Flipkart recently acquired eBay’s India business in an announcement that made a huge splash across the country. With Flipkart already having acquired Myntra and Jabong, and talks of a Snapdeal acquisition picking up steam, this level of consolidation comes clearly as a direct response to internet behemoth Amazon’s aggressive expansion strategies in India.

With this acquisition play, Flipkart stands to gain primarily on two fronts.

eBay’s Seller Network

Firstly, eBay has built a strong network of authorized and highly-rated global sellers, something that Flipkart can leverage to drive increased sales and market share.

Per Flipkart’s announcement to the press — “Flipkart and eBay have signed an exclusive cross-border trade agreement, as a result of which customers of Flipkart will gain access to the wide array of global inventory on eBay, while eBay’s customers will have access to unique Indian inventory provided by Flipkart sellers. Thus, sellers on Flipkart will now have an opportunity to expand their sales globally.”

At DataWeave, we ran our proprietary data aggregation and analysis algorithms over eBay’s websites and unearthed some interesting numbers about their seller network.

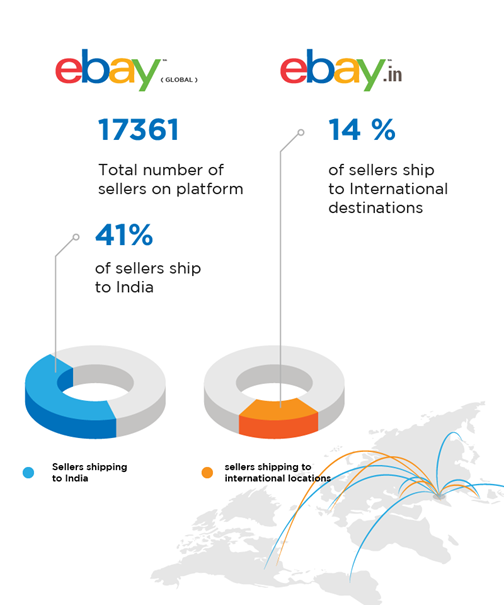

eBay.com has a global network of 17,361 sellers, 41% of whom ship to India. Therefore, this acquisition opens the door for Flipkart to gain access to over 7000 global eBay.com sellers who ship to India — a huge boost to the range of products Flipkart can host on its platform.

Additionally, a sizable chunk — 14% — of eBay.in sellers ship to international destinations. This provides Flipkart with opportunities to expand its reach globally.

The other, rather lesser known advantage that Flipkart stands to gain from this acquisition is in the refurbished and pre-owned goods space.

The Emergence of Refurbished and Pre-Owned Goods

The market for refurbished and pre-owned products is estimated to be between $15 billion and $20 billion globally, with exponential growth forecast for the near future.

Part of the reason for growth in this segment is it yields higher returns on investment for retailers. While a retailer typically earns 3–5% margin by selling a new smartphone, refurbished smartphones fetch 7–8% margin, and pre-owned smartphones 9–10%.

The Hidden Advantage

eBay has established itself over the years as a reliable source of refurbished and pre-owned products, with impressive levels of authentication and warranties. We did a quick analysis of eBay.in, Flipkart, and Amazon to identify their relative strengths in this space.

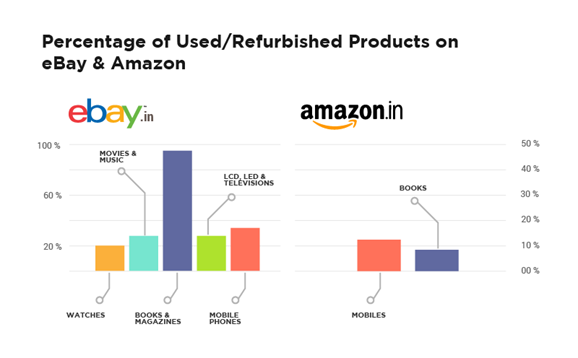

Unsurprisingly, Flipkart has close to zero refurbished or pre-owned products hosted on their website. With Amazon, 12% of mobile phones and 9% of Books on their website are refurbished or pre-owned, the largest selling categories in this space.

eBay.in, though, has a significant share of these products across categories — 95% of books & magazines, 36% of mobile phones, and 28% of televisions — a substantial portion of eBay’s business.

With this acquisition, Flipkart can now take a gigantic step into the relatively more profitable and exponentially growing refurbished and pre-owned products space. It will also be a strong competitive differentiator for the company as they go head to head with Amazon in India.

While the refurbished and pre-owned goods space poses a series of advantages for retailers, it sits well with consumer preferences as well, drawing more shoppers, and retaining existing ones.

Influence of Shopping Behavior on Product Assortment

Refurbished and pre-owned products provide consumers with attractive alternatives, both in terms of price and variety. Shoppers today explore and research new, pre-owned and refurbished products, all at the same time, and compare prices across e-commerce websites before deciding on a purchase.

As a result, comprehensive product assortments across price ranges and attributes drive higher engagements, traffic and improve customer conversion and retention rates, as they cater to a more diverse set of consumers.

For modern retailers, this reinforces the importance of investing in tools that enable to them to identify high-value gaps in their assortment and plug them. To achieve this, they need up-to-date, accurate data, at scale, on the assortments of their competitors.

DataWeave’s Assortment Intelligence solution is designed to give retailers near-real-time insights on competing retailers’ product mix and suggests product additions to retailer catalogs.

Click here to know more about how Assortment Intelligence can help your retail business manage assortment efficiently and profitably.