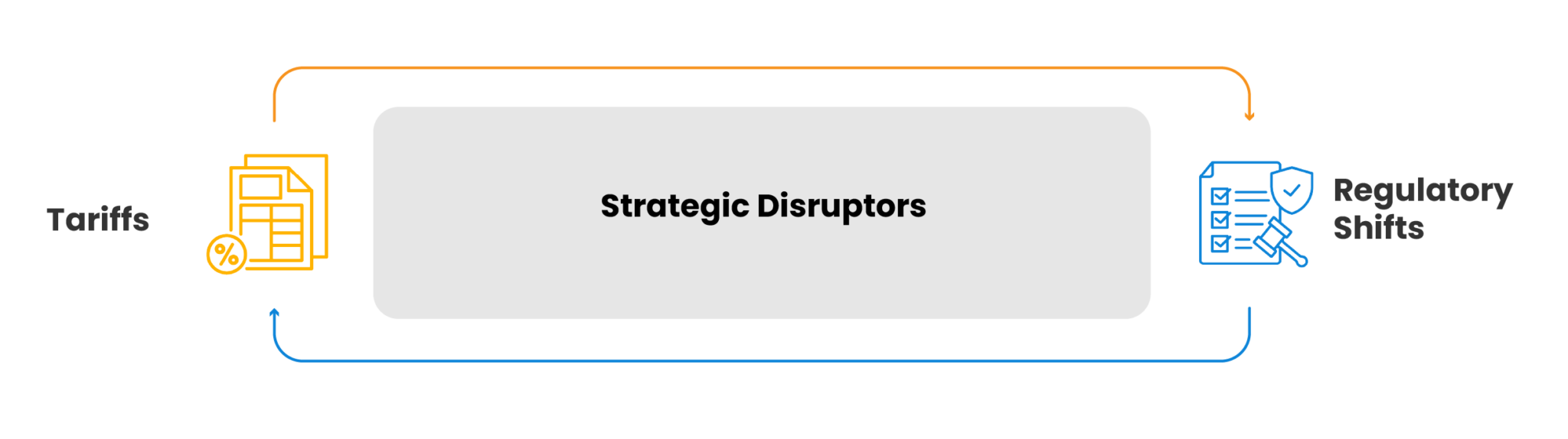

Disruption Is Now the Baseline

Tariffs can spike landed costs overnight, regulations rewrite labelling rules, and competitors slash prices before your team finishes its daily stand-up. And yet, some consumer brands thrive.

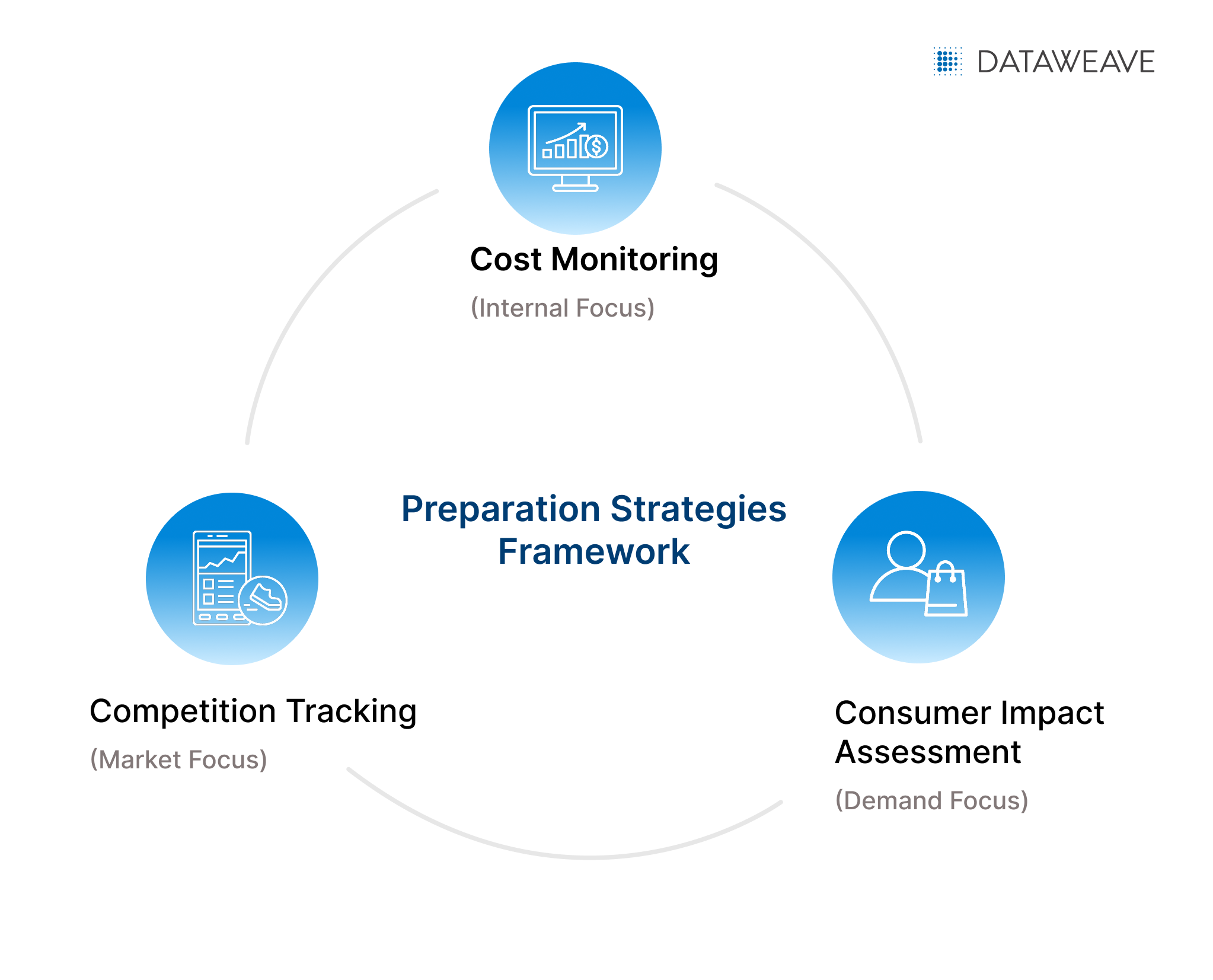

The winning brands see changes early, decide quickly, and execute flawlessly across the digital shelf. This post blends three decades of pricing and merchandising expertise with timely digital shelf insights from DataWeave, offering a clear path forward for brands navigating today’s volatile retail environment.

From Cost Shock to Chronic Uncertainty

Tariffs are no longer just one-off headlines; they’ve become an unpredictable, ongoing variable in the global marketplace. The true challenge isn’t always the duty rate itself, but the constant whiplash of not knowing if, when, or how much that duty will change. This pervasive uncertainty is having a tangible impact:

- Market Uncertainty: Tariff talk alone disrupts planning and fuels market instability.

- Operational cost inflation: Shifting trade rules raise expenses across sourcing, freight, and distribution.

- Compromised SKU-level Margin: The profitability of individual products is under constant threat.

- Shrinkflation: Brands shrink product quantities to mask rising costs, risking consumer trust.

Unpredictable Competitive Response: Delaying price moves while watching competitors can erode margins as much as tariffs.

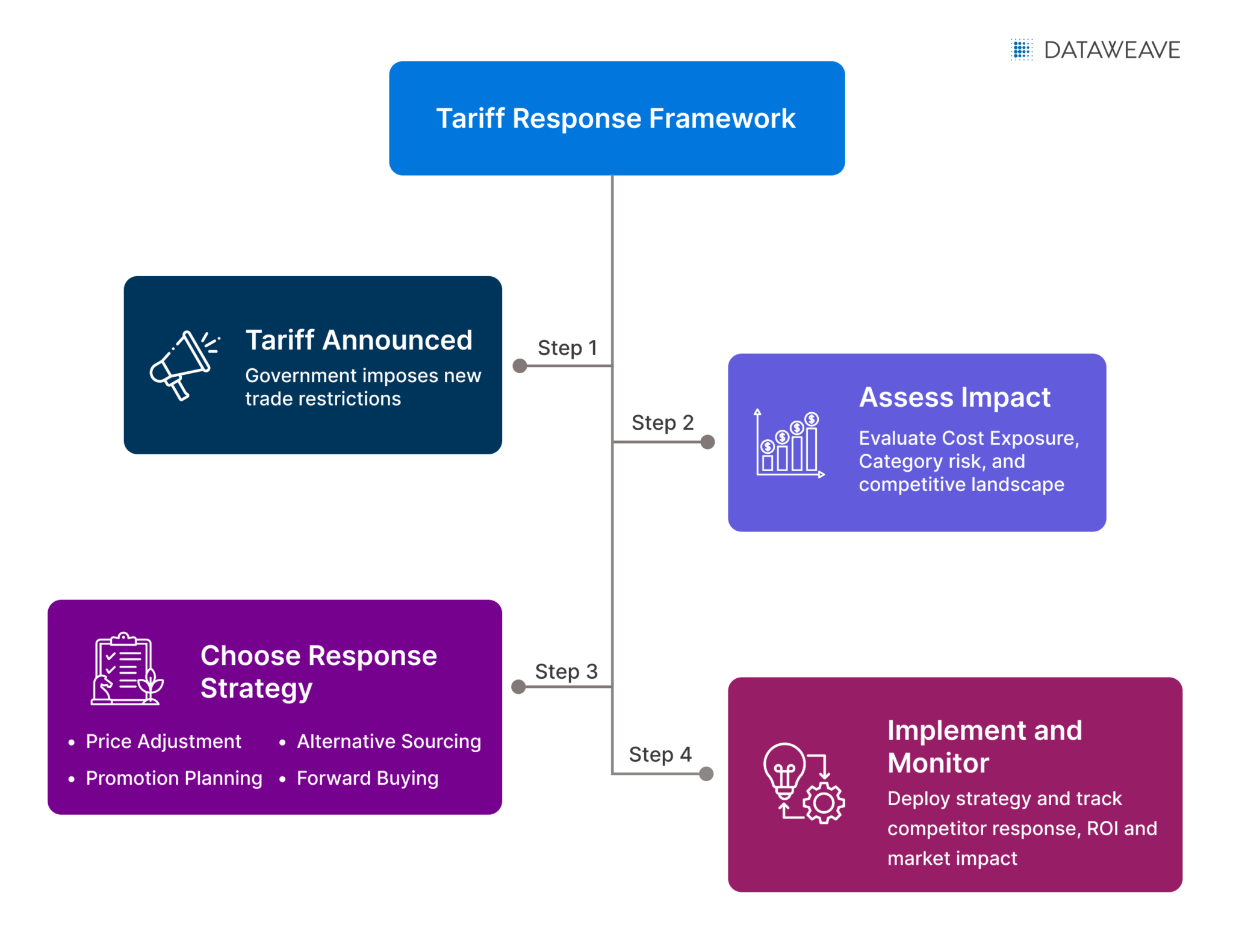

To stay ahead, pricing decisions must be stress-tested against multiple tariff scenarios and aligned with likely competitor reactions. Timing matters as much as accuracy, move too soon or too late, and margins suffer either way.

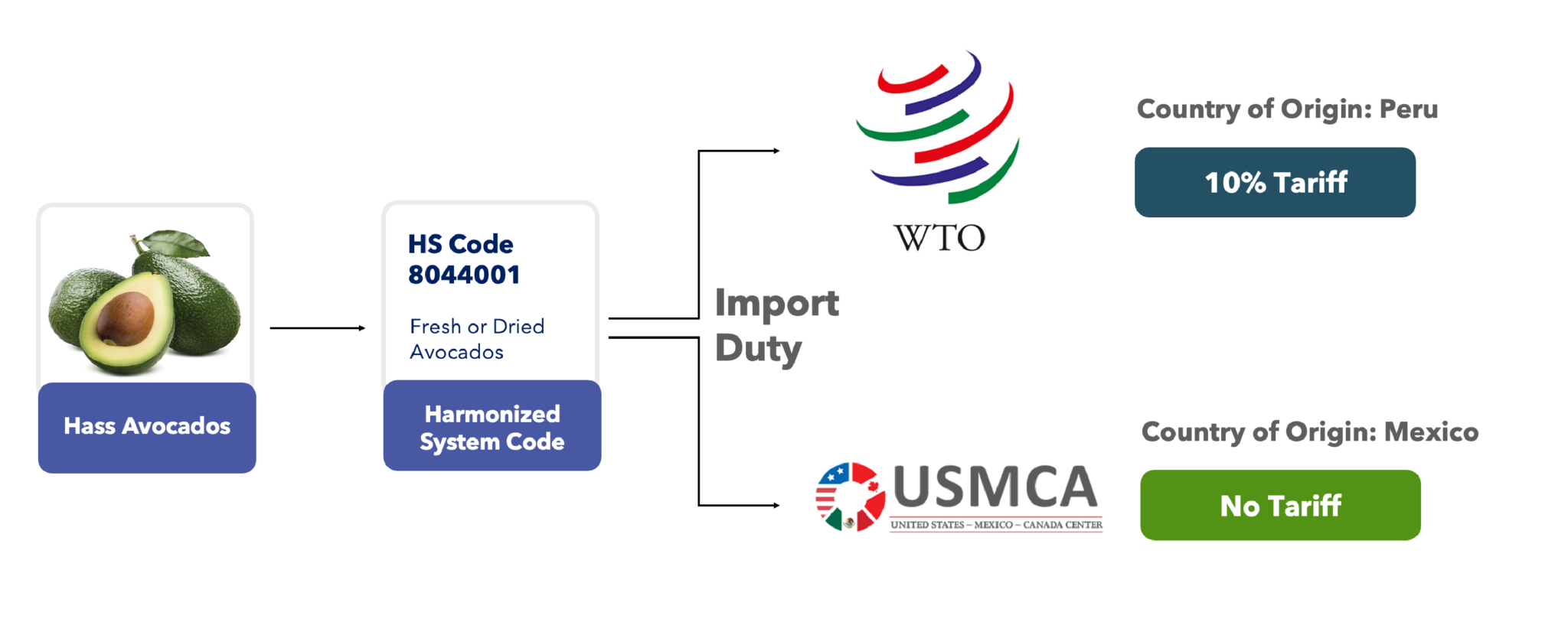

The Tariff Math No One Can Afford to Get Wrong

When it comes to tariff disruption, the difference between profit and loss often hinges on a precise understanding of a three-step process. Get any part of this chain wrong, and the financial ripple effect can undermine pricing and promotions. The duty you pay, therefore, is the direct result of the following three critical steps:

Step 1: Harmonized System (HS) Code

- What it is: A six- to ten-digit classifier that drills down to product sub-types.

- Why it matters: A single digit change can shift an item into a higher-tariff bracket.

Step 2: Country of Origin

- What it is: The nation in which the imported item was made.

- Why it matters: Mis-tagging the origin can lead to mis-pricing and inaccurate margin calculations.

Step 3: Trade-Agreement Overlay

- What it is: Differentiation between the World Trade Organization (WTO) baseline tariffs and special trade agreements (e.g., USMCAUnited States-Mexico-Canada Agreement).

- Why it matters: The same HS code can result in significantly different duties, up to a 10% swing, depending on the originating country (see the example below).

This isn’t just about paying the correct duty; it’s about safeguarding your bottom line in a global marketplace where every digit and every designation carries substantial weight.

The wrong origin, the wrong rule, the wrong margin.

Hard Numbers: Where Prices Are Already Climbing

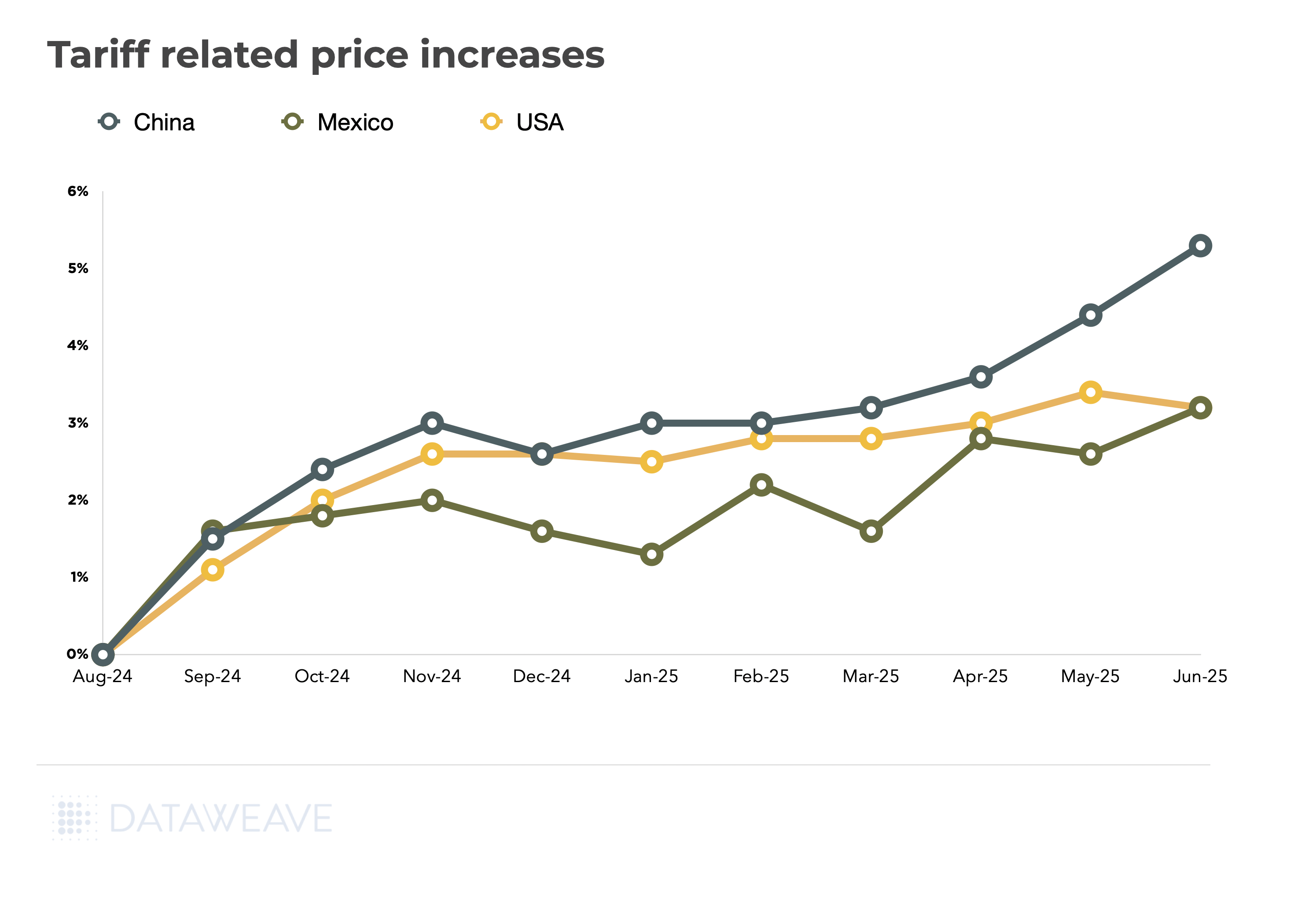

DataWeave’s latest digital shelf analysis shows import-driven price inflation diverging sharply by source country.

The intricate dance of HS codes, country of origin, and trade agreements directly translates into the prices consumers see. And the data doesn’t lie. Below, we delve into the hard numbers: where prices are already climbing, as illuminated by DataWeave’s latest digital shelf monitoring, showing significant import-driven price inflation by source country.

- China: Products sourced from China are up 5%. This is largely attributable to the numerous tariffs currently imposed on Chinese goods.

- Mexico: Prices for products from Mexico have risen by 3%.

- United States: Interestingly, even U.S.-sourced products show a 3% increase.

This rise in U.S. product prices might seem counterintuitive if tariffs are solely focused on imports. However, the reality lies in the global supply chain for many products.

Consider guacamole as an example: While the final product might be “Made in the USA,” its components often come from various international sources. Avocados might be imported from Mexico, lime juice from Central America, and seasonings from India or China. Even packaging could originate in Asia. Each of these imported components can be subject to tariffs. Therefore, even if an item is assembled in the U.S., the tariffs on its constituent parts contribute to an overall price increase, explaining the rising rates for U.S.-sourced goods.

Action step: Map tariff exposure at both finished-goods and component-level to avoid “Made in USA” blind spots.

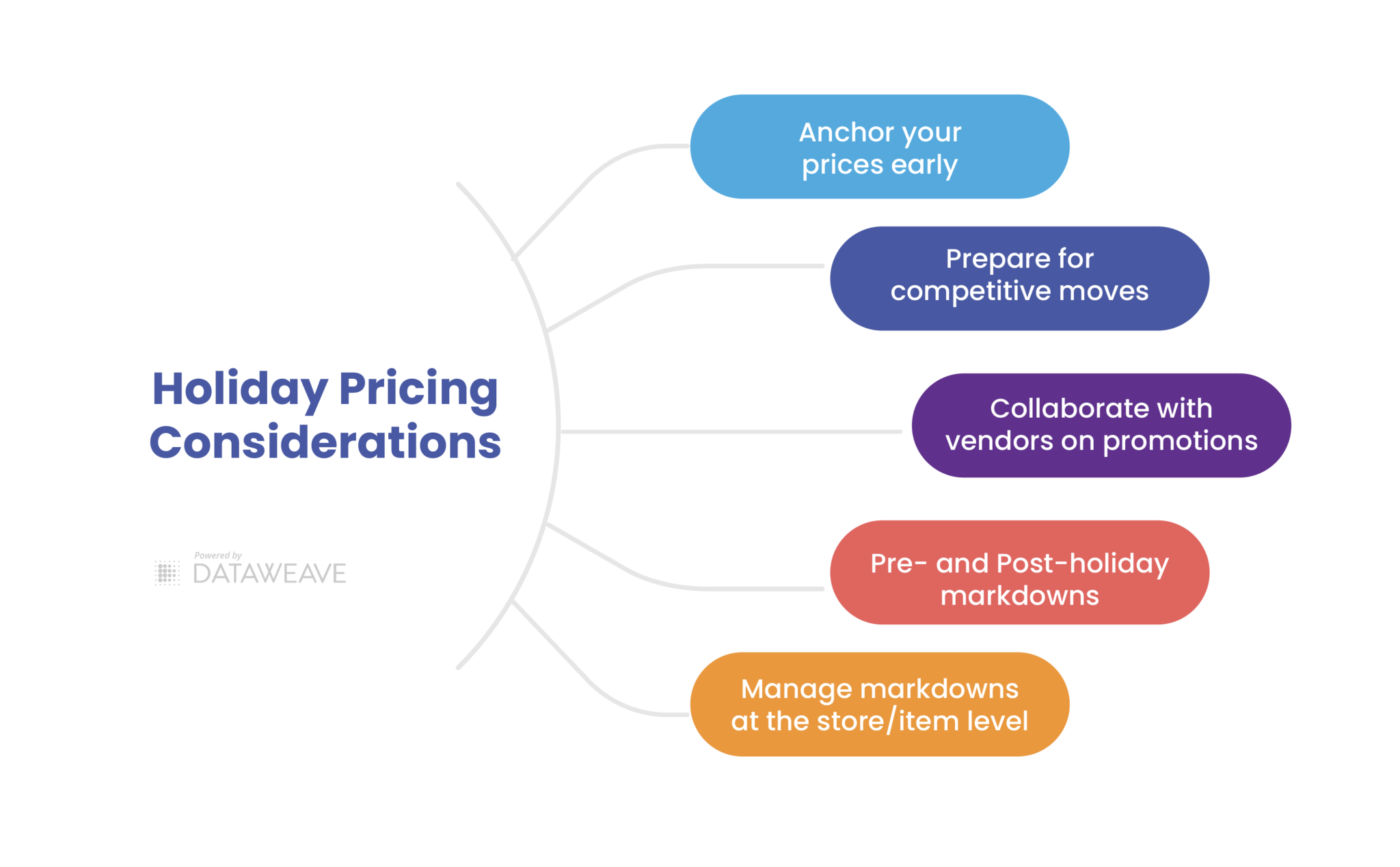

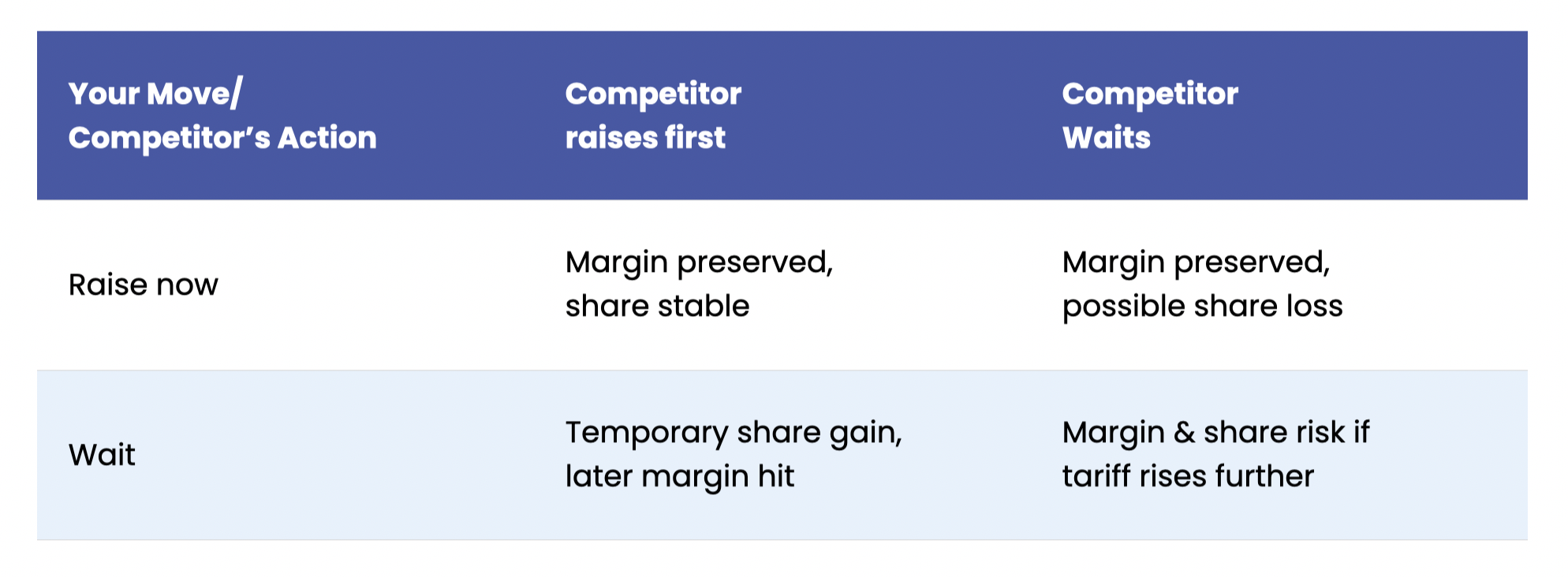

Timing Is a Competitive Weapon

With duty tables and competitor reactions changing fast, the question is: move first or follow? Early movers recoup cost fastest but risk overshooting if tariffs ease; laggards may enjoy a brief price advantage but suffer sudden margin compression.

The Strategic Dilemma

The table below illustrates this strategic choice and its potential outcomes:

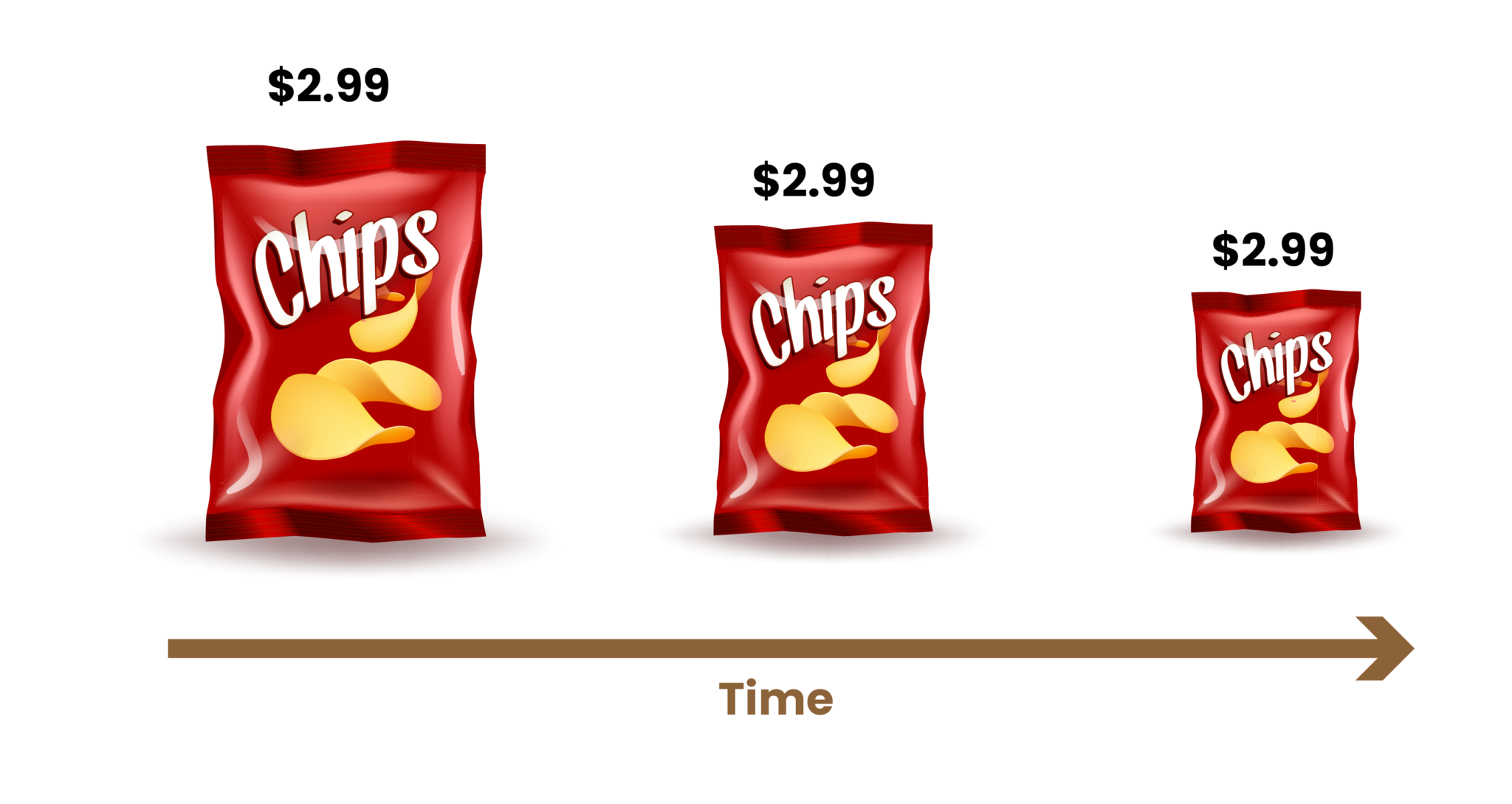

Shrinkflation: Margin Patch or Trust Erosion?

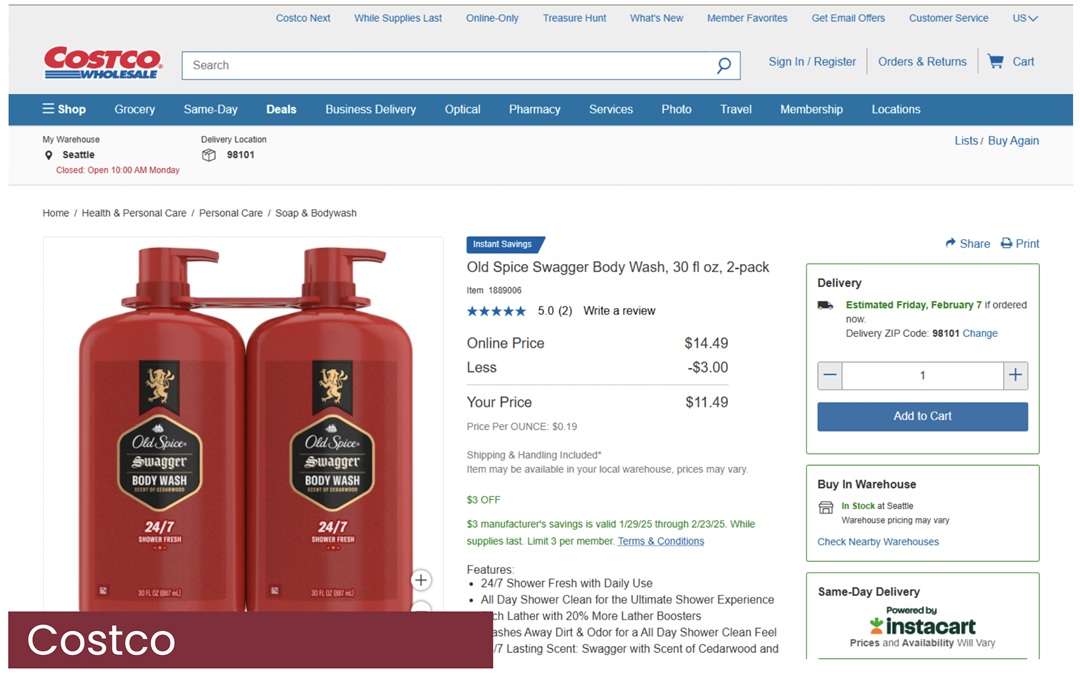

Beyond direct price adjustments, many brands are turning to shrinkflation to manage tariff-driven cost pressure, shaving net weight instead of hiking prices. DataWeave’s analysis reveals an average package reduction of 5 – 6%, with extreme cases reaching 15 – 25%, sometimes even coupled with a shelf-price increase.

While this can cushion immediate margin, it comes at a significant cost: brand credibility. Savvy shoppers quickly spot these changes, sharing “before-and-after” photos online and fueling consumer frustration. What begins as a margin patch can rapidly erode trust and damage long-term loyalty.

Ultimately, navigating this volatile environment requires dynamic intelligence and a holistic pricing strategy that balances profitability with market share and, crucially, consumer trust.

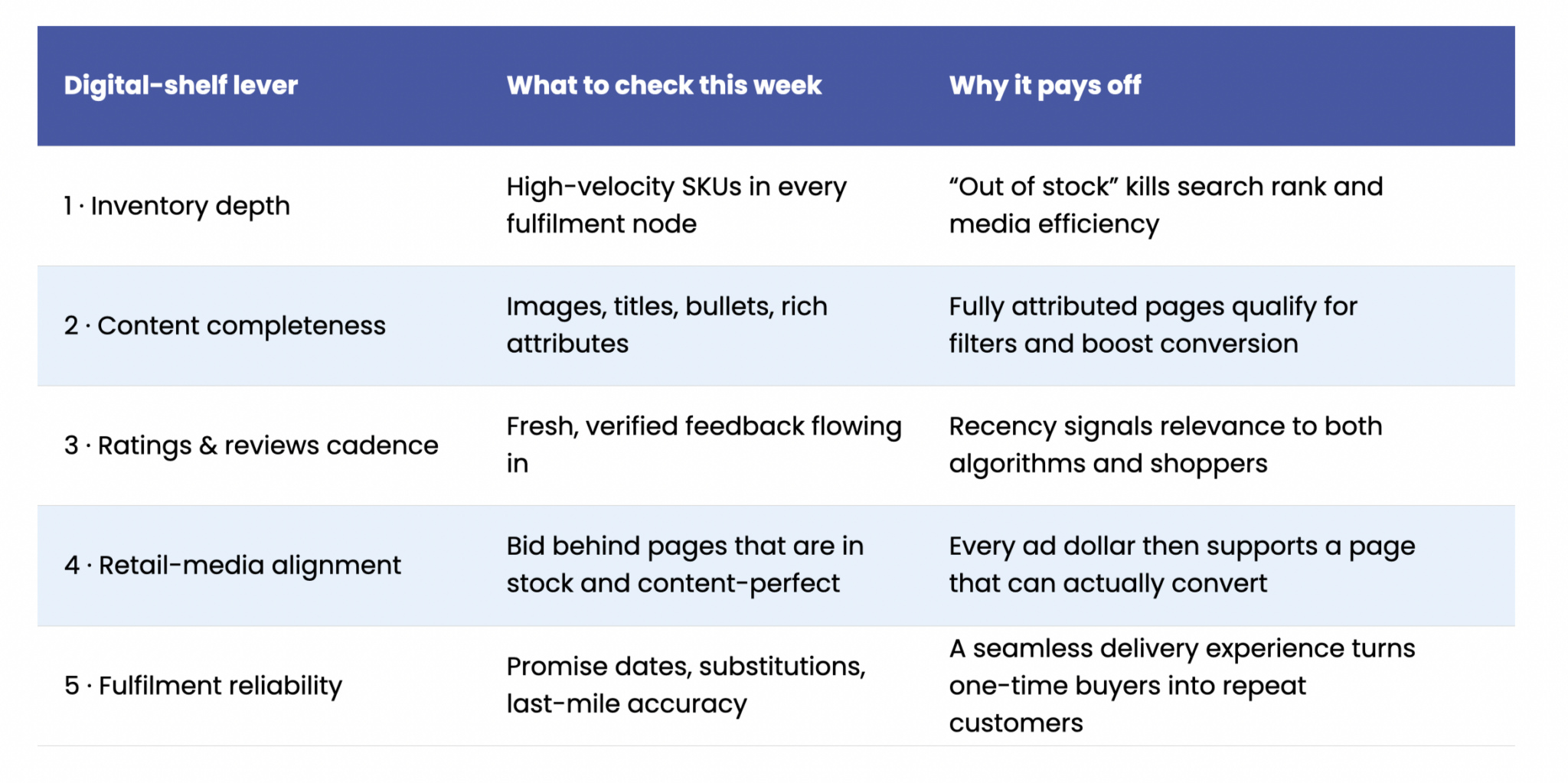

Price Hikes May be Inevitable, But You Can Still Run Your Digital Shelf

Tariff‑driven cost pressure can force list‑price increases, but it does not dictate how well your products show up, sell through, or satisfy shoppers online. Those outcomes still hinge on five levers that live entirely inside your control. Master them and you cushion margin hits while protecting (or even expanding) share.

The Five Levers of Digital‑Shelf Control

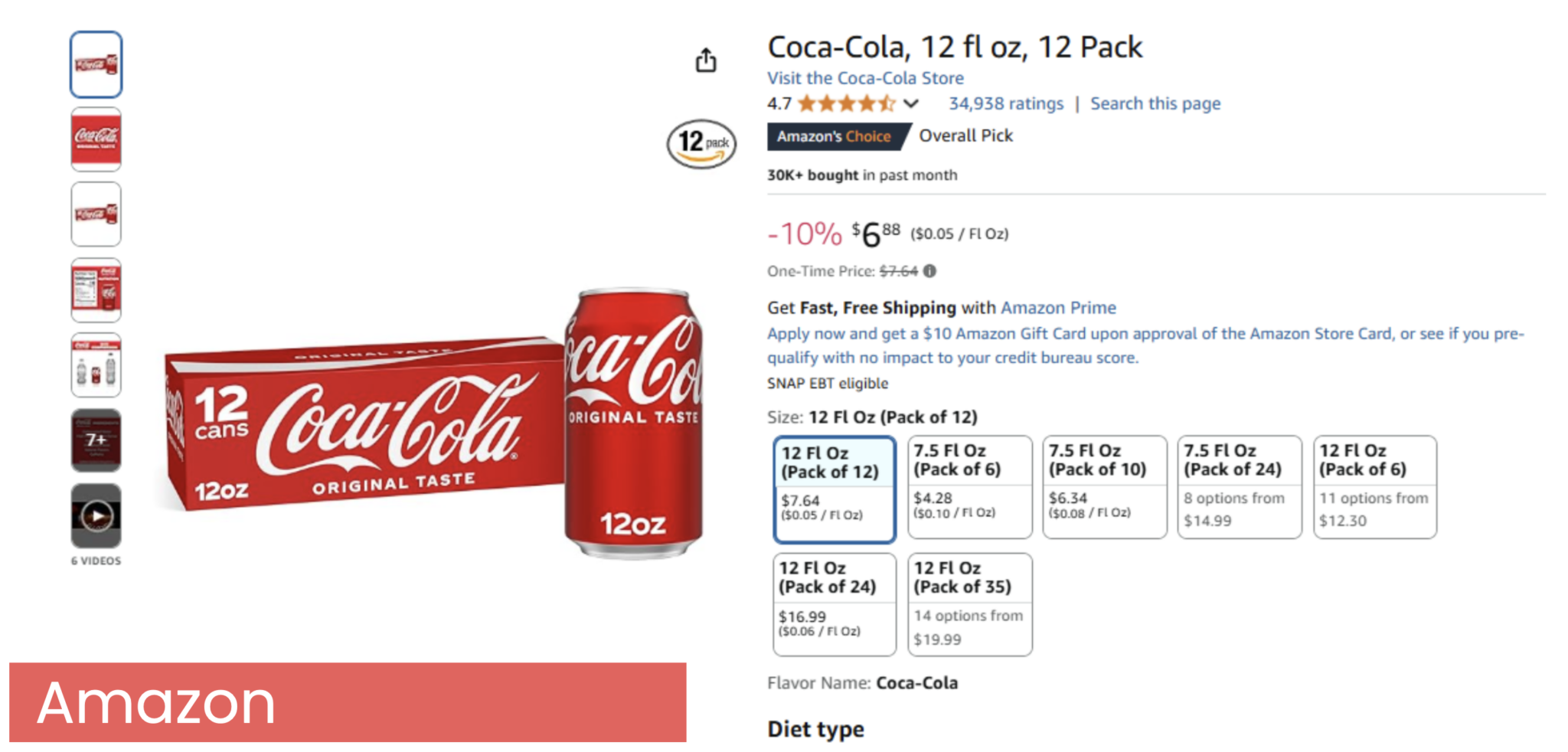

- Inventory Depth – Maintain online in‑stock rates above 95 percent for high‑velocity SKUs and flag substitute logic when unavoidable out‑of‑stocks occur.

- Content Quality & Accuracy – Keep titles keyword‑rich, imagery crisp, and attributes complete so search filters never bury you.

- Ratings & Reviews Cadence – Proactively request fresh reviews to earn retailer search boosts and reassure value‑conscious shoppers.

- Retail‑Media Precision – Bid where pages are healthy and in‑stock; pause spend on broken listings that leak conversion and ROAS.

- Fulfillment Excellence – Monitor pick‑pack accuracy, on‑time delivery, and substitution rates; each one influences retailer algorithmic visibility.

Content Hygiene Keeps You Visible, Compliant, and Conversion-Ready

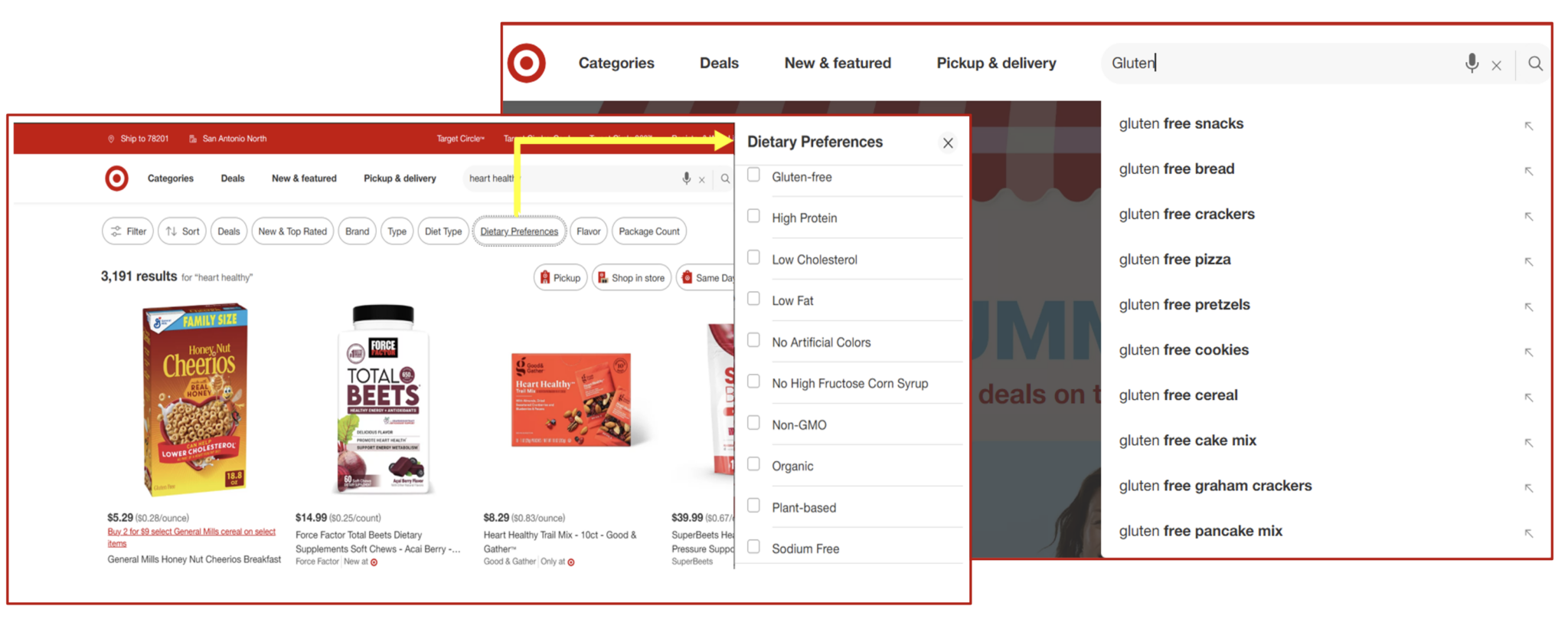

Missing or incorrect product attributes (e.g., “gluten-free,” “caffeine content”) can swiftly jeopardize both regulatory compliance and your product’s fundamental search visibility. Simply put, if it’s not labeled right, it won’t be found.

This impact plays out in two crucial areas:

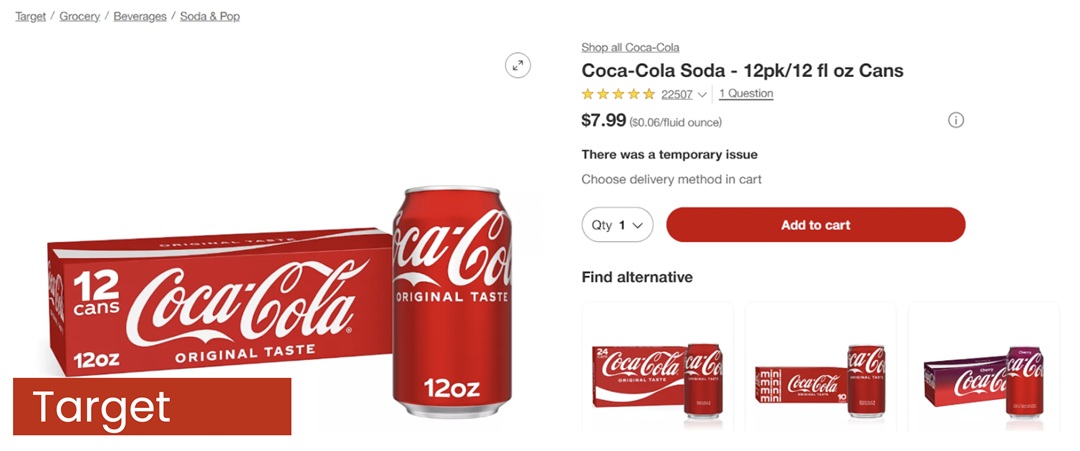

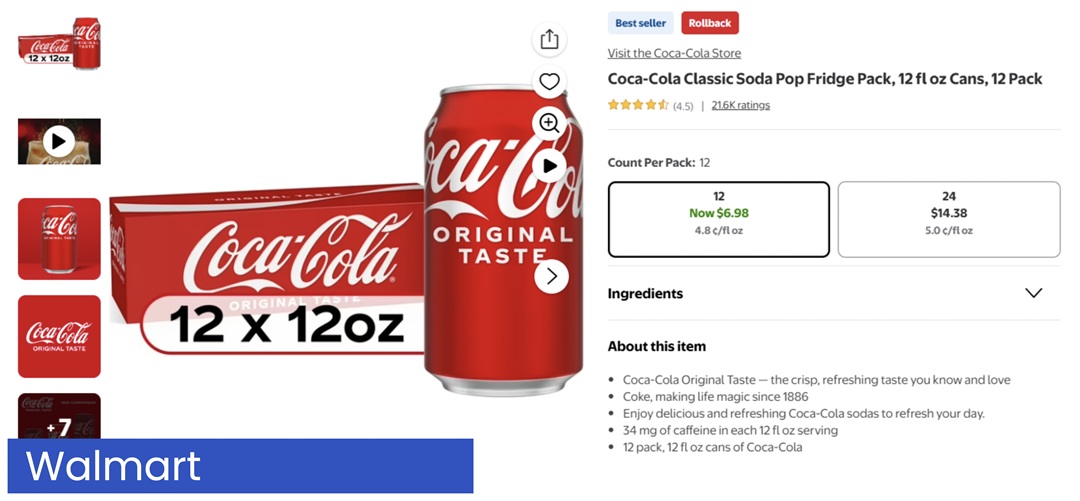

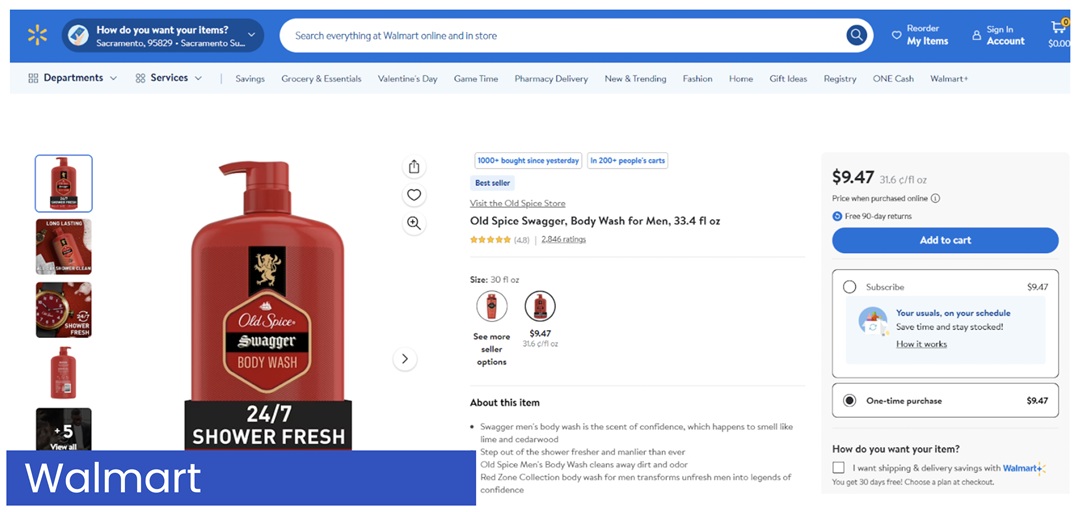

- Retailer Search Visibility: Filter logic on major e-commerce platforms like Target.com, Walmart.com, and Instacart is increasingly driven by precise attribute tags (e.g., “gluten-free,” “BPA-free,” “0g added sugar”). Fail to provide or correctly format these claims, and your product will simply never appear when shoppers apply these critical search filters. You become invisible to a motivated audience.

- Regulatory Compliance: Global regulatory bodies, including the U.S. FDA and EU authorities, now treat online product detail pages as officially regulated labeling space. This means that a single missing allergen statement or an inaccurate nutritional claim can trigger severe consequences, from product takedowns and hefty fines to a devastating “straight-to-zero” share of search. Non-compliance isn’t just a legal risk; it’s a direct threat to your market presence (see example below).

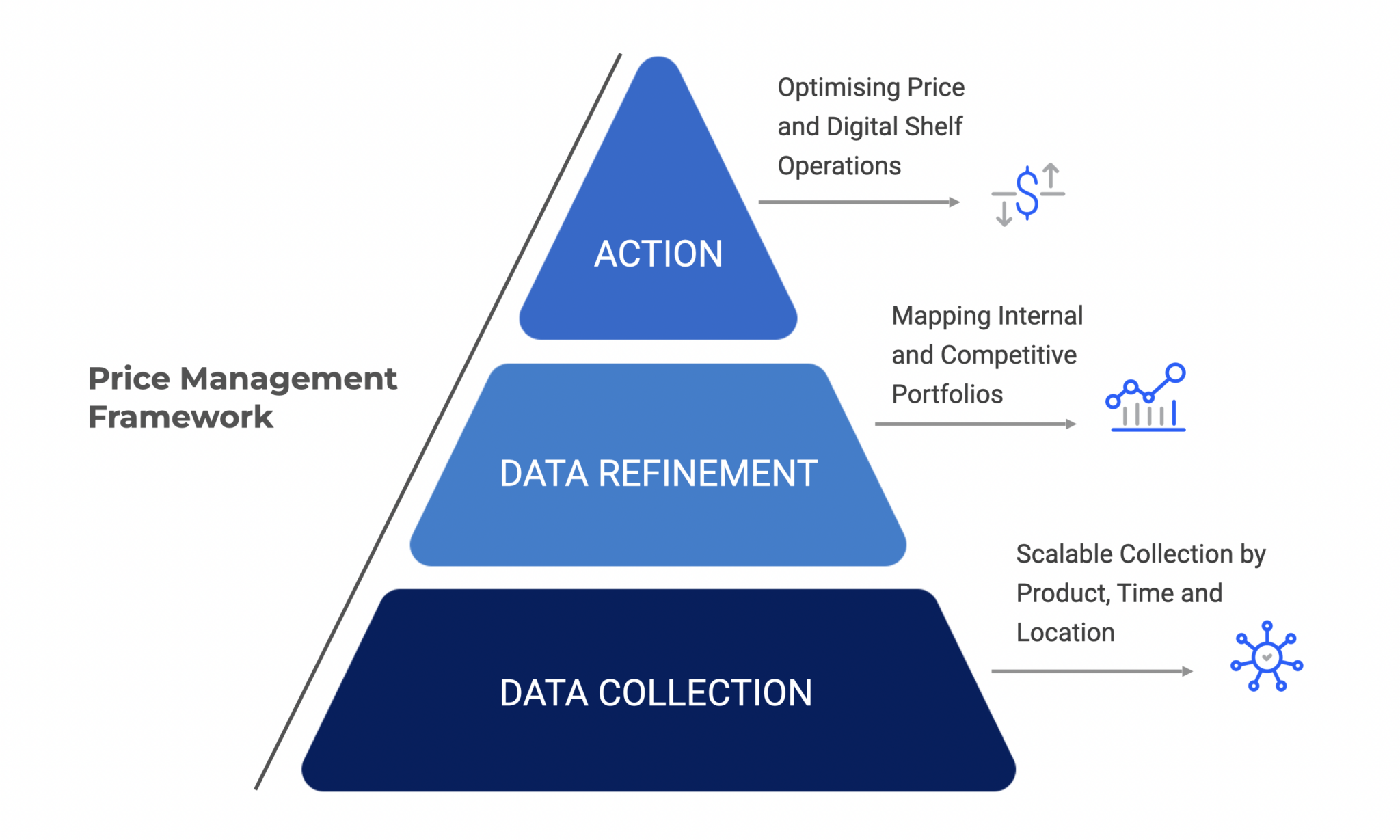

The Hygiene Playbook: Audit → Score → Fix → Grow

Your Product Detail Pages (PDPs) are your digital storefronts, and they need to be impeccable. Modern content-intelligence tools are like vigilant auditors, constantly scanning, structuring, and scoring every PDP across your retail network.

Tools like DataWeave do the heavy lifting by:

- Surfacing critical gaps: They’ll pinpoint issues like blurry images, inaccurate titles, or missing nutrition information.

- Optimizing for search: They ensure your product attributes align with live search filters, turning claims into clicks.

- Flagging compliance risks: You’ll know about potential issues before regulators or retail partners ever do.

- Quantifying your impact: Get a clear Content Quality Score that your teams can own and improve, week after week.

When you execute this well, it’s not just about tidying up; it’s a powerful growth engine. This proactive approach fuels every step of the digital customer journey – from getting found, to winning the click, converting the cart, and ultimately, capturing reviews that boost your search rankings.

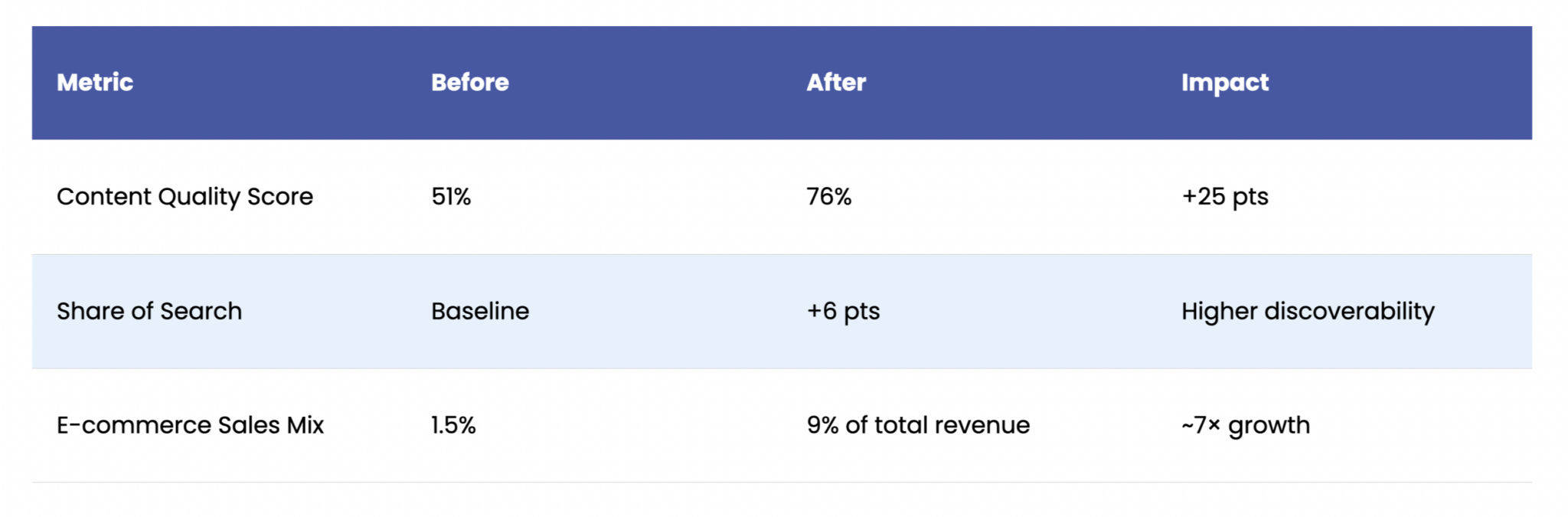

A Case Study: Bush’s Beans Converts Visibility into Revenue

Before Bush’s Beans achieved rapid success with their “audit → scorecard → rapid-fix” approach, they confronted a significant hurdle. Here’s how they overcame it to drive impressive revenue growth.

The Challenge

Bush’s Beans saw its e-commerce contribution stall at just 1.5 percent while competition in canned goods intensified. A quick audit revealed three root causes:

- Dipping online sales that signalled slipping visibility and conversion.

- Fragmented product content across major retailer sites as images, titles, and claims were inconsistent or missing altogether.

- Heavier category competition making it harder to hold first-page search positions.

The Fix

The brand adopted DataWeave’s Digital Shelf Analytics to create a single source of truth for every PDP. A lean internal team then:

- Ran content audits across priority retailers to surface incomplete or non-compliant attributes.

- Prioritized quick wins focusing on high-velocity SKUs where simple edits (e.g., adding pack-size keywords or allergy statements) would unlock search filters.

- Tracked progress weekly using an automated scorecard to keep everyone focused on the next set of fixes.

The Win

Twelve months later the numbers told the story:

Bush’s Beans transformed their product data into a strategic asset, significantly improving online visibility, safeguarding brand reputation, and driving sustained revenue growth. Accurate and complete product pages ensured compliance and boosted search rankings, directly increasing sales. While you can’t control external factors like tariffs, you can control the quality and compliance of your product pages and that control directly translates margin pressure into market share gains.

Unified Insight: Turning Signals into Sustained Advantage

Imagine one living dashboard where every digital shelf signal like timely price moves, share-of-search shifts, retail media spend, on-shelf availability gaps, compliance flags, MAP breaches, plus content and review health flows together. With that single lens, the “whose numbers are right?” debate disappears and cross-functional teams can act in minutes rather than days.

A consolidated feed lets you:

- Build market awareness: Spot competitor price changes as they happen, understand who owns first-page search, and measure the true lift of retail media campaigns.

- Mitigate emerging risks: Surface impending out-of-stocks before rank erodes, catch claim or label errors ahead of audits, and receive instant alerts when a seller breaks MAP.

- Activate growth levers: Prioritize content edits that open search filters and use ratings and reviews trends to fine-tune messaging and assortment.

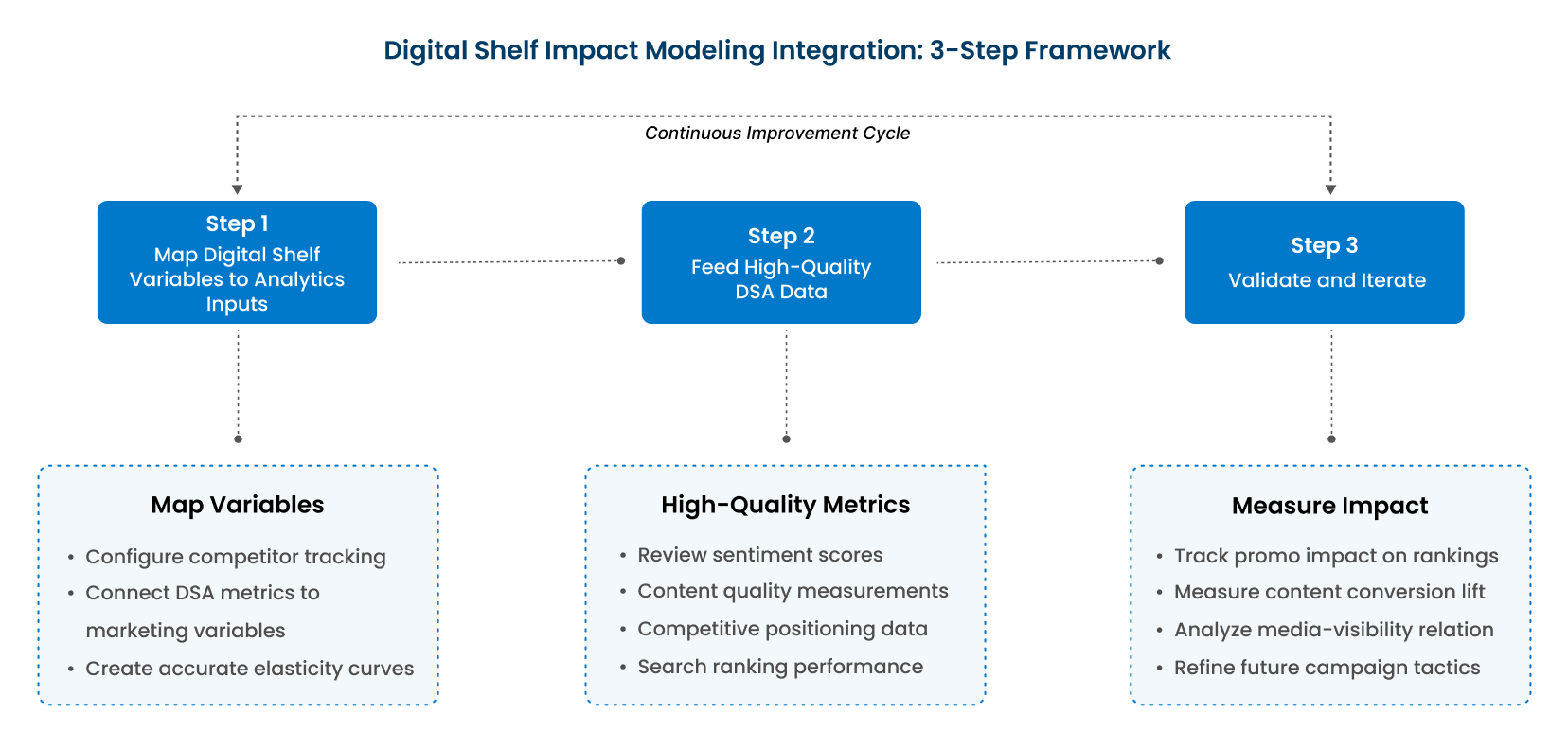

Brands that weave these signals into one workflow move faster than the disruption. That’s the connective tissue highlighted in our recent post on pairing Digital Shelf Analytics with Digital Shelf Impact Modelling: when granular shelf data sits beside strategic performance metrics, smarter decisions follow.

A platform like DataWeave brings the pieces together quietly ingesting millions of price checks, availability reads, and PDP audits each day, then presenting only the next best actions. The payoff is simple: sharper market awareness, lower operational risk, and growth that compounds with every iteration.

Keep Moving, Keep Winning

Tariffs, evolving regulations, and agile competitors are no longer storms; they are the climate. Brands that pair a clear, shared insight stream with rapid execution turn volatility into durable advantage. Keep your data united, keep iterating on the five digital-shelf levers, and every new headwind becomes another step ahead.