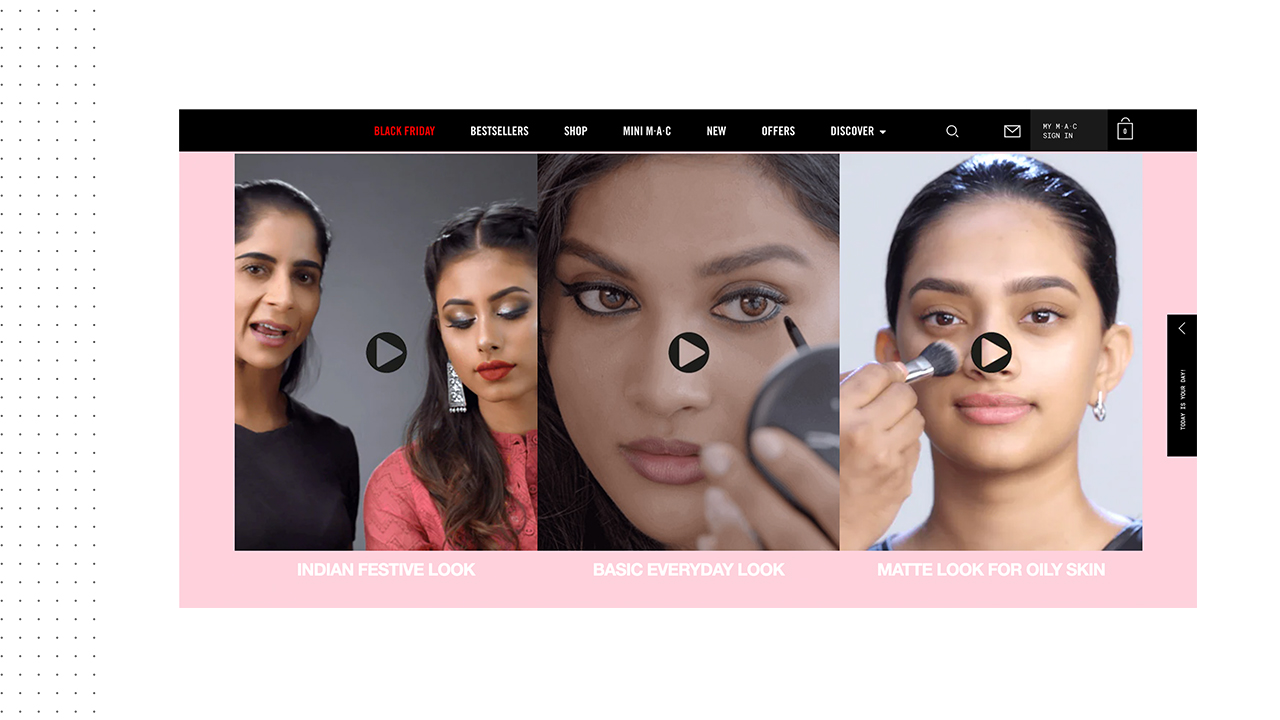

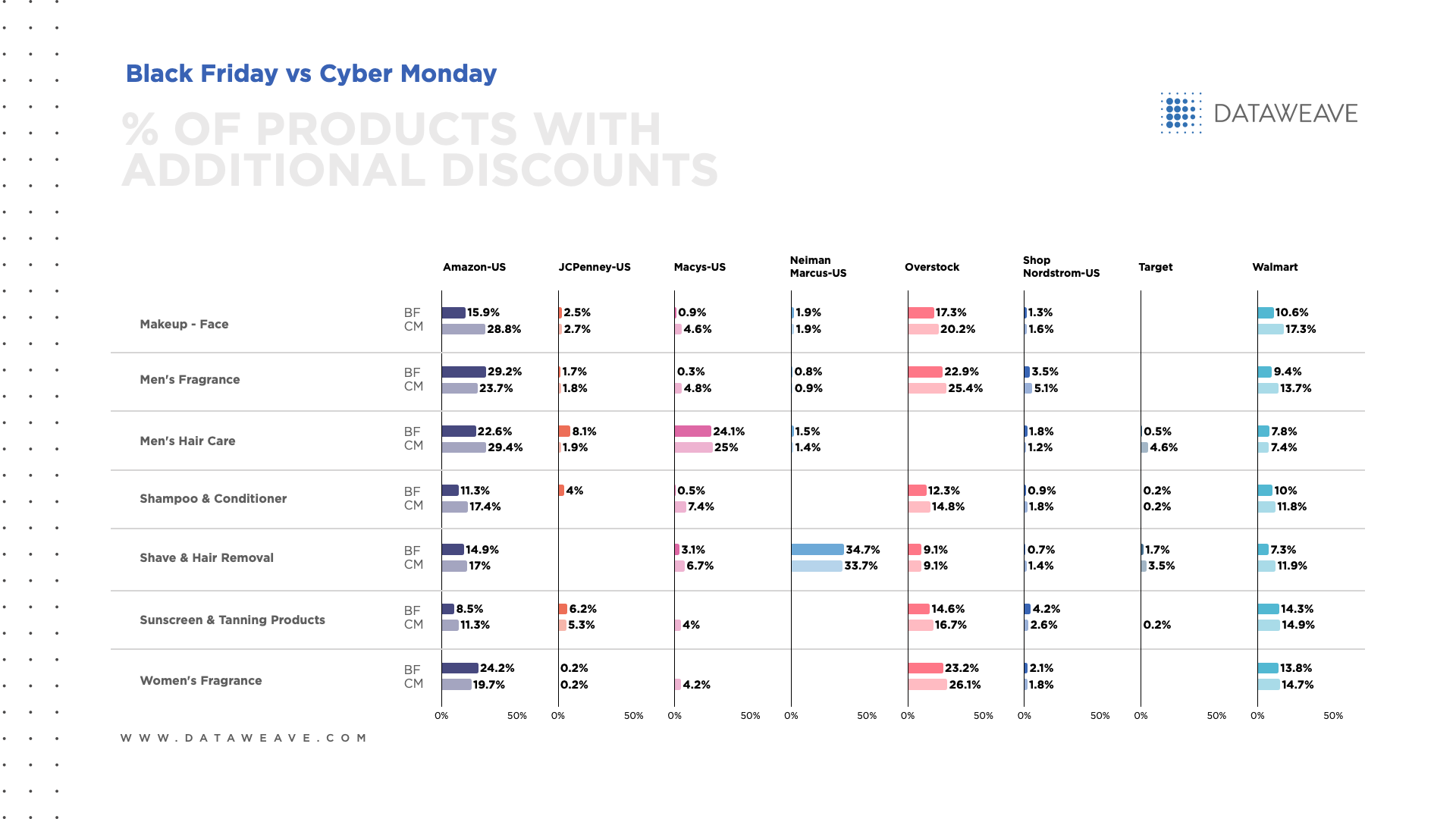

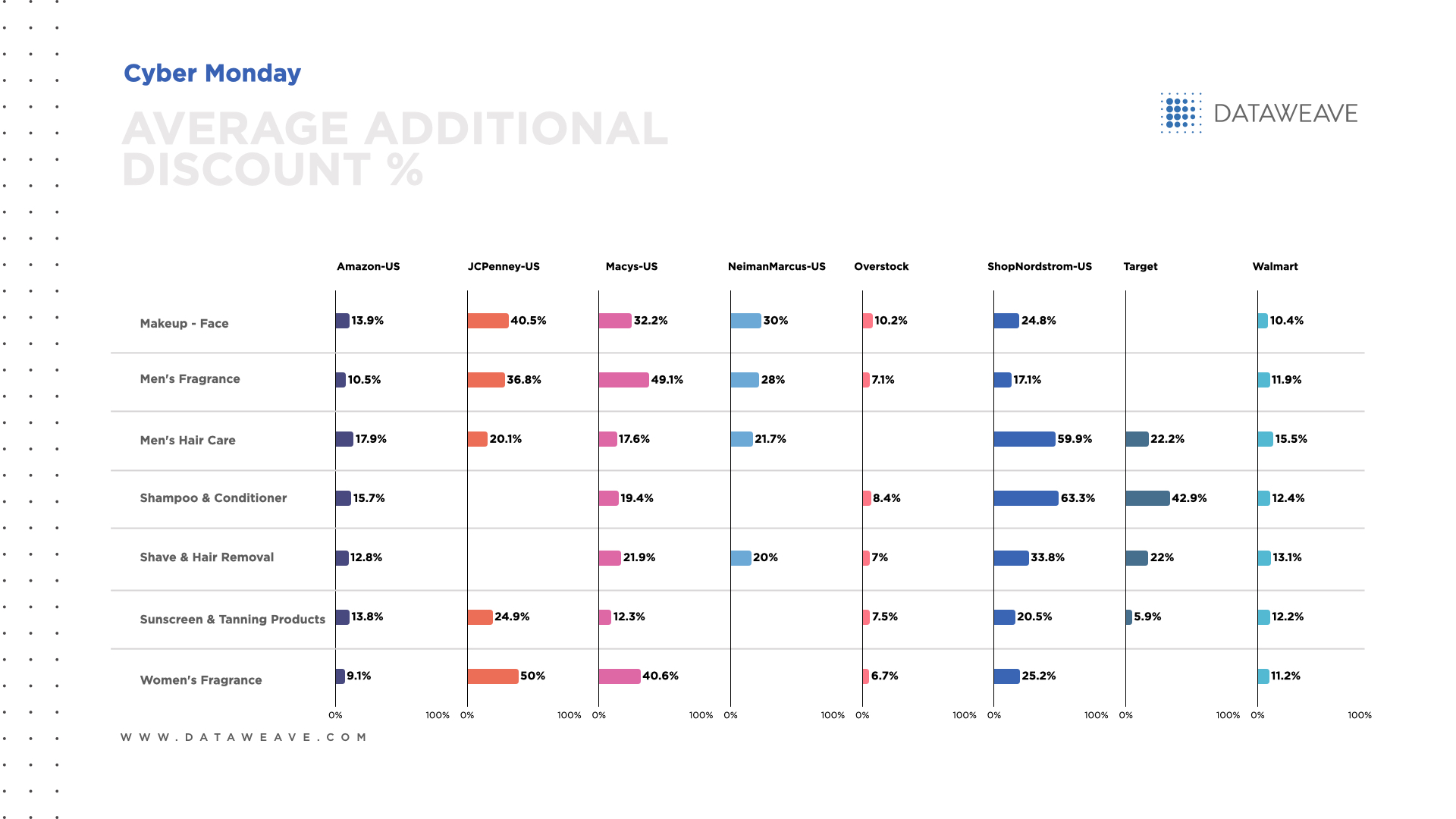

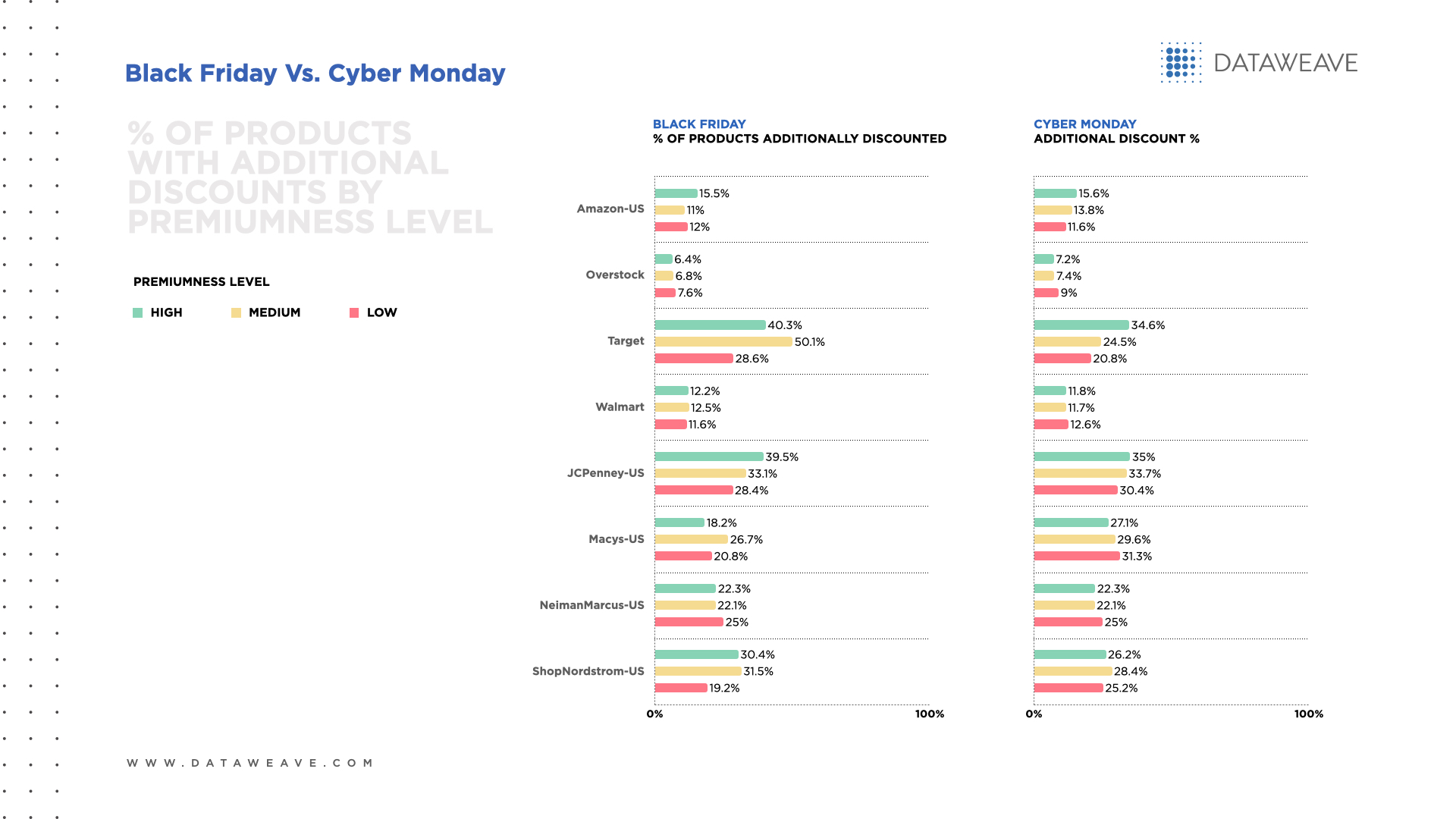

Retailers who follow MAP guidelines can lose out to platforms that do not follow these pricing guidelines. Non-MAP following platforms undercut the price of products to drive sales and secure higher traffic. In such instances, brands can incentivize MAP following retailers to encourage them to comply with MAP guidelines while not affecting the competitive edge. It can be in the form of laxity of rules during promotion seasons like New Year, Christmas, and Black Friday sales. The laxity of rules for promotional seasons should be used as an exception to the general rule, and outlined in the guidelines.

c. Implement an AI-driven MAP monitoring

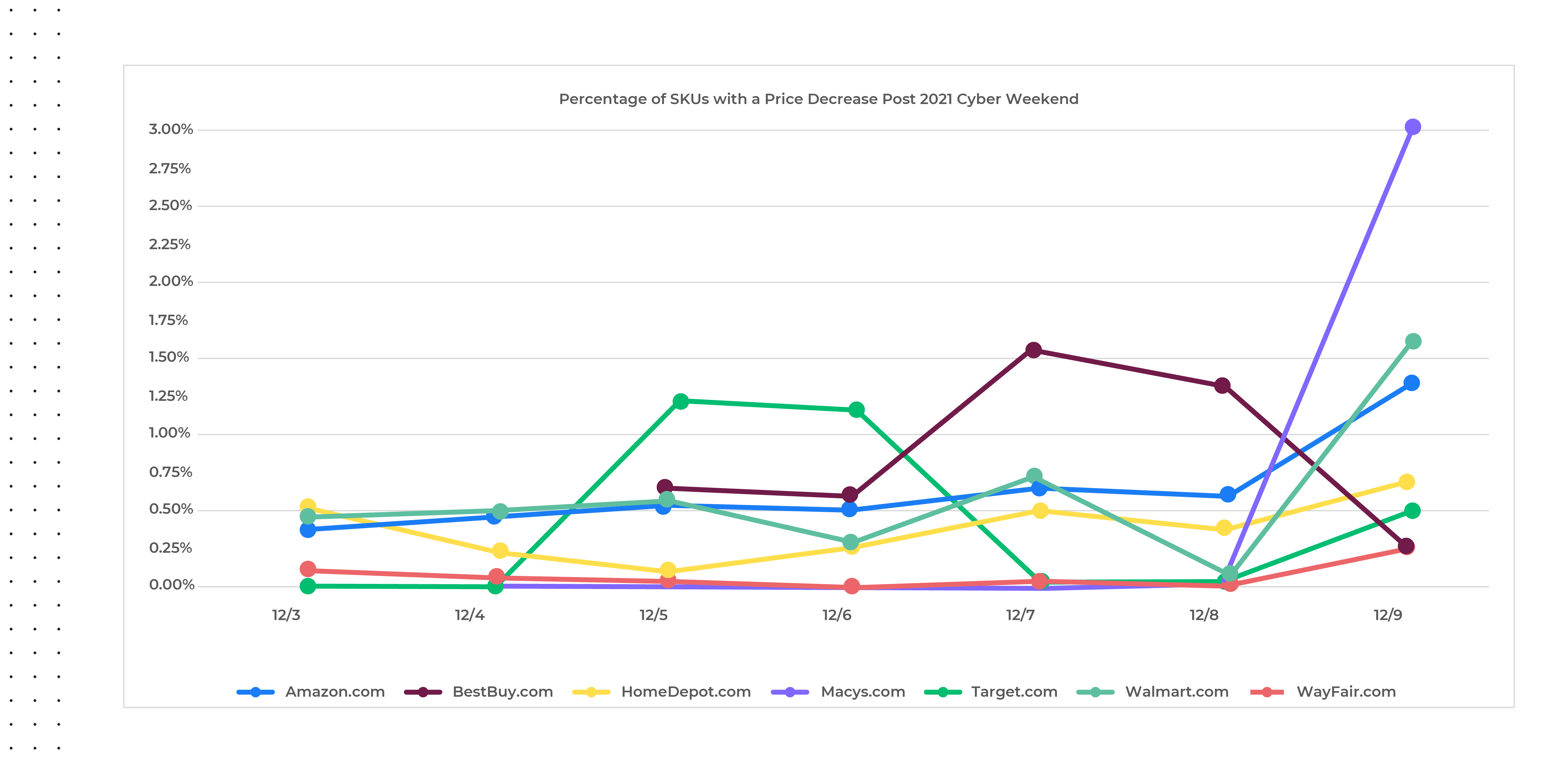

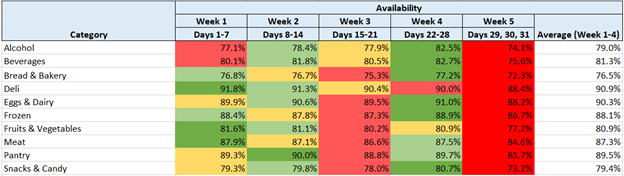

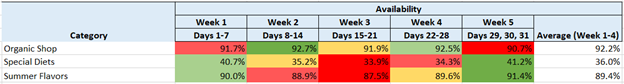

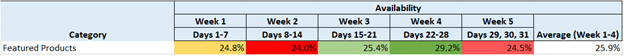

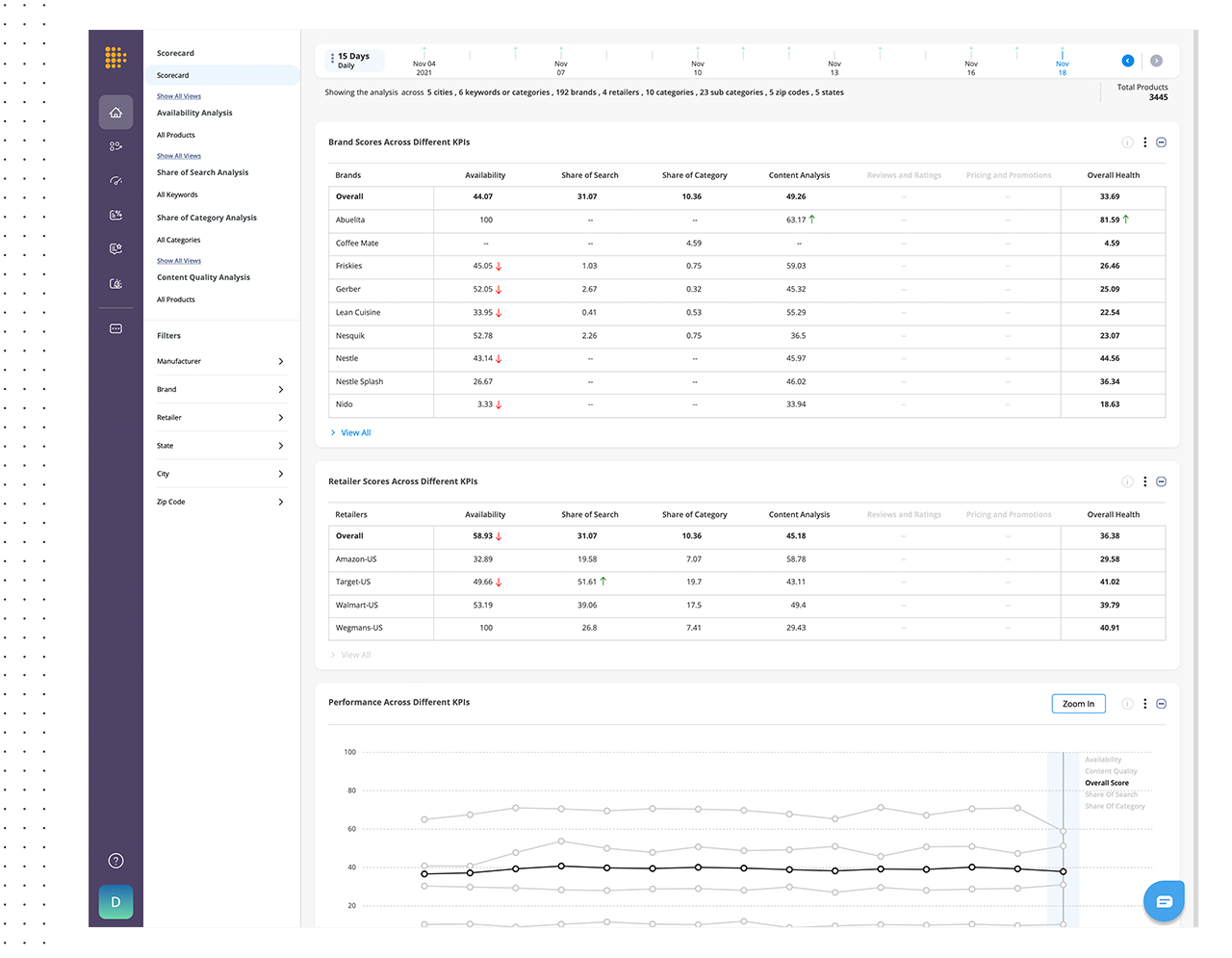

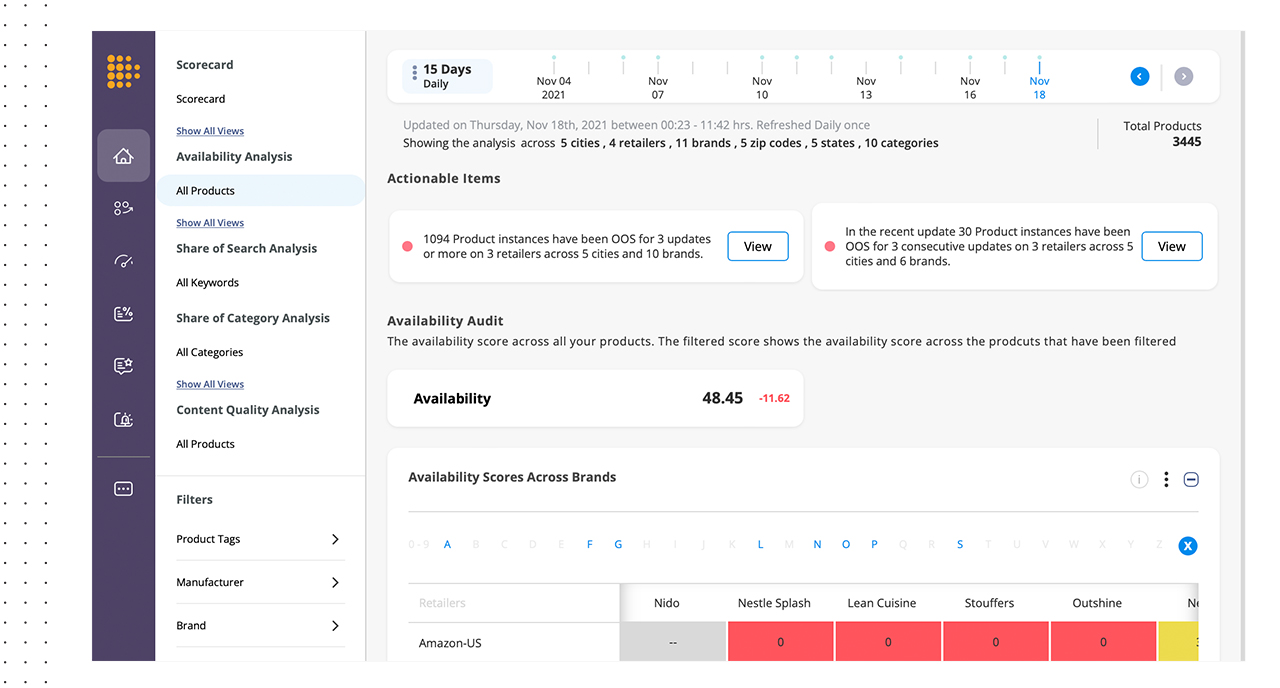

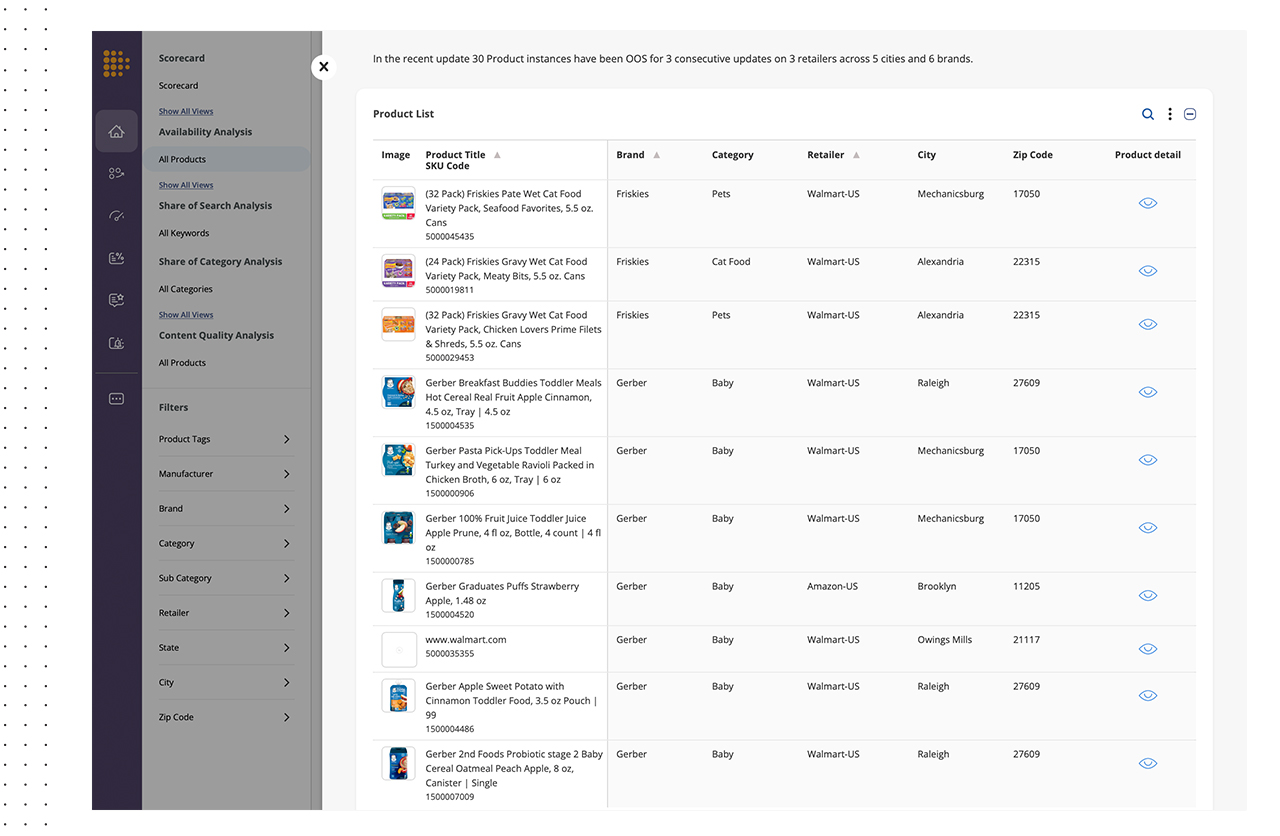

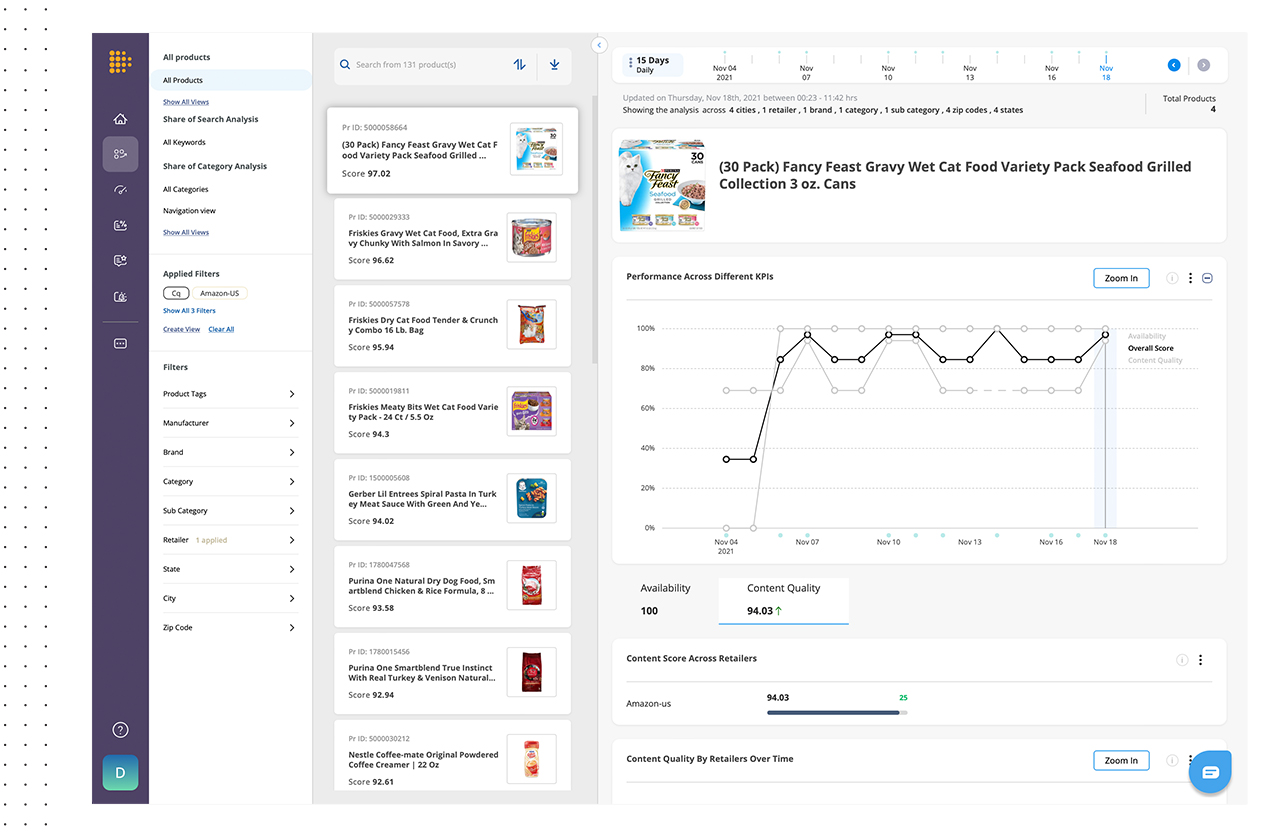

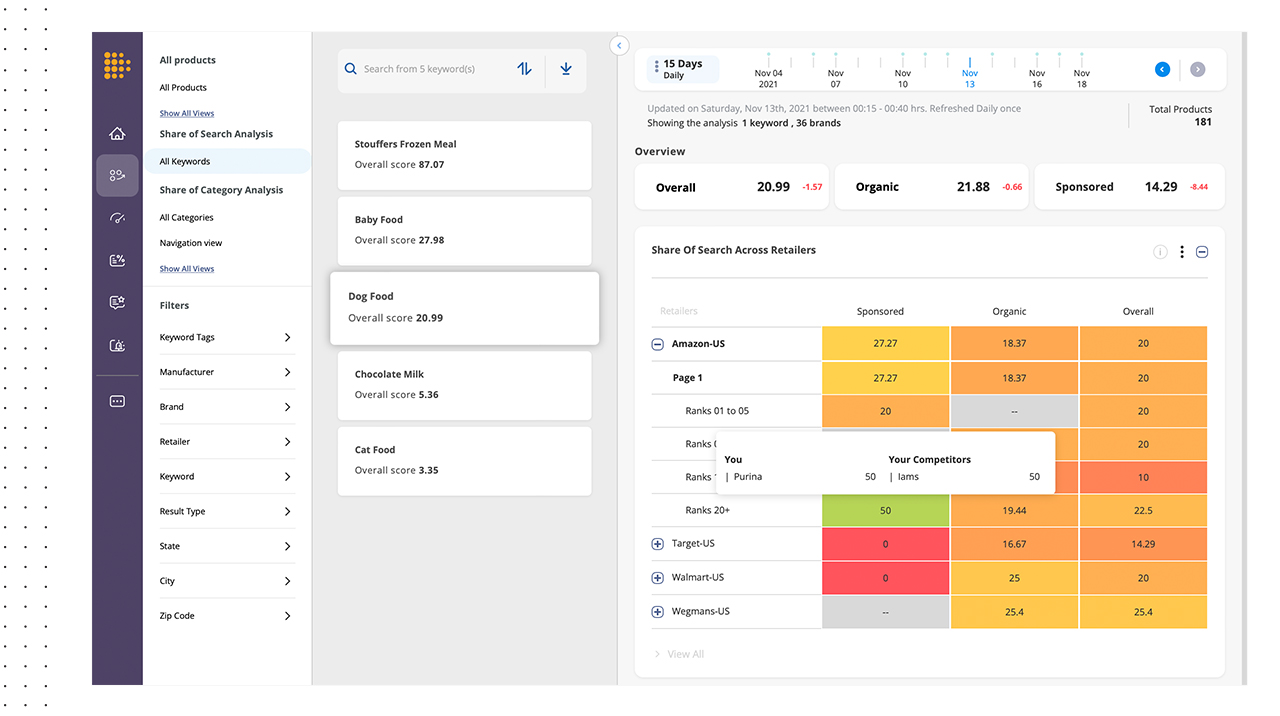

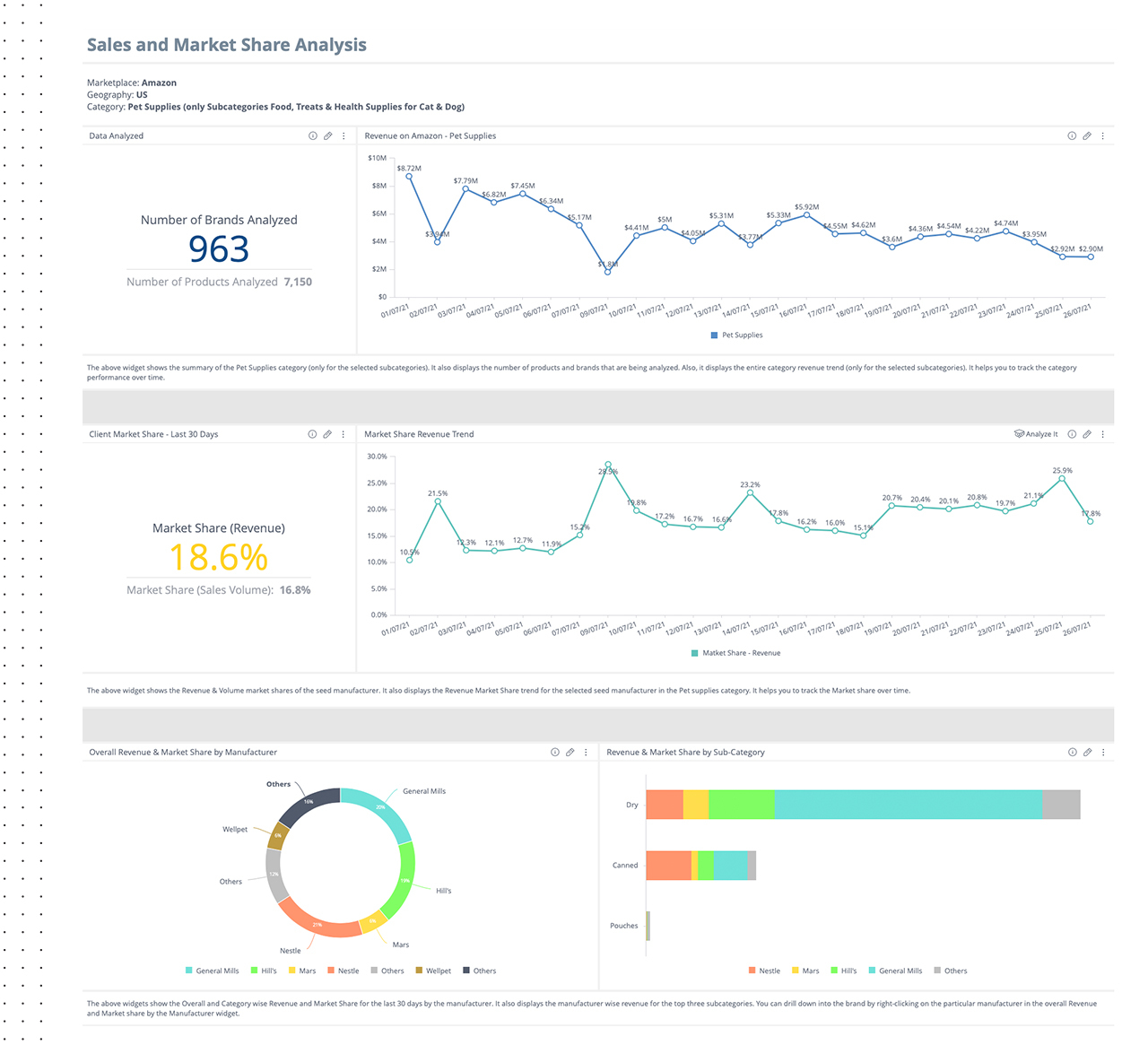

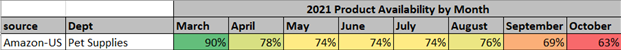

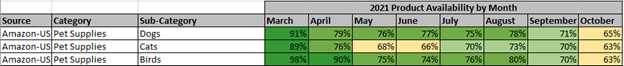

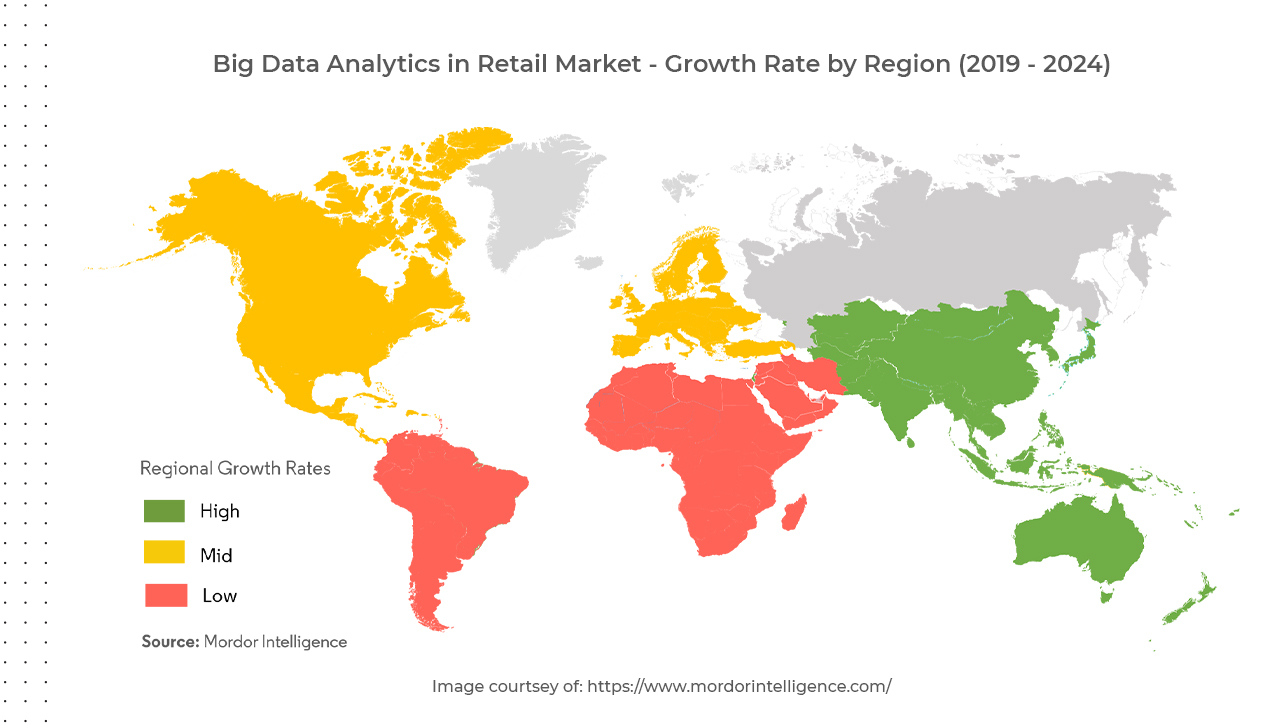

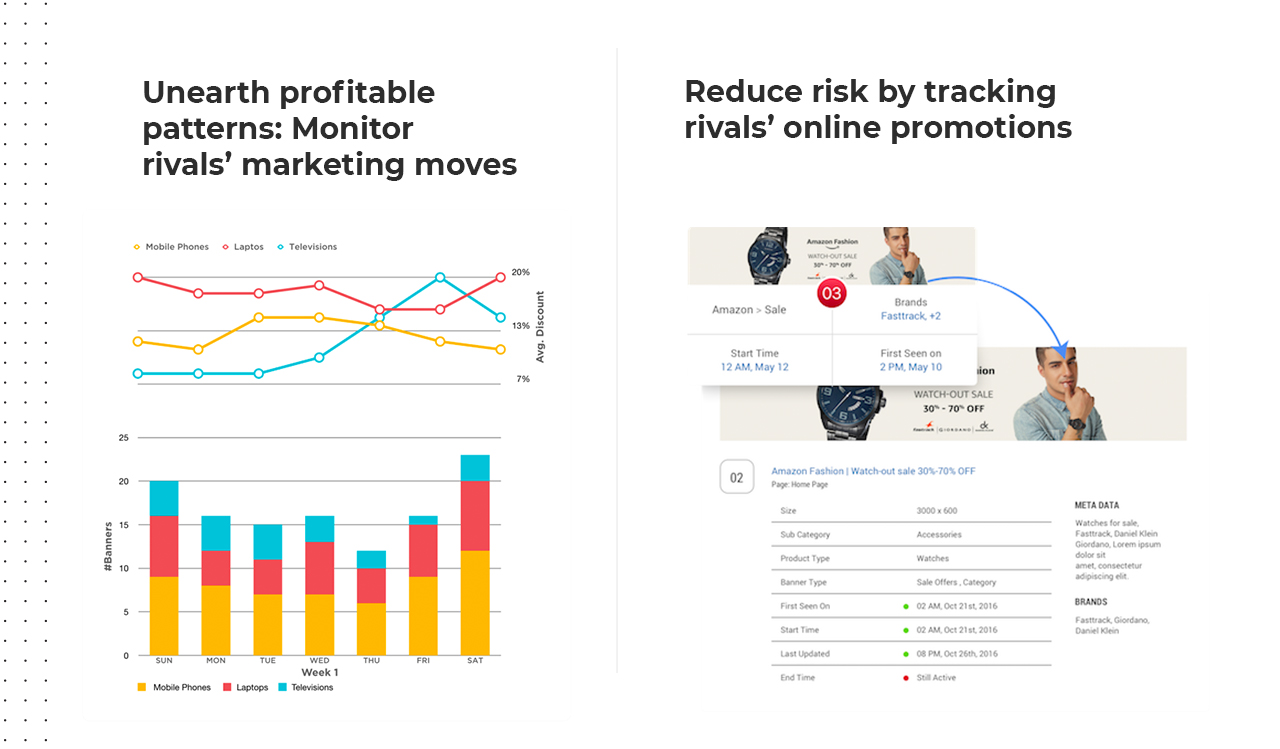

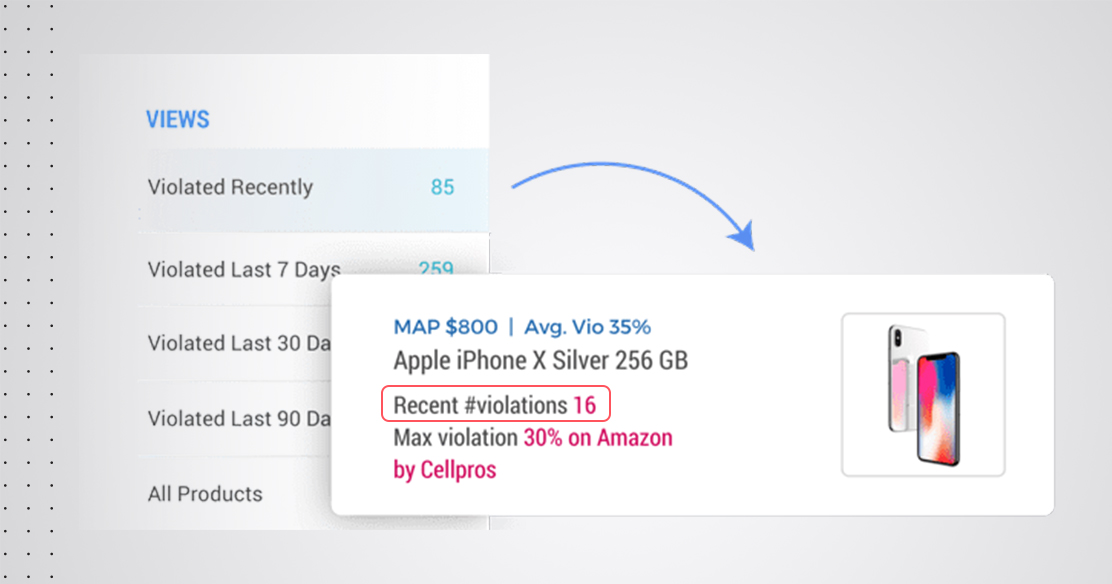

When product distribution is spread across the globe through a network of resellers and retailers, keeping a close watch on all platforms for multiple products can become difficult. With the expansion of online marketplaces, manually tracking the pricing of numerous products on multiple platforms is time-consuming and unsustainable. An automated AI-driven monitoring platform can track the pricing of all products sold across hundreds of online platforms and identify violations around the clock. Such platforms can alert brands of violations, price inconsistencies, or suspicious activities in real-time.

d. Send cease and desist to MAP violators and unauthorized dealers

Brands must enforce a MAP policy to ensure price parity among retailers and resellers. Brands must systematically monitor prices across retailers, social media, marketplaces, and price comparison websites. Whenever brands encounter a MAP violation, they should take action by sending a cease and desist letter to unauthorized sellers. For legitimate sellers, brands can notify them and outline the steps that will be taken if they don’t comply. Brands must be consistent in enforcing MAP policy violations, signaling retailers and unauthorized sellers that there will be repercussions for MAP violations.

4. Conclusion

The trend towards online shopping helps businesses to cut overheads, allowing their products to be sold at a significantly reduced price. Although price appears to be the most effective consumer attraction strategy, significantly lowering product prices can devalue products and hurt brand reputation in the long term. However, including and enforcing MAP policies helps brands to manage their reputation and allows retailers to manage their margins.

Want to see first-hand how DataWeave can help brands track MAP Violations, Counterfeit products, and identify unauthorized sellers? Sign up for a demo with our Digital Shelf experts to know more.