Earlier this year, we witnessed Amazon and Walmart going head to head in a CPG goods price war of fluctuating intensity that soon rippled out to embrace the entire grocery industry.

This further intensified with Amazon’s takeover of Whole Foods and the Whole Foods’ subsequent announcement hinting at significant discounts toward the end of August.

(Read Also: Amazon’s Whole Foods Pricing Strategy Revealed)

Soon, Target announced it was lowering prices on literally “thousands of items.” As Mark Tritton, Target executive vice president and the chief merchandising officer put it, “We want our guests to feel a sense of satisfaction every time they shop at Target.”

To drive home the seriousness of their intent, Target nominated grocery staples such as cereal, paper towels, milk, eggs, baby formula, razors and bath tissue and vowed to, “eliminate more than two-thirds of their price.”

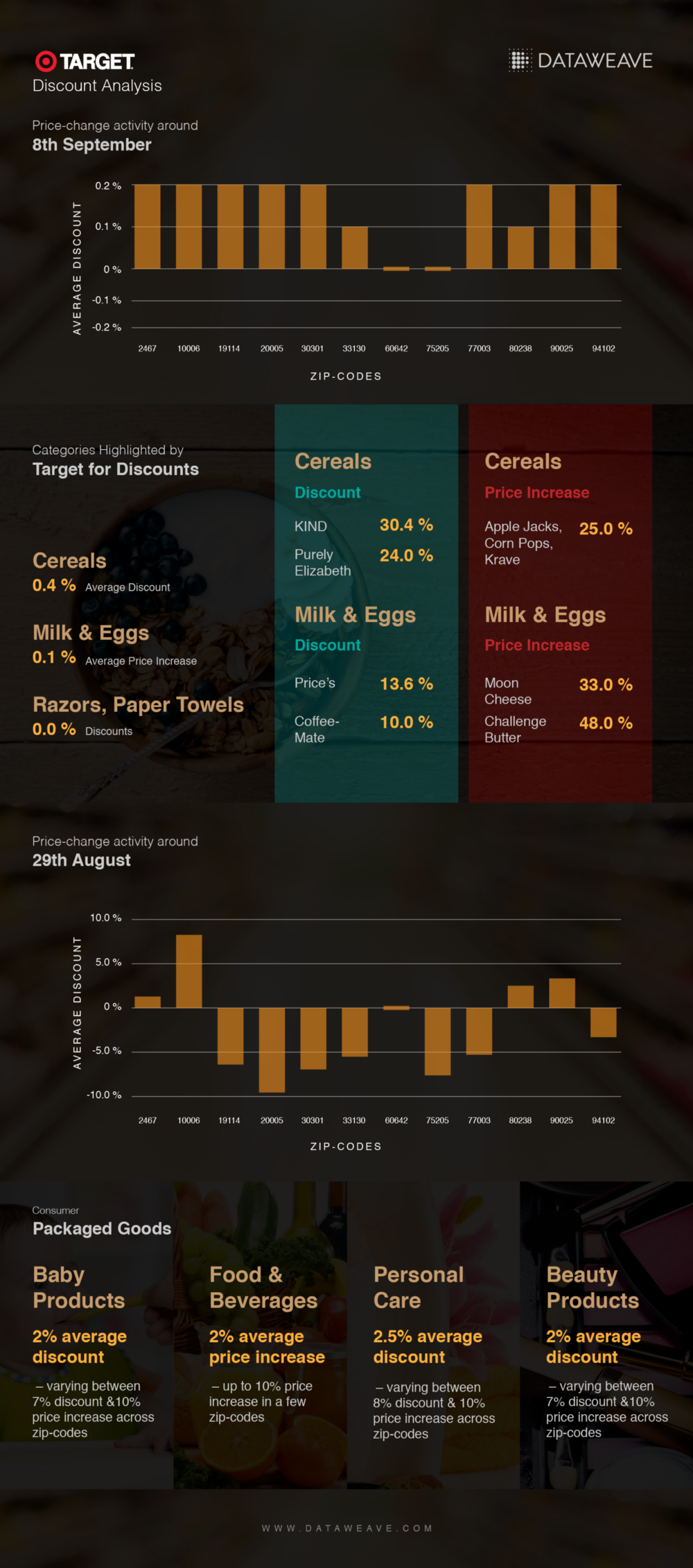

At DataWeave, we focused our proprietary data aggregation and analysis platform on Target’s reported price reduction. Our team acquired data on the prices of over 160,000 products listed by Target across 12 zip-codes selected at random. The platform then took two snapshots. Firstly, between 23rd August and 30th August which included the Whole Foods’ price reduction (to study any possible reactions on price) and, secondly, between the 6th September and 13th September, which included Target’s discount strategy announcement.

Of the categories Target identified as priorities for its discount strategy, only baby products, cereals, and Milk & Eggs displayed significant price drops. This price discounting effect varies, however, across brands in each category. In cereals, while KIND (30.4%) and Purely Elizabeth (24%) displayed high discounts, Apple Jacks, Corn Pops, and Krave more surprisingly increased their prices by up to 25% each.

Similarly, in the Milk & Eggs category, Price’s (13.6%) and Coffee-Mate (10%) exemplified hefty discounts, while Moon Cheese and Challenge Butter increased their prices by 33% and 48% respectively in the same time period. By comparison, Razors and Paper Towels showed no price changes whatsoever across the review period.

Interestingly, we observed greater price-change activity coinciding with the time of the Whole Foods’ announcement (between 23rd and 30th of August) than the later time period. Once again, however, no definite price discounting pattern emerged from the study, indeed the team found discount rates fluctuated significantly across categories.

Looking across the spectrum of CPG categories pricing, we saw significant, sustained variation across both categories and zip-codes.

Beauty products showed a 2 percent discount on average although this varied by zip-code, fluctuating between a 7 percent discount and an actual 10 percent price increase. F&B showed a 2 percent price increase, which jumped to 10 percent in some zip-codes. Personal care displayed a 2.5 percent increase on average, varying anywhere between an 8 percent discount and a 10 percent price increase. Baby products surprisingly recorded a 4 percent price increase on average during the study.

So, What Does This All Mean?

Based on our analysis, Target’s pricing strategy appears to be a combination of very closely concentrated discounting, complemented by selective price increases. Is discounting more a perception than a reality at this stage of the CPG cycle?

Aggressive price discounting has never been a decisive factor in successfully building Target’s consumer franchise. However, given the current trading environment and the continued pressure applied by competitive omni-channel strategies, which has seen a host of new entrants elbowing their way into the market, we anticipate price will continue to play a prominent role in retailing.

We suspect, based on evidence we gathered, that price discounts are more a highly targeted weapon in the fight for market share than a broadsword slashing of prices across the board. As Target’s CEO Brian Cornell noted during an earnings call, the company experienced “a meaningful increase in the percent of our business done at regular price and a meaningful decline in the percent on promotion.”

If you’re interested in DataWeave’s data aggregation and analysis technology, and would like to learn more about how we help retailers and brands build and maintain a competitive edge, visit our website.