Americans spent a whopping total of $10.8 billion online this Black Friday. As Thanksgiving Week 2024 wraps up, one thing is clear: the consumer electronics category continues to dominate seasonal shopping trends. Fueled by a blend of enticing deals and high consumer demand, the sector delivered competitive discounts across subcategories like wearables, gaming, and mobile devices.

At DataWeave, we analyzed discounting trends in the U.S. consumer electronics market during this year’s sales events. Using our AI-powered pricing intelligence platform, we tracked pricing and promotions for 22383 SKUs across Amazon, Walmart, Target, and Best Buy from November 10 to 29. We focused on the top 500 products ranked for each search keyword on each retail site, using targeted terms aligned with categories like “gaming” and “apple.” Here’s what we uncovered.

Also check out our insights on discounts and pricing for health & beauty, grocery, apparel, and home & furniture categories this Black Friday.

Retailers Battle It Out with Competitive Discounts

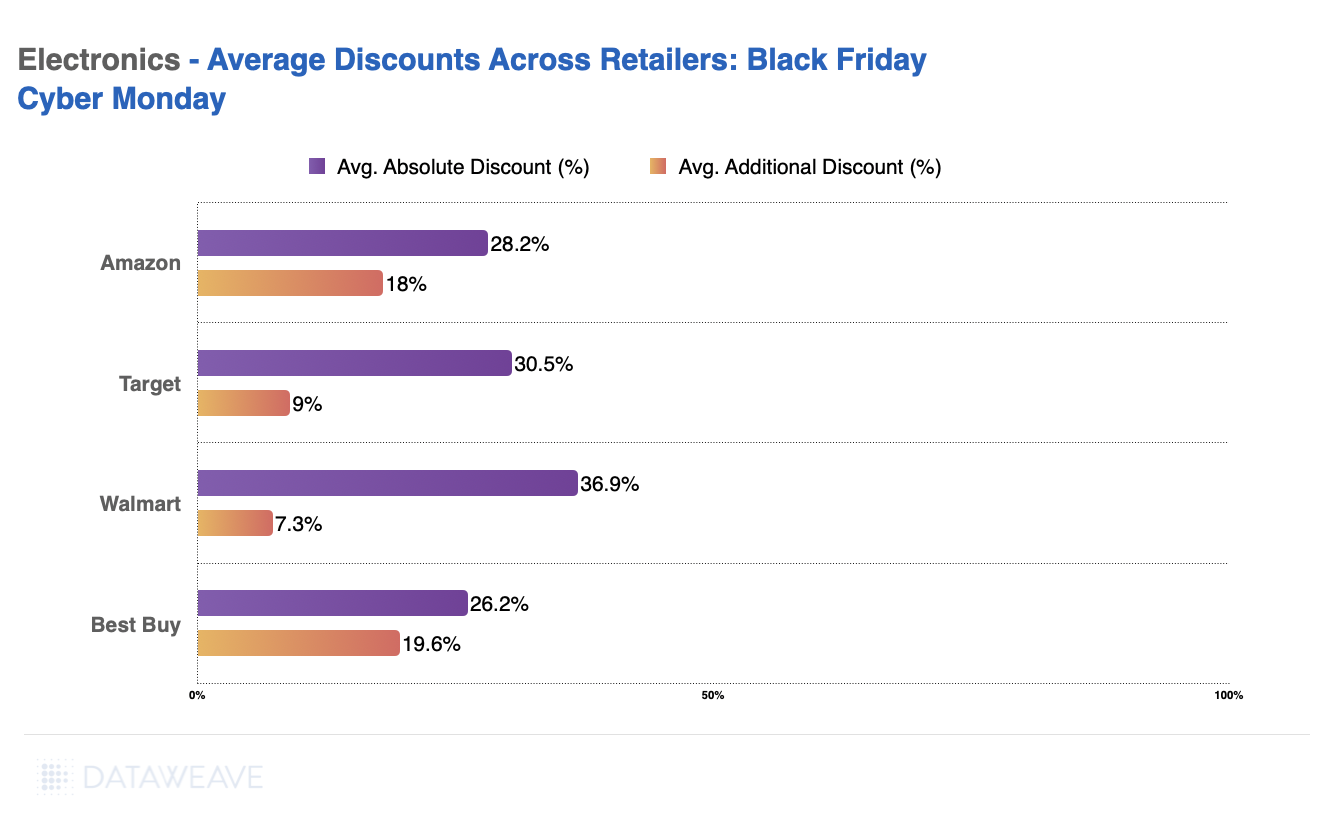

Discount trends reveal clear leaders in terms of markdowns:

- Walmart offered the deepest average absolute discounts at 36.9%.

- Amazon and Target followed closely, highlighting a diverse range of deals designed to appeal to budget-conscious shoppers

- Best Buy, the specialist consumer electronics retailer, offers the lowest discounts this Black Friday at 26.2%.

Note: The Absolute Discount represents the reduction of the selling price compared to the Manufacturer’s Suggested Retail Price (MSRP). The Additional Discount reflects how much lower the selling price is during Black Friday compared to its price a week before the sale. This metric reveals the actual or effective value of the sale event, beyond the standard discounts typically offered.

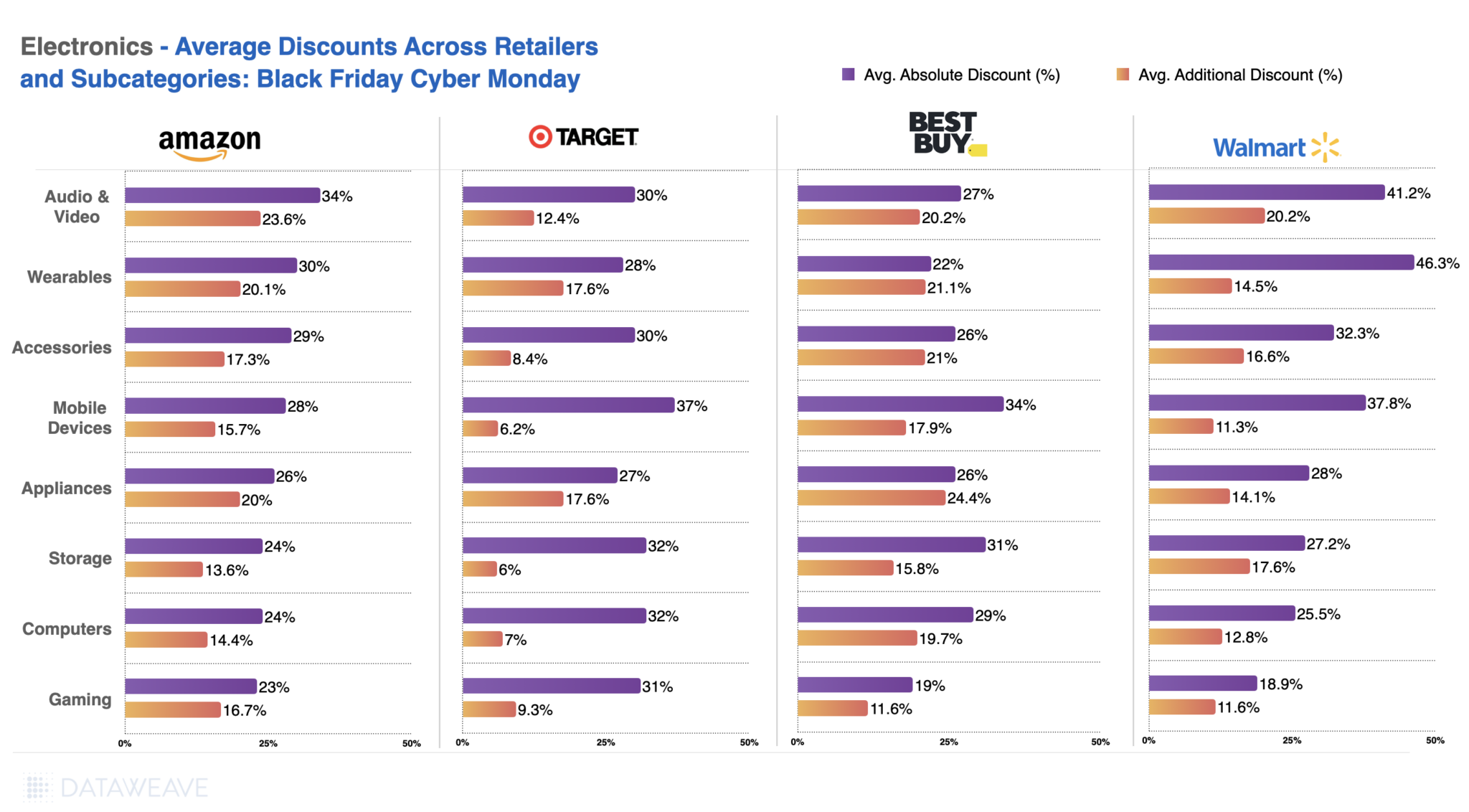

Subcategory Spotlight: Where the Best Deals Happened

From audio & video to wearables, each retailer carved out competitive advantages across subcategories.

- Both Amazon and Walmart offered high discounts in audio & video and wearables, but Walmart led, with discounts up to 46.3%.

- Best Buy, meanwhile, offered high absolute discounts on Mobile Devices(34%) and Storage (31%), followed by high discounts on wearables and Audio & Video.

- Amazon maintained a balanced approach, excelling in audio & video and mobile devices.

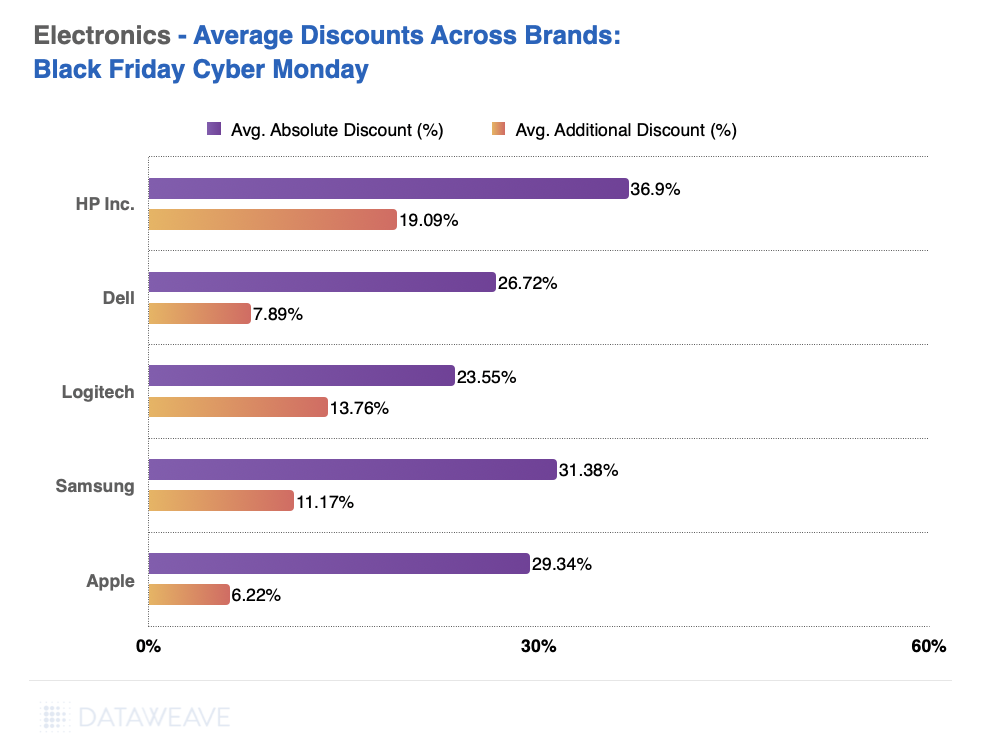

Brand-Level Insights: HP and Samsung Dominate

The biggest winners this year were brands that strategically leveraged Black Friday discounts to boost visibility and sales:

- HP took the top spot with average discounts of 36.9%, followed by Samsung at 31.4%.

- Despite its premium reputation, Apple offered an average discount of 29.3%, signaling a shift in strategy to attract deal hunters.

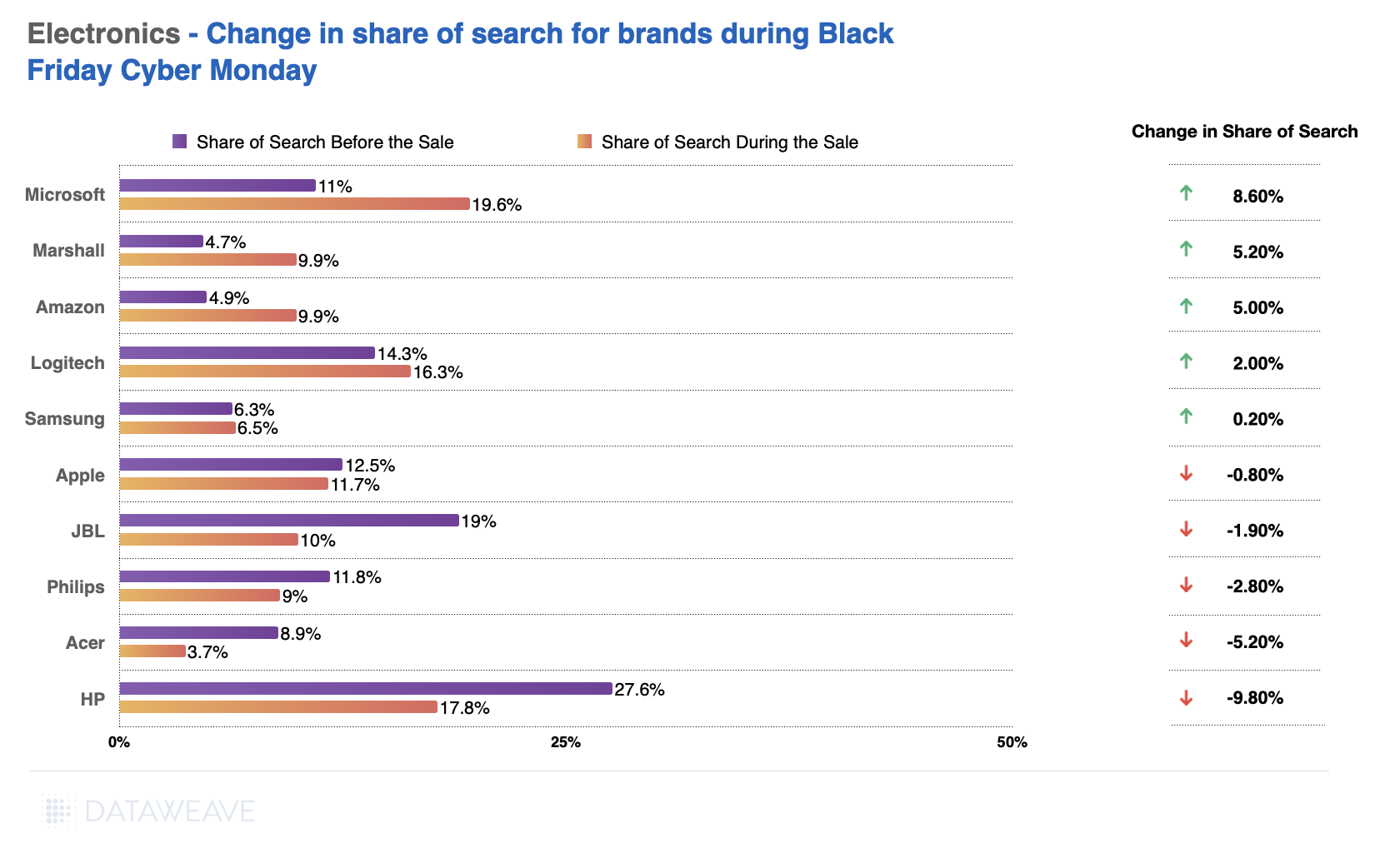

Share of Search: Shifting Consumer Attention

Search trends reveal how discounts shaped brand visibility:

- Microsoft saw the largest spike in share of search (+8.6%), thanks to aggressive pricing on gaming consoles and accessories.

- Marshall and Amazon also saw significant gains in visibility.

- Surprisingly, HP experienced a sharp decline (-9.8%), indicating missed opportunities despite steep discounts.

Consumer Electronics: Lowest-Priced Retailer Analysis

In the previous analysis, we focused on the top 500 products within each subcategory for each retailer, showcasing the discount strategies for their highlighted or featured items. However, to identify which retailer offered the lowest or highest prices for the same set of products, it’s necessary to match items across retailers. For this, we analyzed a separate dataset of 340 matched products across retailers to compare their pricing during Black Friday. This approach provides a clearer picture of price leadership and competitiveness across categories.

Here are the key takeaways from this analysis.

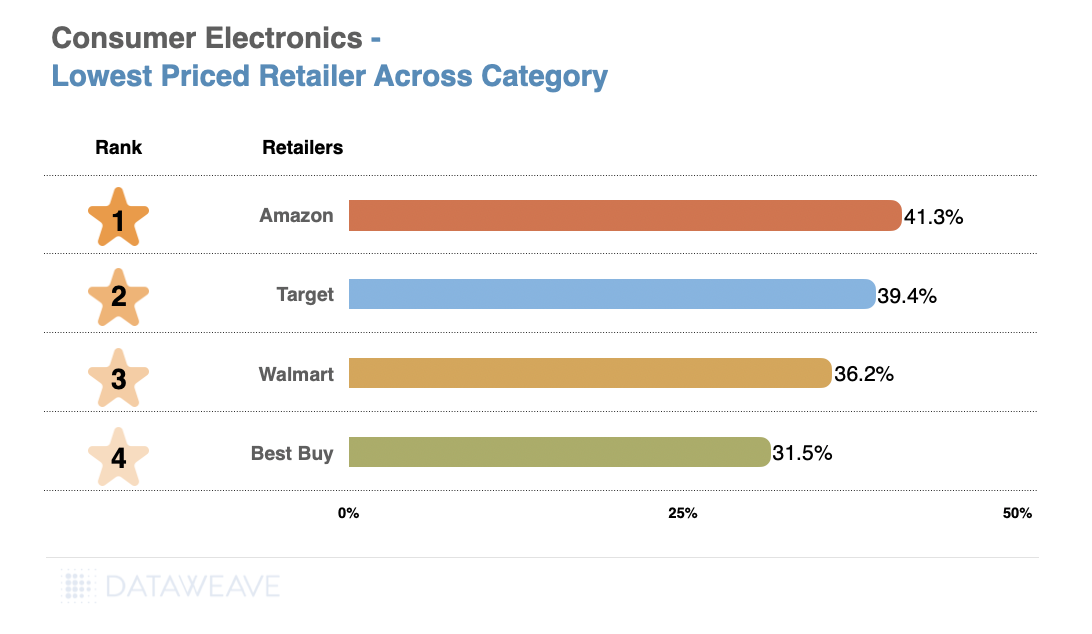

Category-Level Highlights

- Amazon leads with the highest average discount (41.35%), offering the most value to consumers. It is followed by Target (39.37%) and Walmart (36.15%).

- Best Buy, the specialist consumer electronics retailer, ranks last with an average discount of 31.53%, emphasizing a less aggressive pricing strategy compared to competitors.

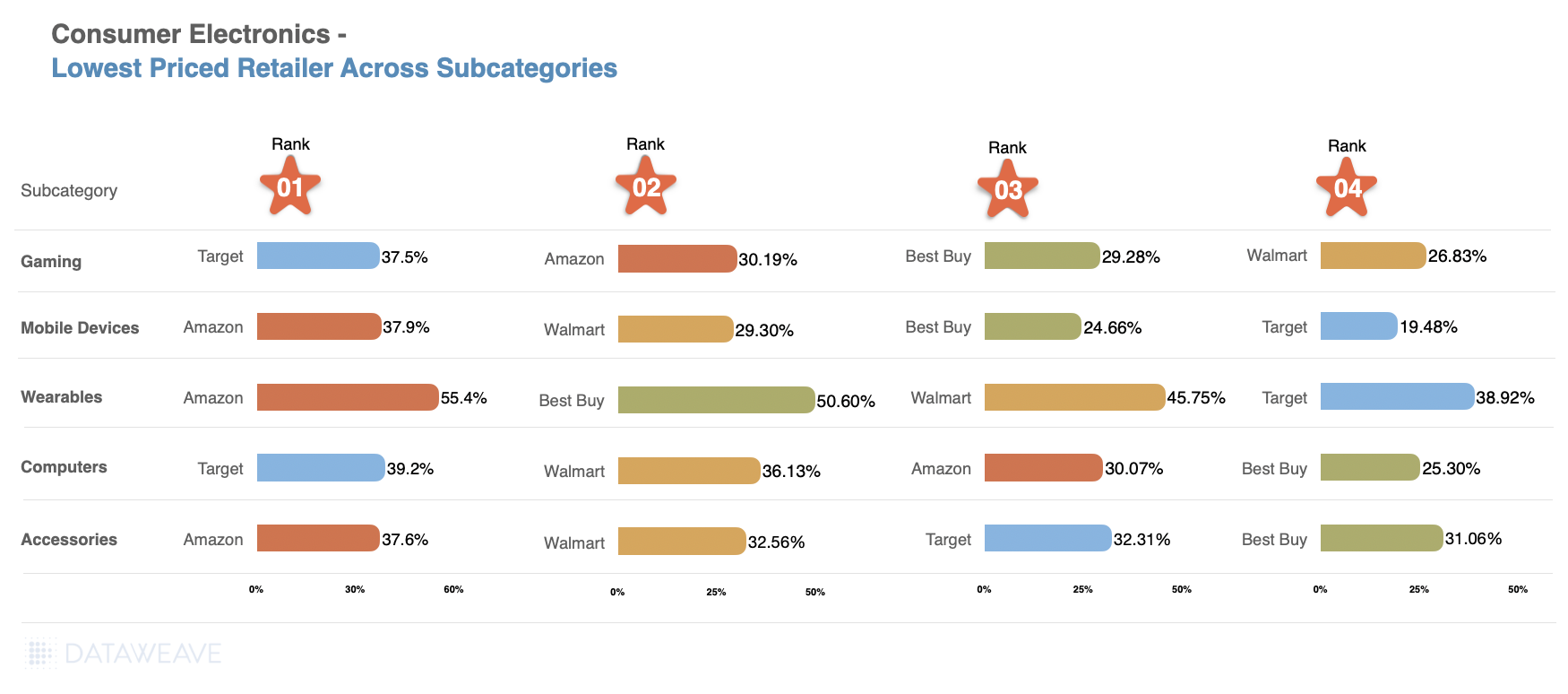

Subcategory Highlights

- Wearables: Amazon offers the steepest discounts (55.40%), followed by Best Buy (50.60%) and Walmart (45.75%).

- Mobile Devices: Amazon also leads (37.94%), with Walmart (29.30%) in second place and Target trailing at 19.48%.

- Gaming: Target takes the lead (37.47%), with Amazon and Best Buy offering similar discounts around 30%.

- Computers: Target again emerges as the leader (39.18%), narrowly surpassing Walmart (36.13%).

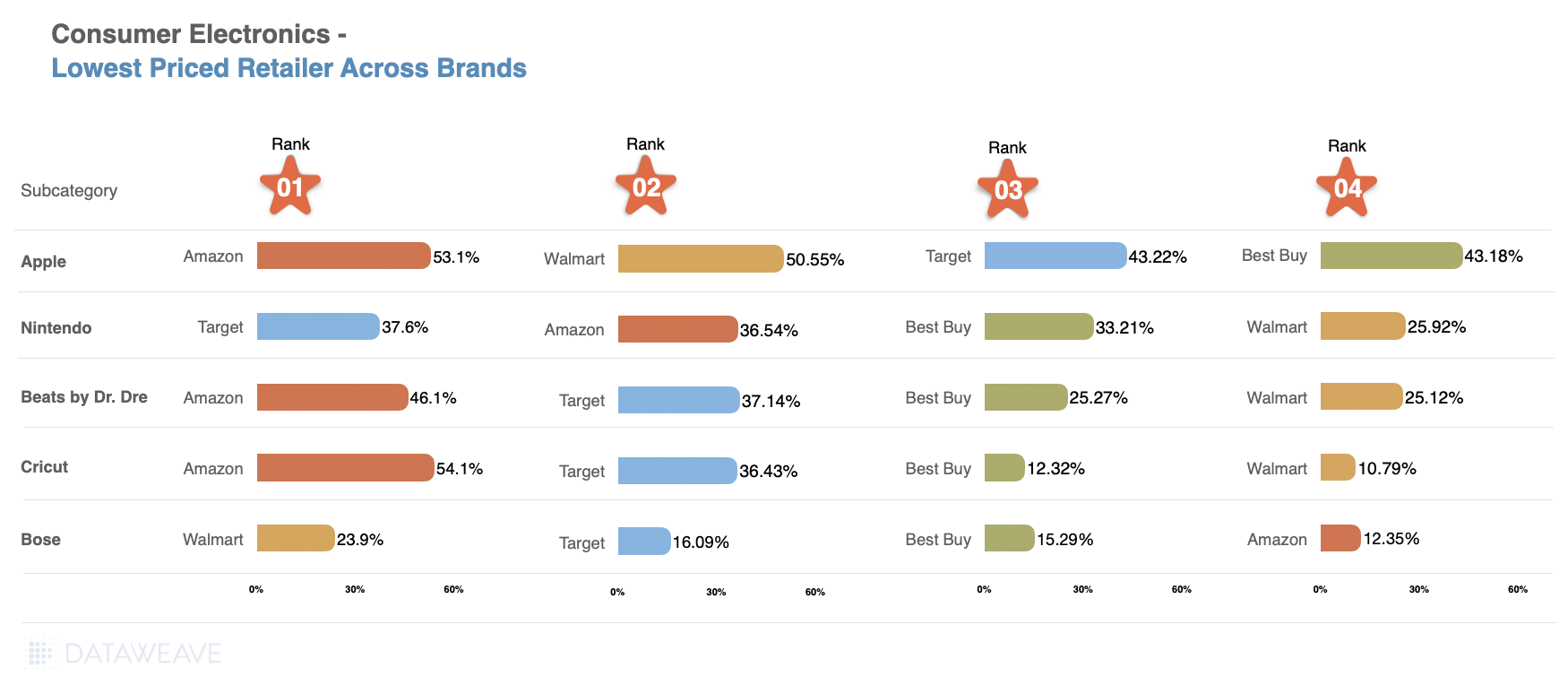

Brand Highlights

- Apple: Amazon dominates with 53.06%, closely followed by Walmart (50.55%), while Target and Best Buy hover around 43%.

- Nintendo: Target edges out Amazon (37.62% vs. 36.54%), with Best Buy (33.21%) and Walmart (25.92%) trailing.

- Beats by Dr. Dre: Amazon leads (46.07%), with Target (37.14%) as the runner-up. Best Buy and Walmart offer comparatively modest discounts around 25%.

- Bose: Walmart emerges as the value leader (23.90%), surpassing Target (16.09%) and Best Buy (15.29%).

- Cricut: Amazon sets a high benchmark (54.13%), with Target far behind (36.43%) for this viral portable printer brand. Best Buy (12.32%) and Walmart (10.79%) offer significantly lower discounts.

What This Means for Retailers and Brands

Retailers looking to stay competitive should focus on strategic discounting and enhanced brand visibility. Brands must align with consumer expectations by:

- Leveraging platforms like DataWeave to analyze discount trends.

- Optimizing pricing and assortment strategies for seasonal demand.

For more insights into consumer electronics pricing, contact DataWeave to discover how our AI-powered solutions can drive success in today’s fast-paced market. Stay tuned for more category-specific analyses in the coming weeks!