An average of $11.7 million per second was the rate at which Alibaba clocked $1 billion in sales during the first 85 seconds of Singles’ Day. As Alibaba’s annual sale event continues to grow in scale, referring to it as a global retail phenomenon is an understatement. Alibaba closed the day having shipped 1.04 billion express packages based on sales of merchandize worth 213.5 billion yuan ($30.67 billion).

This performance shredded any lingering concerns analysts may have harbored about the prospects of this year’s sale, given the international backdrop of the ongoing trade skirmish between the US and China.

Along with attractive discounts across a range of product categories, Singles’ Day also promised an integrated experience fusing entertainment, digital and shopping, in stark contrast to other large global sale events like Black Friday, which focus predominantly on discounts.

At DataWeave, we set out to investigate if all the hype resulted in actual price benefits to the shoppers and how the various categories and brands performed in terms of sales during the event. To do this, we leveraged our proprietary data aggregation and analysis platform to capture a range of diverse data points on Tmall Global, covering unit sales (reported by the website) and pricing associated with Tmall Global’s major categories over the Singles’ Day period.

Our Methodology

We captured 5 separate snapshots of data from Tmall.com during the period between October 25 and November 14, encompassing over 15,000 unique products each time, across 15 product categories.

To calculate the average discount rate, we considered the percentage difference between the maximum retail price and the available price of each product. We also looked at the additional discount rate, for which we compared the available price during Singles’ Day to the available price from before the sale. This metric reflects the truest value to the shopper during Singles’ Day in terms of price.

Our AI-powered technology platform is also capable of capturing prices embedded in an image. For example, the offer price of ¥4198 was extracted accurately from the accompanying image by our algorithms and attributed as the available price while ¥100 from the same image was ignored.

This technology was employed across hundreds of products using DataWeave’s proprietary Computer Vision technology.

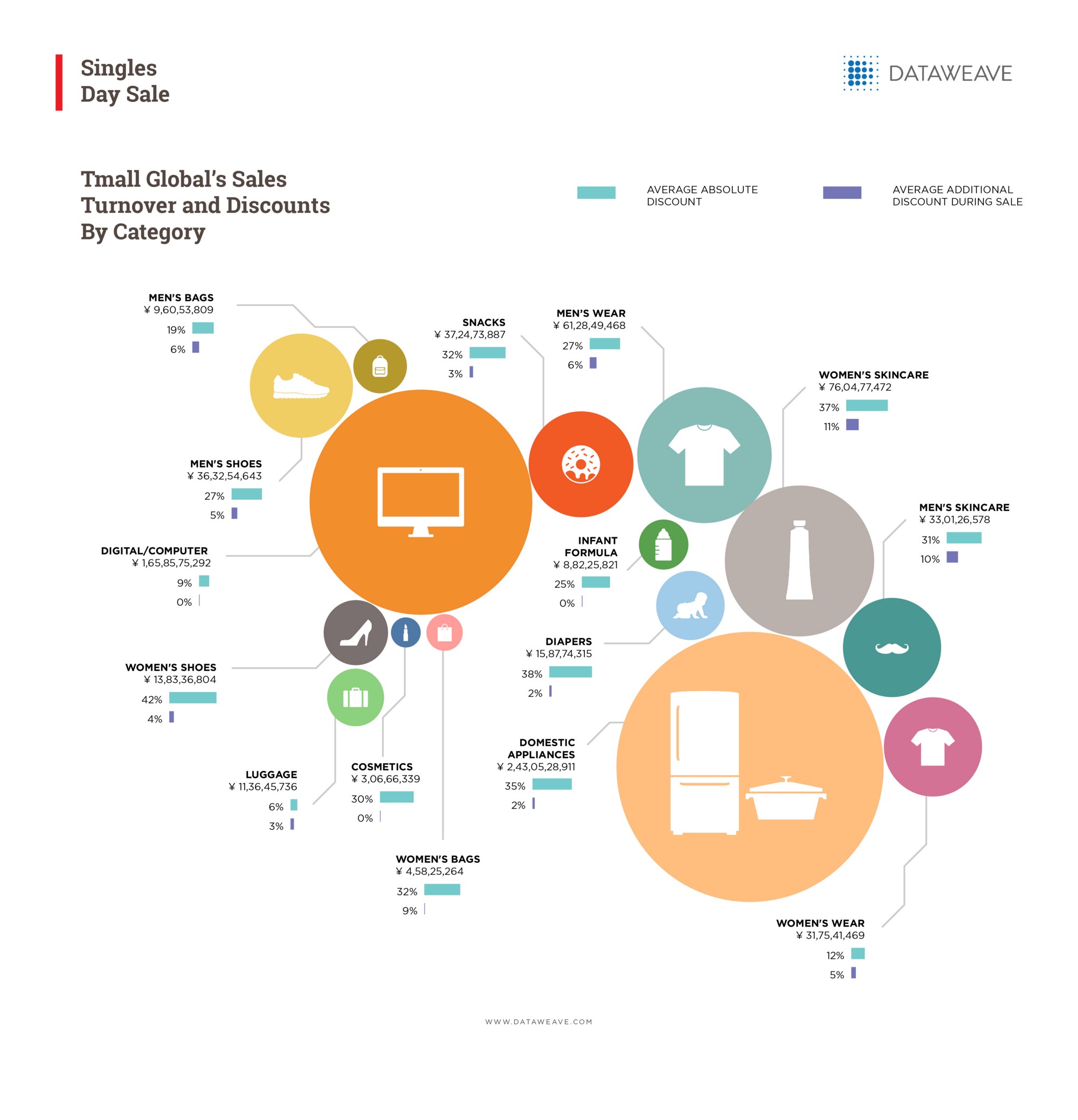

Domestic Appliances and Digital/Computer Categories Powered Turnover

The Domestic Appliances and Digital/Computer categories dominated the Singles Day Sale in terms of absolute sales turnover. This isn’t surprising, since the average order value for these categories are typically much higher compared to the other categories analyzed.

What clearly stands out in the above infographic is that the two largest categories in terms of sales turnover had average additional discounts of only 2 per cent and 0 per cent — a rather surprising insight. In general, with the exceptions of Women’s skincare, Men’s skincare, and Women’s bags (11 per cent, 10 per cent, and 9 per cent respectively), all other categories saw low additional discounts during Singles’ Day.

However, the absolute discounts across the board were consistently high, with only Luggage (6 per cent), Digital/Computer (9 per cent) and Women’s wear (12 per cent) staying significantly below the 20 per cent mark. In fact, eight categories enjoyed absolute discounts greater than 30 per cent.

Among common categories between Men and Women, the Men clocked more sales in Men’s wear, shoes, and bags. Only skincare proved to be an exception, where Women’s skincare generated twice the turnover of their Men’s equivalent.

The Infants category was another intriguing sector to emerge during the sale. Both Diapers (38 per cent) and Infant’s Formula (25 per cent) were substantially discounted, despite only receiving low additional discounts of 2 per cent and 0 per cent respectively – indicating aggressive pricing strategies in this category even during non-sale time periods.

The biggest takeaway from our analysis is the lack of any correlation between sales turnover and additional discounts, or even the absolute discounts.

International Brands Make Gains

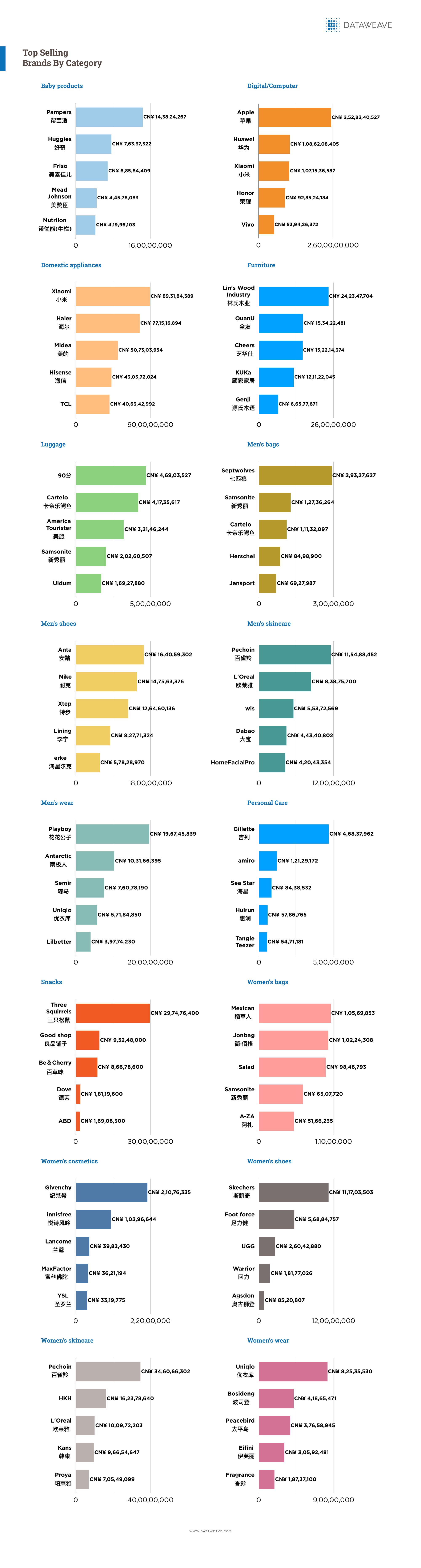

International brands continue to penetrate the Chinese market showing up amongst the Top 5 brands of 13 of the 16 categories on sale.

In the Diaper category, Pampers delivered nearly twice the sales turnover of its next biggest competitor. As expected, Apple and Huawei battled it out for honors in the Digital/Computer category although Xiaomi enjoyed pleasing results, nearly matching Huawei’s sales to go with its sales leadership of the Domestic Appliances category. Local brands, though, swept the Domestic Appliances, Furniture and Women’s Wear categories.

The challenge posed by Chinese brands was illustrated by Nike’s spot in the second place in the highly competitive Men’s Shoes category after Anta.

International brands topped only five of the 16 categories and Top 3 positions in ten categories. Still, there’s a growing presence of international brands in China’s eCommerce.

Gillette won handsomely over its competition in the Personal Care category while Skechers enjoyed a similar result in Women’s Shoes, racking up nearly twice the retail sales of its nearest competitor. Another category dominated by international brands was the Women’s Cosmetics category where international brands accounted for 4 of the Top 5 brands.

Similarly, Samsonite’s acquisition of American Tourister gave it two top 5 brands in the Luggage category. Other global brands to make the cut during the Singles’ Day sale included L’Oréal, Canada’s Hershel, Playboy, South Korea’s Innisfree and Japan’s Uniqlo.

It’s Not All About Price On Singles’ Day

The dramatic rise in shopping during Singles’ Day is not driven solely by price reductions. Alibaba’s commitment to its “New Retail” strategic model has led the Chinese giant to channel its impressive resources to focus on bringing together the online elements of its business with the more traditional offline aspects of its retail distribution. This is combined with entertainment to create a larger story based around the shopper’s overall “experience” rather than just driving “attractive prices” as a short-term retail hook.

Alibaba is betting big on erasing the line between online and offline and its futuristic vision of structuring retail around the way people actually want to shop. Based on the consistently impressive results of Singles’ Day year after year, “New Retail” has a promising future.

If you wish to know more about how DataWeave aggregates data from online sources to provide actionable insights to retailers and consumer brands, check out our website!