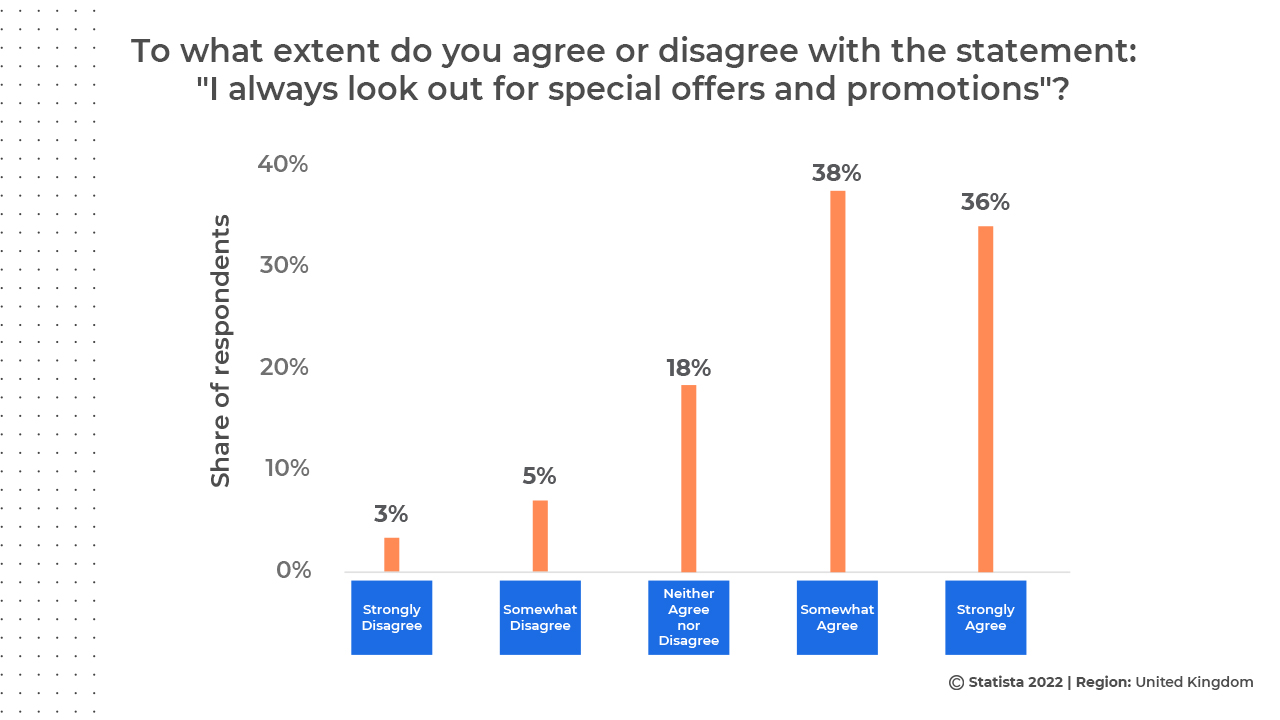

Customers love discounts, and promotions are the most effective tool to attract shoppers and increase sales during the holiday season and clearance sales. According to a survey, 76% of UK customers look for discounts before purchasing a product. Promotional discounts encourage customers to try new brands. And this is why brands often have a special coupon for first-time users.

According to Software Advice, discounting tops the pricing strategy for retailers across all industries. It is preferred by 97% of survey respondents over other promotional strategies.

Retail Trends in the UK for 2022

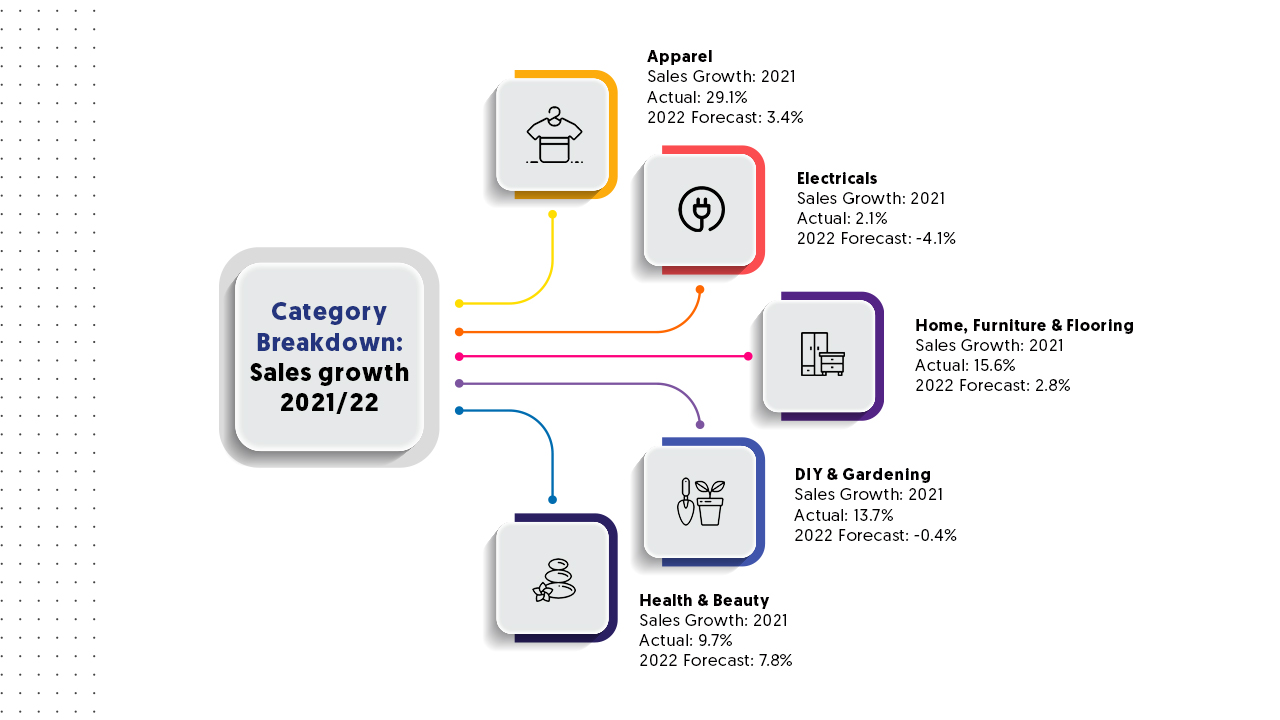

The arrival of the Omicron variant in December 2021 slashed the shopping mood of UK customers and led to a 3.7% monthly drop in retail sales, but sales were still higher than February 2020 levels when Covid-19 first hit worldwide. Sales during the holiday season in 2021 took a hit due to a consistent decline in product availability and an increase in prices. Inflation too started to rise in 2021 and is expected to increase by 7% by spring 2022. However, despite inflation, retail sales jumped back in January 2022. In fact, it is predicted that inflation will be a key driver of sales growth, with underlying demand across categories being uneven. Keeping that in mind, let’s look at sales growth across categories in 2021 and projected growth in 2022.

Discounting Trends we saw in the UK in 2021

Methodology

- We tracked prices on the three biggest Sales Days in the UK

– Amazon Prime Day, June 21st & 22nd 2021

– Black Friday, Nov 26th, 2021

– Cyber Monday, Nov 29th, 2021

- Categories tracked: Beauty, Fashion, Electronics, Home Improvement, Furniture

- Websites tracked: Amazon UK, OnBuy, eBay UK, Etsy, Wayfair, Selfridges, John Lewis

Prime Day, Black Friday, and Cyber Monday are three of the biggest sales days with comparable discounts. However, according to new research, in 54% of cases, it depends on the category of product you’re after that determines the volume of discount you get. For example, tech items such as smartphones, laptops, games consoles, smartwatches, and wireless speakers were cheaper on Black Friday but may not necessarily have been cheaper on the other sale days.

We wanted to see which sale period had the most number of products on discount during the three big sale events. We also wanted to see which of those three sales would’ve been the best for consumers to get a higher section of products at a discount.

How Big were the Discounts?

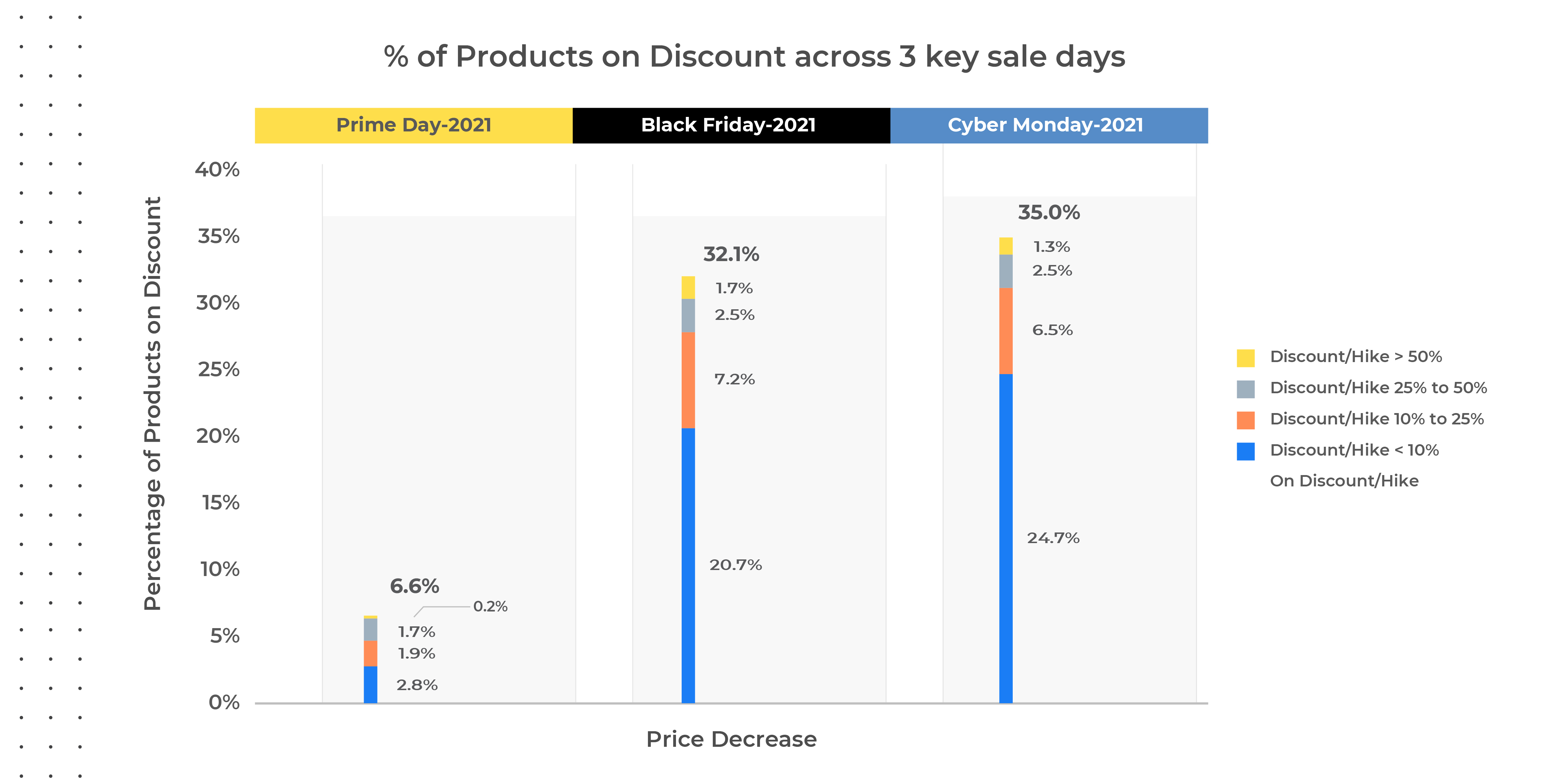

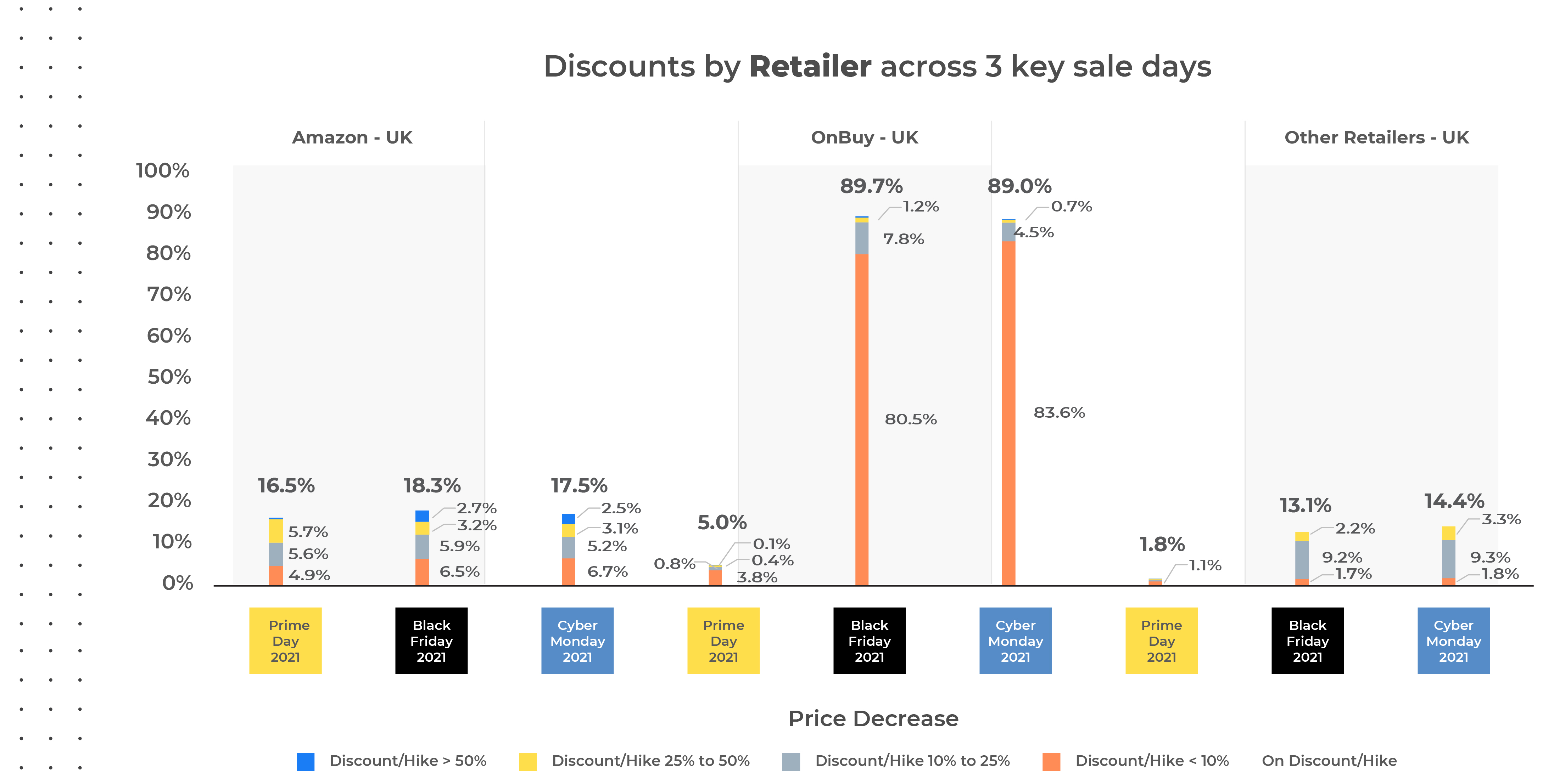

32% of products went on discount during Black Friday, 35% on Cyber Monday, and only 6.6% on Prime Day. One factor contributing to the low Prime Day percentage is the fact that not all retailers participate in discounting wars during Prime Day since it’s an exclusive Amazon-only sale. Customers looking for the best deals would’ve gotten them during the holiday season with a combination of the Black Friday & Cyber Monday sales.

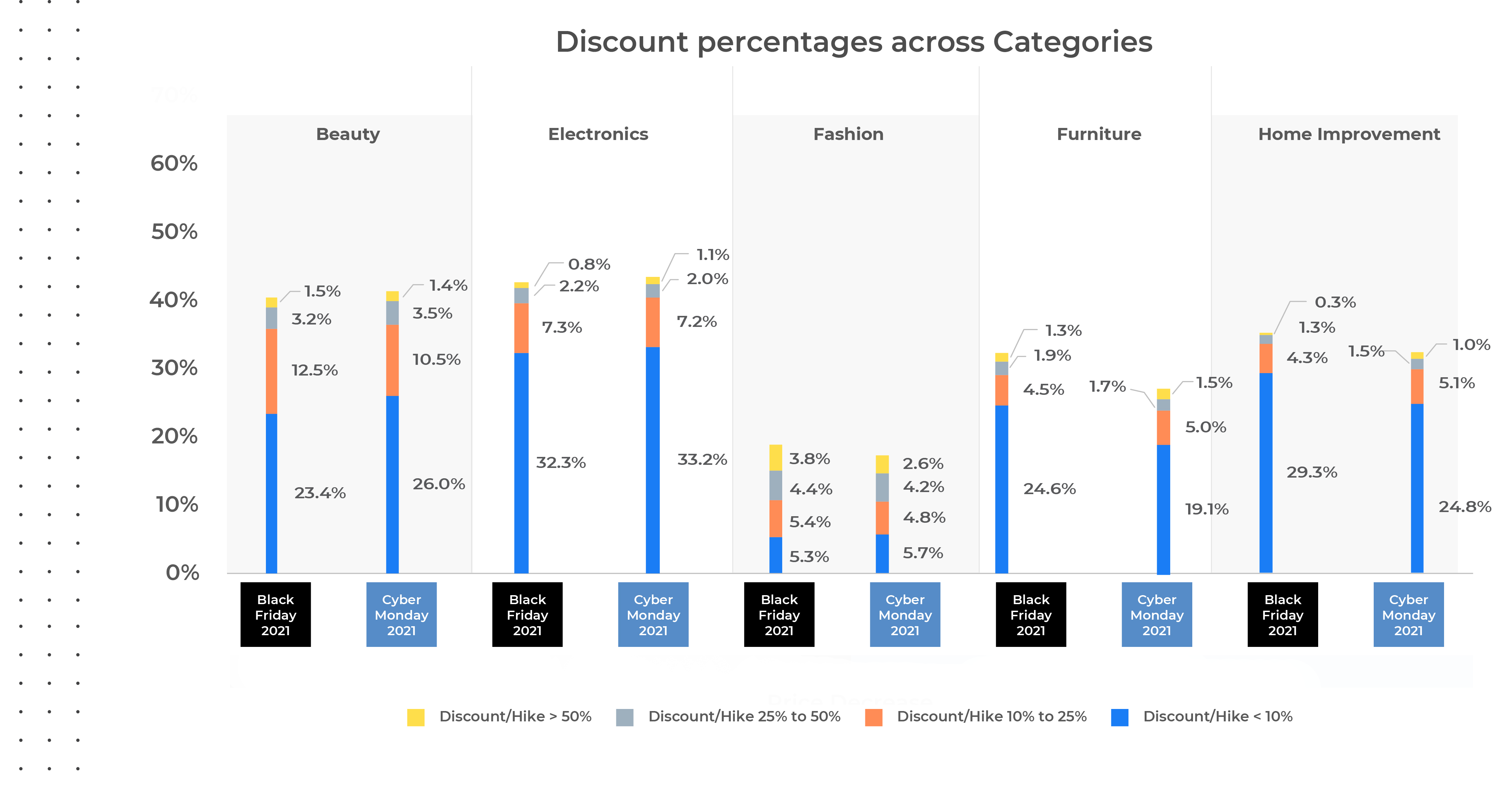

Another interesting thing to note is the percentage discount – on Prime Day, only 0.2% of products had a discount of over 50% of all the discounted products. While on Black Friday & Cyber Monday that number was 1.7% & 1.3% respectively.

In conclusion, more products were offered at a discount on Black Friday & Cyber Monday; and the total percentage discount on those products was also higher.

Which Categories had the Maximum Discount?

On Black Friday, an estimated 47% of consumers in the UK planned to shop for electronics, whereas 40% of customers planned to shop for clothing and footwear during Black Friday to Cyber Monday. The top-selling categories across the 48 hours of Amazon UK’s Black Friday 2021 sale included Home, Toys, Beauty, Books, and Health & Personal Care.

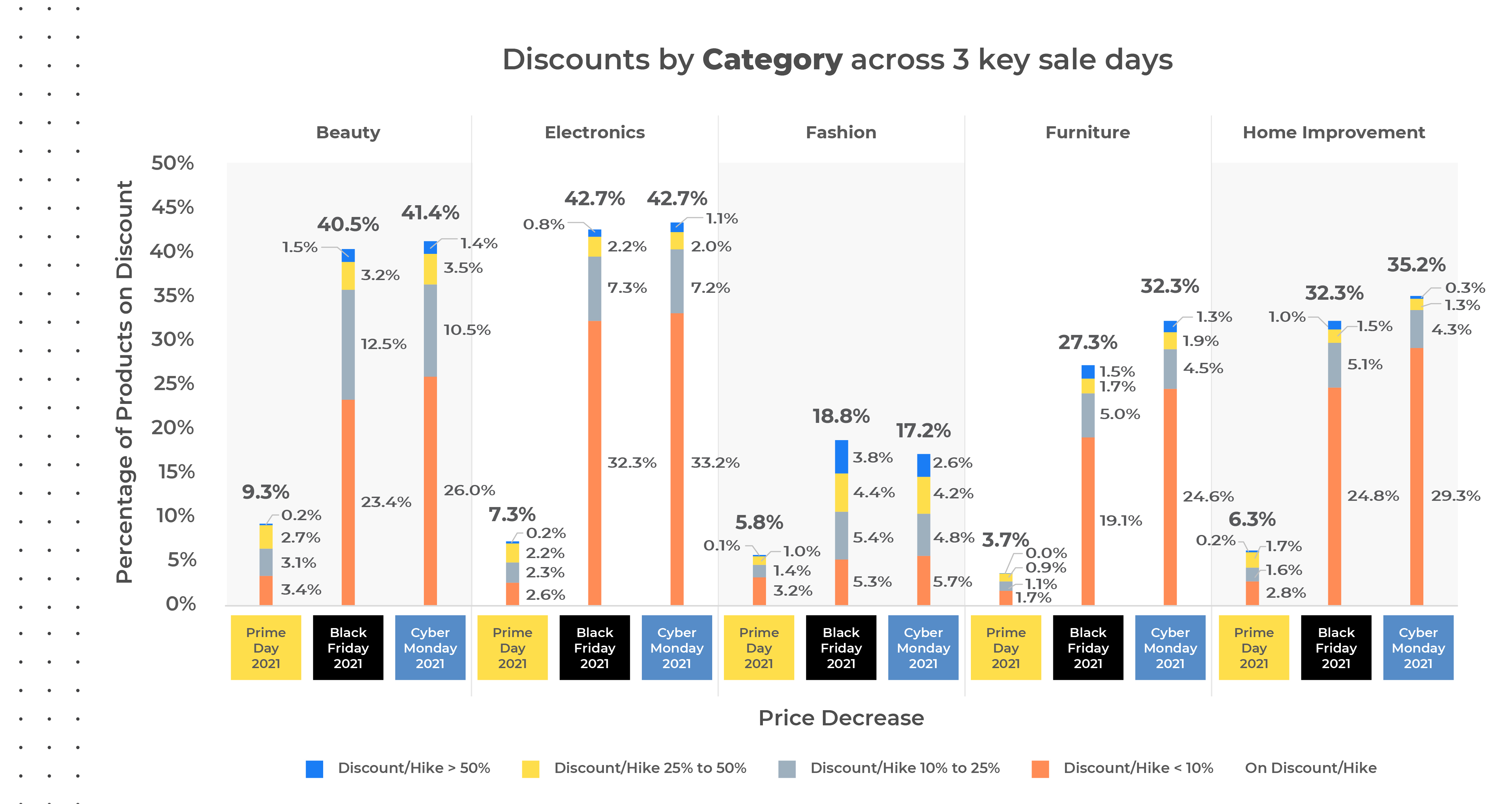

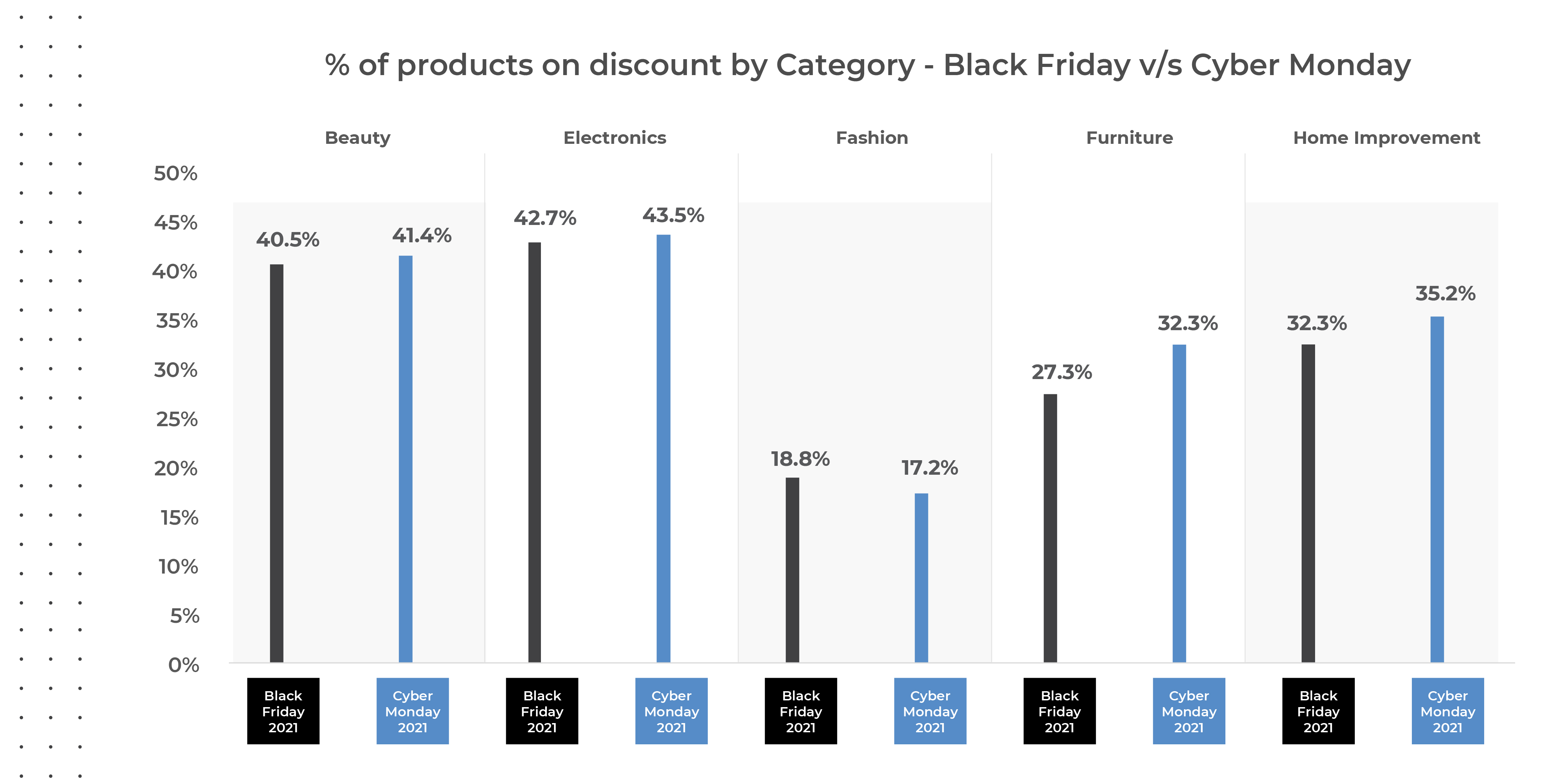

Our data shows that Categories with the highest discounts were Beauty and Electronics with the highest discount on all 3 sale events. These 2 categories had discounts on over 40% products on Black Friday & Cyber Monday while categories like Home Improvement were in the 30 – 35% range, Furniture in the 27 – 32% range and Fashion has the least products on discounts at a little over 15%

In the fashion category in the UK, Amazon UK offered the highest percentage of items with a price decrease (31.6%), whereas eBay offered the most significant magnitude of price decrease (14.3%).

Which UK Retailers gave the most discounts?

OnBuy is an emerging marketplace in the UK that offers impressive discounted prices and is taking on top UK marketplaces like Amazon. It’s ranked Britain’s fastest-growing eCommerce platform in 2020 and also the fastest grower by traffic. The low listing fees starting at 5% allow sellers to competitively price their products, making them more accessible to a greater number of buyers with huge discounts. The most prominent deals and discounts are highlighted on the landing page and featured across OnBuy’s social pages to grab the audience’s attention.

This was clearly reflective in the data we gathered from the 3 big sales in 2021. Most retailers in the UK, including Amazon offered at best 20% of their products, in the categories we tracked, at discount. The only outlier was OnBuy – OnBuy offered close to 90% of their products at discount!

OnBuy was able to offer a comparatively high number of discounted products than their competition because the magnitude of the discount was much much lower. The platform offered minimal discounts; out of the 90% of discounted products, 80% of those products had discounts that were less than 10%. As opposed to other retailers who had under 7% of their products on discounts of less than 10%.

OnBuy’s discounting strategy built a perception that they were the biggest discounters, even when the discounts were not as deep.

Black Friday v/s Cyber Monday – which one was better for holiday shoppers?

Black Friday kicks off the holiday shopping season and is synonymous with some of the most significant sales after Thanksgiving. But until recently, Cyber Monday has become a great way for eCommerce retailers to capitalize on holiday discounts and expand their most beneficial sales events of the year.

In 2021, retailers pulled in $8.9 billion in Black Friday online sales and a total sales of $10.7 billion on Cyber Monday. In the YOY review, Black Friday saw a decline of 1.3% from 2020’s record of $9.03 billion, and Cyber Monday saw a drop of 1.4%, only $100 million shy of $10.8 billion in 2020.

Across Beauty, Home Improvement, Electronics & Furniture categories, we saw that more products were on discount on Cyber Monday v/s Black Friday. However, the opposite was true for the Fashion Category. In the Fashion Category, we saw a marginally higher number of products on Discount during Black Friday than Cyber Monday.

Across both sales, the Electronics category offered the highest discounts at over 40% of products discounted compared to other categories on both Black Friday & Cyber Monday. However, a very small fraction of the products had a discount of over 50%, indicating the lack of ‘BIG blockbuster deals’ in this category. At the same time, the Fashion category offered the least number of deals with less than 20% products on discount, but the highest magnitude of discount across the board! On Black Friday, 3.8% of products had discounts higher than 50%, and 2.6% of products on Cyber Monday. In most other categories, between 1 – 1.5% of products had over 50% discount. However, Fashion brands offered more than 50% discount on 2x the average number of products on both sale days.

Why did the Fashion Category offer such high discounts? Brands are now capitalizing on customers’ need for instant gratification in the age of see-now, buy-now fashion trends by offering their products at high discounts. It also allows them to quickly eliminate overstock. However, this has given rise to fast fashion, a trend that focuses on rapidly producing low-quality clothes in huge volume. Fast fashion focuses on replicating trendy pieces like streetwear and fashion week designs, not four times a year but every week, if not daily. Fast fashion promotes brands to manufacture and sell low-quality merchandise that goes out of trend as soon as buyers wear it once. There is little to no time for quality control, and pieces are thrown away after a few wears. In the UK alone, 300,000 tonnes of used clothes are buried or burned in landfills each year. However, every element of fast fashion from rapid production, competitive pricing, to trend replication has a detrimental impact on the planet.

Conclusion

The effects of COVID-19 can be seen far and wide in the UK retail industry, especially with a steep rise in inflation. Fortunately, even though retail sales in the UK declined during the 2021 holiday season due to the Omicron variant, they increased during Black Friday and Cyber Monday. Sales also jumped back in January 2022 and are further projected to grow by 5% in 2022. Additionally, brands can sustain the impact of disruptive factors throughout 2022 by ensuring their Digital Shelf is updated and flexible enough to react swiftly to both threats and opportunities in order to maximize the chances of success.

Reach out to the team at DataWeave if you’d like to make smarter pricing & discounting decisions with up-to-date competitive insights.